Winter is Here—Which Space SPACs will Survive?

A Framework for Identifying Space Companies That Will Survive A Macroeconomic Winter

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or investment recommendations; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS and SPIR at the time of this post, 8/4.

BUFFETT’S BAD ADVICE

“Be greedy when others are fearful”

- Warren Buffett

Investors looking to make money in a down market often refer to the classic Warren Buffet quote above; however, without a proper framework for evaluating potential investment opportunities, you are more likely to carelessly lose money than you are to make it.

Investing in a down market requires a shift in mindset.

In addition to focusing on growth potential and a good story, we must consider if a company can survive the oncoming economic winter, meaning “can the company I want to invest in survive without having to raise more capital in the next 12-18 months?”

“SURVIVAL IS A NECESSARY PRECONDITION FOR GROWTH”

The quote above from Josh Wolfe, Co-Founder & Managing Partner of Lux Capital, inspired me to more closely analyze the space SPACs with the goal of determining which of them will survive the next 12-18 months of potentially volatile macroeconomic conditions and achieve the long-term growth their leadership teams speak of.

The space SPACs are some of the best capitalized space companies in the industry, and they provide us with quarterly updates on financials and strategic outlook.

Armed with this information, we can analyze which of these companies are in a position to not only survive the economic winter, but emerge on the other side stronger than before…and which will potentially freeze to death (bankruptcy), or be eaten by predators (be acquired).

This knowledge is what can give us the confidence to be “greedy when others are fearful.”

In this post we will explore the following:

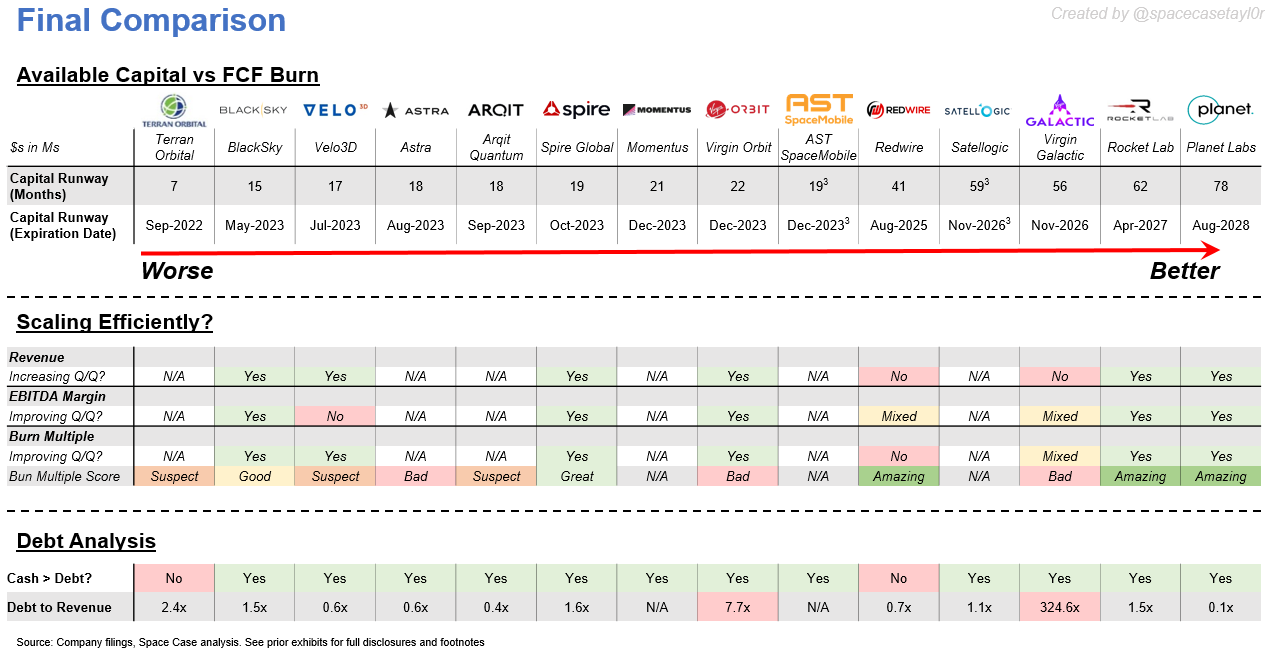

Total available capital vs Free Cash Flow (FCF) burn rate

Management commentary on cash position and cash burn

Execution on the path to profitability

Debt and solvency

While there are many other factors that we could consider when evaluating space SPAC survival chances, I believe the revenue and growth stories are already well understood, while the above factors have not received as much attention—thus we will limit our focus.

