March 2023 Space Stock Review+ ULA M&A

Topic of Interest: Analyzing the Potential Sale of United Launch Alliance

Hello fellow space enthusiasts! 🚀

Some of you may have noticed I missed February’s Space Stock Review; it turns out it’s a lot harder to buckle down and write these analyses now that I am working in the space industry full-time! Nonetheless, we’re back on track for March.

In this month’s Space Stock Review:

📈 March + 1Q23 Market Overview

✍️ Space Stock Performance + Valuation

🚀 Topic of Interest: Analyzing the Potential Sale of United Launch Alliance

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (4/11/23).

1. MARCH + 1Q23 MARKET OVERVIEW

Same story, just a different month.

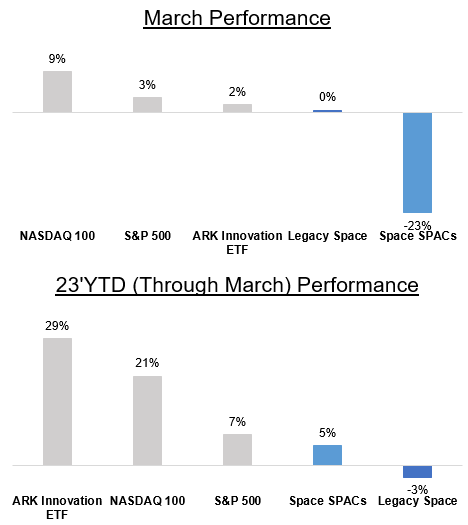

The space SPACs were down over -20% yet again in March and year-to-date they have lagged the broader market, mostly missing out on the tech stock rally through 1Q23. However, legacy space stocks have performed even worse through 1Q23 at down -3%.

The stock market in 2023 has been marked by volatility, with sizable swings driven by changing expectations for the Federal Reserve’s interest rate actions and speculation about the health of the broader economy.

The beginning of 1Q23 was a continuation from the end of 2022, with investors primarily focused on inflation and the Fed. Through mid-February things seemed to be going well—December inflation (released mid-January) ticked below 7% and investors started thinking that the Fed might stop raising rates sooner rather than later (maybe even cutting rates by the end of the year). However, that positive sentiment changed in the second half of February.

Soft January inflation data (released mid-February) suggested that inflation was looking sticker than most were expecting (including the Fed), leading to renewed investor concern that interest rates would need to go higher and stay there longer than expected (i.e. bad for stocks)

But then in the span of one week, three regional US banks failed (Silvergate Capital on 3/8, Silicon Valley Bank on 3/10, and Signature Bank on 3/12) and investor sentiment shifted again to the point of view that the Fed would have to lower rates sooner than later (i.e. good for stocks) given the need to balance inflation versus broader financial market stability.

However, just because the S&P 500 ended 1Q23 up +7% doesn’t mean all stocks did well in the quarter—in fact, nearly 90% of the S&P’s +7% gain can be attributed to just seven megacap tech stocks (AAPL, MSFT, NVDA, TSLA, META, AMZN and GOOG) (link to source). This explains why the ARK Innovation ETF and the NASDAQ 100 have done so well at +29% and +21%, respectively (both indexes are highly concentrated in megacap tech).

Market rallies driven by just a handful of stocks are not a sign of true market strength, and I am personally airing on the side of caution with regards to my outlook for stocks through the rest of 2023. I am firmly on the team of expecting interest rates needing to go higher and stay there longer than expected to combat inflation, which is bad for stocks in the near term.

2. SPACE STOCK PERFORMANCE + VALUATION

Performance Commentary

In March, performance can mostly be broken down by SPAC and non-SPAC (see image above).

This makes sense to me given the focus on a credit crunch / increased recession risk following the regional banking failures in March—the less mature and unprofitable SPACs are more at risk than the more mature legacy space companies are, and thus their stocks underperformed.

Through 1Q23, manufacturing has greatly outperformed the other subsectors at +32% in 1Q.

This outperformance is primarily driven by Redwire’s inexplicable +56% return in the quarter.

Specifically, shares of RDW increased nearly +50% in one day (2/15) on huge volume, but with no company-specific news before or after that date to have caused it.

