May 2024 Space Stock Review + AST SpaceMobile's Vibe Shift

Includes Commentary On RDW, LLAP, SATS and ASTS

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

🛰️ Thoughts on AST SpaceMobile

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

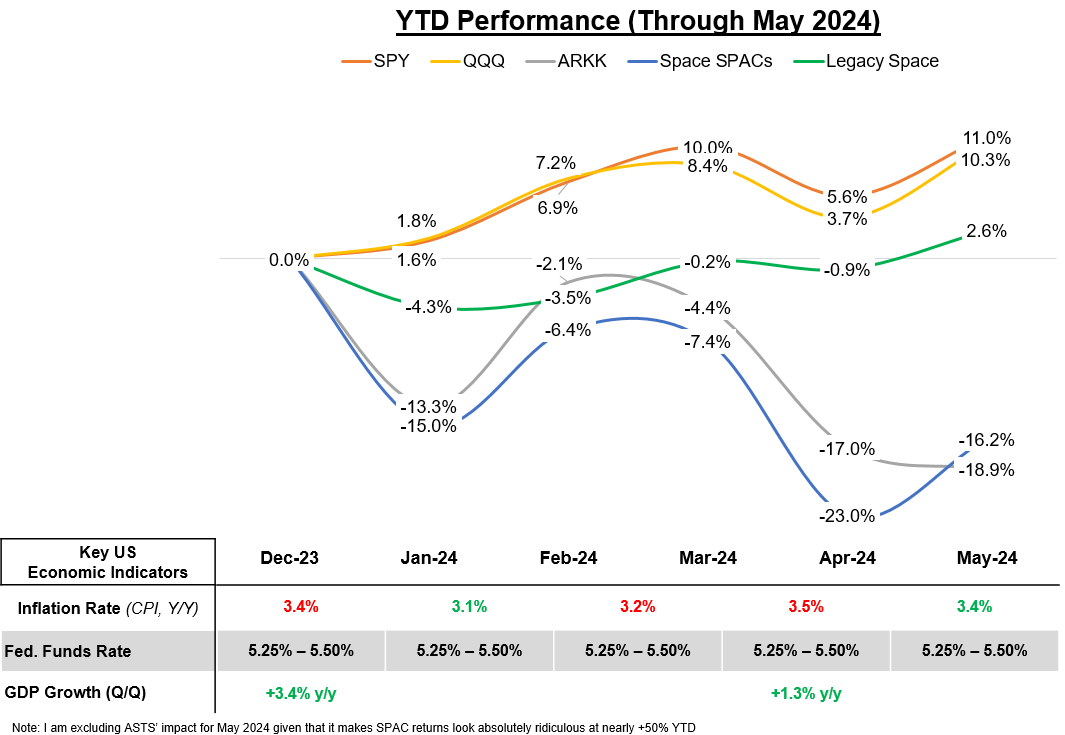

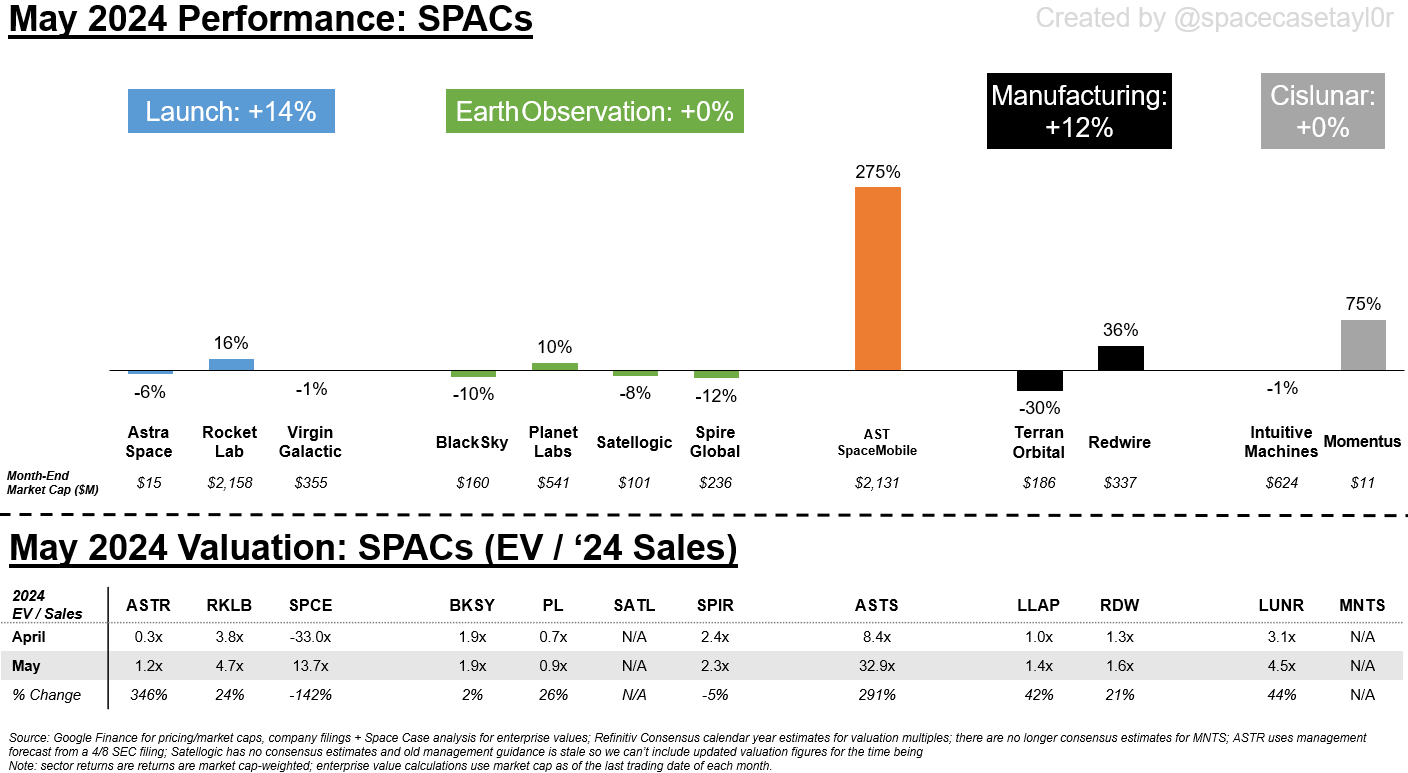

It was a tale of two cities for space investors in May 2024—either you owned AST SpaceMobile / ASTS shares, or you didn’t (ASTS shares increased 275% last month following commercial agreements with both AT&T and Verizon).

However, even ex-ASTS, both the SPACs and broader stock market bounced back in May after a tough April with solid gains as economic indicators continued to suggest that inflation is moderating and the US economy is less stable than it seemed earlier this year (both of which suggest to investors that the Federal Reserve may still cut interest rates in 2024).

Notably, the broader market’s returns in May were entirely driven by just 4 AI-related stocks—Nvidia (of course), Microsoft, Apple, and Alphabet; per the WSJ (link), those four companies added more value to their market caps than the other 499 S&P 500 companies combined (note: there are actually 503 companies in the S&P 500—the name is a lie!).

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

2. SPACE STOCK COMMENTARY

Redwire / RDW had another strong month in May, with its +36% performance bringing the stock to +80% YTD.

While the stock’s momentum this month was helped by broad positive investor sentiment in May, Redwire also benefitted from another solid earnings report where the company grew revenue (for the 8th straight quarter), reported positive EBITDA (5th straight quarter), and generated positive free cash flow (3rd out of the last four quarters) in 1Q24

