December 2023 Monthly Space Stock Review + Top Case Closed Memes from 2023

Includes Stock Commentary on ASTR, LLAP, RKLB, MNTS, SATS, and CMTL

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

😆 Bonus: The Top 25 Case Closed Memes from 2023

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, RKLB and SPIR at the time of this post (1/4/24).

1. MARKET COMMENTARY

Public Markets

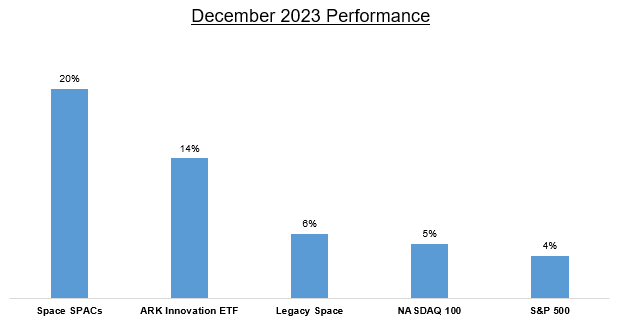

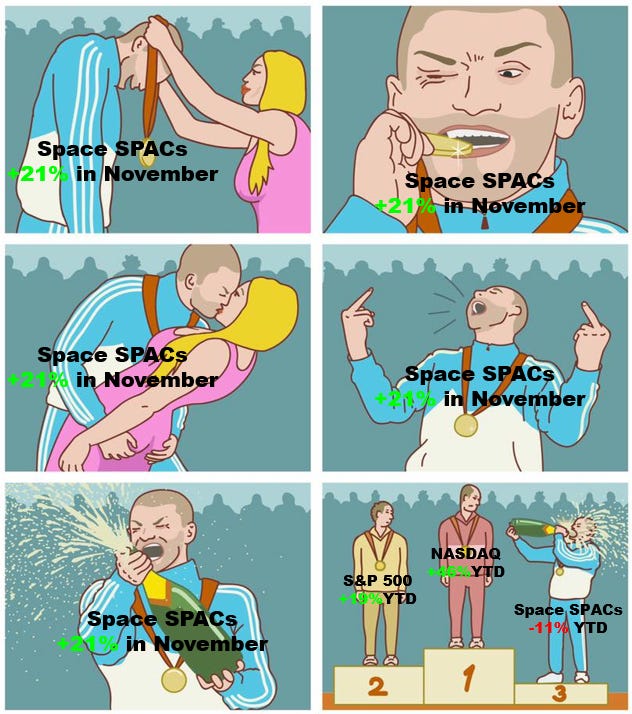

Space SPACs rallied hard in December, closing out the year with their 2nd consecutive monthly gain over +20%.

However, the SPACs were not alone in having a good December—stocks across the board rose given positive investor sentiment around the possibility of a “soft landing” scenario where inflation decelerates without a recession occurring, and the Federal Reserve signaling it is both done raising rates and likely cutting rates in 2024.