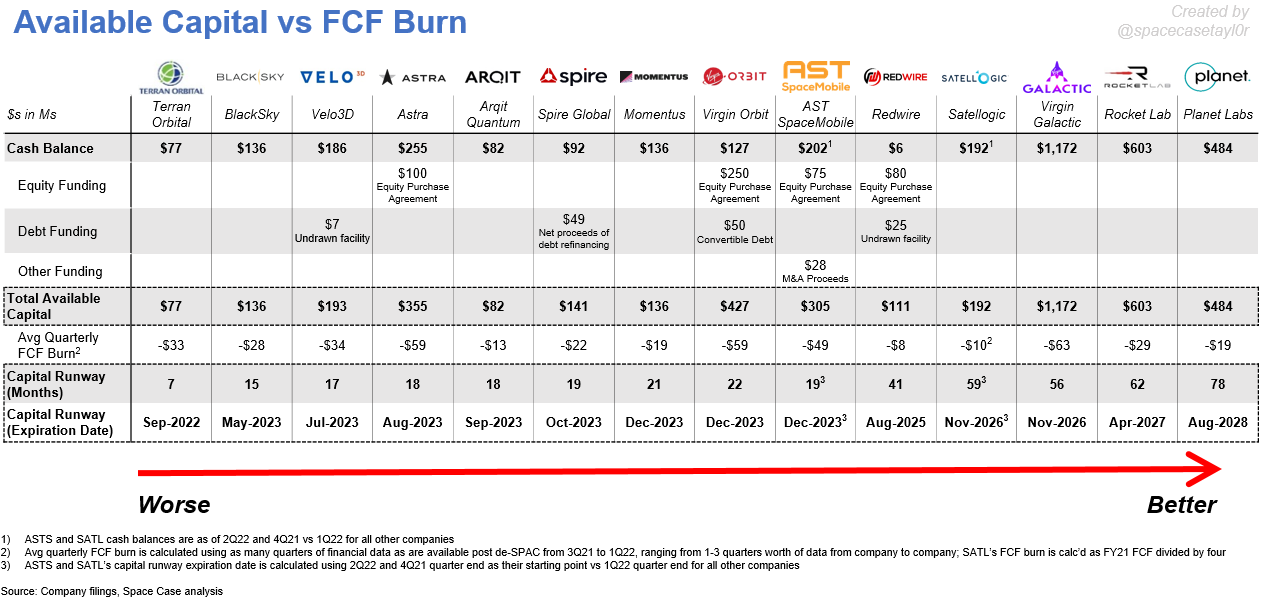

TOTAL AVAILABLE CAPITAL VS BURN RATE

The space SPACs are not cash flow positive (except Redwire, which is hovering around breakeven)—this means that each quarter their cash balances are declining.

Therefore, the most important analysis we can do is to compare each company’s cash balance + other sources of capital (such as proceeds from pending asset sales, unused debt financing, or from an equity purchase agreement (i.e. a deal where the company has a guaranteed buyer if it wants to sell more stock to raise money)) vs their average FCF burn to determine their capital runway, or the amount of time their current available capital will last.

For this exercise I will define FCF as operating cash flow minus capex (both taken straight from the balance sheet).

Operating cash flow is cash used (or generated) in the company’s day-to-day operations.

Capex is cash used to for the purchase, improvement, or maintenance of long-term assets.

For space companies this refers to cash used for things such as purchasing/developing manufacturing facilities, building satellites, etc.

