December Space Stock Review

Topic of Interest: MAXAR-mizing Value…Read-throughs from Maxar's Acquisition

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 December + 2022 Market Overview

✍️ Space SPAC Performance and Valuation

🗣️ Topic of Interest: MAXAR-mizing Value…Read-throughs from Maxar's Acquisition

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (1/8/23).

1. DECEMBER MARKET OVERVIEW

2022 ended with a whimper for the space SPACs, as the group ended the year down -70% following a -21% decline in December.

While the broader market also suffered in December due to continued concerns related to inflation/rising interest rates/a potential recession, legacy space outperformed yet again at +1% in December, ending 2022 at +10% (outperforming the S&P 500 by ~30%!!).

Given that over 90% of the market cap in my legacy space index comes from aerospace & defense companies, as Payload Space’s Mo Islam highlighted in his 2022 market review legacy space companies outperformed in 2022 due to “increased demand in response to Russia’s longer-than-expected war in Ukraine and the growing threat posed by China, a military and space near-peer adversary,” (link to Payload’s full 2022 market review).

At the same time, the space SPACs were punished for being unprofitable, capital-intensive businesses that may need to raise additional capital in the middle of a recession next year, in addition to most of them missing their original guidance figures.

Though to be fair, space SPAC underperformance was not unique given that the group traded in-line with the ARK Innovation ETF (which can be thought of as a proxy for tech/growth stocks) at down roughly -70% in 2022; in general, growth stocks suffered in 2022 as rising interest rates disproportionately hurt the valuation of these companies whose profits predominantly lie in the future and are therefore worth less in the present day in a rising rate environment.

Comparing monthly performance over the last 12 months highlights the divergence in performance between legacy space stocks vs the space SPACs in 2022.

YTD performance

Legacy Space: +10%

Space SPACs: -69%

Months of positive/negative returns

Legacy Space: 7mo / 5mo

Space SPACs: 4mo / 8mo

Months of double-digit negative returns

Legacy Space: 1mo

Space SPACs: 7mo

2. SPACE SPAC PERFORMANCE AND VALUATION

December Returns Commentary

It is hard to call out any one trend regarding space SPAC stock performance in December—only 2 companies didn’t see double-digit declines (BlackSky and Redwire) and the only commonality between them is that they both have colors in their names.

Of note in the month however, Arqit Quantum, Planet Labs, and Satellogic all gave us business updates:

Arqit Quantum announced (link) "as a result of further innovation in our technology, we no longer need to build or operate quantum satellites." As a result, I will no longer be including Arqit in my space SPAC writeups.

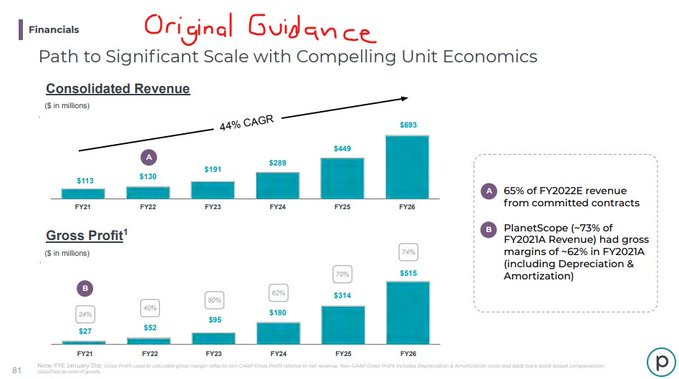

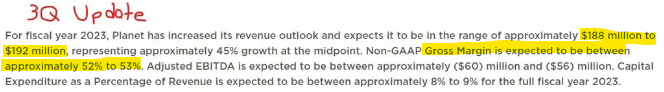

Planet Labs reported 3Q results (link) that beat management guidance across the board and were highlighted by material y/y improvement in both gross profit + EBITDA margins.

Also notably, Planet remains the ONLY space SPAC on track to meet its original SPAC guidance—hats off to the team at Planet for creating a realistic forecast and then executing according to plan.

Satellogic gave its 1st business update since going public (link), with disappointing, but not entirely surprising results financial results given how we have seen the majority of space SPACs miss their original guidance. There were also a number of interesting updates regarding constellation buildout progress/plans, and go-to-market strategy. Key details included:

2022E revenue of $7M (midpoint of range) vs $37M prior guidance

2023E revenue of $40M (midpoint of range) vs $83M prior guidance

Has enough cash to fund 2023 business plans and expects to reach EBITDA breakeven in 2024 (no change vs prior).

