Hello fellow space enthusiasts! 🚀

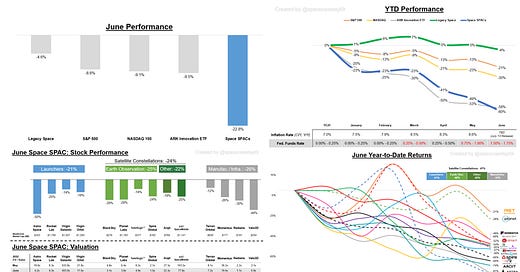

In this month’s Space Stock Review I made 6 charts to help you better understand space stock performance and valuation trends in June and through 2022 Year-to-Date (YTD).

Here is what is in store for you:

📊 June + YTD Market Overview

🖱️ Double-Click on Space SPACs

📈 Stock Performance and Valuation Trends Commentary (June + YTD)

✍️ Drivers of June SPAC Performance

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or investment recommendations; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS and SPIR at the time of this post, 7/6.

JUNE + YTD MARKET OVERVIEW

“Legacy space good, new space bad.”

This has been the mantra for space stock investors all year—and June was no different.

Legacy space stocks yet again outperformed the S&P 500, while space stocks logged another over -20% decline.

This was the 4th month of 2022 where legacy space stocks outperformed the broader market.

Meanwhile, this was the 3rd monthly of over -20% for space SPACs in 2022, the 4th month of double-digit declines, and the 5th month of negative returns.

MACROECONOMICS IS DRIVING THE BUS

Across the board, the major driver of this past month’s poor stock market performance was inflation:

On June 10, the US Bureau of Labor reported that inflation in May had unexpectedly accelerated to 8.6% y/y from 8.3% y/y in April.

This was the highest rate of inflation in 40yrs, and was higher than expectations leading up to the report (economists were not anticipating inflation to accelerate m/m).

Subsequently, the Federal Reserve raised interest rates by 75bps in June, which compared to a 50bps increase in rates in May; the June increase was the Fed’s biggest rate increase since 1994, and was an aggressive move relative to what investors had been expecting prior to the May CPI readout.

LEGACY SPACE SET UP TO SUCCEED

As I’ve said before, I expect legacy space stocks to continue to outperform the space SPACs until we see material changes in the macro environment given the former’s larger, more stable and diversified businesses.

Namely, we need to see inflation peak and begin to decline (FYI the June CPI report is on 7/13), and we need to see what the 2Q22 GDP readout is given 1Q’s -1.6% report—two consecutive negative quarters indicates that we are in a recession, which is important because as Payload’s co-founder Mo Islam recently put it: "[whether we are in a recession or not] affects sentiment and ultimately dictates how much consumer and investors are willing to open up their wallets.”

“…until we have more certainty regarding the economic outlook, larger and more stable businesses (like the companies that comprise the S&P 500 and my legacy space index) will continue to outperform tech and growth stocks in aggregate.”

- Space Case, May 2022 Space Stock Review (link)

“I believe legacy space’s outperformance in 2022 speaks to the relative stability of the larger, more established, and diversified legacy space businesses, and also can be somewhat attributed to geopolitical tensions that tend to benefit aerospace & defense companies (which make up the vast majority of the market cap in my legacy space index).”

- Space Case, April 2022 Space Stock Review (link)

Looking at the YTD chart, legacy space’s strength despite worsening macro conditions (and space SPAC underperformance) is even more clear:

DOUBLE-CLICK ON SPACE SPACs

Stock Performance Commentary - June

Space SPAC performance this month was universally bad—each sub-category declined over -20%, in-line with the overall -23% decline for space SPACs in total.

Valuation Commentary - June

On the valuation front, in June we saw a continuation of several trends observed in May:

Rocket Lab (trading at 6.3x) is getting closer to trading in-line with other non-launch space stocks (earth observation (EO) and manufacturing/infrastructure median valuations are in the 3x to 4x range).

Satellogic’s premium vs other EO companies is narrowing (4.9x for SATL vs EO group median of 3.1x excluding SATL, compared to SATL trading closer to 20x in past months)

Spire Global continues to trade at a discount to EO peers (SPIR trading at 1.5x vs EO SPACs with a 3.8x median valuation, ex-SPIR)

Manufacturing pure-plays (Redwire, Velo3D) are currently trading at a notable discount to nearly every other space SPAC (RDW at 1.7x and VLD at 0.9x vs space SPAC median of 6.4x excluding those two companies)

I assume this is due to an anticipated slowdown in demand as we enter a recession and the Federal Reserve raises interest rates.