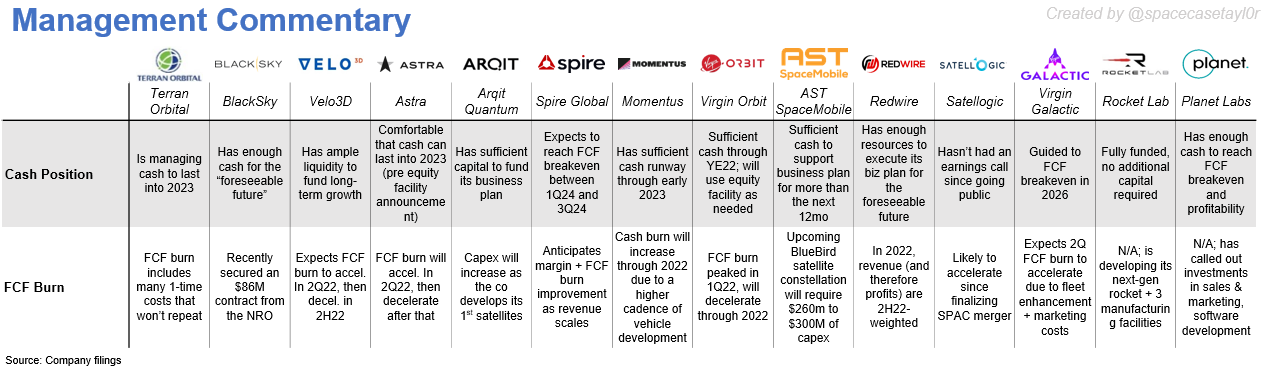

The table above is helpful to summarize what recent past performance suggests the capital runway is for the space SPACs…but a more complete picture takes into account future expectations from each company’s management teams.

Key Takeaways

Planet Labs and Rocket Lab each have capital runways and management commentary that strongly suggest they have enough cash to last for years—they are in a position of strength going into this recession/period of inflation and rising interest rates.

Meanwhile Terran Orbital, Astra, Momentus and Virgin Orbit management commentary doesn’t quite line up with my projected capital runways:

Terran Orbital expects its capital to last into 2023 vs my 3Q22.

Momentus speaks to an early 2023 cash runway vs my 4Q23.

Virgin Orbit and Astra both speak to cash lasting through 2022/into early 2023 which doesn’t align with my estimated longer capital runways.

However, this is because each company has raised money since their 1Q22 earnings calls ($50M and $100M, respectively), and their commentary is now stale.

Spire Global and Virgin Galactic have differing capital runways, but each of their management teams have drawn a line in the sand and put forth explicit timelines for when they expect to be FCF breakeven—statements of confidence for their long-term financial outlook.

I am inclined to give more credence to Spire’s statement relative to Virgin Galactic, given the latter’s consistent disappointing execution and inability to stick to operational timelines.

BlackSky and AST SpaceMobile both have estimated cash runways expiring during 2023 and both have clearly changing circumstances that may affect cash burn in the future:

BlackSky’s 10-year National Reconnaissance Office EOCL contract for minimum $86M (awarded post 1Q22) likely bolsters its financial positioning.

ASTS’ FCF burn thus far has included impact from development of its BW3 test satellite which is set to launch in 3Q22; going forward, I believe FCF burn will accelerate given that the company’s focus will then pivot to manufacturing and launching its constellation of 20 BlueBird satellites, which is expected to cost between $260M to $300M in total.

I am inclined to believe the BlueBird construction process will come in at the high end of its estimated range (or higher) given the gradual cost creep during the BW3 preparations.

Note: BW3 construction costs increased from an initially projected $66M to $83M in total through 1Q22, and will likely continue to incur more costs until launch in 3Q22.

