September Space Stock Review + Valuation 101

Topic of Interest: Why Should Space Investors Care About Interest Rates?

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 September Market Overview

🗣️ Topic of Interest: Why Should Space Investors Care About Interest Rates?

✍️ Space SPAC Performance and Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (10/6).

1. SEPTEMBER MARKET OVERVIEW

In September the space SPACs ended their two-month streak of positive monthly returns, finishing the month down nearly -22%, far underperforming the broader market (SPY), tech stocks (ARKK and QQQ), and legacy space stocks.

September performance represented an unfortunate addition to the space SPACs’ 2022 track record:

5th month of negative returns

4th month of worse than -20% performance

4th month of having the worst returns vs other indices (SPY, QQQ, ARKK, legacy space)

Year-to-Date, the space SPACs are down -62%—nearly 2.5x worse than the S&P 500’s -25%.

However, if we zoom out you can see that the space SPACs weren’t alone in facing a tough September.

The S&P 500’s -9.6% return was the index’s worst monthly return of 2022, and was the worst monthly return for the S&P 500 since the pandemic hit in March 2020.

While September actually started off strong with the S&P trading +4.0% through 9/12, the August inflation readout on 9/13 turned market sentiment sour. Although August inflation was +8.3% y/y—which represented a deceleration vs July’s +8.5% y/y inflation—it was higher than Wall Street expectations of +8.0% y/y, which dashed investor hopes that a material deceleration in inflation could lead to less aggressive interest rate hikes from the Federal Reserve.

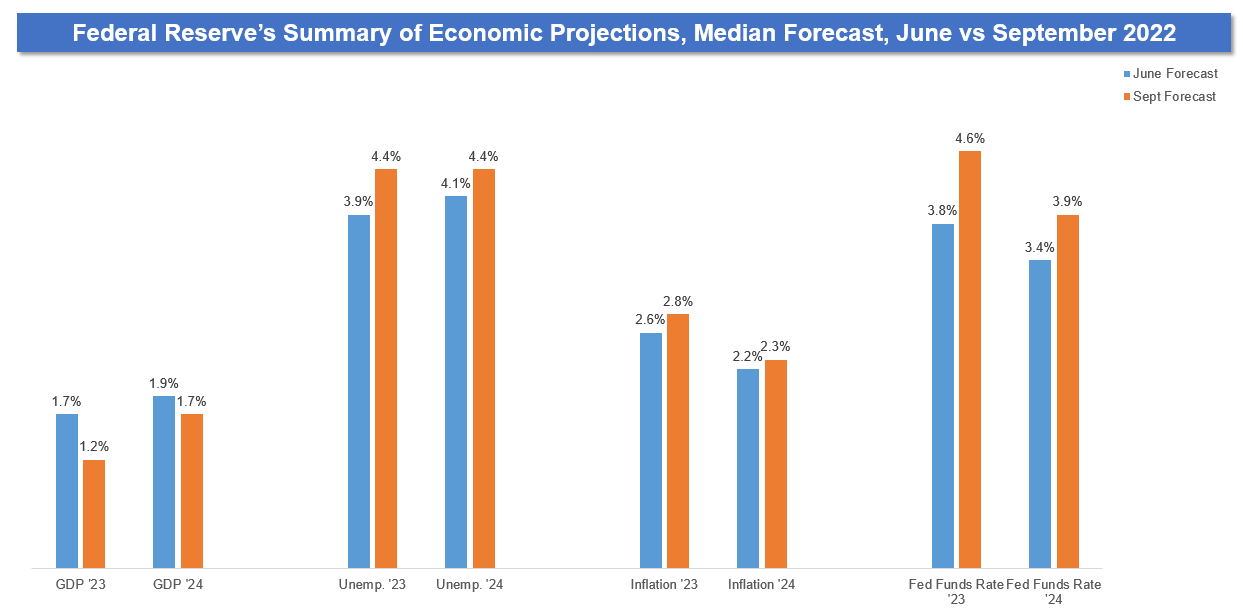

Later in September, the Federal Reserve validated investor pessimism when it raised interest rates another +0.75% and indicated that it 1) believes it will need to more aggressively raise interest rates to combat inflation vs prior estimates and 2) the battle to reduce inflation is likely to result in lower GDP growth and higher unemployment vs prior estimates.

The +0.75% rate hike was expected, but the additional commentary was a surprise—and not a good one.

Note from Space Case: SPAC September performance + valuation comps are in section #3 instead of their usual slot at #2.

2. TOPIC OF INTEREST: WHY SHOULD SPACE INVESTORS CARE ABOUT INTEREST RATES?

At this point, anyone paying attention to the news understands that “higher interest rates = bad for stonks.”

But can you clearly articulate why that is the case?

When I was writing my commentary about September market performance, I realized I couldn’t do so—I needed a refresher.

