Starlink: Is This Time Different?

Despite similarities to past LEO satcom ventures, Starlink is on the verge of history by avoiding bankruptcy

Hello fellow space enthusiasts! 🚀

📖 This post was inspired by reading “Eccentric Orbits: The Iridium Story,” a book about the most famous failure in the history of the space industry

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. All information in this post is either publicly available or based on Space Case estimates. Please do your own research before investing.

Starlink is unusual in the world of satellite communications (satcom) because it hasn’t gone bankrupt.

Early satcom businesses in the 1960s-80s almost entirely used geostationary (GEO) satellites to deliver radio communication, broadcast TV, telephony, and eventually internet connectivity to places terrestrial networks either couldn’t economically build out to (i.e. rural and remote locations) or couldn’t reach at all (maritime, in-flight, etc).

This changed in 1987 when Motorola proposed the Iridium system, the first low earth orbit (LEO) satcom network, which promised better performance than GEO systems.

While Iridium is a profitable, multi-billion dollar business in the present day, in 1999 the company defaulted on $1.5B of debt and was forced to file one of the largest bankruptcy claims in US history (at the time).

Iridium is not alone in its early failure—all major attempts to build LEO satcom businesses have failed at first, except for one: Starlink

Unless you have been living under a rock, you have definitely heard of Starlink (SpaceX’s satcom business)—and for good reason:

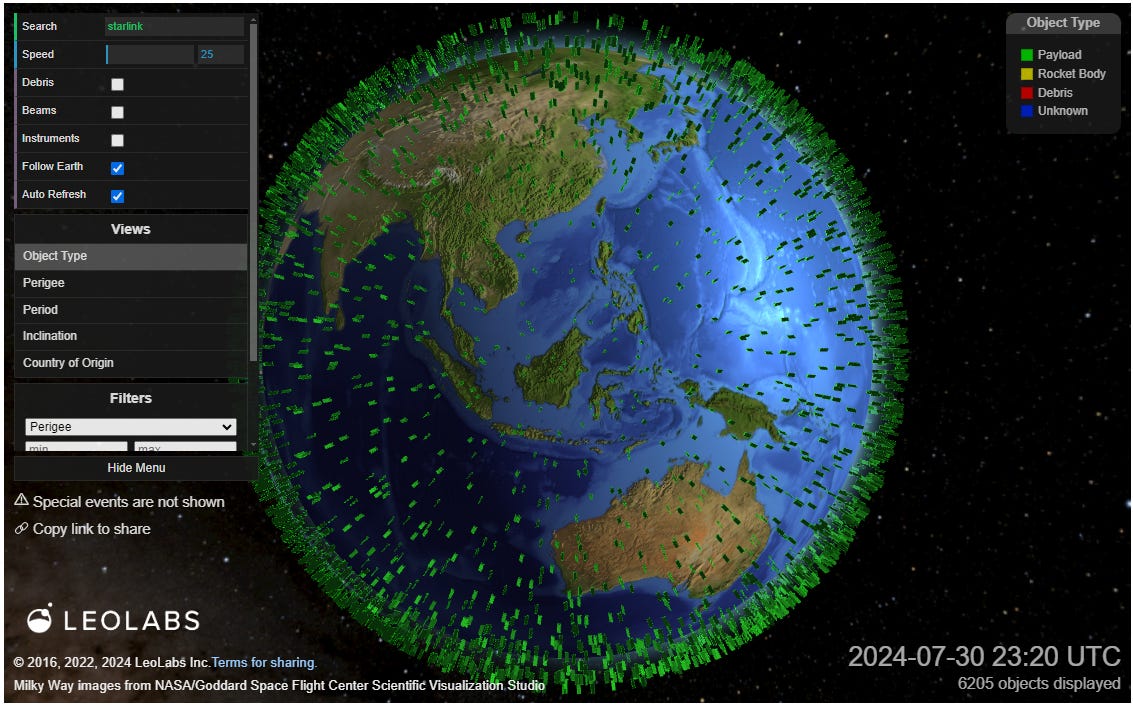

Starlink’s 6,215 satellites on orbit represent 60% of all satellites currently orbiting the earth (as of 7/26/20241)

Since debuting commercial service in 2020, Starlink has amassed over 3 million users and is targeting $10 billion of revenue in 20242

SpaceX’s valuation growth from $10B in 2015 (the year Starlink was announced) to $210B3 as of July 2024 has mostly driven by the growth of Starlink (I believe Starlink accounts for at least $150B of SpaceX’s total $210B valuation, if not more)

However, as a student of history and knowing what has happened to LEO satcom ventures of the past, I can’t help but question Starlink’s future since believing it can become a viable business without failing at first requires you to utter the four most dangerous words in investing: “this time is different.”