As I’ve said before, Redwire’s consistently positive financial performance sets it apart from the rest of the space SPAC pack for the time being, though the earth observation SPACs are nipping at its heels as they near profit and cash breakeven themselves

Going forward, RDW shareholders must ask themselves: 1) How long can RDW continue to grow topline and at what rate? 2) Will the company require purchasing more assets to continue growing revenue, and if so, what types of companies will it pursue? 3) Can the company continue to grow margins?

The Terran Orbital / LLAP drama continued in May, with the stock dropping -30% in the month after Lockheed Martin / LMT withdrew its bid to acquire LLAP

LLAP shares dropped -17% the day after LMT withdrew its bid for the company, and they have been in freefall since then, indicating that investors are negative on the company’s outlook as an independent company

Not helping matters is the fact that Rivada—the mystery LEO megaconstellation whose $2.4B satellite manufacturing contract is seemingly the only way Terran can survive as an independent company (link 1, link 2 to prior discussion of this deal)—only paid LLAP $1.7M in 1Q24 (per LLAP’s 1Q24 10-Q, link); this adds credence to the idea that Rivada hasn’t yet secured the funding needed to pay Terran to build its 300 satellite constellation

On the 1Q earnings call, LLAP management said investors + analysts should expect to see increasing payments from Rivada to LLAP as 2024 progresses—this story isn’t over yet!