VALUATION 101

The space SPACs have gotten hammered relative to the S&P 500 and legacy space stocks this year, down -62% vs -25% and -14%, respectively.

Though this is a complicated subject, the biggest driver of this underperformance is the monetary policy that the Federal Reserve has implemented to combat inflation—namely its decision to raise interest rates from near-0%.

Rather than discuss why raising interest rates can reduce inflation (that is a whole different conversation), I will review the basics of why rising interest rates are bad for stocks—especially growth stocks like the space SPACs.

One way investors calculate valuation is by measuring the net present value (NPV) of a company’s future cash flows via a discounted cash flow (DCF) model.

The most important concept of a DCF is “the time value of money” which is the idea that $100 in the present day is worth more than $100 in the future because of:

Earnings Potential. The present day money could in theory be invested and grown to >$100 in the future.

Future Risk. The future $100 could have its value eroded by inflation or some other unforeseen event.

For more on this concept, check out this video from the master of valuation—NYU’s Professor Aswath Damodaran.

Below is a basic DCF formula.

Interest rates matter in a DCF because they are incorporated into the variable “r” or the discount rate, which is the rate of return used to calculate the value of future cash flows in the present day. The discount rate is often approximated using a company’s weighted average cost of capital (WACC).

WACC accounts for the costs associated with raising debt or equity capital. WACC is also the minimum rate of return a company must earn in order to breakeven when using its capital to grow the business (i.e. returns must be > WACC)

We will focus on costs associated with debt capital—this means the interest payments that a company will pay to buyers of its bonds when it is raising debt capital.

There is an inverse relationship between the interest rate embedded in a company’s bonds, and the risk associated with the company being able to pay back the initial loan and/or make scheduled interest payments.

For example, a company that has a low chance of defaulting and/or is very likely to make its interest payments will offer bonds that pay a relatively low interest rate. Investors do not need a great incentive to buy this company’s bonds since there is a level of certainty involved with their investment—they are very likely to earn a steady return from the periodic interest payments, and will likely receive their initial loan back at the bond’s maturity date.

Meanwhile a company that has a high chance of defaulting and/or is unlikely to make its interest payments will have to offer bonds with higher interest rates in order to entice investors to take on the risk of buying their bonds that have less certain returns.

The least risky bonds in the US are treasury bonds from the Federal Reserve, which is the central bank of the United States—it has never defaulted on its debt. The Federal Reserve’s treasury bonds offer the lowest interest rates in the US, and corporate bond interest rates offer a “premium” above treasury bonds given their higher risk levels.

When you hear that the Federal Reserve is raising interest rates this is referring to the Federal Funds Rate, which is the interest rate used as a baseline for setting other interest rates such corporate debt.

If the federal funds rate goes up, you can assume that interest rates for any other type of debt will also increase.

Okay we’ve gone pretty far down the finance rabbit hole—let’s bring this conversation back to our original question: why should space investors care about interest rates?

If the Fed is raising interest rates, this means that the denominator in the DCF calculation becomes greater (all else equal) because the discount rate (“r”) is increasing, which results in a smaller present day value of a company’s future cash flows.

Given that most space startups (including the SPACs) are not profitable in the present day, rising interest rates are more meaningfully negative for them than it is for more mature businesses that are already cash/profit-generative—most of newer space companies’ value lies in their future cash flows vs mature businesses that are generating profits in the present day.

This is why the space SPACs, as well as all other types of growth stocks, have repeatedly gotten hammered harder than more mature companies that are generating profits now in the present day.

Now, to be fair—the valuation risk from rising interest rates is only one of many reasons why higher interest rates are bad for space companies…and many of the reasons why higher interest rates are bad for space companies + space investors also apply to other industries.

However, rather than go into those other reasons here (this post is already long enough) I will highlight a few of the better answers I received when I posed this question to my astute Twitter audience.

I hope you find this refresher on interest rates and valuation as useful as I did!

