May Space Stock Review + Bonus: 1Q22 Space SPAC Earnings Review

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Recap:

📊 May Overview

🖱️ Double-Click on Space SPACs

✍️ 1Q22 Space SPAC Earnings Review: Key Themes and New News

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or investment recommendations; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of $ASTS and $SPIR at the time of this post, 6/10.

MAY OVERVIEW

Different month, same story:

In May, the S&P 500 and legacy space stocks continued to outperform the NASDAQ, the flagship ARK ETF, and space SPACs as concerns regarding macro factors (interest rates, inflation, supply chain and commodities challenges, etc) more acutely impacted tech and growth stocks. This is the 4th month of 2022 where space SPAC performance has been negative, and the third month of double-digit declines.

“Higher inflation and slower [economic] growth are now the consensus view but that doesn’t mean it’s fully discounted,” Morgan Stanley’s Mike Wilson said (per CNBC).

I believe that until we have more certainty regarding the economic outlook, larger and more stable businesses (like the companies that comprise the S&P 500 and my legacy space index) will continue to outperform tech and growth stocks in aggregate.

DOUBLE-CLICK ON SPACE SPACs

Stock Performance

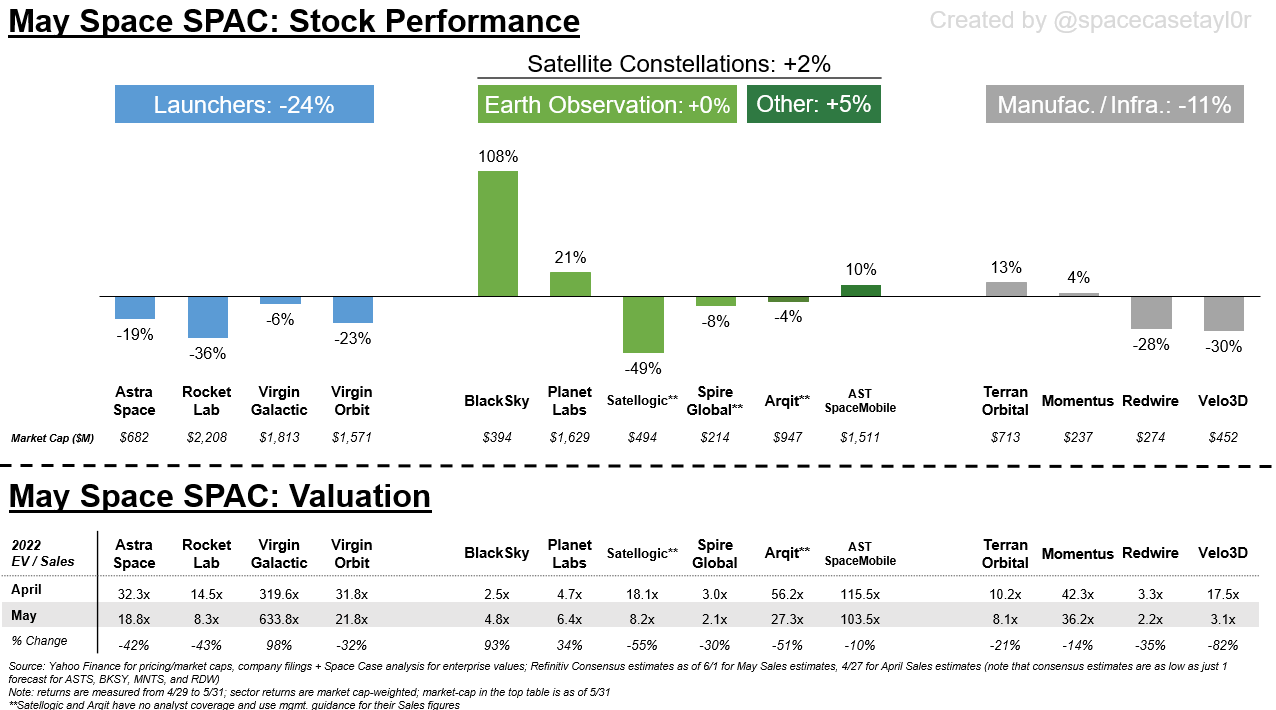

May’s -13.7% aggregate decline for space SPACs was primarily attributable to launcher stocks given that they declined -24% and the sum of their market caps represents >50% of total space SPAC equity value.

Meanwhile earth observation stocks saw a huge range of performance:

BlackSky and Planet’s positive returns are attributable to being awarded 10-yr contracts with the NRO (potentially worth >$1B each).

