Stars, Stripes, and Satellites

How the Space Development Agency is Both Upgrading Military Space Tech & Unleashing a New Opportunity for Commercial Space

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of RKLB at the time of this post (1/25/24).

The US military has a long history of using space technology.

Since launching its first satellite onto orbit in 1958, the US military has increasingly relied upon space tech for:

Intelligence, surveillance, and reconnaissance (ISR)

Satellite communications (Satcom)

Position, navigation, and timing (PNT)

However, as space has transitioned from a purely peaceful sanctuary of science and exploration to a warfighting domain, legacy military space capabilities are now outdated and vulnerable. As a result, the US government created the US Space Force and its budget has doubled in just three years, going from $15B in 2021 to $30B in 2024.

Within the Space Force, one of the most exciting modernization efforts comes from the newly formed Space Development Agency (SDA), both because of its ambitious goals for quickly implementing new technology as well as its plans to leverage the commercial space industry manufacturing base.

With an annual budget of $4B-$5B, the SDA’s plans to build a new military satellite constellation for communications and hypersonic missile defense have created an exciting opportunity for satellite manufacturers—since 2020, the SDA has already awarded nearly $11B worth of contracts to build, launch and operate 455 satellites, and through the end of the decade it will likely award up to $20B more worth of contracts.

While the SDA is still just a fledgling agency, its early success with quickly procuring (i.e. purchasing) and deploying cutting edge space technology by utilizing commercial capabilities has positioned the agency as a symbol of hope that the Department of Defense (DoD) can procure new technology on a timeline of relevance in the face of an increasingly hostile geopolitical landscape.

In this post I will provide an overview of:

What are GEO Satellites? Why Does the US Military Use Them?

Why does the US military want to upgrade its space technology?

What is the SDA and why is it supposedly a “fix” given the current geopolitical environment?

The $30B+ SDA contract opportunity through the 2020s + Who has won how much money already?

Investor Considerations

Conclusion

1. WHAT ARE GEO SATELLITES? WHY DOES THE US MILITARY USE THEM?

Traditionally the government has used geostationary or geosynchronous (GEO) satellites for ISR, satcom, and PNT.

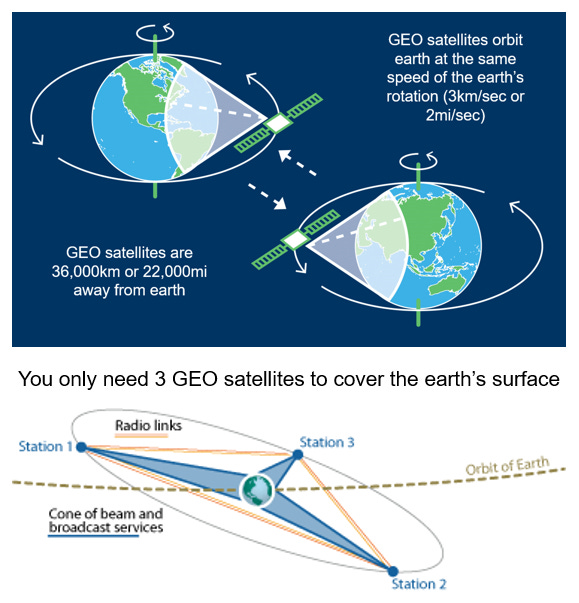

As the name suggests, satellites in GEO orbits travel at the same rotational rate as Earth and appear to remain fixed over a location on the ground below, providing a stationary platform for the continuous relay of communications signals or earth observation data.

GEO satellites are great for providing broad-based and reliable capabilities and it is clear why the US military (or any global superpower) would like using them:

You can position GEO satellites to provide service to a specific area on earth (ex. satellites can focus on places like southeast Asia, the Middle East, eastern Europe, etc.).

