Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of PL, RKLB, and SPIR at the time of this post (3/6/24).

1. MARKET COMMENTARY

Public Markets

February 2024 was a great month for stocks.

Space stocks bounced back after a tough January and the S&P 500 + NASDAQ indices both hit new all-time highs after their strongest February performances since 2015 (per the WSJ), driven by investor optimism underpinned by AI-tech enthusiasm (euphoria?) and a continued outlook for lower interest rates.

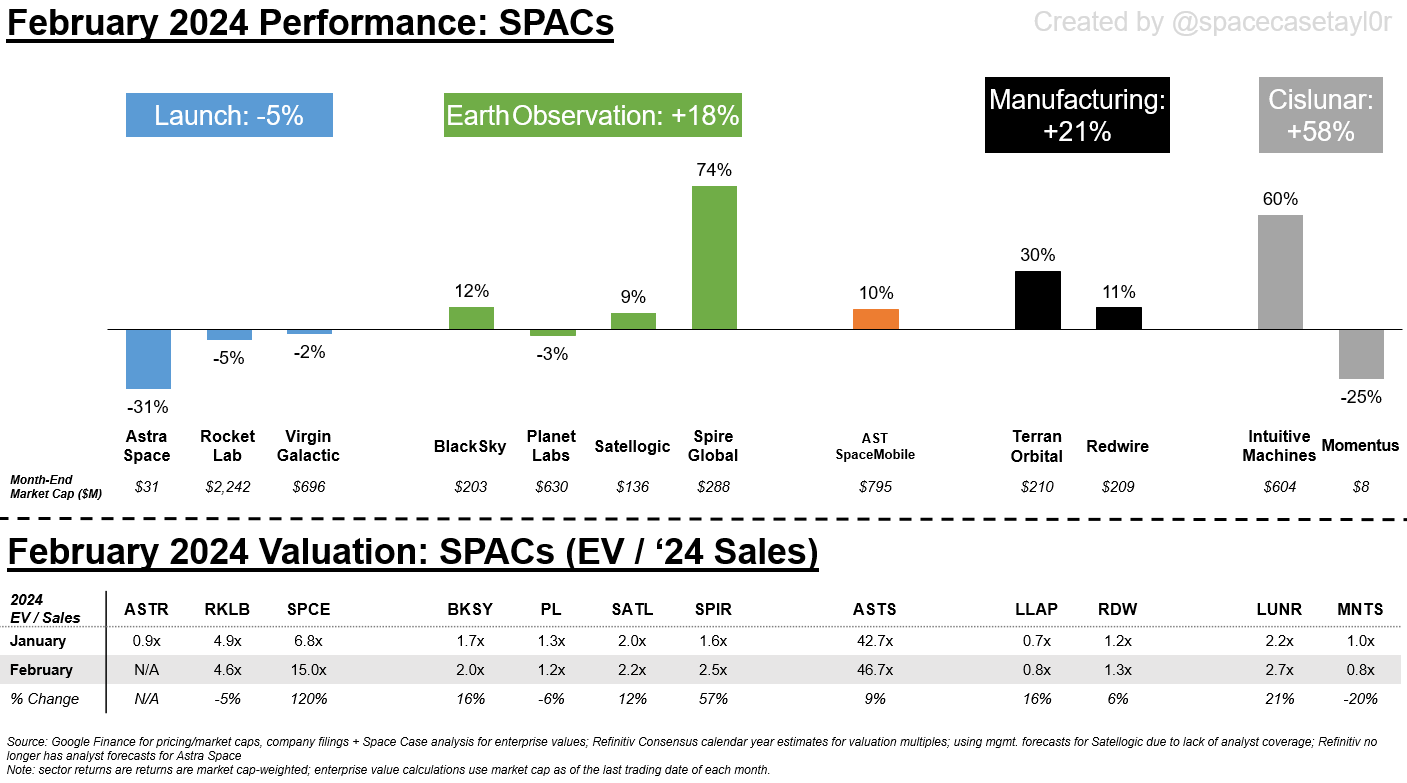

Year-to-date, similar to 2023 the SPACs are beating legacy space at -1.0% vs -3.5% (respectively), but both groups are lagging the broader market.

However, if we zoom out and look at performance since October 2023, despite the S&P 500 and NASDAQ’s four-straight months of gains over this time period, growth stocks (i.e. ARK Innovation + space SPACs) are actually in the lead (and legacy space lags in this POV as well).

Private Markets

We won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends + insightful analysis:

Tech M&A: Valuation vs Growth (from Friends & Family Capital)

Venture rounds have gotten a lot smaller over the past two years

How many years does it take the average startup to get to each venture stage? (Carta)

2. SPACE STOCK COMMENARY

Astra / ASTR is still trading above the latest take-private offer from its founders ($0.80/sh as of 3/4 vs $0.50/sh take-private offer)

I originally highlighted this mispricing in December (link) after ASTR shares were trading 50% above a take-private offer of $1.50/sh

Now at $0.80/sh (as of 3/4) vs an updated $0.50/sh take-private offer, the mispricing difference is even greater with a 60% delta!

I can’t explain why this is—it makes no sense!