Prior to this month Satellogic had avoided the anti-SPAC/risk-off sentiment that has plagued most growth stocks this year, but its luck ran out in May and the stock declined -49% without any real negative news.

Valuation Commentary

Rocket Lab (trading at 8.3x) is getting closer to trading in-line with other non-launch space stocks (EO and manufacturing/infrastructure median valuations are both 5.6x).

BlackSky re-rated from 2.5x nearly 5x following the announcement of its NRO EOCL contract.

Spire continues to trade at a material discount to its earth observation peers at 2.1x.

If Redwire and Velo3D are indicators for where space-related manufacturing stocks trade, then Terran Orbital’s multiple still has room for compression.

1Q22 SPAC EARNINGS REVIEW - KEY THEMES AND NEW NEWS

Normally in this section of my monthly recaps I would review individual stock performance drivers; however, 13 of 14 space SPACs reported 1Q22 earnings in May so I am instead focusing on notable themes and/or new news from each company’s earnings report.

Launchers

Astra (-19% in May; 1Q22 earnings report on 5/5)

Earnings Notes

Management emphasized their outlook for accelerating launch cadence both in the near-term—as the company builds upon success in 1Q22 (2 orbital launches) and looks to complete 3 launches for NASA over the next few months—and in the long-term, as Astra debuts its next-gen rocket + launch systems, which are designed with a more rapid launch cadence in mind.

The company’s high-margin space services are seeing traction with customers (ex. 61 spacecraft engines ordered through early May, including from satellite manufacturer LeoStella).

See more complete earnings summary here:

Non-Earnings Notes

Astra hosted a SpaceTech day on 5/12 where management discussed in detail its next-gen rocket and launch system (summary here).

The next-gen rocket (rocket 4.0) will be bigger and enable Astra to target a larger portion of launch customers; management alluded to production of this rocket beginning in 2H22 and expects to produce them at a weekly pace.

The next-gen launch system (launch system 2.0) will require just 8 crew members to operate vs 21 prior, and was designed with weekly launch cadence in mind.

Investors clearly liked the presentation, as $ASTR shares traded +7.7% that day (vs the S&P being flattish).

Rocket Lab (-36% in May; 1Q22 earnings report on 5/16)

Earnings Notes

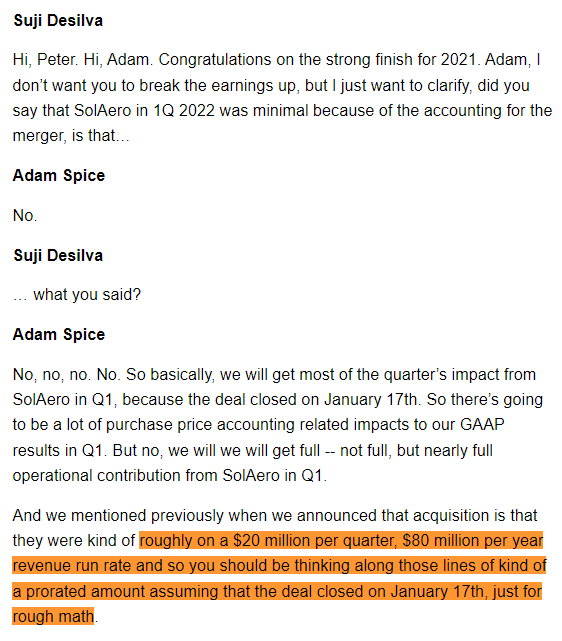

While management emphasized Rocket Lab’s increasing levels of vertical integration across its space systems business (from solar panels to GNC software to Photon spacecraft), they noted that the company is still in the early days of recognizing sales synergies from this strategy.

We can see why they hedged the outlook for their space systems business by looking at revenue backlog:

While backlog increased from $241M at YE21 to $545M in early March at the time of their 4Q21 earnings call, management said backlog increased just 1% since then, reaching $551M as of 5/16.

Additionally, 2Q revenue guidance of $51M - $54M suggests that excluding launch revenue ($7.5M/launch for 3 launches = $22.5M), space systems revenue will be down q/q ($28.5M - $31.5M in 2Q vs $34.1M in 1Q22).

I have previously highlighted lack of space systems revenue growth as a potential risk to $RKLB shares:

However, with new top-of-the-line solar cell technology coming to market later this year and new production facilities in Long Beach and Colorado coming online in the future to better support the growing customer demand for their satellite systems, the long-term outlook for RKLB’s space systems business remains bright

Hopes to continue to ramp launch cadence (recent launches have averaged one launch every 31 days) given Rocket Lab’s expansion of launch pads; however, noted that launch cadence is ultimately driven by customer readiness.