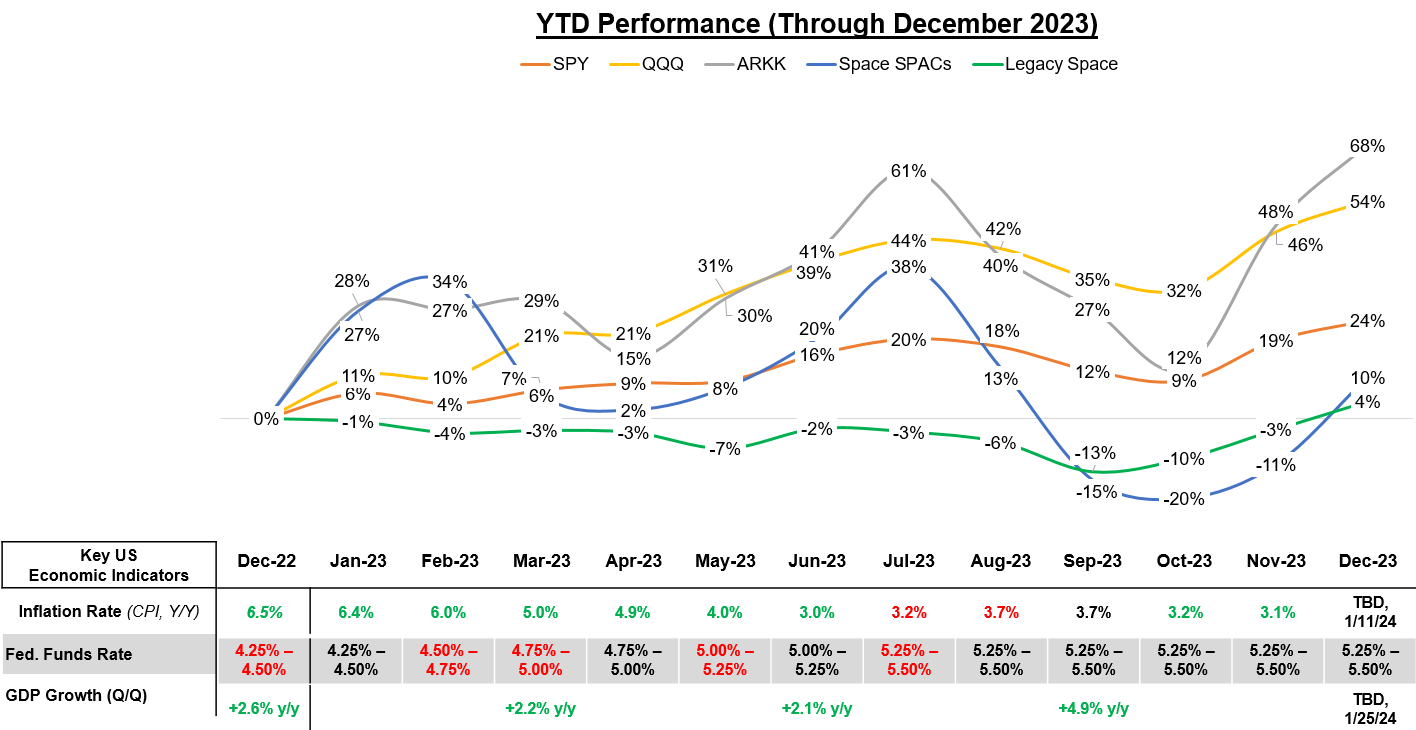

Taking a step back, we can see that 2023 was fairly a volatile year for stocks and there was strong correlation between CNN’s “Fear & Greed Index” (top chart above, link) compared to when the stock market went up or down (bottom chart above):

Negative shocks like the US banking crisis in March and the October escalation of the Israel-Hamas war drove investor sentiment towards “fear” and drove ~10% declines in the S&P 500

The emergence of ChatGPT in January/February and Nvidia’s massive earnings beats in May/August created a mania around the potential of artificial intelligence and led to +9% and +19% market rallies

The end of Federal Reserve rate hikes and the potential for rate cuts in 2024 drove the end of year spike in “greed” and subsequently spurred a very strong 4Q stock rally of +16%

Zooming back in—the SPACs were not exempt from this volatility, with 9 of 12 months’ returns exceeding 10% (positive or negative)

In the end, the S&P 500 ended the year +24%—more than 2x returns for the space SPACs (+10%) and 6x returns for legacy space (+4%).

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends + insightful analysis:

Elad Gil on capital efficient businesses

Space Case note: if you only read one of the links this month, make it this^^ one

Late stage venture capital invested is down way more than early stage

Comparison of VC fundraising from 2020-23 (both cash raised and valuation)

2. SPACE STOCK COMMENARY

2023 Performance

I know everyone reading this newsletter loves space and investing, but this was not a great year for space stocks (especially relative to the safer and more conservative alternative of having invested in the S&P 500 which generated +24% returns):

Only 6 of the 27 space stocks I cover beat the S&P 500, and 11 of the 27 had positive returns for the year

Launch was the only category that beat the S&P 500 (and only by 1%), driven by the leading space stock of 2023—Rocket Lab🚀🎉

Position/Navigation/Timing, Manufacturing, and Aerospace & Defense stocks had positive returns, but just barely; and every other category of space stocks was negative

Of course, this assumes investors held their stocks from 12/31/22 through 12/31/23—depending if you bought or sold at some point in the middle of 2023, results may have been better or worse.

December 2023

Is it just me, or is Astra / ASTR mispriced?

At $2.19/share at the time of writing (1/2/2024), Astra is trading 46% above co-founders’ Chris Kemp and Adam London’s take-private offer of $1.50/sh

I’m not sure why the stock would trade above that offer price other than the stock getting caught up in low-volume trading at the end of 2023

Rocket Lab / RKLB rallied in December not just because the rest of the market was up, but because the company disclosed a new $515M contract to build 18 satellites for the US government (likely the Space Development Agency, link)

While I assume this contract doesn’t affect near-term results because most of this revenue won’t be recognized until 2026/27 when Rocket Lab is actually delivering satellites to its customer, this contract win is notable because it is a sign of the maturation of the company’s Space Systems business

Terran Orbital / LLAP’s +41% in December was likely attributable to rumors that began on 12/11

On 12/11 the WSJ published an article (link) stating that LLAP was looking for a buyer by the end of 2023

The same day, TechCrunch published an article (link) stating that an internal company memo said CEO Marc Bell was denying the acquisition rumors and he would buy the company with a business partner if Terran did decide to go private

Meanwhile an SEC filing on 12/11 (link) disclosed that the company had hired investment bank Jefferies to conduct a formal review of strategic alternatives, which could include an investment, sale of the company, or a take-private transaction

Regardless, LLAP traded up 74% from 12/11 through the end of the month—investors were probably hoping to benefit from the premium that an acquisition or take-private offer would entail

Momentus / MNTS just can’t catch a break—on 12/5 the company disclosed (link) that three of the five payloads it had planned to deliver into orbit on the 11/11 SpaceX Transporter-9 mission were not released from a 3rd party deployer system