26 operating satellites in orbit as of YE22 vs 34 planned by YE22 previously (note: the company has 4 satellites that were launched as part of SpaceX’s Transporter-6 mission on 1/3/23).

Plans to launch up to 21 satellites in 2023, reaching 47 operational satellites by YE23 (which will give the company the ability to remap the Earth every 2 weeks) vs prior expectations of reaching 63 operational satellites by the end of 2023.

While constellation growth is slower than expected, management was keen to highlight that Satellogic’s current satellite fleet is “the largest commercial fleet of sub-meter resolution satellites in the world with the largest daily data collection capacity [6.2M^2 km daily].”

Established a new business line, Space Systems (satellite sales), that will allow Satellogic to sell satellites directly to select customers where satellite ownership is important (with <8mo build-to-launch cycles).

Highlighted deals to serve the Albania, Ukrainian, and Mexican governments with this sovereign earth observation service.

Struck partnerships with key distribution and EO analytics/insights players (Palantir, AWS, Ursa Space, Kleos Space, Astraea, SkyFi, Up42, and more).

2022 Returns Commentary

In reality, the SPAC “winners” in 2022 were still losers.

Planet’s -29% and AST SpaceMobile’s -39% still underperformed the S&P 500’s -19%; meanwhile most space SPACs lost somewhere in the range of -60% to -70% of their market cap.

Looking at subsegments, earth observation SPACs outperformed launchers and manufacturing/infrastructure companies.

This makes sense to me in the context of earth observation companies steadily growing revenue, marching toward profit breakeven, and having a diversified revenue stream backed by counter-cyclical spending from the US government…

…while the launchers aren’t scaling as quickly as desired (and are diversifying away from launch in the case of Rocket Lab) and the manufacturing/infrastructure SPACs are the most likely to be impacted by a recession.

Valuation Commentary

The biggest trend that stuck out to me this month was how Satellogic’s valuation changed after it reported earnings:

SATL valuation doubled in December not because the stock price went up, but because 1) management decreased their 2023 revenue outlook by -50% (i.e. lowered the denominator of their enterprise value / sales multiple); and 2) I updated my enterprise value calculation for the company’s expected YE22 cash balance (this resulted in my calculation for SATL’s EV to increase, which increased the numerator of their EV/sales multiple).

SATL shares did decrease -31% following its guidance revision, but I believe the stock has additional room to decline given that SATL probably shouldn’t be trading at a higher multiple than Planet Labs.

If SATL had the same 3.0x multiple that PL was trading at the end of December, then SATL shares would be at $2.22 or -36% lower than on 1/6 (last trading day before I published this post).

3. TOPIC OF INTERST:

MAXAR-mizing Value…Read-throughs from Maxar's Acquisition

M&A szn is upon us.

Initially I was very surprised by Maxar’s unexpected acquisition announcement in mid-December, but the more I thought about it, the more it made sense.

Near-term: Hedging the Legion Constellation Buildout

Since 2021 one of the major negative catalysts for Maxar’s stock has been the numerous delays in its Legion satellite program; specifically, the initial launch has been pushed back 4x since 2021 (from September 2021 to 2Q22 to September 2022 to 4Q22 to January 2023).

This slippage is notable because Maxar has taken on quite a bit of debt to build these satellites (its >5x debt/EBITDA rating has led to “B” credit ratings from rating agencies; B-rated credit is generally considered high risk). Delays in launching the Legion satellites has meant delays in their monetization and delays in paying off Maxar’s debt.

No doubt, public market investor concerns regarding Legion delays and Maxar’s debt have put pressure on company management. By securing a deal to go private, Maxar can now focus on the execution of building out its Legion constellation without having to worry about distractions from public market investors.

Additionally, a key component of this deal is the 60-day window allowing Maxar to shop for a better offer, which effectively hedged the buildout of its Legion constellation.

Conveniently this timeframe ends February 14, which is after the long-awaited initial launch of the 1st two Legion satellites, currently slated for January 2023.

If this initial mission goes according to plan, the success should force potential buyers to increase their bid for Maxar.

Given that Legion is a key component of Maxar’s growth plans, I imagine a strategic investor (i.e. an aerospace & defense prime or big tech) wouldn’t come in over-the-top with another offer until they confirm that this 1st mission is completed successfully.

