In this month’s Space Stock Recap:

📊 April Overview

🖱️ Double-Click on Space SPACs

🤔 Performance Drivers

APRIL OVERVIEW

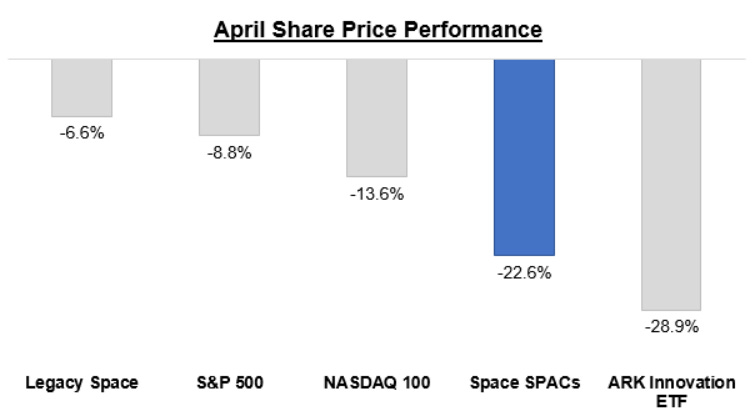

2022 is so far the year of legacy space…at least in the world of space stocks.

Legacy space stocks have outperformed both the market AND space SPACs three out of four months this year (March being the one month legacy space lost to the S&P 500).

On the other hand, space SPACs have yet to have a positive-return month and recorded their 2nd month with returns down over -20%.

The macro drivers of April’s negative stock market performance were a continuation of trends investors have been dealing with since late 2021:

“Stocks closed out a dismal month as investors contended with a slew of headwinds, from the Federal Reserve’s monetary tightening, rising rates, persistent inflation, Covid case spikes in China and the ongoing war in Ukraine.”

- Hannah Miao + Tanaya Micheel, CNBC (link)

I believe legacy space’s outperformance in 2022 speaks to the relative stability of the larger, more established, and diversified legacy space businesses, and also can be somewhat attributed to geopolitical tensions that tend to benefit aerospace & defense companies (which make up the vast majority of the market cap in my legacy space index).

DOUBLE-CLICK ON SPACE SPACs

Most space SPAC stocks declined double-digits in April, with only Planet (-1% decline) and Satellogic (the lone company that had positive stock performance at +12%) avoiding this trend. Having said that, some negative performances were notably worse than others (Arqit and Velo3D in particular).

In total, earth observation was ~flat and launchers declined a mere -16%, while other satellite constellations declined -37% and manufacturing/infrastructure declined -46%.

SPACE SPAC PERFORMANCE DRIVERS

(Does not include commentary on every space SPAC)

Launchers

No notable catalysts for launchers in April. The best-to-worst ranking of performance however (RKLB, VORB, ASTR, SPCE), seemingly aligns with general investor sentiment on the launchers.

Earth Observation

Planet Labs / $PL: -1%

Planet’s stock was buoyed by a consistent stream of announcements in April:

Customer acquisitions on 4/1, 4/5, 4/18, and 4/20 (NGOs, Civil gov/agriculture, financial).

Release of a new product utilizing VanderSat capabilities on 4/12 (Planetary Variables).

Announced a partnership with SynMax on 4/18 to enhance ability to serve energy customers and better track illegal maritime activity.

Unveiled new details regarding next-gen Pelican satellites on 4/21.

Satellogic / $SATL: +12%

$SATL took an early lead vs space SPAC peers in April following the launch of five additional satellites on 4/4, which brought its constellation to 22 satellites and marked the initial deployment of its new Mark V satellite model.

While I’m not sure this event alone was enough to sustain $SATL’s April outperformance, press around the time of launch emphasized the connection between Satellogic and Peter Thiel’s Palantir, which could have driven incremental investor interest in $SATL.