Noted that RKLB’s newest launch pad at its existing NZ complex doubles launch capacity without doubling supporting infrastructure.

Reiterated expectations for an inaugural launch from NASA’s Wallops launch facility before YE22 (which bodes well for the tailgate I am planning for the event 🤠).

Acknowledged that because Russia’s Soyuz can no longer service a large portion of commercial launch demand, Electron pricing has strengthened and there is a gap in medium-lift launch capability from 2024-27 timeframe when “a tremendous number of both government and commercial media constellation come to market,” which represents an opportunity for Neutron.

Non-Earnings Notes

The biggest non-earnings news for Rocket Lab this quarter was its successful mid-air recapture of a 1st stage booster via helicopter on 5/2. The company is pleased with initial results, and will improve its technique during future launches.

Virgin Galactic (-6% in May; 1Q22 earnings report on 5/5)

Earnings Notes

The biggest news from earnings was that re-commencement of commercial flight service was delayed from 4Q22 to 1Q23 due to supply chain disruptions + hiring difficulties.

Ticket sales remain on track to reach 1,000 by re-commencement of flight service—Virgin Galactic has now sold 800 tickets vs 750 at its last earnings report in February.

Management stated that at this point tickets being sold are for flights in the 2025-26 range, though by then $SPCE’s next-gen Delta vehicle will be in service and will help to materially accelerate flight cadence.

Tickets are currently sold at $450k, but the company may adjust this price after they hit 1,000 sales.

Management went into extensive detail regarding the RFI process for its next-gen vehicle (Delta). I didn’t find this particularly interesting, but perhaps people with engineering degrees did.

Non-Earnings Notes - N/A

Virgin Orbit (-23% in May; 1Q22 earnings report on 5/11)

Earnings Notes

Management emphasized that VORB’s simple, flexible, and responsive launch technology is leading to differentiated opportunities vs traditional launchers.

Noted that air-launch is the only launch option for a land-locked country like Poland (VORB signed an agreement to work with the Polish Space Agency in March).

“With our technology almost any 747 compatible airport could become a spaceport giving our customers a unique level of global access to space” - Dan Hart, CEO.

Believes VORB’s rapid response capability is of particular interest to national security customers, given the ability to start rocket flight from almost any location on Earth and the potential for using VORB’s technology for hypersonic missile research.

Stated that while there is demand for VORB’s services, the company is just beginning to invest in technology to accelerate its launch cadence and production capabilities.

Is building a two additional 747 1st stage aircrafts to augment launch capability (delivery targeted for 2023).

Investing in production facilities that support throughput of 20 rockets/year.

Non-Earnings Notes - N/A

Earth Observation

BlackSky (+108% in May; 1Q22 earnings report on 5/11)

Earnings Notes

Reaffirmed FY2022 revenue guidance of $58M to $62M.

Non-Earnings Notes

I am less focused on BlackSky’s earnings report because BY FAR the biggest news for BlackSky this month came as a surprise—the NRO announced its Electro Optical Commercial Layer (EOCL) contract awards, which included BlackSky as a winner (see my original discussion of this news here).

BlackSky was expected to win a portion of this contract, but management had been calling out a mid-summer award vs late May.

This was a big deal for BlackSky—while its initial contract value is relatively small ($72.7M in the 1st two years, $85.5M over the 1st five years), there is huge upside depending on growth in demand from the NRO (the contract could grow up to $1B in total over the 10yr contract period).

Clearly the assured stream of revenue and material contract upside gave investors more certainty in BlackSky’s growth outlook—the stock went up +177% in the four days after the announcement.

Going forward the real question is how much will BlackSky increase its 2022 revenue guidance—enough to justify the stock’s nearly +100% increase in valuation multiple? We will see in August, during the 2Q22 earnings call.

Planet Labs (+21% in May; has not yet reported 1Q22 earnings)

Non-Earnings Notes

Similar to BlackSky, Planet’s biggest news in May was being awarded a portion of the NRO’s EOCL contract—however, unlike BlackSky we do not know the details of Planet’s contract.

Planet is in a blackout period leading up to its C1Q22 earnings call on 6/14, and therefore the company has not been able to discuss its contract details.

While this will undoubtably be one of the biggest topics on Planet’s upcoming earnings call, I would expect that Planet’s EOCL deal is bigger than BlackSky’s contract given its more established constellation and longer-tenured relationship with the NRO.

Satellogic (-49% in May; hasn’t reported 1Q22 earnings, but released FY21 results on 5/3)

Earnings Notes

I didn’t find anything material in Satellogic’s FY21 report that would explain the downturn in $SATL shares. Updates included:

Expects to have 34 satellites on-orbit by YE22 vs prior expectations for 37 satellites on-orbit by YE22 (26 on-orbit as of time of writing).