Valuation Commentary

SATL is no longer trading at a premium vs earth observation (EO) peers.

In my December space stock review (link) I highlighted that SATL shares were at risk given that the stock was trading at ~5x 2023 revenue following the company’s mid-December update, compared to EO peer avg multiple of 2-3x revenue.

Since then, SATL has declined -30% and its 2.8x revenue multiple is now ~in-line with the rest of its EO cohort.

LUNR—fairly valued?

When the Intuitive Machines SPAC was 1st announced, haters lamented that we were seeing a cislunar space company go public at a $1B valuation; however, in the context of the company’s anticipated 2023 revenues, it wasn’t a (totally) crazy valuation—the deal was priced at 2.8x 2023E revenue.

Since de-SPACing, LUNR has traded at ~2x 2023 revenue, which is in-line with other space stocks (both SPACs and legacy space). This begs the question—is LUNR the 1st space SPAC that was fairly priced right from the start? The answer to that question depends on how much you believe consensus/management’s 2023 revenue forecast.

Consensus is expecting $389M of revenue for LUNR in 2023 (this compares to management’s guidance for $300M from December 2022 (see image below); the difference is consensus also includes increased backlog following NASA updating LUNR’s 1st mission landing site to be on the lunar south pole).

This compares to contracted (i.e. secured) revenue of $159M in 2023, or ~40% of the consensus estimate.

So if you want to buy LUNR stock, you have to ask yourself—do you believe LUNR can secure the $230M of uncontracted revenue that consensus is expecting to be reported in its $389M estimate?

3. ANALYZING THE POTENTIAL SALE OF UNITED LAUNCH ALLIANCE

The theme of mega-mergers & acquisitions (M&A) within the space industry has continued into 2023.

On March 1st news broke that the world’s 2nd most prolific rocket company, United Launch Alliance (ULA), was potentially up for sale.

Details surrounding the potential deal have been sparse, but there has been no shortage of speculation regarding who would buy the company, originally created as a 50/50 joint venture between Lockheed Martin and Boeing in 2006 (link).

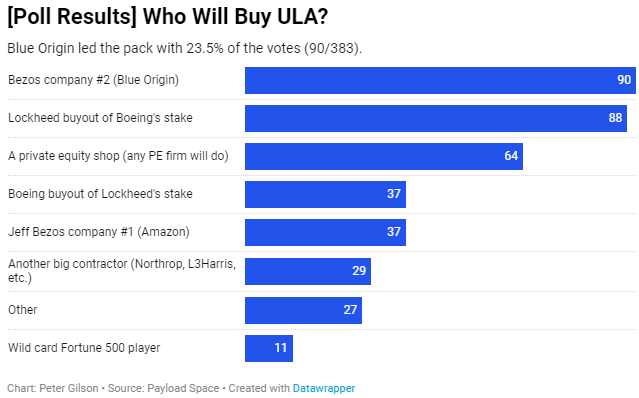

Comments on the tweet above (from Ars Technica’s Eric Berger, who originally shared the rumor) and results from Payload Space’s reader poll suggest that the consensus opinion is Jeff Bezo’s Blue Origin is the leading candidate to purchase ULA.

However, after reviewing the considerations of ULA’s existing owners and potential buyers, I think the answer is pretty clear:

Lockheed Martin is buying out Boeing’s stake in ULA.

In this post I will discuss A) what is ULA worth? and B) why Boeing is selling and why Lockheed is the most likely buyer from the pool of six potential buyers, and C) considerations regarding the timing of the sale.

A. WHAT IS ULA WORTH?

My estimate: $4B-5B.

Normally valuing a private company can be quite difficult because you don’t have insider information regarding financials.

However, ULA is owned 50/50 by two public companies so we have some publicly reported information to start working with: Lockheed Martin’s 2022 10-K tells us that ULA’s 2022 operating income was $200M1.

Using NYU’s valuation multiple by sector data, we can see that profitable aerospace & defense companies generally trade at 24x next year's operating income and 30x last year's operating income2, which compares to 18x and 20x multiples, respectively, for the legacy aerospace & defense companies included in the Space Case valuation comp. The NYU and Space Case multiples suggests that ULA is worth somewhere between $4B-$5B3.