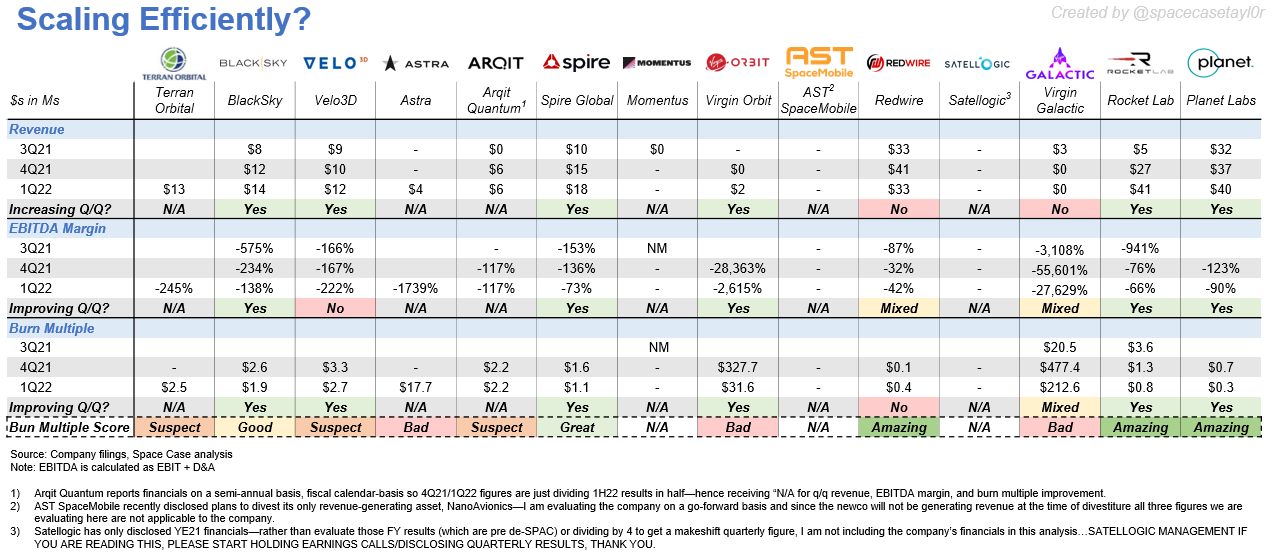

EXECUTION ON THE PATH TO PROFITABILITY

In addition to analyzing capital runway, we must examine which space SPACs are actually moving toward profitability.

Actions speak louder than words. We cannot simply take management’s word that they will be profitable by X year or in Y months—let us measure if they are actually losing less money (on a relative basis) as they scale!

This can be shown by:

Growing revenue quarter-over-quarter

The space SPACs are small enough where seasonality shouldn’t materially impact revenues / their revenue opportunity is large enough that I would expect AND want to see sequential growth in revenue.

Sequential improvement in EBITDA margins

I don’t expect the space SPACs to be profitable overnight, but progress towards breakeven profit margins would be strong evidence that management is growing their businesses in an efficient manner.

Sequential improvement of Burn Multiple (i.e dollars of FCF burned per dollar of revenue generated)

Burn Multiple (a term coined by investor David Sacks in an April 2020 substack post) is a way to measure how efficiently an unprofitable company grows its revenue.

Winners

Rocket Lab and Planet Labs display sequential improvement for all three metrics, and score “amazing” on the Burn Multiple scale.

Spire Global displays sequential improvement for all three metrics, and scores a “great” on the Burn Multiple scale—not quite a perfect score, but very good nonetheless.

This is a sign that management could indeed hit their 1Q24 to 3Q24 FCF breakeven goal.

BlackSky shows sequential improvement for all three metrics, and has a “good” Burn Multiple—I am interested to see if this score improves following the NRO’s EOCL contract, which may or may not cause the company to incur engineering costs to implement/scale with the NRO.

Virgin Orbit only has two quarters worth of info, but it is off to a good start with sequential improvement for all three metrics; however, it has a “bad” Burn Multiple—the former is an encouraging sign, but there is a lot of fat to trim on that Burn Multiple of $32 and its EBITDA margin is horrible. Something to keep an eye on going forward.

Losers

Virgin Galactic did not show steady sequential improvement with any of the metrics examined, and had a “bad” Burn Multiple.

Given that this is basically a pre-revenue company, I’m not sure this is a fair analysis—the only figure that really makes sense to look at is 3Q21 Burn Multiple, since the company technically completed a sub-orbital flight that quarter and recognized revenue. However, a $21 Burn Multiple is still…“bad”

Redwire did not show steady sequential improvement with any of the metrics examined, yet it had an “amazing” Burn Multiple.

This is not totally surprising—Redwire garners a significant amount of its business from government agencies, and with the federal government operating via a continuing resolution for much of the year the company’s revenue growth has been pushed later and later into 2022.

We know that Redwire is already the company closest to operating at breakeven levels today (it has posted positive EBITDA in the past)—hence the “amazing” Burn Multiple—but because its revenue generation is lumpy it is not consistently improving revenue, EBITDA margin, and Burn Multiple.

Terran Orbital, Astra, and Arqit Quantum did not have enough info to look at sequential financial performance, but they all did poorly with the Burn Multiples that we could calculate