2021 adj. EBITDA loss of -$30.7M compared to deal forecast of -$32M prior.

Mgmt reiterated plans for FCF breakeven in 2024.

Non-Earnings Notes

No major news here…but I think $SATL’s relative underperformance vs other space SPACs was reflective of the market finally catching up to $SATL shares—it has been trading at a premium (+20x multiple or greater) vs earth observation peer stocks, which have been trading more in the mid-to low single-digits. $SATL had until now escaped the risk-off/anti-SPAC sentiment that has plagued the space SPACs since late 2021—so I was not surprised to see this month’s decline in shares.

Spire Global (-49% in May; 1Q22 earnings report on 5/11)

Earnings Notes

Spire had a strong financial quarter, beating top and bottom-line guidance for 1Q and raising the low end of its FY22 ARR guidance (now $101M - $105M vs $100M - $105M prior), with strength coming from space services and weather solutions.

Management emphasized that the company is seeing momentum in all areas of its businesses:

Spire’s aviation and maritime solutions provide customers unique insights into the supply chain, and can help customers better track movement of goods in the midst of supply chain constraints

Spire’s weather solutions are bound to play a more important role than ever as we enter hurricane season.

Additionally, Spire’s GNSS-RO measurement capabilities has garnered significant interest from government entities looking to better monitor GPS signal jamming.

Spire’s space solutions (aka hosted payloads and constellation-as-a-service) will continue to grow over time, as new contracts like the one Spire signed with NorthStar, start small and are set to multiply in size over time.

Management expects to be cash-flow positive in 22-28mo.

Non-Earnings Notes

Just as management highlighted on the earnings call, Spire’s weather and space solutions businesses are humming right along:

Spire signed a multi-million dollar contract with a key government reconnaissance contractor for weather solutions.

The company successfully launched five more satellites on SpaceX’s Transporter-5 mission on May 25th, and now has a constellation of ~125 operational satellites.

These newest satellites included both core Spire data collection capabilities, as well as hosted payloads for HANCOM inSPACE, Myriota, and the UK Ministry of Defence.

Other Satellite Constellations

Arqit Quantum (-4% in May; 1Q22 earnings report on 5/12)

Earnings Notes

Most of Arqit’s earnings call focused on addressing the criticism of its technology development stemming from a WSJ article in April (link):

Management highlighted results from an independent assurance report (link) that “confirms the security proof of Arqit's customer end point symmetric key agreement software in that it creates keys which are zero trust and computationally secure.”

Emphasized a partnership with Blue Mesh, a UK IoT company, that enabled Arqit to execute a terrestrial demonstration of its cybersecurity services in an industrial environment (link).

Noted that 98% of shares subject to lockup agreements voluntarily agreed to extend the lock-up period until September 2022 (vs March 2022 prior).

Management believes this signals long-term support of the company—to be fair, the stock was trading at a 50% premium to SPAC deal valuation in March, so I agree that to voluntarily lockup shares for more time signals confidence in the company’s outlook through 2022.

Anticipates seeing more material revenue from commercial and government partnershipd in the 2nd half of 2022 (compared to $7M of revenue in the 1st half of Arqit’s F2022).

Non-Earnings Notes - N/A

AST SpaceMobile (-4% in May; 1Q22 earnings report on 5/12)

Earnings Notes

Management reaffirmed that the company’s test satellite, Blue Walker-3, is on-track for a “summer” 2022 launch.

Given that the last day of summer is September 21 and SpaceX has to inform AST of its launch date at minimum 60 days ahead of time, this means that SpaceX will inform AST of its launch date no later than July 23 (note that this doesn’t mean either company will announce the launch date on July 23 however).

Management also provided additional details re: the BW3 testing process: 1) confirm the satellite is on its proper orbit within a few hours of launch, 2) unfurl BW3 within 1-2 weeks of launch, 3) 6mo of testing with MNO partners.

The earnings call had a number of new analysts calling in to ask questions, including representatives from Morgan Stanley, Scotia Bank, and B. Riley, in addition to the usual suspects from Deutsche Bank and Quilty Analytics—this suggests we can anticipate initiations on $ASTS from these institutions in the future.

Non-Earnings Notes

Importantly the company obtained a $75M committed equity facility via B. Riley, locking down additional capital to fund growth (if needed). The deal seems minimally dilutive, with $75M representing just ~5% of current market cap and potentially issued equity will only receive a 3% discount to $ASTS market value.