Is Starlink set to repeat history and go bankrupt before emerging as a viable LEO satcom business? Or will it buck the trend and become the first LEO satcom company to build a self-sustaining business from the beginning?

In this post, we will answer the question “is this time different?” for Starlink by discussing the following:

Why Build a LEO Satcom Business?

What Went Wrong with Past LEO Satcom Ventures?

Is this time different for Starlink?

Conclusion

Investor Considerations

1. WHY BUILD A LEO SATCOM BUSINESS?

Early satcom businesses used GEO satellites because they are able to provide consistent service to broad areas of earth.

GEO satellites orbit earth the at the same rotational speed as our planet, making them appear stationary at a fixed position in the sky and thus capable of providing consistent and reliable satcom coverage since ground antennas can be aimed in one direction and don’t have to track the satellite’s motion across the sky

Animation of a GEO satellite orbiting earth (wikipedia)

GEO satellites look like dots in the night sky since they stay in the same place above the earth’s surface 24/7, while stars are constantly on the move relative to the earth’s position (source)

Additionally, GEO satellites are so far away from the earth (nearly 36k kilometers or 22k miles) that one GEO satellite can see up to one third of the earth at a time and three GEO satellites working together can cover nearly the entire earth’s surface

Illustration showing 3 GEO satellites covering the earth (link)

However, the reliability and broad coverage of GEO comes with a price—latency.

Every communications network has latency (the time delay between a user request for data and a server’s response to the request), but GEO satcom is the biggest offender:

Terrestrial cable and fiber networks have as little as 20-30 milliseconds of latency, which is near the limit of the human brain’s ability to perceive change in the outside world

This compares to GEO satcom which has AT BEST 0.5-1.0 seconds of latency; GEO satellites are so far from earth that it takes signals hundreds of milliseconds to physically travel through the network in space

Unlike GEO satcom however, LEO satcom has low latency that is comparable to terrestrial networks (in the range of 30-70ms4); this is because LEO satellites orbit the earth “only” 300km-2,000km (200mi-1,200mi) away vs 36,000km (22,000mi) for GEO

Signals travel ~10x less distance between space and earth in LEO systems compared to GEO systems, and as a result LEO systems have 10x lower latency

[Source for video above is Starlink’s website, link]

However, just like GEO satcom’s broad coverage and reliable service comes with the cost of high latency, LEO satcom’s low latency comes with a cost as well—massive scale needed for global coverage.

LEO satellites are so close to earth that they can only “see” a few percent of the earth’s surface at a time—a global LEO system requires hundred to thousands of satellites for robust service, which adds up to billions of dollars in buildout costs!

[video above visualizes the growth of Starlink’s >6k satellite constellation; video is from Starwalkapp on Instagram, link]

In a world increasingly reliant on high-volume and high-speed communication of data, the latency in GEO satcom systems has rendered GEO basically unusable for applications that require real-time communications (like streaming, video conferencing, online gaming, and other high data rate activities); while building a global LEO system of hundreds to thousands of satellites seems daunting, the potential for creating a global broadband network is an opportunity too alluring to ignore.

2. WHAT WENT WRONG WITH PAST LEO SATCOM VENTURES?

Despite the intimidating scale of what it takes to build a LEO satcom system (billions and billions of dollars), there have been five brave (crazy?) attempts to create LEO satcom businesses prior to Starlink…and each of them failed at first:

Iridium (went bankrupt, but is now a profitable, publicly traded company)

ORBCOMM (went bankrupt, was later acquired by private equity)

Teledesic (returned capital to shareholders and shut down)

Globalstar (went bankrupt, but is now a profitable, publicly traded company)

OneWeb (went bankrupt, and was later acquired by Eutelsat)

Each of these companies had their own unique circumstances, but rather than going through the details of their individual stories in this post (there are books that do this for us, links in the footnotes5) let’s review the four main reasons for their failures:

1. Building Cool Technology vs Solving Real Customer Problems

(Guilty: Iridium, ORBCOMM, Globalstar)

The cardinal sin that Iridium, ORBCOMM, Globalstar committed was focusing too much on technological innovation and not enough on product innovation—they wanted to build a novel communications system instead of building a solution for a known customer pain point in a way that required novel technology. Customers don’t care if your product’s underlying technology is LEO satcom or “magic moon rocks” (link), they just care about solving their problem.