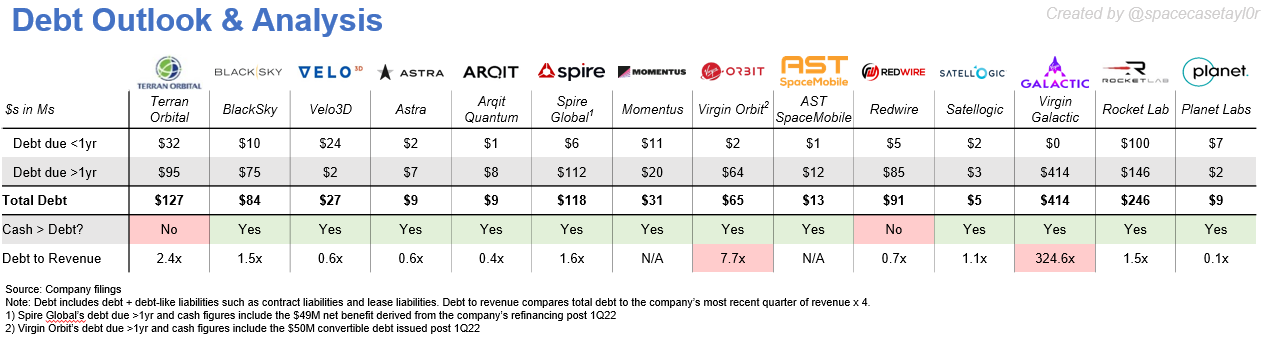

DEBT AND SOLVENCY

Last but not least, is debt.

If a company goes bankrupt, debtholders have priority on claims on the remaining business while equity shareholders do not.

While few of the SPACs have enough debt for this to be a worrisome topic, this would be an incomplete analysis without looking into debt.

KEY TAKEAWAYS

As suspected, debt is not an overwhelming issue for the space SPACs—only Terran Orbital and Redwire don’t have the cash on hand to cover all their debt, though the latter has an equity purchase agreement that would cover nearly all of its $91M in debt

Virgin Orbit and Virgin Orbit both have stretched themselves thin in terms of how many turns of revenue it would take to pay off their debt (calculated as total debt / (the last quarter of recorded revenue x 4))

Virgin Galactic is pre-revenue, so that explains their outrageous figure.

Virgin Orbit’s 7.7x revenue figure should improve as it scales operations, but it is still very high for any type of company—let alone an early-stage space startup.

OVERALL CONCLUSION

Let’s tally the score

Keeping in mind our mantra of “survival is a prerequisite for growth,” we want to see companies with:

Solid capital runway (lasting beyond 2023)

Efficient scaling (i.e. sequential improvement in the metrics we focused on + a “good” or above burn multiple)

Cash > debt, and debt to revenue at most ~2x

Tier 1 (3 for 3 meeting all the criteria above)

Rocket Lab and Planet Labs

This is no surprise. Before doing this research I could have told you that these two companies would perform the best in these analyses.

This is partly because they are the most mature companies of the space SPACs, but also because they have the best management teams that are considering all of the points we made in this post about focusing on efficient growth.

Tier 2 (2 for 3 meeting the criteria above)

Spire Global and BlackSky

The one criteria each of these companies miss out on is capital runway lasting beyond 2023.

While Spire Global management is confident enough in their business outlook that they have guided to FCF breakeven by a specific point in time, the outlook for BlackSky is less certain—either revenue growth needs to pick up, the company needs to grow costs at a decelerating rate, or management needs to raise additional capital. The current pace of operations is not sustainable.

Tier 3 (1 for 3 meeting the criteria above)

Velo3D, Astra, Arqit Quantum, Momentus, AST SpaceMobile, Redwire, Satellogic, Virgin Galactic

From the perspective that we used in this analysis—are the space SPACs growing efficiently? (“survival is a prerequisite to growth”)—these companies are mostly missing the mark.

While this may change as they further scale their businesses—space companies are notorious for prolonged “valley of death” periods with low revenue and high capital outlays, which makes me wary of these stocks.

Tier 4 (0 for 3 meeting the criteria above)

Terran Orbital

I am less concerned about Terran Orbital’s “suspect” Burn Multiple, and more concerned about the company’s relatively higher levels of debt and relatively lower levels of cash on hand.

Management would likely state that the company’s contracts for Tranche 0 and 1 of the Space Development Agency’s Transport Layers will provide enough capital to keep the lights on, but I think the CFO’s job is going to be very tough in the near-term given available capital vs recent FCF burn (which to be fair was likely abnormally high due to one-time costs associated with going public).

GOING FORWARD

Regardless of your outlook for the capital markets, the framework we just reviewed is a useful tool for identifying growth companies (public or private) that are best-positioned to survive difficult macroeconomic times and emerge stronger on the other side—hopefully it can give you the confidence to “be greedy when others are fearful!”

Really useful thanks. But planet is down 65% since SPAC. RL is down 60%. Effectively you're saying they've been unfairly punished 😎

Hi, i would like to exchange thoughts with the author. Any suggestions how i do that