March 2024 Space Stock Review + 4Q23 SPAC Financial Review

Includes Commentary on RKLB, ASTR, LLAP, MNTS, and CMTL

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

💡4Q23 SPAC

EarningsFinancial Review

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of PL, RKLB, and SPIR at the time of this post (4/21/24).

1. MARKET COMMENTARY

Public Markets

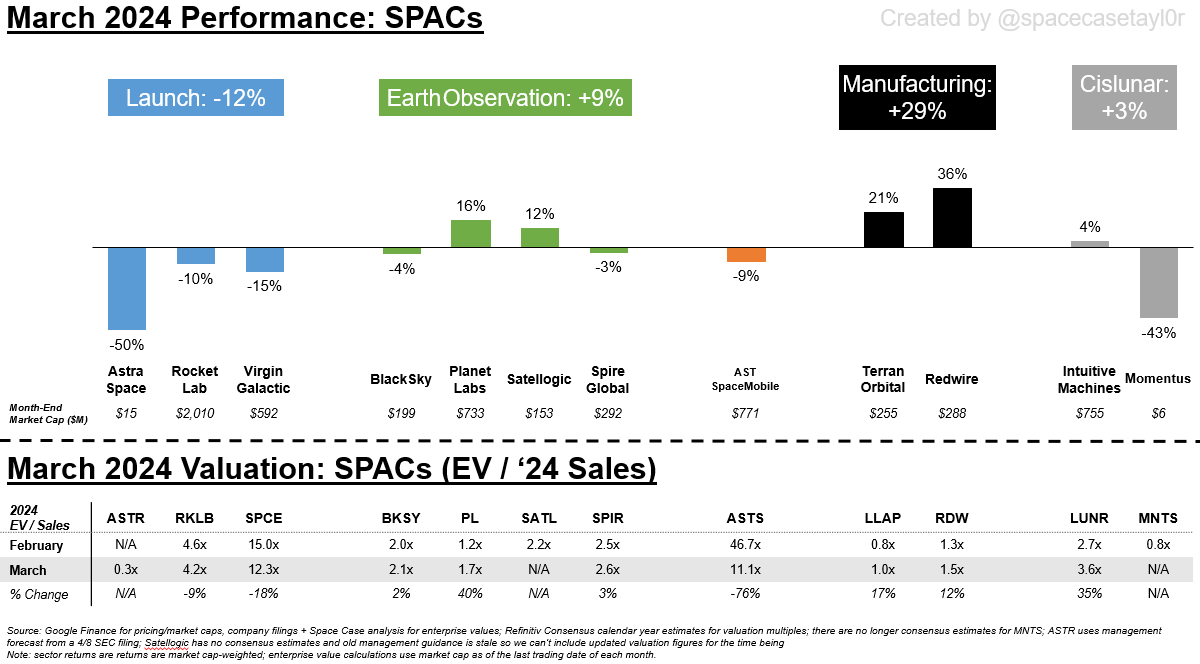

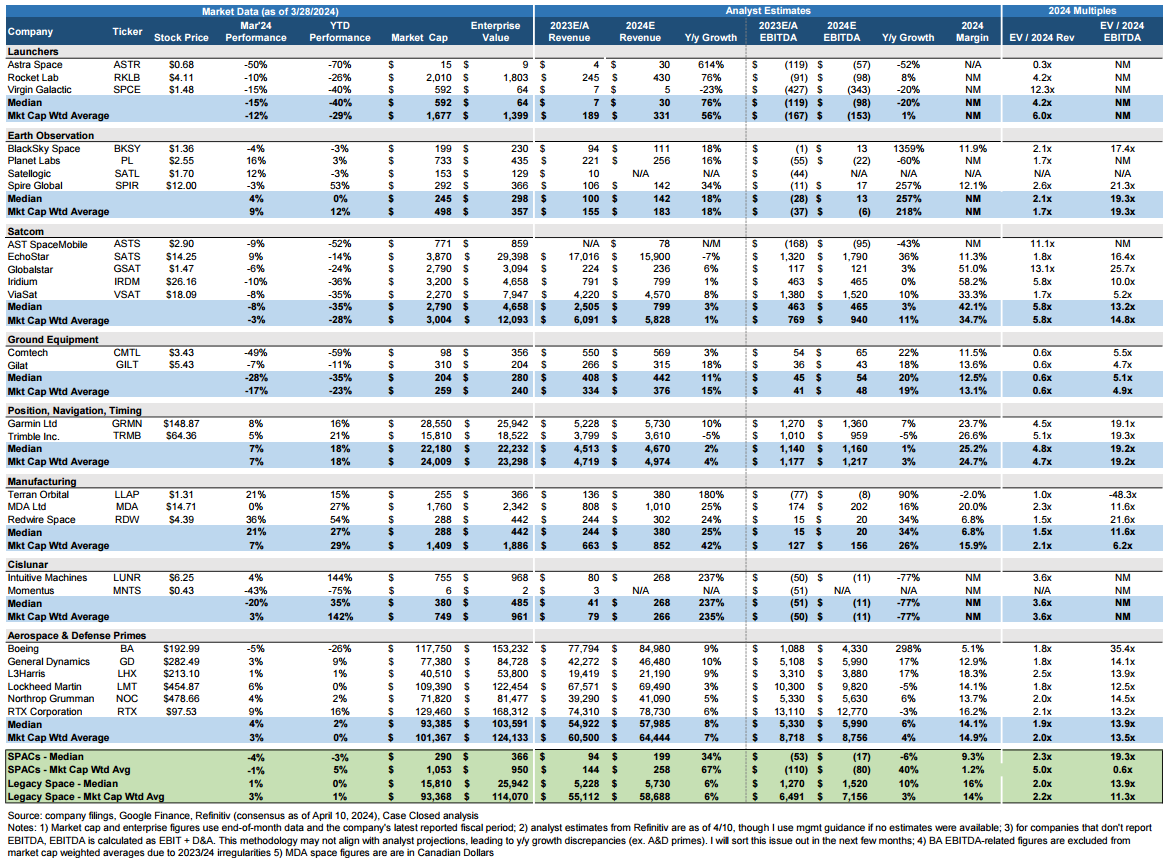

Stocks continued to climb higher in March 2024, with the S&P 500 capping off its strongest 1Q since 2019; legacy space companies took the pole position in March, with aerospace & defense leading the way (RTX (+9%), LMT (+6%) and NOC (+4%)), while the space SPACs lagged.

Broadly speaking, the market’s strength in March was driven by continued economic optimism and an outlook toward interest rate cuts, combined with investor enthusiasm regarding the potential of artificial intelligence.

However, market sentiment has soured in April as recent economic data (such as March’s CPI readout, see above) and commentary from the Federal Reserve has suggested that inflation isn’t as close to being tamed as investors had hoped, dousing hopes of interest rate cuts and renewing fears of rates being higher for longer.

As I have discussed numerous times before (link to my previously written primer on “Why Should Space Investors Care About Interest Rates?”), higher interest rates are worse for growth companies (like the space SPACs or stocks held by the ARK Innovation ETF) relative to more established companies like legacy space or those included in the S&P 500; the chart above shows how ARKK shares have had a much stronger negative reaction to the change in investor sentiment vs the S&P 500.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