Iridium, ORBCOMM, Globalstar never truly established product-market-fit and they entered bankruptcy because the subscribers they thought would flock to their satellite telephone and low-bandwidth data services didn’t materialize quickly enough to service their debt payments.

Obviously hindsight is 20/20, but in Teledesic co-founder Tren Griffin’s post about Iridium (highly recommended link), he notes that the excitement around Iridium’s new technology led to a “goal-seek” business forecast from the company that justified the costs required to build out the constellation.

Additionally, this case study from Dartmouth’s Tuck School of Business (link) highlighted the mental hoops that Iridium’s stakeholders went through to approve the full Iridium system buildout despite its numerous red flags.

2. Poor Unit Economics

(Guilty: Iridium, ORBCOMM, Globalstar, Teledesic)

Looking back at early LEO satcom ventures from the present day, we now know that the technology needed to economically develop a LEO satcom constellation just didn’t exist in the late 1990s / early 2000s. The Iridium, Globalstar, and ORBCOMM constellations were extremely expensive to build relative to the level of service they could deliver because:

Launch costs were an order of magnitude too high

Satellite manufacturing costs were multiple orders of magnitude too high

Ground equipment technology used in modern day systems (phased array antennas) hadn’t moved beyond military applications yet, so the cost of developing them for commercial applications would have been too high

Teledesic escapes some of my commentary here since the constellation aimed to deliver 100Mbps speed service to customers and was originally projected to cost $9B (implying a buildout cost vs service quality profile similar to that of Starlink), but given that the venture was in large part shut down due to ballooning costs, the $9B build cost estimate clearly turned out to be too optimistic.

There are a TON more details on unit economics of early LEO satcom businesses vs Starlink later in this post to back up my claims, so read on!

3. Taking Too Long to Commercialize

(Guilty: Iridium, ORBCOMM, Globalstar, Teledesic, OneWeb)

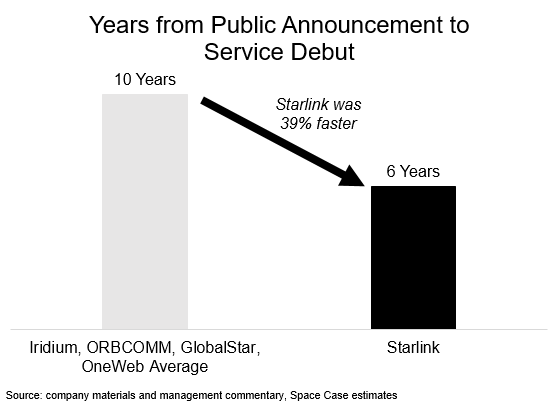

On average, it took the early LEO satcom businesses ~10 years to begin selling service to customers, largely due to regulatory hurdles and manufacturing challenges associated with the newness of LEO satcom as a category:

The communications industry is highly regulated and there was not a set regulatory process for approving LEO satcom systems in the 1990s; businesses like Iridium, Globalstar, ORBCOMM, and Teledesic had to both establish a number of regulatory “1sts” as well as appease legacy communications operators prior to rolling out their service.