MNTS shares traded down -39% between 12/5 and the end of December as yet another mission setback does not bode well for this company and its dwindling cash balance

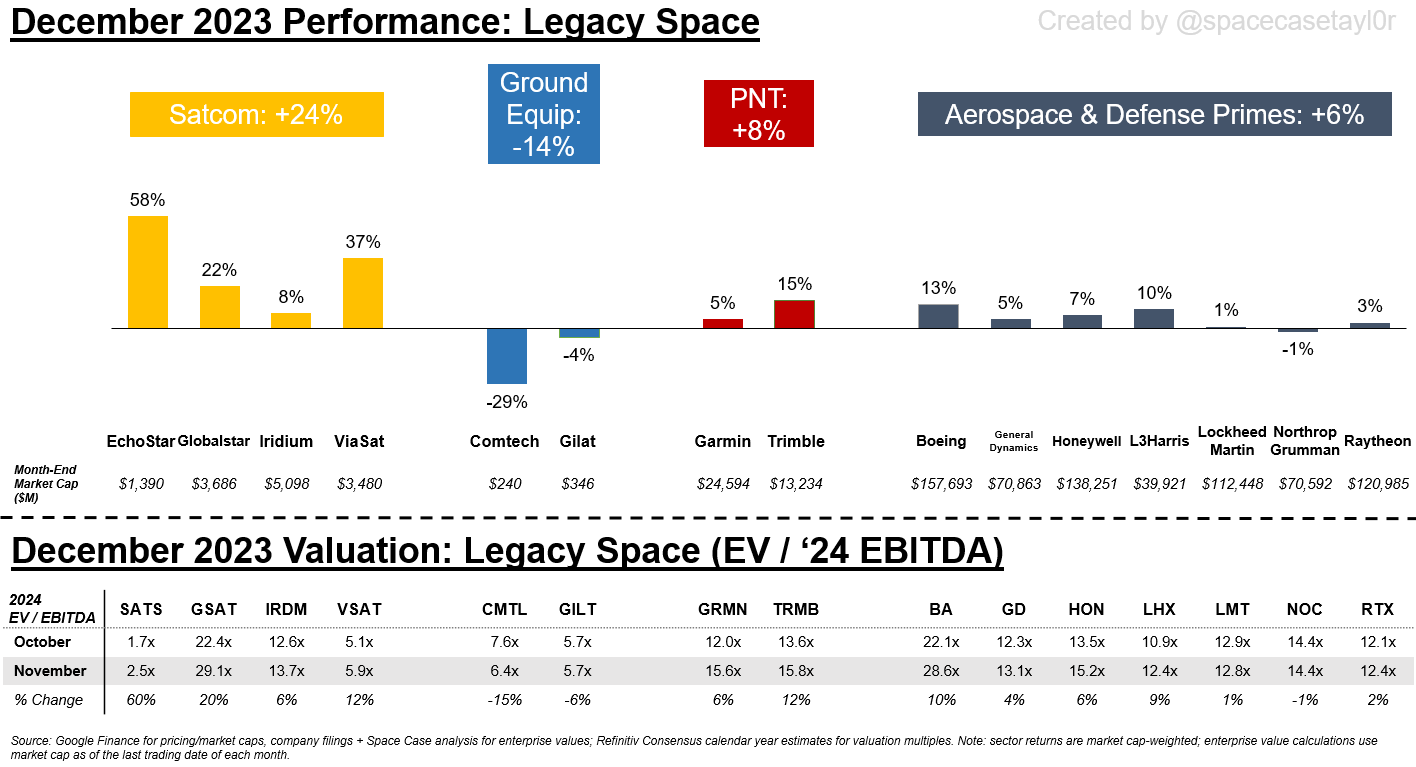

EchoStar / SATS traded up nearly +60% in December as the likelihood of its planned merger with Dish Networks increased—notably, shares were +33% through year-end after receiving FCC approval for the merger on 12/7

The merger was completed on 12/31/23

Comtech / CMTL shares took a dive after 12/7 (trading down -33% through YE23) when the company reported F1Q / C3Q earnings and noted that it did not close a debt refinancing agreement it had previously told the investing community it would complete before the 12/7 earnings report

The company has until 10/2024 before its existing credit facility is up for repayment, and management remains upbeat about the company’s ability to refinance its debt before then or extend the facility with its current creditor

Having said that, the clock is now ticking for management to secure financing in difficult capital market conditions—hence the negative reaction from investors

3. BONUS: THE TOP 25 CASE CLOSED MEMES FROM 2023

If you’ve made it this far in the newsletter—thank you for reading!

Your reward is a list of what I believe are the top 25 memes I made for Case Closed in 2023—please pick your favorite meme from this list and tell me which one it is in the comment section!

Thanks for reading everyone—I’m looking forward to sharing even more space financial analysis in 2024!

pick: Space SPACS beating Legacy Space...

Pick: Earnings scorecard outlook