Of course there are puts and takes to what exact multiple ULA deserves4, but I am not trying to get in the weeds here; for our purposes we will say this estimate is close enough and conclude that ULA is worth $4B-5B.

Of note, Aerojet Rocketdyne did try to buy ULA for $2B in 2015, but this was when the future of ULA was in question—ULA was at risk of going out of business due to an expected drop in military and intelligence satellite launches + lack of success in securing civil and commercial launch contracts. This AJRD bid was a lowball offer to see if it could acquire a distressed asset for a cheap price. Ultimately ULA wasn’t sold in 2015, and its prospects improved greatly between 2015 and the present day with Tory Bruno at the lead (check out this article showcasing Tory’s mindset for how he turned ULA from near-bankrupt to solidly profitably).

B. WHY IS BOEING SELLING?

BLUF - Boeing needs to pay down debt and lately its space business has been a drag on operations; selling its 50% stake in ULA for $2B-$2.5B would provide much needed financial flexibility and help reorient its portfolio away from space.

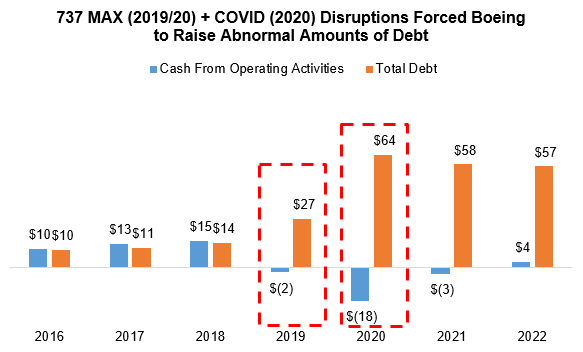

Boeing has been in a precarious financial position since 2019 and 2020, when the company's cash flow generation came to a halt after its 737 MAX aircraft was grounded following multiple crashes5 and COVID-related travel slowdowns both materially impacted the company's core aviation business.

With its aviation profit generator essentially shut down, Boeing was forced to issue $50B of net debt to fund operations and management suspended all shareholder return programs (both dividends and share repurchases).

Following the spike of debt on Boeing’s balance sheet in 2019/20, credit rating agencies6 downgraded Boeing’s debt to the lowest tier of "investment grade" (IG) ratings (just barely above “high yield” status, i.e. junk bond status), meaning that agencies saw greater risk of Boeing defaulting on its debt and/or not making interest payments on time given the company's abnormally high debt load combined with its cash flow generation issues.

Since 2019, Boeing management has been highly focused on paying down debt (including >$5B of maturities coming up in 1H23) to maintain its IG credit rating. Keeping this IG is important because slipping to junk bond status would increase Boeing’s interest rate payments to bondholders, diverting cash from its core operations.

At the same time, I don’t think Boeing management is very fond of its portfolio of space businesses right now: Boeing’s Defense, Space, and Security segment has been underperforming, and management discussion of long-term drivers for the segment almost entirely focuses on defense and security vs space (ex. 13 mentions of “defense” on its 4Q earnings call vs 2 mentions of space; the trend is the same through all of the company’s 2022 earnings calls and conference presentations).

Given this setup, while ULA is profitable, I think it is pretty obvious that Boeing’s management team is open to selling ULA (a non-core asset) for a lump sum of $2B-$2.5B of cash vs receiving ~$100M of operating profit per year (especially in the context of a rising interest rate environment where the scales are tilted toward present day cash flows being preferable vs the promise of future cash flows that are worth less in the present day (link)).

Additionally, by accelerating its debt reduction plans after selling ULA, Boeing management is also effectively accelerating its timeline for reinstating shareholder capital return programs.

C. WHO IS BUYING BOEING’S STAKE OF ULA?

LOCKHEED MARTIN

BLUF - Lockheed Martin isn’t looking to sell its stake in ULA. It has ample financial flexibility and is looking to double-down on the recent success of its space businesses. Additionally, it is the only company that could see material cost savings by fully acquiring ULA. However, regulatory scars from the past could prevent the company from committing to fully owning ULA.