2. SPACE STOCK COMMENTARY

I have been questioning why Astra / ASTR is trading above its take-private offer of $0.50/sh for months.

While a -50% decline in March brought the stock closer to where I think it should my opinion, ASTR is still trading at $0.61/sh as of 4/19, representing 22% downside for anyone who is somehow still holding this stock

In the meantime, Astra’s management team gave us one last creative forecast before disappearing from the public eye. An SEC filing from the other week shows the company splitting its launch and spacecraft engine businesses + providing quarterly forecasts through 2025 (see below + link)

Rocket Lab / RKLB shares are down -34% in 2024 (as of 4/19) and down -56% since their 52-week high of $8.05/sh in July 2023. I have seen quite a few folks on X lament the share price declines and question why the stock is doing so poorly. While I think RKLB is the best-in-class space SPAC (and I am a shareholder), I believe RKLB shares actually have more near-term downside potential from here:

Although RKLB is trading at an all-time low-valuation (see chart below), at 3.7x next-12mo revenue the stock is still valued at a premium vs SPAC peers, which have traditionally traded at ~2x revenue

Additionally, while there is material upside potential for shares long-term, RKLB is capital intensive, has lumpy revenue, and manufacturing isn’t traditionally a high margin business—all these factors could contribute to downward pressure on shares in a high interest rate environment (like right now).

