Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

👀 In Case You Missed It: Best of Case’s X Posts

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of PL, RKLB, and SPIR at the time of this post (2/6/24).

1. MARKET COMMENTARY

Public Markets

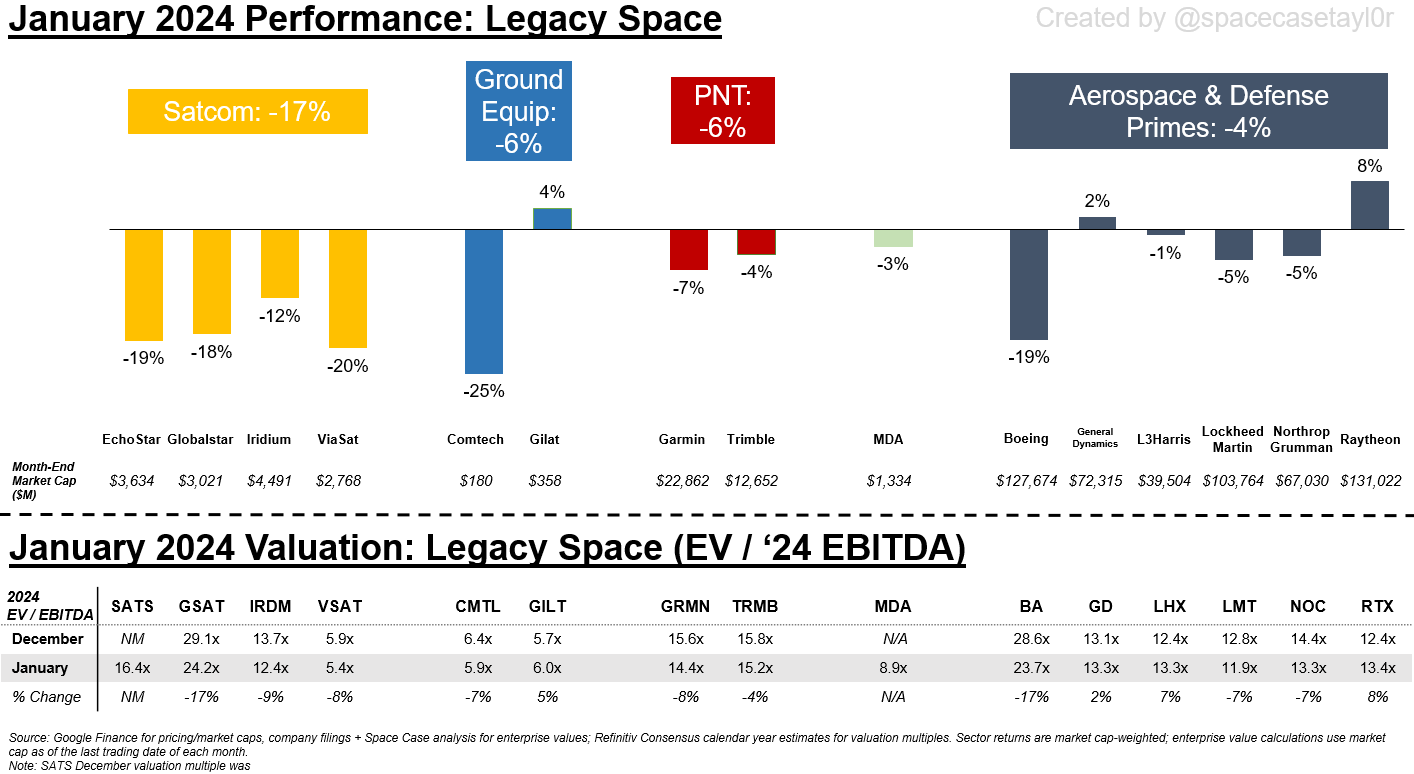

Space stocks did poorly versus the broader market in January 2024, with legacy space and the space SPACs both seeing month-over-month declines compared to the S&P 500 and NASDAQ each continuing their 3rd straight month of gains.

Despite a higher-than-expected December inflation readout, the stock market continued to rally in January (as it has since November) given sold underlying economic conditions (ex. 4Q23 US GDP growth beat expectations) and an outlook for interest rate cuts later in 2024.

Notably, the Magnificent 7 stocks (META, MSFT, AMZN, AAPL, GOOGL, NVDA, and TSLA) continued to lead the market higher after reporting solid 4Q earnings in January (though it was really the Magnificent 6 in January, as TSLA had a tough month and reported meh 4Q earnings).

We don’t disagree with investor interest in artificial intelligence (AI) stocks right now given the long-term growth potential for AI-related products and services; however, we would also say that now is a good time to evaluate space stocks (when they are out of favor) to be ready for when investor enthusiasm for space returns.