Ever since LMT was forced to abandon its planned $4.4B acquisition of Aerojet Rocketdyne in 2022 due to opposition from anti-trust enforcers, the company has had financial flexibility; it is currently operating at historically low levels of leverage and when asked by analysts, management has said it is still active in pursuing M&A:

"While the Aerojet Rocketdyne transaction did not pan out for us, that doesn't mean that we're not still active out there from an M&A perspective"

Jay Malave, LMT CFO, JPMorgan 2023 Industrials Conference (Mar’23)

At the same time, the company is bullish on its space business. Earnings call commentary suggests management is looking at LMT’s Space segment as a key area of growth in the near-term, with highlighting “programs of record” such as Orion and classified program captures. Additionally, LMT recently announced the creation of Crescent Space Services LLC, a subsidiary that will offer lunar services. These are indicators of a company focused on growing its space segment (versus Boeing, which hardly speaks about its space business).

Lockheed buying out Boeing’s stake of ULA also just makes sense! The company would vertically integrate its current space business with one of its primary launch providers (likely leading to major cost savings for Lockheed, since it could launch satellites at-cost with ULA instead of with a markup), and with strategic control of ULA Lockheed could (in theory) decide to further invest in ULA to stay competitive in a launch market that is heating up with competition aiming for at least partial reusability (versus managing the ULA JV with Boeing, which has likely been reluctant to agree to invest any more than is necessary in ULA given its debt issues).

From a regulatory perspective: given emergence of SpaceX as a viable supplier of medium-to-heavy launch services (+ a number of developing launch providers), the main regulatory concerns that the FTC raised in 2005/06 surrounding the creation of ULA should be alleviated (link)…but you never know if LMT management still has battle scars from the tricky situation (link to Wikipedia for the history of ULA).

NORTHROP GRUMMAN

BLUF - Northrop likes space, but there are a few reasons it wouldn’t make sense for the company to buy Boeing’s ULA stake: regulatory upside limitations; Northrop’s existing partnership with Firefly Aerospace; and Northrop is focused on investing its capital to support long-term franchises (B-21, GBSD, Kuiper).

At first glance, Northrop is a compelling potential buyer of Boeing’s ULA stake because the company views its space segment as a key part of its growth outlook.

“…there are many areas of our business that are showing growth because of close alignment with [DoD] budget priorities. I put our whole national security space business, high on that list.”

David Keffer, Northrop Grumman CFO, Cowen 44th Annual Aerospace/Defense & Industrials Conference, Feb’23

“Now turning to 2023 guidance…We expect Space Systems to remain our fastest-growing business.”

David Keffer, Northrop Grumman CFO, 4Q22 Earnings Call, Jan’23

However, there are a number of reasons why it doesn’t make sense for Northrop to purchase Boeing’s ULA Stake.

While NOC is a vendor for ULA (it has supplied solid rocket boosters for ULA’s Atlas V and will do the same for the Vulcan Centaur, recently winning a $2B multi-year contract from ULA to do so (link)), the FTC’s 2006 consent decree required ULA to treat its parent companies the same it would treat any other company. My understanding is that NOC wouldn’t be become any more vertically integrated or realize any cost savings by acquiring Boeing’s ULA stake. However, I do see the strategic value in NOC acquiring a stake in ULA even if there are minimal financial gains; NOC’s solid rocket motor business is highly tied to ULA’s success—perhaps it wants to have a seat at the table for determining the future of this LoB.

Northrop already has a partnership with Firefly Aerospace for launch capabilities. While the partnership is centered around Firefly’s current small launch and planned medium launch capabilities, which technically doesn’t overlap with ULA’s Vulcan Centaur heavy launch capability, it would seem odd for Northrop to double down on partnerships with multiple unproven rockets (note: ULA’s Vulcan is set to debut on 5/4/2023, though this date could potentially slip following an anomaly during testing on 3/29; Firefly’s medium launch vehicle is set to debut in 2025, per the company’s website).

Northrop is currently focused on investing to satisfy multiple long-term franchise programs. Management has highlighted that it is currently operating with unusually high capital intensity (i.e. capex as a % of revenue) to expand manufacturing capabilities in order to satisfy recent long-term contract awards related to franchise programs, including for the B-21 bomber, Ground Based Strategic Deterrent intercontinental ballistic missile, and supplying ULA with solid rocket boosters to support existing ULA customers and Amazon's Project Kuiper. Acquiring ULA would require diverting capital from these investments that are expected to drive long-term growth, which doesn’t make sense to me.