3. SPACE SPAC PERFORMANCE AND VALUATION

PERFORMACE COMMENTARY

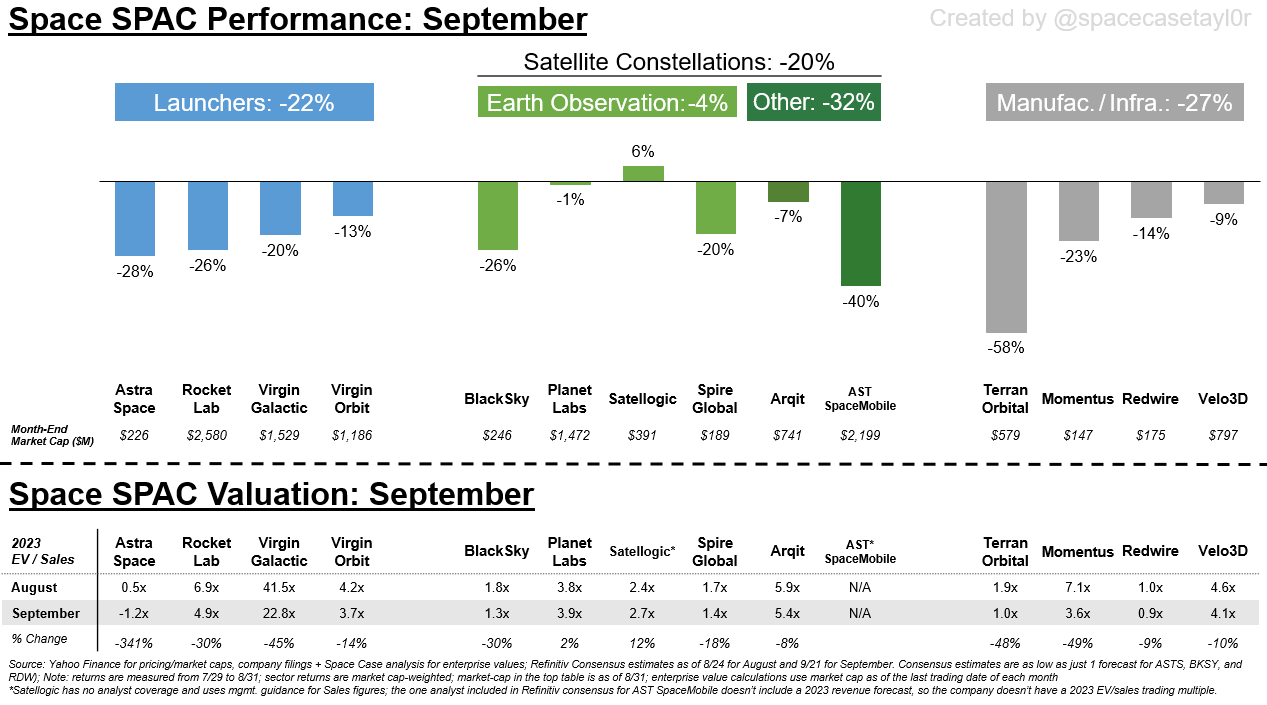

September was a tough month, but Earth Observation (EO) companies fared better than the other space SPACs.

Satellogic was the only space SPAC with positive returns in September—every other space SPAC was negative (though Planet Labs fared the best of the rest at -1%, and traded as high as +32% following a strong 2Q earnings report in mid-September)

It is hard to discern what drove Satellogic’s outperformance given that the company rarely discloses business performance (and isn’t required to do so given its “foreign private issuer” status); however, the company did disclose two new contract awards late in September:

Additionally, Rocket Lab hosted an investor day on 9/21 showcasing 1) progress made since De-SPACing in August 2021, 2) the company’s current roadmap, and 3) development of the company’s next-gen rocket—the Neutron launch vehicle.

This presentation, while executed very smoothly, did not sway investors—Rocket Lab traded down -2.6% the day of its investor day vs -1.7% for the S&P 500; it also traded in-line with other launch peers in September.

Personally, I am not a fan of investor days unless a management team feels that it needs to materially change the narrative on its stock.

I have worked in both sell-side equity research and corporate investor relations, and I have created/attended/listened to somewhere between 10-20 investors days—I have rarely seen a stock trade up after an investor day.

If a company isn’t presenting material new information like an entirely new strategy or technology, investors are likely to be disappointed by what they do hear.

For the space SPACs, I can understand management teams wanting to get in front of investors as often as they can to raise awareness about their company + future plans—however, I think it is likely a better use of management’s time to focus on attending investor conferences and participating in group meetings and/or fireside chats to achieve this goal.

Doing so fosters relationships with sell-side analysts by helping them get paid via corporate access, and it provides management with direct access to the investors who attend these events (which is important given that the SPACs are still in the process of establishing institutional long-term shareholders).

VALUATION COMMENTARY

I’ve pivoted my valuation multiples to 2023 revenue vs 2022 revenue prior.

Investors value companies with multiples based on forward-looking expectations—normally they would make the pivot to the next year’s estimates in July, but I decided to wait until all the space SPACs reported 2Q earnings (Planet Labs was on 9/12).

Overall, no big changes after switching to 2023—of course the actual multiples changed, but within each category the rankings stayed roughly the same:

Rocket Lab trades at a premium to other launchers at 4.9x vs the group median of 3.7x (ex-SPCE, whose valuation multiple doesn’t matter because it isn’t generating meaningful revenue in 2023).

Planet Labs trades at a premium to other EO companies at 3.9x vs the group median of 2.1x.

Velo3D trades at a premium to other manufacturing/infrastructure companies at 4.1x vs the group median of 2.3x.