Late in April, Satellogic announced two partnerships that demonstrated execution of the company’s strategy to partner with 3rd parties to maximize distribution for analytics and insights capabilities:

A partnership to bring Satellogic’s imagery and video onto Orbital Insight’s geospatial intelligence platform.

A partnership with Geollect, a leading geospatial intelligence and data analysis company, to offer maritime domain awareness capabilities.

Other Satellites

Arqit Quantum / $ARQQ: -48%

Arqit stock crashed in April following a WSJ article that contained testimonies from former employees and people outside the company questioning Arqit’s technology capabilities, financial forecasts, and company culture.

Prior to April, Arqit was a space SPAC anomoly—its stock had been trading >$15 (aka ~50% above deal valuation). Given the current market environment, this crash was overdue.

Manufacturing & Infrastructure

Terran Orbital / $LLAP: -33%

Terran Orbital’s April underperformance matches volatility patterns that most SPACs experience upon de-SPACing. The stock bounced back to some degree after Jefferies initiated coverage of $LLAP with a BUY rating on 4/19, but it wasn’t a strong enough recovery to offset losses earlier in the month.

Momentus / $MNTS: -12%

$MNTS shares were quite volatile in April, up nearly +40% at one point before finishing down -12%. The spike to +40% occurred after the company announced that it had signed a multi-launch agreement with SpaceX for four missions spanning 2022 and 2023.

I question if the spike to +40% was organic stock price movement—management had already announced these launch agreements on its 4Q21 earnings call three weeks earlier.

More likely, investors not familiar with the space industry were still experiencing PTSD from AST SpaceMobile’s +45% single-day movement on 3/9. AST’s 3/9 spike resulted from its own announcement of a similar multi-launch agreement with SpaceX, which triggered a short squeeze situation (details here). I am willing to bet investors (and/or trading algorithms) read the headline “…Multi-Launch Services Agreement” and quickly attempted to exit their short position in $MNTS…which resulted in a +49% single-day move!

The stock sold off through the rest of the month, which lends credence to the idea that $MNTS’ early-April share price appreciation was not driven by fundamentals.

Redwire / $RDW: -29%

$RDW shares sold off -29% on 4/1, the day after the company’s 4Q21 earnings call, where management:

Lowered 2022 revenue guidance by -25% at the midpoint of its newly projected range vs original SPAC guidance.

Announced that it likely wouldn’t file its 10-K on time (which probably scared investors following the four-month delay in filing its 3Q21 10-Q).

Noted that it may need to raise additional capital, which could include dilutive equity financing.

Following this news, the stock remained range-bound at roughly -29% for the rest of the month.

Velo3D / $VLD: -62%

Velo3D’s stock was April’s biggest loser, ending the month down -62%. Honestly, I am never 100% certain what drives VLD’s stock, and this month is no exception. However, I do have some guesses:

It seems fair to assume weakness is at least partly due to anticipated impact from continued inflation, rising interest rates, supply chain delays, and a general negative macroeconomic outlook. But these factors have been ongoing for months, so it is hard to say these are the main drivers of underperformance.

A spicier theory for $VLD’s underperformance is that the 3/31 announcement of automated aerospace & defense manufacturer Hadrian’s latest fundraising (link) signals growing competition for existing domestic aerospace & defense manufacturers, as investors look to fund and “rebuild” America’s industrial manufacturing capabilities. This effort represents a threat to all existing A&D manufacturing companies…even for companies that may consider themselves disrupters, like Velo3D.

This is an excellent overview. Part of me says to look on the bright side though, and see that at least, and finally, significant capital is flowing into riskier space sector technology of all sorts, and that will be good for the sector, if not for any individual companies and investors.

But the glass-half-empty part of my sentiment says that the real challenge for these start-ups is revenue, which is to say market creation and growth. Investors since the days of Amazon (or Uber today, among others, etc.) maintain their enthusiasm when they see revenue and growth, even with no profit, even with major billion dollar losses.

All these companies need to produce, on a tempo consistent with the initial dollar enthusiasm of the SPAC. Otherwise, Houston, we have a problem.