L3HARRIS

BLUF - LHX is still digesting 2 other major acquisitions, so I have a hard time envisioning that it is also going to attempt to buy in to ULA on top of that.

L3Harris is another A&D company commonly listed as a potential buyer of ULA given its recent appetite for acquisitions; however, I would cross them off the potential buyer list given the other material deals the company is still integrating.

Just in the past year L3Harris has acquired ViaSat’s Tactical Data Link business for $1.9B and has announced its intention to acquire Aerojet Rocketdyne for $4.7B.

While LHX is clearly enthusiastic about expanding its presence in the space market and is a supplier for ULA’s Vulcan Centaur rocket (Aerojet Rocketdyne will supply engines for the 2nd stage), LHX management has made it clear that their near-term goals are 1) integrate the VSAT TDL and AJRD businesses and 2) maintain an investment-grade credit rating (acquiring ULA probably requires taking on debt, and that wouldn’t help this latter goal).

AMAZON

In theory, Amazon has the capital to buy ULA and invest in it to truly challenge SpaceX (note: the company ended 2022 with nearly $80B cash on the balance sheet). With ULA’s assets, Amazon could (again, in theory) invest to create point-to-point rocket transport capabilities and even enable Amazon to expand its logistics capabilities and get direct access to the in-space economy.

However, that is just a silly pipe dream. In reality, we got indication that Amazon isn’t looking to buy ULA this past month from Dave Limp, SVP of Devices and Services at Amazon, as part of the company’s Kuiper terminal reveal (link).

BLUE ORIGIN

Consensus seemingly can’t help but fall in love with the idea of Blue Origin buying ULA given continued delays in the development of Blue Origin’s New Glenn rocket and the potential for Tory Bruno (who cleaned up ULA) to help “turnaround” the company. Additionally, people seem to think that because Blue supplies ULA with BE-4 engines, this makes the two companies a good fit.

I strongly disagree with this view.

I view Blue Origin as operating with a 100+ year, long-term vision and its launch efforts are focused on lowering the cost of access to space via reusability.

Delays are not ideal, but what is a 2020 debut vs 2024 or 2025 in the context of Blue’s goal of expanding humanity’s presence in the solar system?

ULA’s Vulcan Centaur has not been designed with reusability in mind the way that Blue Origin’s New Glenn has been—I find it hard to believe the company would give up on New Glenn and pivot to Vulcan.

If you don’t believe me, listen to Jeff Bezos’ 2019 speech where he laid out his vision for Blue Origin—I think his stance is pretty clear.

PRIVATE EQUITY

If 100% of ULA was being sold, then I would have private equity higher on my list of potential acquirers given that ULA’s strong manifest into the late 2020s represents a steady stream of potential dividend payments for a PE investor.

However, given that I don’t see Lockheed selling its stake of ULA, I don’t think private equity will be interested in only purchasing Boeing’s 50% stake of ULA.

Additionally, Tory Bruno already did the cost-cutting work that private equity is known for, laying off hundreds of workers and increasing operational efficiency at ULA in order to stay competitive with SpaceX during his 9yr tenure at the helm of the company.

(For more on private equity activity in the space industry, I recommend checking out Filip Kocian’s comprehensive post on the subject).

D. TIMING OF THE SALE

Something recently brought to my attention was the impact of the timing of the ULA sale and how it relates to the United States Space Force’s (USSF) upcoming Phase 3 National Security Space Launch (NSSL) contracts, which will award $10B for ~70 missions between 2025-30 (link).

There are two categories of contracts being awarded:

Lane 1: ~30 less demanding missions; this category is meant to enable newer launchers to compete for USSF contracts.

Lane 2: ~40 more difficult missions with contracts reserved for only 2 more established and reliable launch providers.

In the USSF’s previous Phase 2 NSSL contracts, they only gave out 2 contracts in total to ULA and SpaceX, with ULA winning 60% of missions and SpaceX winning 40% of missions.

For the Phase 3 contracts, it is expected that SpaceX will win 60% of Lane 2 missions and ULA will win 40% of missions—flipping the market share from the Phase 2 awards.