Additionally, satellite manufacturers in the 1990s were used to building only a handful of GEO satellites per year—they were not prepared to build 10s of satellites per year for LEO satcom customers, so it took time to get the supply chain established for these new LEO satcom ventures

Unfortunately, this delay between idea conception (early 1990s) and go-to-market (late 90s / early 2000s) played a large role in the downfall of LEO satcom businesses because the rapidly evolving telecommunications market moved on without them:

Iridium, Globalstar, and ORBCOMM had originally been targeting markets that terrestrial networks couldn’t serve (ex. Iridium had infamously based a large portion of its original business model on serving “the traveling businessman”)

However, while the LEO satcom systems were busy getting regulatory approval, building out their supply chain, and then launching their satellites, the terrestrial communications industry experienced significant growth and investment in the 1990s fueled by the expansion of the internet and the introduction of wireless technology (this was a time period known as The Telecom Bubble)

The Telecom Bubble of the 1990s and early 2000s resulted in a massive buildout of terrestrial communications network footprints (both wireless and fixed networks) that ultimately encroached on LEO satcom’s anticipated “unserved markets,” causing LEO satcom offerings to seem both outdated and expensive in comparison—as a result, LEO satcom was relegated to even smaller niche markets when they did roll out service. The companies were unable to generate the returns on investment needed to support their business models

OneWeb is in a slightly different situation given that its quality of service today is semi-competitive with terrestrial (up to 195Mbps downloads speeds), but the company is still guilty of taking too long to move from idea to commercialization (9 years from public announcement to service launch)—OneWeb might have avoided bankruptcy if it had been closer to fully funded when the COVID crisis occurred in 2020, allowing the company to avoid the need to raise capital in terrible market conditions (of course this is easier said than done and hindsight is 20/20)

4. Overreliance on Debt + Capital Markets Volatility

(Guilty: Iridium, ORBCOMM, Globalstar, Teledesic, OneWeb)

Debt is a dangerous tool for any unprofitable business, let alone pre-revenue startups.

Given the slower-than-expected growth for Iridium, Globalstar, and ORBCOMM’s businesses, these companies all filed for Chapter 11 bankruptcy within 3yrs of launching commercial service once it become apparent they wouldn’t be able to make necessary interest payments on the debt they had raised; making matters worse was that these companies went into distress right around the time the Dotcom and Telecom bubbles burst in the early 2000s—market sentiment was absolutely terrible, and investors were not interested in funding these floundering businesses, instead forcing them to be restructured in bankruptcy.

Having operated and attempted fundraising during this difficult period, Teledesic co-founder Tren Griffin put it best when describing how bad market conditions were in the early 2000s:

“One day you could raise billions of dollars to build something like a massive fiber based national or global telecommunications network and the next you could literally not raise 3 cents. Just reading about this shift in the ability of a business to raise new funds is not sufficient to convey how swift the change from internet bubble to internet bust really was. If you went through the internet bubble and its collapse you were forever changed. Your muscle memory is just different than other people who did not have the same experience.”

While Teledesic escaped bankruptcy (I assume because it didn’t raise debt), the company did ultimately close down its operations because of frozen capital market conditions and inability to fundraise.

Similar to the early LEO satcom businesses, OneWeb financed its operations using billions of dollars of debt prior to generating any revenue; also similar to the early LEO satcom businesses, OneWeb management was forced to file for bankruptcy due to frozen capital market conditions in 2020 related to the COVID-19 pandemic damaging the company’s ability to fundraise.

3. IS THIS TIME DIFFERENT FOR STARLINK?

I think this time is DEFINITELY different for Starlink because unlike prior LEO satcom attempts:

Starlink has materially lower launch, satellite, and ground equipment costs

Starlink’s service is competitive with existing communications services

Starlink has rapidly built and monetized its technology

Elon Musk (and therefore SpaceX/Starlink) can raise capital at will

1. Starlink Has Materially Lower Launch, Satellite, and Ground Equipment Costs

Lower Launch Costs

SpaceX has disrupted the space industry with its partially reusable Falcon 9 rocket offering customers all-time low pricing for launch service (expressed in dollars per kilogram); however, Starlink is the only satellite operator truly reaping the game-changing cost benefits enabled by high cadence, reusable rockets6

External SpaceX customers can purchase a ride to LEO on a Falcon 9 rocket for $69.75M or $3,170/kg7

But Starlink is part of SpaceX, so there is no markup on Falcon 9 launch pricing and Starlink satellites are launched at-cost; as a result, Starlink “pays” $28M8 or $1,591/kg per mission on a Falcon 9 rocket

Compared to the failed prior LEO satcom businesses, Starlink’s launch cost advantage is even more dramatic:

Compared to the earliest LEO satcom businesses (Iridium, Globalstar, and ORBCOMM), Starlink’s launch costs are ~10x lower than what they paid for launch (on a $/kg basis)

Compared to OneWeb (a good proxy for modern day LEO satcom businesses not exclusively using SpaceX for launch), Starlink’s launch costs are 80% lower on a $/kg basis

Going forward, Starlink’s launch costs should continue to decline as SpaceX’s rocket technology becomes even more efficient; SpaceX’s next-gen Starship rocket could enable Starlink launch costs in the $500-$100/kg range in the future vs just under $1,600/kg today in 2024.