I don’t anticipate RKLB appreciating until we see some combination of company narrative progression (Neutron tech and/or business development, satellite manufacturing deals, M&A, etc) and more broadly a risk-on attitude in the markets; missing/beating Neutron development timeline guidance could also impact the stock in the near-term.

Terran Orbital / LLAP and Momentus / MNTS both didn’t hold 4Q23 earnings calls, but for different reasons:

LLAP 1st delayed its 4Q23 earnings release, and when it did release earnings it cancelled the actual earnings call…probably because it is impossible to speak to analysts and investors about the business outlook while negotiating an acquisition with Lockheed behind the scenes! (link to context on LMT takeover bid for LLAP)

MNTS on the other hand told the SEC that it couldn’t file its 10-K on time, and has shared zero communications about a 4Q call with the investing community. I am guessing management is very busy figuring out the company’s cash flow situation right now—Momentus has been averaging low-teens quarterly cash burn for the last few quarters compared to $10M of cash as of 3Q23 + $19M of capital raised since 3Q23, which suggests the business is running on fumes right now…

Redwire / RDW had a great March with a +36% performance (though shares have come back to earth in April and have mostly given up March’s gains).

Last month’s strong performance was driven by the company’s solid 4Q23 earnings, where the company reported its 4th straight EBITDA-positive quarter and its 2nd FCF-positive quarter out of the last three quarters. This is on top of 2024 guidance for $300M of revenue (+23% growth y/y), which was well ahead of pre-earnings consensus of $278M.

The combination of these results puts RDW is in a class of its own vs SPAC peers given consistent profitable operations + the beginnings of FCF generation + material revenue growth.

Comtech / CMTL shares had a brutal March, down -49% after the company reported F2Q24 earnings that missed revenue guidance and saw analysts revise full-year 2024 revenue and EBITDA down -9% and -18% respectively after the report.

CMTL’s tough March continues the stock’s downward trajectory which began in December 2023 when the company announced that it had not re-financed a credit facility that was now due for repayment in less than 1yr (October 2024).

Since then, CMTL shares have declined -85% (through 4/19) as the company has still yet to announce a refinancing for its $168M of debt due in October. On the earnings call, the CFO did indicate the company is closing in on a debt restructuring plan “consisting of a term loan coupled with an asset-based revolving loan,” but the call ended without the company taking questions from analysts likely because on 3/12 (six days before the earnings report) the Comtech board of directors terminated the company’s CEO “for cause due to conduct unrelated to Comtech’s business strategy, financial results or previously filed financial statements”