On the other hand, if for some reason the initial mission isn’t successful or needs to be furthered delayed, Maxar has protected its downside risk with the Advent deal already in place.

Long-Term: Focus on Technology and Product

As part of the deal announcement Maxar and Advent emphasized plans to accelerate investment in next-generation satellite technologies and data insights, as well as strategic M&A. These types of long-term investments are understandably more easily done while private than while public, given less acute pressure from investors on specific timing and magnitude of returns and capital requirements.

Given Advent’s focus on serving the US government ($28B invested across defense, security and cybersecurity sectors over the last three years), it seems safe to assume that any technological or product investments Maxar makes will be dual-use, and it also makes sense that Maxar will look to partner or combine with other Advent portfolio companies that have experience serving satellite and defense platforms.

Investing in 3D Capabilities

The deal press release specifically highlighted advanced machine learning and 3D mapping as potential areas of investment. This matches up with Maxar’s strategy prior to the deal, where it has acquired or partnered with various companies over the past few years to bolster its 3D capabilities:

In 2022 Maxar acquired Wovenware “to bolster ML and 3D data production capabilities” and it partnered with Blackshare.ai to “extend 3D geospatial capabilities”

In 2020 Maxar acquired Vricon, “a leader in satellite-derived 3D data for defense and intelligence markets”

This quote from Maxar’s 3Q earnings call in November illustrates why the company is so committed to strengthening its prowess in 3D:

“We see the world shifting from operating in a 2D paradigm on flat screen devices…to 3D immersive technologies like augmented reality AR, virtual reality, VR and digital twin simulations that mimic the physical world…often referred to as the Metaverse….we see an opportunity for our 3D digital twin of the earth to be the reference globe for this shift in technology from 2D to 3D. Immersive 3D applications need an accurate version of the world to use as a basemap, just as the 2D mapping applications do today with our Vivid basemaps.”

The Price is Right?

The 129% premium Advent paid is eye-catching, but doesn’t seem crazy when you take a step back:

Maxar was trading near 2yr-lows at the time the Advent deal was announced (~$23/sh before deal announcement vs $18/sh in September)

The Advent deal’s $53/sh buyout is in-line with early 2021 highs achieved right before the Fed began its current rate hikes.

Taking this into consideration, I actually think Advent got a pretty good deal.

Additionally, Advent is clearly a believer in investing in counter-cyclical, dual-use technology given its existing portfolio (remember, its invested $28B in dual-use tech over the last 3yrs); by purchasing Maxar, it is acquiring an industry leader with established relationships within the US government in a fast-growing sector that that fits within the dual-use mandate and is far from maturity.

Some would argue that paying 3.3x for Maxar’s low/0-growth revenue doesn’t make sense given that Planet was also trading at ~3x around the time of the deal and it has materially more revenue growth than Maxar does; however, I would note that private equity is all about harvesting returns from already profitable businesses and Maxar is already a profitable business (both EBITDA and FCF) while Planet is not—buyer intent matters.

Space SPAC Read-throughs

While the Jefferies note in the tweet above states that this “deal points to the attractiveness and opportunities in space (which have been discounted by the public markets) and ongoing consolidation which could occur as opportunities materialize,” I would caution investors thinking that all space SPACs are set to see a bump in valuation any time soon.

As I’ve highlighted before “survival is a necessary prerequisite for growth” (a quote actually attributable Lux Capital GP Josh Wolfe), and only SPACs set to survive the next 12-24mo will get to benefit from improving public market sentiment on space companies—this suggests that only Planet Labs and Rocket Lab are in a safe position to benefit from improving investor sentiment in the future given their strong balance sheets and improving profitability (link to prior analysis).

Additionally, Maxar received a premium valuation because of who was buying it—a strategic private equity investor that prized acquiring a leading and profitable space company that serves the US government.

When thinking about potential space SPAC buyout candidates, it is hard to imagine that they would receive material premiums vs today’s trading levels since they will probably be having to choose between takeover offers, going bankrupt, or extreme equity dilution.

The one upside for BlackSky / Satellogic / Spire Global is that if there is a bidding war for Maxar following its successful Legion mission in January, then remaining public EO companies could see acquisition interest. I say BlackSky / Satellogic / Spire Global and not Planet Labs because the former three companies have legitimate bankruptcy concerns when looking at the next 12-24mo, while Planet Labs has >$400M of cash on its balance sheet and probably isn’t interested is being acquired right now.