Lower Satellites Costs

In general, all electronic devices have benefited from Moore’s Law, the 1965 prediction from Intel co-founder Gordon Moore that microelectronics would steadily become more cost efficient and enable smaller and smaller electronics to become more and more powerful.9

However, not only have smaller and more cost-performant microelectronics allowed your iPhone to pack more compute capability into its 6-inch body than the entire Apollo rocket had when it launched men to the moon in 1969, but satellites today are more cost-performant than ever thanks to Moore’s Law enabling aerospace engineers to build more computing capability into smaller satellite form factors.

This is especially important for LEO constellations since they require hundreds to thousands of satellites—operators need to carefully balance the relationship of each satellite’s processing power vs manufacturing cost and mass (which influences launch cost)10.

To measure how much Moore’s Law has benefitted satcom technology cost-performance since the 1990s / early 2000s, we will analyze two key satellite unit economic metrics:

Manufacturing cost per bit ($ / bit): this metric compares a satellite’s manufacturing cost vs its data transmission bandwidth; cost per bit represents the expense of transmitting a single bit of information through the satellite—a lower cost per bit figure is better!

Link to the Quilty Space Starlink presentation where I sourced my Starlink satellite manufacturing cost estimates from (link) The difference between the cost per bit of the satellites made in the 1990s (Iridium is the only company we have solid data for) and the satellites made in the 2010s/2020s (OneWeb, Starlink) shows the impact of Moore’s Law improving the cost efficiency of satellite microelectronics over the last 20+ years

The difference between OneWeb’s cost per bit and Starlink’s cost per bit can partially be explained by Starlink’s vertical integration, where the company builds its satellites in-house and aggressively focuses on reducing costs by simplifying its supply chain and using the cheapest components possible that still meet mission requirements; this compares to OneWeb outsourcing its satellite manufacturing to a legacy space prime (Airbus) that captured some margin of profit on top of what it charged OneWeb (and with Airbus’ supply chain vendors charging their own profit margins on top of that). Starlink’s satellites also benefit from economies of scale, since the company has built more than 10x the number of satellites that OneWeb has (over 6,000 for Starlink vs over 600 for OneWeb). The combination of these two forces has resulted in Starlink’s satellites being ~10x more cost performant than its LEO satcom competitor, OneWeb.

Throughput per kilogram (bit / kg): this metric shows how effectively a satellite's mass is used for data transmission, which is critical for minimizing launch costs—a higher bit per kilogram figure is better!

Using bits per kilogram, it is again very clear to see how modern LEO satcom satellites are more cost-performant than older LEO satcom satellites (again, we only have reliable data for Iridium) thanks to Moore’s Law improving the mass efficiency of satellite microelectronics over the last 20+ years

We can also see that Starlink satellites are more mass efficient vs OneWeb satellites, but the advantage is not as great as it was with cost per bit; we note that Starlink is already launching its 3rd iteration of satellites (v2 mini) and its fourth gen satellite (v3.0) should be launching within the next year—this rapid rate of innovation has given the company more chances to improve its satellite’s performance to mass ratio relative to OneWeb (which is still on its 1st generation satellites, and has paused development of its 2nd generation satellites for the time being)

Lower Ground Equipment Costs

Although ground equipment isn’t as sexy as satellites and rockets, a satcom system isn’t worth anything without terminals that connect users to the network; additionally, group equipment plays a crucial role in the business model for satcom systems because they usually accounts for a significant portion of satcom system total costs.