Bulls would likely argue however, that RDW and VLD are dual-use companies and government spending on aerospace & defense is expected to increase regardless of macroeconomic conditions.

Stock Performance Commentary - YTD

Looking at YTD tells only a slightly different story—satellite constellation operators fared better than launchers and manufacturing/infrastructure companies, but in general most space SPACs are down -50% or more through 2022.

Valuation Commentary - YTD*

While space SPAC valuations look more and more appealing each month (and they have come down even more significantly when comparing vs original deal valuations), I would caution investors who look at this chart and think “Cheap! Time to buy!”

As I mentioned earlier in this post, until we have clarity on the macroeconomic situation there is likely more room for valuation compression for growth stocks.

We also know that original deal valuations were total BS—you can’t look to them as your grounding for how “cheap” the space SPACs look now.

JUNE SPACE SPAC PERFORMANCE DRIVERS

While most of this month’s across-the-board negative performance can be explained by macro factors, it is still useful to examine material news from each company during June.

Launchers

Astra Space / ASTR: -50%

Astra had another unsuccessful launch on June 12 during the 1st of its three planned NASA’s TROPICS missions. ASTR shares declined -24% the first trading day after this event.

This failure increased investor uncertainty regarding Astra’s capabilities and near-term financial outlook, let alone its longer-term prospects of weekly launch/rocket production cadence.

Astra needs to both string together a series of consecutive successful launches AND increase cadence between launches in order for shares to appreciate—of course, easier said than done.

Rocket Lab / RKLB: -20%

On 6/28 Rocket Lab successfully launched NASA’s CAPSTONE spacecraft, which was designed to test a new orbit around the Moon.

This was a notable event not just because it kicked off a busy 2H22 for lunar missions, but because the mission utilized both Rocket Lab’s Electron rocket AND Rocket Lab’s Photon interplanetary spacecraft bus which will transport the CAPSTONE satellite from Earth orbit to lunar orbit.

On 6/9 Rocket Lab was contracted by Ball Aerospace to build a solar array for a future NASA mission intended to study variability in Earth’s atmosphere.

While we don’t know the size of this contract, it is encouraging to see Rocket Lab capture new space services contracts (i.e. non-launch), as I believe lack of space services revenue growth post-acquisition of SolAero, Advanced Solutions, Planetary Systems Corp, and Sinclair Interplanetary is weighing on RKLB shares (as I have highlighted this concern following both the company’s 4Q and 1Q earnings reports (link)).

Virgin Galactic / SPCE: -14%

N/A

Virgin Orbit / VORB: -18%

Notably, Virgin Orbit announced multiple news items related to emerging international launch opportunities, which underscores the flexibility of its horizontal takeoff capabilities relative to vertical takeoff competitors (which have been much slower to expand launch sites internationally).

The company established a Brazilian subsidiary + received an operator’s license for conducting launch operations from the Alcântara Space Center—one of the most advantageous launch sites in the world given its near-equatorial position.

VORB highlighted multiple US/UK government joint missions related to Virgin Orbit’s launch from Spaceport Cornwall later this year, which will be the 1st space launch taking place in the UK.

Virgin Orbit also hired an in-house Investor Relations officer on 6/21 (Stephen Zhang, previously working in IR at Raytheon). This made Virgin Orbit the 9th of 14 space SPACs to hire a full-time IR rep—Astra, Arqit Quantum, Satellogic, Terran Orbital, and AST SpaceMobile being the remaining companies that haven’t hired one.

Having worked in IR in the past, I am a proponent for having an in-house IR rep vs utilizing 3rd party reps like the five companies listed above do.

Earth Observation Constellation Operators

BlackSky Space / BKSY: -29%

BlackSky promoted Henry Dubois (previously Chief Development Officer) to Chief Financial Officer—while CFO turnover is always of interest, I actually found something else within this press release to be even more interesting.

BlackSky reaffirmed its 2022 revenue guidance range of $58M to $62M, and mentioned that the NRO contract increased “our conviction in the 2022 revenue guidance”—this statement caught my eye.

Following BlackSky’s NRO contract award, which guaranteed $72.7M of revenue over the next two years, many investors (including myself) were expecting BlackSky to raise its 2022 revenue guidance.

So I was surprised to see reaffirmation of the current guidance in the press release, which suggests the contract award matches what the company had previously been anticipating winning.