Private Markets

We won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends + insightful analysis:

This Silicon Valley clip is making the rounds again, and it is just too good

“Why didn’t anyone tell me I could take less?!”

2. SPACE STOCK COMMENARY

Changes to Coverage in 2024

We’re making two changes to space stocks we cover in 2024:

Honeywell / HON was removed from the Aerospace & Defense subsector

Only ~10% of Honeywell’s revenues come from space, and it has a larger consumer business than the other A&D companies - it doesn’t make sense to include going forward

MDA Space / MDA has been added to the Manufacturing subsector

We generally only cover US stocks, but we are making an exception for MDA since it is just across the border in Canada and the company reports nice clean quarterly earnings (unlike most foreign companies, which generally only provide annual or 6mo reports)

Despite closing over $300M in much-needed financing (link, link), AST SpaceMobile / ASTS declined -52% in January; the capital came from a combination of strategic partners ($155M from AT&T, Google, Vodafone), existing investors ($51.5M from an existing credit facility) and an equity offering ($100M)

While a $307M raise with more than half coming from high-quality partners should have been reason to celebrate, ASTS shares traded down on the news for a variety of reasons:

The $100M equity offering was priced at $3.10/sh vs $4.16/sh pre-announcement (a 25% discount), indicating lack of institutional investor interest in the offering

The fundraise was only ~50% of management’s previously stated goal of $550M-$650M additional capital they said they would need to raise to fund building, launching, and operating the company’s 1st 25 satellites

The fundraise was executed poorly (see here for an articulation of investor frustration)

Terran Orbital / LLAP declined -27% in January despite receiving (some amount of) payment from its lead customer, Rivada Networks

Context: Rivada’s contract with LLAP makes up $2.4B of Terran’s $2.6B contracted backlog, and Rivada was supposed to have paid Terran $180M by YE23. However, in 4Q23 LLAP management said they didn’t expect to receive the money from Rivada before the end of 2023

On January 2, LLAP announced they had received a payment from Rivada and without stating the size of the payment, LLAP said Rivada was “current on all outstanding invoices” (link); given the lack of clarity on payment size, it feels safe to assume Rivada paid less than the expected $180M. Additionally, in the press release LLAP management said it “does not plan to provide any further updates or otherwise publicly comment on the Rivada Contract…except as required by the Securities and Exchange Commission or in updates in connection with the Company’s quarterly and annual financial reporting”

Investors hate uncertainty, and the combination of not announcing the Rivada payment amount + the weird statement about not wanting to comment on the Rivada contract (which accounts for 92% of LLAP’s backlog) have clearly left investors feeling increasingly uncertain about LLAP’s future

Intuitive Machines / LUNR had a volatile January, trading -18% before ending up +48% to end the month; the only material news we could find for LUNR in January was that the company raised $11.8M of cash from warrant conversion related to its original SPAC transaction

More cash is always good news for unprofitable companies, but this news likely wasn’t the driver of LUNR’s January performance

Fresh off completing a merger with Dish Networks, we are highly skeptical of the new EchoStar / SATS—a business with declining revenue, below-average margins, and 11x net debt to EBITDA (alarmingly high)—continuing to trade at 16x EBITDA (in-line with LEO satcom peers) for very long

As we noted last month (link), Comtech’s / CMTL stock has suffered since the company missed a projected timeline to refinance its $184M of debt (CMTL shares are down -50% since the management told investors this news); while the company received a $45M strategic investment in January (which helps with financial flexibility and working capital), CMTL’s October 2024 debt repayment still looms large

Context: CMTL management had hoped to refinance the company’s $184M credit facility by October 2023, but it did not, and as a result the debt turned into a ‘current liability’ (i.e. debt due in <1yr) since it is due for repayment in October 2024, which has created uncertainty for investors (and investors hate uncertainty)

Another month, another announcement of bad news for Boeing / BA; this time, BA shares are down -16% since 1/5 when the door of a 737 Max blew off mid-flight

This terrible quality control issue overshadows what seems to be solid demand for Boeing’s aviation products, as Boeing has recently resumed commercial plane sales in China after a multi-year pause and backlog for the company’s Commercial Airplanes segment is now at $441B

See here (link) for an overview of more issues found with the 737 Max on 2/5

3. IN CASE YOU MISSED IT: BEST OF CASE’S X POSTS

We post a lot more on X than for the Case Closed newsletter; in case you don’t follow Space Case on X, here are our best X posts from January 2024:

The space stock commentary for January had the same energy as, "Other than that, Mrs. Lincoln, what did you think of the play?"

How is rocketlab not manufacturing when more than 50% of their revenue comes from

Manufacturing!