We can’t compare Starlink ground equipment costs vs prior LEO satcom ventures due to lack of reliable data, but focusing on just Starlink, we can see that the company has quickly reduced the financial burden of manufacturing its ground equipment:

When Starlink first debuted in 2020, user terminals cost the company $3,00011 to manufacture vs the dishes being sold to customers for $599; there was clearly a strong need to reduce this cost, since no company can provide a $2,401 subsidy to customers indefinitely

By April 2021, Starlink had reduced terminal costs by 50% to ~$1,50012; while this represented significant progress, the company was still heavily subsidizing terminal manufacturing since the dishes were still being sold to customers at $599/terminal

However, in September 2023 Starlink announced that the cost to manufacture user terminals had finally been reduced to under $59913 so that the company was no longer subsidizing user equipment

In the present day of August 2024, Starlink is now offering its standard user terminal for $499/terminal (at least in the US); the $100 lower sales price vs late 2023 potentially reflects further reductions in terminal manufacturing costs, with the company passing along cost savings to customers.

2. Starlink Service is Competitive with Existing Internet Service Providers

Starlink originally targeted providing internet connectivity to rural areas primarily served by GEO satcom or low-quality terrestrial internet service providers (i.e. non-fiber offerings); with over 3M users 3-4 years after debuting commercial service, it is clear the market likes Starlink’s service…and we believe the company is no longer satisfied with just serving rural markets.

Starlink internet service quality varies by subscription tier and geographic location, but most customers receive >100Mbps download speed and <100ms latency service.

The standard pricing for fixed (i.e. not mobile) internet for US customers is $120/mo (+$299-$499 in upfront equipment fees); international subscription pricing and equipment fees vary greatly by country, but are generally <$100/mo and $250-$499 for equipment (link).

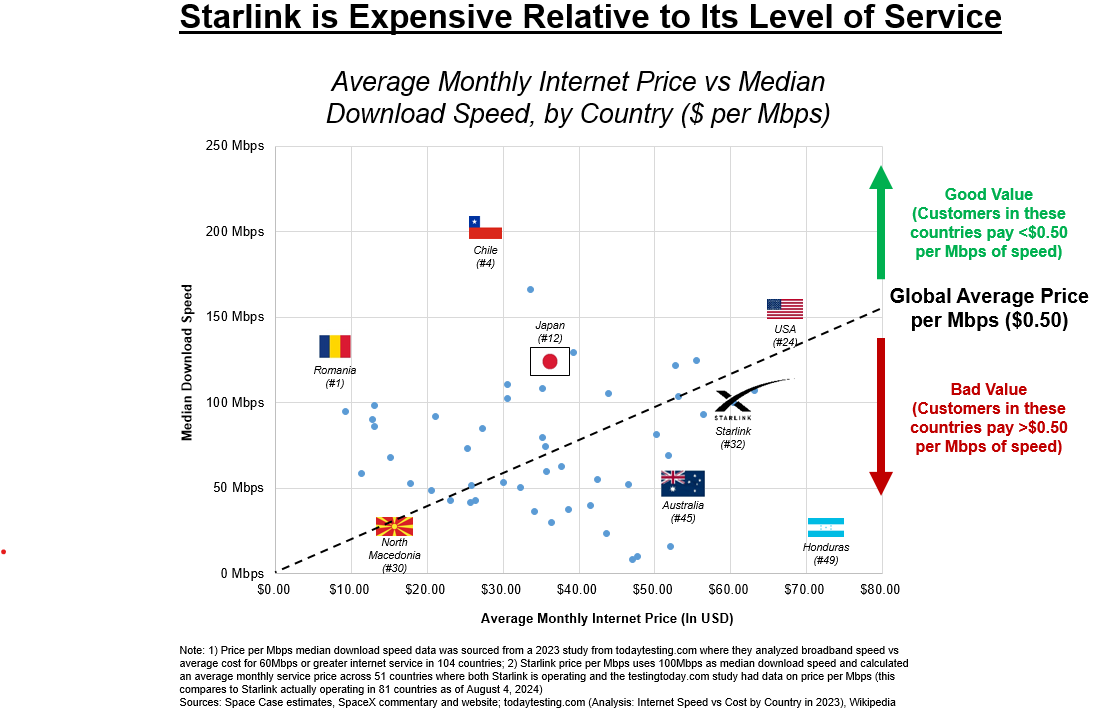

These are expensive prices relative to the level of service delivered—when looking at monthly service price vs median download speed ($ / Mbps), Starlink generally ranks worse than most terrestrial broadband providers14 (and this metric doesn’t take into account the upfront fees required to purchase Starlink’s necessary satellite dish + router equipment, which is often several hundred dollars)

Similar to the cost per bit metric we looked at in the prior section, price per Mbps is a cost-performance metric that looks at monthly price charged to customers vs Mbps of median download speed

Link to the todaytesting.com study on $ / Mbps (link)

However, despite this, Starlink’s quality of service is generally better than competition in the rural markets where it has initially gained traction (see below image); as a result, users have been willing to fork over the extra cash for its service

Going forward, Starlink is likely planning to graduate from dominating less competitive, but small rural markets and will increasingly look to compete in larger, but more competitive suburban and urban markets.