I was surprised to see EchoStar / SATS’ stock up +20% in May

There was little positive news in the company’s 1Q earnings, which included continued subscriber hemorrhaging (-81k Boost mobile subscriber losses, -26k broadband subscriber losses, and -348k pay-TV subscriber losses), continued free cash flow losses (-$226M FCF in the quarter) and no update on the company’s planned debt refinancing (>$2B of debt maturities in the next 12mo vs $887M of cash & cash equivalents on the balance sheet)

Analyst reactions post-call generally estimate that SATS has <6mo before the company will be forced to file for bankruptcy (link), so unless we are all missing something, SATS’ positive performance in May seems misguided

3. AST SPACEMOBILE’S VIBE SHIFT

The Sp🅰️ceMob cult has to be feeling pretty good after AST SpaceMobile / ASTS’ absolutely insane May, where shares increased 275% in the month following commercial agreements with both AT&T and Verizon.

ASTS shares were near all-time lows in April following 1) the company’s much delayed, dilutive and somewhat underwhelming funding announcements in January (see here and here), as well as 2) further delays for the launch of the company’s 1st revenue-generating satellites (shifted from 2Q24 to 3Q24).

However, there was a vibe shift in May:

First, on 5/15 the company reported 1Q earnings which included a number of positive developments including signing the company’s 1st official commercial agreement with AT&T (which management believes created a template for other telcos to build off of and would lead to more commercial agreements). See here for more of my thoughts on the company’s 1Q earnings report (link)

Then, on 5/29 in an unexpected surprise, Verizon announced both an official commercial agreement with AST as well as its commitment to $100M of funding for AST ($65M in prepayments for service and $35M of convertible debt). See here for @spacanpanman’s succinct takeaways on the significance of this agreement + funding (link)

At this point, non-Sp🅰️ceMob cult investors may be starting to believe that AST has both less funding risk as well as regulatory risk than prior to the AT&T / Verizon deals:

On Funding Risk: I estimate at least five of AST’s current MOU partners are large enough to underwrite somewhere between $100M-$200M in pre-payments and strategic investments (Telefonica, Orange, Claro, MTN, and Etisalat are all roughly AT&T/Verizon-sized (link)). Additionally, the US Export-Import Bank (a common source of project funding for satcom companies) is reportedly reviewing $5B of proposed satcom loans right now—obviously a large chunk of that is from the European-based Rivada Space Networks (which needs to fund its multi-$B constellation), but the Ex-IM bank generally loans at least $1B-$2B/year to US companies, so AST could be in-line to receive some portion of that funding. Between these two sources, AST might be able to raise the $350M-$400M needed to fully fund its 1st 25 revenue-generating BlueBird satellites without further diluting shareholders—remember this is far from a sure thing however

On Regulatory Risk: AST has yet to receive market access approval in the US from the FCC. However, with both AT&T and Verizon (two companies that are generally opponents) on its side, regulatory approval seems like it is probable (though admittedly I don’t read FCC filings as obssessively as I do SEC filings, so there could be something important I am missing here); if the company does receive FCC approval, I assume other international regulatory bodies will then use a framework for market access approval similar to the framework that the FCC and AST agreed upon.

As AST finally nears commercialization (“only” 2yrs later than management expected in their original SPAC presentation materials, link) I view constellation monetization as the biggest question mark for the company:

Telco carriers probably don’t actually care if retail customers sign up for SpaceMobile services, since partnerships allows them to use SpaceMobile service as a marketing tool without committing more than their agreed upon investment or prepayment dollar amount (which is a drop in the bucket relative to the billions of dollars they spent on marketing or network capex in a given year anyways); any revenue generated from customers signing up for SpaceMobile will just be upside benefit.

I am always wary of companies pitching ‘we will capture a small percent of a large market’ and after iPhone user ambivalence towards the value-add of SOS satellite texting (link), I can’t help but be skeptical towards large-scale consumer adoption of SpaceMobile; the government and IoT use cases are much more interesting in my opinion, since contracts can be larger and customers are less price sensitive / are willing to pay a lot for certain capabilities

We won’t know anything about SpaceMobile uptake until at least 4Q24/1Q25 once the initial BlueBird satellites are on-orbit and commissioned, but we may get some insight into Starlink + T-Mobile’s mobile satcom go-to-market strategy (and success) fall this year (link).

Hi Casey - glad to see ASTS up as I bought that about a year ago. Hope all is well with you and you are enjoying the summer. Pam

Thanks for the analysis as always! While EO stocks have slumped for an extended period already, what do you think about the recent DoD CASR program or related defense-related trends will affect or change the way people see about $BKSY?

Since $BKSY has a closer connection and stronger background in defense.