It only takes 3 GEO satellites to cover the entire earth

You always know where the GEO satellites are, which helps with mission planning

However, the reliability of using traditional GEO satellites come with a cost because GEO satellites are:

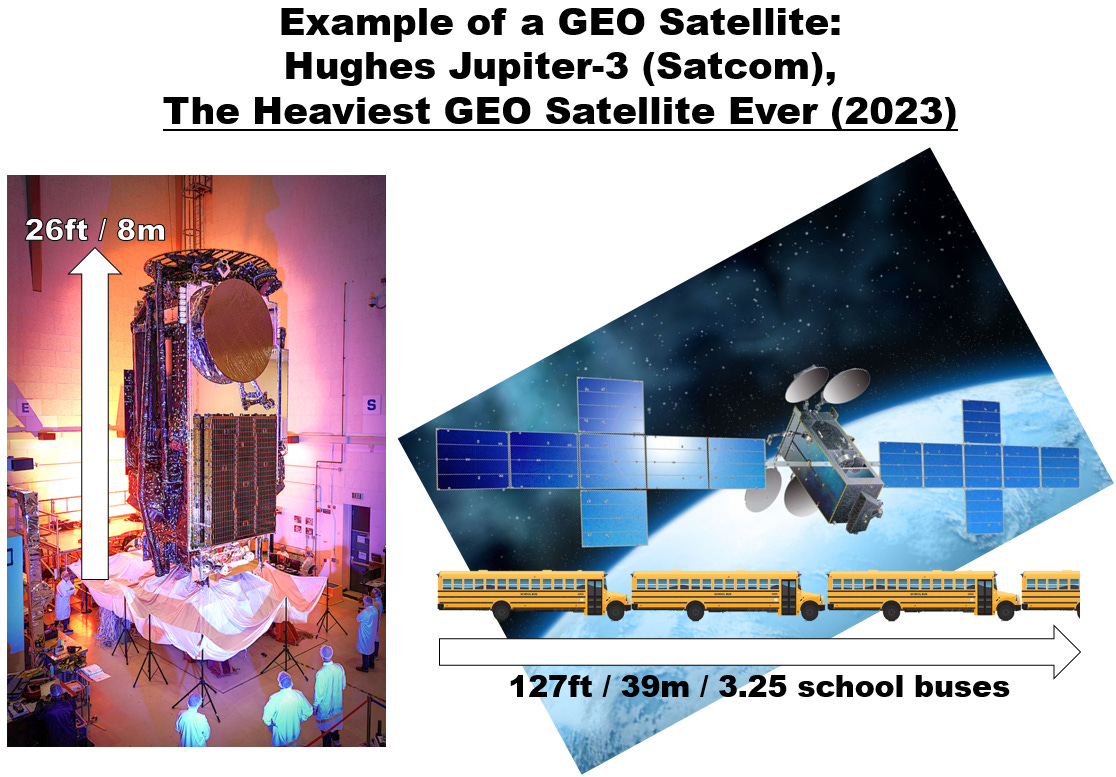

Massive (as big as a school bus)

Costly (generally >$1B per satellite)

Take so long to design and build (~7.5yrs) that the tech onboard the satellites is often outdated before leaving the ground

In addition to being big, expensive, and hard to replace, military GEO satellites also make for “big, fat, juicy targets” for potential adversaries because:

Their fixed position above earth’s surface makes their location very predictable

Each satellite plays a crucial role (satellite locations are chosen for specific reasons; each satellite provides service for thousands of people and assets)

Legacy GEO satellites have limited maneuverability (fuel is precious; they generally weren’t made to move around more than needed to maintain their position above earth)

2. WHY DOES THE US MILITARY WANT TO UPGRADE ITS SPACE TECHNOLOGY?

Reliance on GEO satellites didn’t used to be a problem for the US military—prior to the 90s they were pretty much the only military heavily utilizing space tech.

As a result, prior to the 90s the US military was moreso focused on the functionality of their space-based systems for terrestrial defense, and was less focused on defense of the satellites themselves.1

However, the US’ use of space technology in the decisively won 1991 Gulf War / Operation Desert Storm marked the 1st time where government space technology played a major role in a military conflict; ever since then, other countries have taken note of the strategic advantage that space capabilities present for military operations.

In particular, China has focused on developing its own space capabilities to match and exceed that of the US, as well as develop weapons that could take advantage of weaknesses within the US systems.

The Office of the Director of National Intelligence’s report says that China’s military, the People’s Liberation Army, plans to “match or exceed U.S. capabilities in space to gain the military, economic, and prestige benefits that Washington has accrued from space leadership.” Those counter-space operations will be “integral to potential military campaigns by the PLA.”