While this would suggest Starlink needs to materially improve its service quality to deliver median download speeds of at least 200Mbps before it can compete with Fiber + Cable (see image above), we believe the company will instead likely balance discounting either user equipment (which we are already seeing) or monthly service fees (as we’ve seen the company do in non-US markets) to win market share:

We have seen other internet service providers successfully utilize this discounting strategy in the United States where Verizon and T-Mobile have captured ~100% of broadband industry subscriber growth for the last several years via their fixed-wireless products (i.e. in-home internet delivered via the company’s wireless service instead of a wired connection) which offer lower speed internet (100Mbps - 200Mbps median download speeds) at a lower prices ($30-$50/mo)

Starlink will probably look to avoid lowering its monthly service price where possible and will instead tempt customers with equipment discounting (which it is increasingly able to do as the manufacturing cost of its terminals continues to decline)

However, at some point Starlink’s terminal manufacturing cost declines will likely stagnate and the company will have to balance the tradeoffs of volume growth vs profitability in deciding if it wants to lower service pricing in core markets like the United States

Additionally, in suburban and urban markets Starlink may even benefit simply by acting as an alternative to existing internet service providers - at least in the United States, internet services is one of the most hated B2C industries

3. Starlink’s Rapid Buildout and Monetization

Time is money for satellite businesses—satellites on the ground can’t generate revenue and the longer it takes to build a constellation and debut a product or service, the more cash a company will burn in the meantime.

While Starlink’s path to becoming a multi-billion dollar annual sales business hasn’t been without hiccups and delays, the company has clearly been focused on moving quickly since day 1 and it was able to launch service almost 40% faster than prior LEO satcom businesses.

However, the company’s sense of urgency didn’t stop at the debut of commercial service—as Starlink’s constellation buildout has accelerated over the last four years, so has its revenue growth.

4. Elon Musk (and Therefore SpaceX/Starlink) Can Raise Capital at Will

A company’s ability to fundraise ultimately comes down to its CEO’s “capital magnetism,” which means Elon Musk is the primary driver of SpaceX’s (and thus Starlink’s) fundraising efforts.

Based on the numbers, Elon Musk is one of the greatest entrepreneurs of all time, having co-founded 8 companies worth a combined $931B that have collectively raised $31.4B of investor capital.

Musk’s entrepreneurial success has given him strong credibility with investors, which has been crucial for Starlink’s development: Starlink was originally estimated to require $10B of capital15 before it would become a self-sustaining business and SpaceX’s rocket business, while profitable, would not be able to foot the entire bill—fundraising external investor capital was destined to play a key role in building Starlink.

However, since Starlink’s establishment in 2015 to the present day in 2024, Musk and his team at SpaceX have been able to pull off what the early LEO satcom businesses couldn’t do, raising over $9.1B (per Pitchbook) to fund not only Starlink’s development, but Starship’s development as well…without going bankrupt!

In the modern day, there is such investor demand for SpaceX equity that the company has created a semi-annual process for employees to sell their stock compensation to external investors (a highly unusual process for a private company); SpaceX management chooses what investors get to participate in the process, and investing in the SpaceX “has become one of the investing world’s most exclusive clubs” (link).

SpaceX has been able to fundraise in good and bad economic times; while prior LEO satcom ventures went into bankruptcy when broader market conditions got nasty, SpaceX’s reportedly largest round of fundraising ($1.9B raised16) took place in 2020 when the financial markets were spooked because of the COVID-19 pandemic (remember that these same market conditions caused OneWeb to fold and go bankrupt)

Past LEO satcom ventures did not this kind of access to capital markets.