Spire Global / SPIR shares rocketed +74% higher in February following the announcement of a partnership with Signal Ocean, as well as a strategic investment from the Signal Ocean that valued Spire at $12.00/sh (link to press release)

While the $10M investment + plans to partner with Signal Ocean to “drive digitization of the maritime economy” are nice, the real difference-maker here was Signal Ocean investing in SPIR at a ~50% higher valuation than market value the day before the announcement ($8.15/sh on 2/8 vs $12.00/sh for the Signal Ocean investment)

In present day, SPIR shares now trade at ~$12.00/sh and for the 1st time Spire Global is trading at a premium versus optical earth observation (EO) peers BlackSky Space / BKSY and Planet Labs / PL

Since 2023, no earth observation company has been able to hold onto the title of “king of EO” and the premium valuation multiple that comes with it for more than 1-2 quarters; for Spire to do this, the company needs to: continue marching towards profitability; print results that match management’s goals to grow revenue well into the double-digits y/y for the foreseeable future; and simultaneously manage Wall Street growth expectations from getting too high—not an easy task!

Having worked in investor relations for a publicly traded company, I know how hard it can be to tamp analyst estimates down when they get excited about growth prospects. While it is easier to let forecasts keep going up since doing so generally leads to the stock going up, not nipping forecasting overenthusiasm in the bud leads to a painful correction + potential lack of investor trust in management in the future

I’m going to skip to the juicy news for Terran Orbital / LLAP and discuss the announcement that on 3/1 Lockheed Martin / LMT made an offer to purchase Terran for ~$600M, or $1.00/sh (link to offer letter; Payload Space overview of the deal)

First, let’s address the elephant in the room—Lockheed Martin couldn’t be more clear in stating that it doesn’t see Rivada Space Networks as a real customer (see quote below). If we believe LLAP management commentary, Rivada’s $2.4B order makes up $2.4B of LLAP’s $2.6B backlog; meanwhile in its takeover proposal, LMT says it expects to remain LLAP’s largest customer for the foreseeable future (i.e. Rivada ain’t real)

“We have invested significant resources conducting our due diligence inclusive of a detailed review of the forward revenue projections and are substantially finished with our process.

Lockheed Martin continues to be Terran's largest revenue generating customer accounting for the majority of the backlog (81% as of December 31st, 2022). In addition to being the largest historical revenue generating customer we are confident that we will continue to be the largest revenue generating customer for Terran for the foreseeable future. As a result, we are uniquely qualified to assess the Company’s near and long-term outlook and accurately ascribe fair value to Terran’s business for all its stakeholders.”

- Lockheed Martin Non-Binding Proposal, 3/1/2024 (link)

On the proposed deal valuation—I actually think $600M is pretty fair, though LLAP shareholders may not like it since $1.00/sh was below the closing price of $1.07/sh prior the announcement and values the company at just 1.4x 2024E revenue. If LLAP management accepts the offer then it means Rivada isn’t a real customer and Terran’s business wouldn’t survive without a bailout from LMT—in case, LLAP shareholders are lucky to get a takeout at the proposed $600M valuation vs something potentially lower in the future as LLAP’s cash reserves dwindle

However, Terran did adopt a “poison pill” following this takeover proposal to guard against any hostile takeover attempts by Lockheed (link), which indicates that management likely isn’t looking to accept this initial proposal. This situation could drag out for months, so buckle up!

Intuitive Machines / LUNR saw its stock run up as high as +121% during its 1st lunar landing mission, with share price volatility mirroring the space community’s blood pressure as we awaited IM-1’s touchdown on the moon

However, as the IM-1 mission concluded on 2/29 and we could all breathe normally again, LUNR share price also settled back to pre-mission levels as well

Iridium / IRDM shares declined -20% in February, including a -13% decline on 2/15 following the company’s 4Q23 earnings report where management highlighted expectations for decelerating revenue and EBITDA growth in 2024

Though management emphasized their focus on free cash flow generation and returning excess capital to shareholders (statements that warm my heart to hear), it is hard to overlook the fact that in the near term IRDM is investing more to generate lower growth vs the recent past (including incremental spending on a nascent direct-to-device business, which won’t be generating revenue for several years)

On top of this, while Iridium is seeing headwinds from Starlink (which management expects to subside by 2025) management also extended the anticipated lifespan of its satellites, which seems to indicate the company isn’t planning to upgrade its underlying technology anytime soon

This situation gives me flashbacks to working in the cable industry where extremely profitable, but slow/no growth incumbents were having incremental market growth eaten away by new entrants with better technology—the story first played out with cable taking copper telco market share, but later it was telco fiber + fixed wireless taking share from cable

The incumbent was always having to invest in their own network to keep up with new entrants, but with questionable returns on new builds

MDA Space / MDA saw its shares grow +30% in February

Though MDA reported solid 4Q earnings + 2024 guidance in February, this was not the source of the stock’s performance in the month given that it reported earnings at the very end of February—honestly I can’t point to anything specific that drove the stock’s performance!

What stands out most to me about MDA however is that although the stock has already seen a great run-up in 2024 (+27% YTD) it potentially has further room to appreciate given that you could argue its above-average anticipated growth should merit the company a valuation premium versus other legacy space companies (MDA 11.5x 2024E EBITDA multiple vs 11x-14x for other legacy space companies)