Secured an experimental license from the FCC to test its BW3 in the US, enabling AST to connect to unmodified cellular devices in Texas and Hawaii. This was obviously a major regulatory hurdle ahead of the BW3 launch this summer—while AST could have tested its technology outside of the US, it undoubtably is better to be able to test from HQ in Texas as well.

Manufacturing & Infrastructure

Terran Orbital (+13% in May; 1Q22 earnings report on 5/13)

Earnings Notes

As I highlighted on my podcast with Aravind Ravichandran (7-Things Space), I thought Terran Orbital’s first earnings call went pretty well—their CEO Marc Bell has previous experience as CEO of a public company, so this is not entirely surprising.

Management is highly focused on supporting the Space Development Agency’s Transport Layer constellation development given that the SDA’s Transport Layer will award contracts for manufacturing 684 total satellites over the next decade, representing a multi-billion-dollar opportunity:

Thus far, LLAP is working on building 10 satellites to support Tranche 0 of the SDA’s Transport Layer, and it was awarded a contract to build 42 more satellites in support of Tranche 1.

Management said that while they are still developing LLAP’s SAR earth observation satellites and plan to launch them late 2022 or early 2023, given Terran’s focus on supporting the SDA’s Transport Layer, the company may de-prioritize the launch of 14 additional satellites originally planned for 2023 depending on capital constraints.

Non-Earnings Notes

There were six Terran-constructed satellites onboard SpaceX’s Transporter-5 mission, supporting both commercial and government customers.

Momentus (+4% in May; 1Q22 earnings report on 5/10)

Earnings Notes

The MNTS earnings call was entirely focused on the company’s upcoming/inaugural on-orbit test of their OTV technology (Vigoride 3).

Management emphasized that this was a test flight and success was not certain:

John Rood, CEO: “In the history of space flight, it's common to experience issues, particularly on early missions. Our intention is not just to perform the planned flight demonstration mission and meet our objectives but also to find issues that we can correct on future flights…We plan to learn from any anomalies we experienced during our inaugural flight and apply the lessons learned to improve our technology going forward.”

Non-Earnings Notes

Subsequently, Vigoride 3 successfully reached orbit via SpaceX’s Transporter-5 mission on 5/25; however, the vehicle experienced a communications anomaly and while it successfully deployed 2 of 9 customer payloads, the company is still working to address the vehicle anomalies and deploy additional customer satellites.

Redwire Space (-28% in May; 1Q22 earnings report on 5/12)

Earnings Notes

Reiterated FY22 revenue and EBITDA guidance despite soft 1Q results, stating that 2022 revenue is now expected to be more heavily-weighted toward 2H22 than previously expected.

Stated that Redwire’s 1Q results were negatively impacted by delays in contract awards (i.e. civil space/NASA orders delayed due to continuing resolutions as a result of delays in approvals for the US Federal Government’s budget), supply chain issues and volatility associated with orders from emerging commercial space companies; however, management emphasized that these revenues aren’t lost, but have been shifted to later in the year.

Expects supply chain constraints to ease in 2Q/3Q this year.

Noted that while revenue backlog was flat q/q, Redwire has >$546M in bids submitted to customers that are awaiting decisions.

Great quote on the current state of, and outlook for, the commercial space sector:

Peter Cannito, CEO: “…recent development in the macro environment has created near-term volatility and some companies are having difficulty raising the capital required to support their growth objectives…Regardless, we still see incredible potential from this segment over the long-term and as the other two segments rely heavily on a vibrant commercial space sector. The long-term growth trajectory for this segment is easier to predict than the timing.”

Highlighted the White House’s recent In-Space Servicing, Assembly, and Manufacturing interagency national strategy, noting that the the WH’s distinction between “in-space” vs the more commonly used “on-orbit” terminology broadens the focus of this category to much greater than Earth orbit to all areas of space such as cislunar, lunar, and interplanetary space.

Noted that RDW’s Archinaut One satellite, the 1st satellite which will manufacture and assemble itself on-orbit, recently completed a design review clearing the way for Redwire to do construction, test and deployment of this mission.

Non-Earnings Notes - N/A

Velo3D (-30% in May; 1Q22 earnings report on 5/10)

Earnings Notes

Overall, no real read-through to the space industry and other space companies.

Reaffirmed all 2022 guidance, highlighting that 75% of the $89M forecasted revenue is in backlog and that there has been substantial demand from new customers.

Emphasized that the majority of backlog is for the company’s next-gen Sapphire XC product.

Noted that while supply chain management has been difficult, the company has been able to avoid delays thus far.

Non-Earnings Notes - N/A