4. CONCLUSION

While LEO satcom ventures of the past failed due to lack of product-market-fit, exorbitant costs, not moving fast enough, and overreliance on debt / inability to fundraise, I believe we can safely say this time is different for Starlink.

Lower costs have enabled Starlink to build out a global network with service that is competitive enough that customers are willing to pay a premium for it; Starlink has reached scale quickly enough that management was successfully able to fund the business through its cash negative phase of development17, and now Starlink has is poised to begin its real purpose of generating the cash needed to fund SpaceX’s overarching mission of building a self-sustaining colony on Mars to make life multiplanetary (link).

5. CONSIDERATIONS FOR INVESTORS

SpaceX investors only have one question they need to answer: just because this time is different for Starlink, does that justify SpaceX’s $210B valuation?

For Non-SpaceX Investors: There are a number of other LEO satcom businesses in development right now, including Telesat’s Lightspeed, Amazon’s Kuiper, AST SpaceMobile, Lynk Global, and Rivada Space Networks.

For investors and stakeholders of those businesses reading this post and wondering to themselves, “is this time different for my LEO satcom business?” both in respect to avoiding bankruptcy as well as considering competitiveness with Starlink, consider the following questions in your own analysis:

Are your costs (launch, satellite, ground equipment, etc) lower than Starlink?

If not, you probably can’t compete head-to-head with Starlink

Are you delivering a service that is actually desired by humans on earth?

Since you probably can’t compete on price with Starlink, you must either deliver better service or target a different market segment than what Starlink is going after

Are you moving quickly enough?

Satellites on the ground don’t generate revenue; the longer it takes to launch satellites, the more cash you will burn

Can your raise the capital needed to build your business?

The capital journey of building a business is one of the most critical strategy decisions a management team will make; fundraising is never easy, so make sure it is a good plan

Starlink’s high cadence of launch (see chart below to see how the growth of annual Starlink launches) allows SpaceX to reduce its internal per-launch costs due to economies of scale (since more launches enables the company to spread out its fixed costs over a larger number of missions) and Wright’s Law (the manufacturing concept that as the production volume of an item increases, its cost fall and quality improves more quickly as the company learns to improve the process). In turn, Starlink also benefits from these launch cost reductions—I recommend listening to Payload Space’s “Pathfinder” podcast featuring economist Pierre Lionnet (link, 39:35 mark) to learn more about the virtuous cycle between SpaceX’s launch costs and Starlink’s launch demand.

The $28m cost to SpaceX for launching a Falcon 9 rocket is a statistic from 2020; while this number is probably lower today in 2024, we use $28M since there hasn’t been an update on SpaceX’s Falcon 9 internal launch cost since April 2020 (source link)

This topic could actually lead us down the path of discussing the tradeoffs between Size, Weight, and Power vs Cost or SWaP-C when building satellites, but I am not going to attempt to explain that subject in this post!

Starlink is actually available in over 80 countries, but I could only find the data needed for these visuals for 52 of those countries. Starlink probably looks better if we had data for all 80+ countries where it operates, since many of the missing countries are less developed and/or island nations were broadband is undoubtedly more expensive on a $ / Mbps basis. Countries excluded include (Bahamas, Barbados, Benin, Eswatini, Fiji, Georgia, Haiti, Iceland, Madagascar, Malawi, Maldives, Micronedia, Mongolia, Mozambique, Panama, Paraguay, Rwanda, Sierra Leone, Zambia, Albania, Finland, Guatemala, Indonesia, Iran, Malta, Tonga, Trinidad and Tobago, Ukraine, and Uruguay)

Elon is an incredible business person, and it's safe to say that his wealth proofs this.

Everything he builds is successfully, he knows how to focus on the key issues and solves them, while at the same time he approaches his companies as any other business, reduce costs to increase profit.

This simple thing is one of the keys to Elon's success with most of his companies.

Excellent insights. Especially how most of the SpaceX valuation is likely due to Starlink, not launchers. I can’t help but see a NASA and space exploration perspective here, the business we see in the headlines vs. the real money. Google comes to mind. The day-to-day visible part of Google is search, but that’s just a front for a business that’s about advertising. And the real business lies below that, a business core all about selling peoples personal data. Quite possibly NASA “search,” exploring space beyond Earth, with partners like SpaceX, ends up being a front, critically linked to many less visible, underlying layers, the money-makers of bits and bytes.