Management didn’t have to reaffirm guidance with this new CFO announcement, and I believe it is less likely that the company revises 2022 revenue guidance higher on the 2Q earnings call in August as a result of having done so mid-quarter.

Planet Labs / PL: -29%

Planet Labs’ reported C1Q22 / F1Q23 earnings mid-June. See below for my summary of the key details from that earnings call:

Satellogic / SATL: -14%

N/A

Spire Global / SPIR: -24%

Spire’s most important news of the quarter was its acquisition of a $120M credit facility from Blue Torch Capital (a private credit lender). Given the current macro environment, I am paying close attention to any news related to cash / capital raising for the space SPACs.

Spire will receive $100M of credit upon closing of the deal ($71M of which will be used to extinguish an existing credit facility), giving the company $29M of capital in addition to the $92M of cash it already had as of 1Q22.

The company can receive an additional $20M of capital once Spire “reaches funding conditions,” which management expects will be reached by YE22.

Other Constellation Operators

Arqit Quantum / ARQQ: -19%

N/A

AST SpaceMobile / 🅰️STS: -19%

ASTS investors got what they wanted—and more—in June, with the company announcing the launch date of its BlueWalker-3 (BW3) test satellite not once, but twice! Just kidding…the 2nd time was announcement of a launch delay.

The company announced on 6/13 that BW3 was scheduled to launch the week of 8/15 via a Falcon 9 rideshare with a number of SpaceX Starlink satellites.

However, management updated investors on 6/29 that SpaceX (not AST) was delaying the company’s launch until “early to mid-September.”

FinTwit hypothesized that the launch was delayed to accommodate a government payload, which has higher priority for SpaceX launches vs commercial payloads.

Manufacturing / Infrastructure

Terran Orbital / LLAP: -12%

Most of the news related to Terran Orbital in June was entirely related to its satellite manufacturing business—the most notable announcement being that it successfully delivered NASA’s CAPSTONE satellite to Rocket Lab for launch to lunar orbit.

While the launch and initial earth orbits en route to traveling to the moon were successful, since beginning a path to lunar orbit NASA has lost contact with the CAPSTONE satellite.

Momentus / MNTS: -26%

On 6/13, Momentus shared an update on its test vehicle that experienced an anomaly shortly after launch on May 25—apparently the spacecraft’s deployable solar arrays that are produced by a third party and are folded and stowed during launch did not operate as intended once in orbit. This resulted in power and communications issues with the vehicle—management’s confidence in carrying out its mission objectives “has substantially declined” since this diagnosis.

Following this news MNTS shares traded down -16%. Since 1st disclosing the in-flight anomaly in late May, MNTS shares are down 35%.

While this news stinks for Momentus, the company’s next scheduled launch is in October as part of SpaceX’s Transporter-6 mission, at which point the Momentus team will grit their teeth and try again.

Redwire Space / MNTS: -26%

Redwire’s most notable news in June was its sale of optical crystals that the company had manufactured on the ISS to Ohio State University—this transaction marked the 1st time that a space-enabled materials product has been sold on Earth, “a significant milestone for space commercialization and a demand signal for Redwire’s space-based manufacturing.”

While the transaction was small (only ~$4k), the unit price at which it was sold was big ($2M / kg), and illustrates the lucrative potential for in-space manufacturers if they are able to scale operations AND find buyers.

The high price can be justified by the fact that “Currently, optical crystals manufactured on Earth have lower damage thresholds due to gravity-induced inclusions and defects which limits the output of high-power laser systems since the lenses are subjected to laser-induced damage. Space-manufactured optical crystals could improve system performance because they have a higher laser damage threshold due to fewer inclusions and defects because of the space manufacturing process.”

Redwire also announced a new CFO (Jonathan Baliff, previously on the Redwire BoD) to replace the existing CFO (Bill Read) that had been with the company since it was private and who managed its early days as a public company.

Mr. Read led Redwire through the difficult process of merging 8 different companies into a single conglomerate, and then taking the new company public—Redwire’s struggle to file its 3Q21 and 4Q21 SEC filings being an indication of the difficulty of the CFO role at that time.

Velo3D / VLD: -44%

On 6/16 Velo3D announced the debut of a new line of 3D manufacturing printers (the Sapphire XC 1MZ), enabling users to print parts up to 1 meter in height and with a total build volume 2x and 9x larger than its two existing 3D printers.

The new printer was built based on feedback from customers in the aerospace, energy, and defense industries, with the first systems expected to be delivered to several aerospace companies in late Q3 2022.