Why does this matter? Something to note is that the press rumors of the ULA sale stated that the deal would occur before year-end; this compares to the Phase 3 contracts being awarded in the summer of 2024.

By monetizing its ULA stake prior to the NSSL awards in 2024, Boeing preserves some of the value that it would lose from selling ULA after the 2024 NSSL awards when it is confirmed that ULA’s share of the premium national security launch market has decreased.

Lockheed Martin’s 2022 10-K states that 2022 operating income from its “equity method investees” (i.e. companies that it has 20% to 50% ownership of) within its Space business segment was $100M, and was primarily attributable to ULA. For simplicity, I am going to assume all $100M is attributable to ULA. LMT has a 50% stake in ULA, so ULA’s full 2022 operating income was ~$200M.

Link to the source for the NYU valuation multiples. NYU’s Aswath Damodaran is widely considered a valuation guru.

I have seen some people look at Boeing’s 10-K and conclude that ULA is worth $1.2B because it shows the balance sheet value of Boeing’s 50% stake in United Launch Alliance is $587M and $587M x 2 = ~$1.2B. However, this is incorrect—the value reflected on the balance sheet is merely an accounting value, and doesn’t reflect how an investor would value the business. The balance sheet value of an equity method investment (again, one where the parent company owns 20% to 50% of the investee) is initially recorded as an asset on the balance sheet with value = cost of the investment. As time goes on and the investee earns profits or incurs losses, the parent company’s share of earnings or losses is recorded on its income statement, and the balance sheet value of the investment is adjusted up for a profit and down for a loss. Additionally, if the investee pays out dividends to the parent company, or the parent company further invests in the investee, the balance sheet value is adjusted up or down, respectively.

A few of the arguments for or against a better multiple than the A&D average 24x operating income, for ULA:

(Deserves a premium): ULA’s future launch capacity is relatively full through 2027 and there is a guaranteed future revenue/profit stream from counter-cyclical demand via the DoD and Amazon’s project Kuiper have bought up most ULA’s launches for the next 4 years regardless of what happens to the broader macroeconomic/space industry.

(Deserves a discount): while ULA has worked to cut costs substantially from its business since 2014, the company likely operates on a relatively thin margin (I would assume it is ballpark to the 10% profit margin typically given to primes who win cost-plus government contracts). Additionally, ULA will likely cede national security launch market share to SpaceX in the upcoming Phase 3 NSSL contract awards.

The Boeing 737 MAX was grounded from March 2019 to November 2020 following multiple crashes (link). The company suffered billions of dollars of losses due to delivery delays, order cancellations, and penalties following these incidents.

Credit rating assignments are more of an art than a science, and they are based on a combination of a company’s history of making interest payments + repaying lenders on time, leverage ratio (net debt to EBITDA), cash on the balance sheet, and general business outlook.

Having an investment grade credit rating is important to a company like Boeing that holds tens of billions of dollars of debt on its balance sheet because an IG rating allows the company to issue debt with a lower interest rate than if it had a non-IG rating. Consider that Boeing had to pay its bondholders >$2.5B of interest in both 2022 and 2021…those figures would have been materially higher if the company didn’t have an IG credit ratings.

Good write up. 100% agree with you that BDS is in managed decline and LMT is most likely suitor.

You left out that NOC already has a launch provider under its tent: OATK, which builds Antares and the Minotaur. The Firefly partnership is goofy and frankly they overpaid for a stake in a (yet to) launch company.

I’m surprised this thorough report and well-researched analysis did not include Raytheon Technologies or General Dynamics. Both of the Big 6 A&D club members have equities in space architectures with Raytheon acquiring the vertical supply chain for satellites. GD is more diverse but like Raytheon takes a ‘own the domain’ approach to market share. Boeing is moving its headquarters to Virginia and building a R&D focused campus across the Potomac from the US Congress. Raytheon and GD are already headquartered there with deep relationships in both the house and senate. If the Boeing strategy is to divest heavy launch, Raytheon and GD are probably already shaping their congressional committee members to limit competition and establish additional barriers of industry to increase confidence from investors that a move into heavy launch would not only increase the stock price but allow them to ‘own the domain.’