3. 4Q23 SPACE SPAC EARNINGS REVIEW

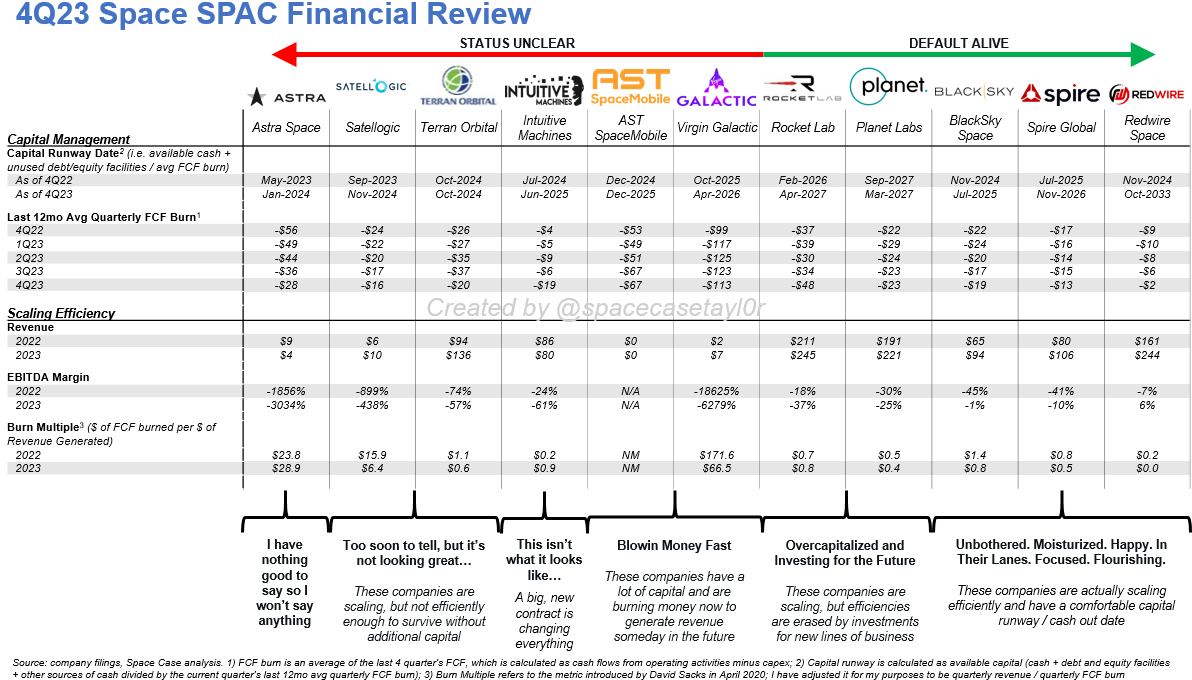

Longtime Case Closed readers are familiar with my ‘Space SPAC Earnings Scorecard’ which we use as a simple framework to qualitatively analyze each company’s progress toward “default alive” status before digging into more qualitative analysis (such as comparing results vs previously issued guidance or analyst expectations, reading management commentary, etc); if you are unfamiliar with my Earnings Scorecard, see here for a refresher (link).

This simplified earnings analysis framework was inspired by Josh Wolfe’s quote “survival is a necessary precondition for growth (link),” and I originally made it in 2022 to identify which space SPACs were in a position to survive the oncoming economic and fundraising “winter” and therefore might be suitable to invest in amidst a market downturn (link to my original “Winter is Here” post).

Recently, I have not found the framework to be as useful as it once was. In my opinion, it is already clear which companies seem to be “default alive” (and I basically called this back in August 2022):

PL, SPIR, RKLB, RDW, and BKSY are okay

For SATL, ASTR, LLAP, MNTS, SPCE, LUNR and ASTS it is not yet clear if they are out of the woods

However, I still find it useful to look at capital management and scaling efficiency metrics to see where each SPAC company is in its maturation journey.

Redwire / RDW, Spire Global / SPIR, BlackSky / BKSY - “Unbothered. Moisturized. Happy. In Their Lanes. Focused. Flourishing.”

These companies have all successfully balanced growth with profitability and are all at or near FCF and EBITDA breakeven.

Rocket Lab / RKLB, Planet Labs / PL - “Overcapitalized and Investing for the Future”

With either moderate cash spend since going public (Planet Labs) or demonstrating the ability to tap into the capital markets at will (Rocket Lab) these two companies are still a ways off from FCF/EBITDA breakeven due to investments in future growth initiatives (Neutron for Rocket Lab, new satellite constellations + data platform for Planet), but they have so much available capital that they aren’t worried about it.

AST SpaceMobile / ASTS, Virgin Galactic / SPCE - “Blowin Money Fast”

ASTS and SPCE are both essentially pre-revenue companies that are on the hook to spend a lot of capital up-front to build the actual hardware they hope to monetize in the future. While they both have raised hundreds of millions of capital to date, elevated FCF burn requires them to constantly raise more money and both company’s management teams have seen increasing difficulty fundraising as of late. There is still fundraising risk with these stocks.

Intuitive Machines / LUNR - “This Isn’t What It Looks Like”

At first glance, LUNR’s financial profile above seems to have almost every metric moving in the wrong direction—however, what is not reflected in the company’s past financials is the $719M NASA OMS III contract that kicked in December 2023 and is set to deliver the company ~$12M of revenue per month for the next 4-5yrs. Management expects that this contract should improve Intuitive Machines’ margin and cash burn profile in 2024 vs 2023.

Satellogic / SATL and Terran Orbital / LLAP - “Too Soon to Tell, But It Isn’t Looking Great…”

While SATL and LLAP both grew revenue and improved cash burn efficiency vs the prior year, I can’t help but wonder if it is too little too late for both companies give cash runways that are set to expire in 4Q24. Unless these companies are expecting significant upswings in revenue generation (which is potentially the case for LLAP if Rivada is a real customer), they will need to tap into a difficult capital markets environment to fundraise.

Astra / ASTR - “I Have Nothing Good to Say, So I Won’t Say Anything”

Rather than discuss the soon-to-be-private company, I used AI to write a song about Astra—check it out! (link below)