- Defense News, April 2021 (link)

And boy has China put its money where its mouth is—since 2005, the country’s pace of space tech innovation has been impressive; for example the country’s launch capabilities have grown from a handful of launches per year in the 1990s to 61 launches in 2022.

Additionally, China has specifically focused on developing space warfighting capabilities that have made US government officials increasingly uneasy.

3. WHAT IS THE SDA AND WHY IS IT SUPPOSEDLY A 'FIX’ GIVEN THE CURRENT GEOPOLITICAL ENVIRONMENT?

Given the looming threat of a conflict with China over Taiwan, there has been a growing sense of urgency to provide the DoD with more resilient ISR and communication capabilities.

Senior leadership in the DoD has known they need to do something different, but for years didn’t take real action—until 2018.

Enter Mike Griffin—a seasoned technocrat with half a dozen advanced degrees and who previously held senior positions at the Pentagon, NASA, commercial aerospace & defense companies and government think tanks (link to bio)

Given his background, I think its safe to say Griffin is intimately familiar with both the vulnerabilities of the US military’s space assets, the US government’s (in)ability to procure innovative technology on a timeline of relevance, and commercial industry’s growing space capabilities

In 2018 Griffin was appointed Under Secretary of Defense for Research and Engineering and within weeks of taking his new position at the Pentagon, he began planning for a new DoD organization that could both reduce dependence on vulnerable GEO satellites as well as enable new space-based capabilities…and do this on a timeline of relevance in the face of growing threat from China.

The result of his effort was the creation of the Space Development Agency (SDA), established in 2019 (link; link) and given a mission to quickly build a low-earth orbit (LEO) constellation of hundreds satellites (i.e. a proliferated constellation) that could be used for missile-defense and communications.

The SDA’s mission to develop a proliferated LEO constellation + creation as an independent organization were chosen for specific reasons:

Proliferated LEO Constellation: Utilizing LEO would increase resiliency through proliferation since LEO constellations require hundreds of satellites for global coverage given how close they are to earth + the speed that LEO satellites travel (10km/sec) make individual satellites more difficult targets vs stationary GEO satellites

Additionally, LEO satellites are smaller, cheaper, and more quickly replaceable than GEO satellites

New, Independent Organization: The SDA needed to be a brand new organization free of legacy DoD inefficiencies to create a new culture of 1) commercial industry partnership + 2) rapid acquisition methods

These goals don’t sound ground breaking, but the standard DoD procurement through PPB&E process is the opposite of quick (taking on average 16yrs from stating a new desire to initial operational capability, link) and it likes costly customized requirements, not what industry is already capable of producing off the shelf.

Now fast forward to the present day…

The SDA’s proposed solution is the Proliferated Warfighter Space Architecture (PWSA), a constellation made of 400-600 LEO satellites that will provide resilient missile-defense and satcom capabilities (link to a PWSA 101 explainer from Payload Space).

Remember that as a new organiztion, the SDA was tasked with 1) commercial industry partnership + 2) rapid acquisition methods—so to build the PWSA as quickly and efficiently as possible, the SDA decided to utilize a “spiral development” program where it will partner with commercial satellite manufacturers to design, build, and then launch satellites for the PWSA in layers (called tranches). New tranches will be ordered every 2 years and will build upon the capabilities of prior tranches.

The SDA has also “audaciously” set a goal for each tranche of satellites to be launched into space and put on orbit in under 3 years from the time of contract award dates; remember this is in comparison to prior satellite constellations that took 10+ years to reach orbit with outdated technology—getting a military satellite on orbit in <3 years is like moving at light speed.

Long term, the SDA hopes to build the PWSA into a 400-600 satellite constellation (300-500 communications satellites referred to as the “Transport Layer”; 100-200 remote sensing satellites referred to as the “Tracking Layer”). This number will fluctuate over time given timing between when the satellites reach their end of life (the SDA is planning for its satellites to have a 3yr lifespan) and when replenishment satellites are launched.

4. THE $30B+ SDA CONTRACT OPPORTUNITY THROUGH THE 2020s + WHO HAS WON HOW MUCH MONEY ALREADY?

Now we get to the good part—the construction and sustainment of the SDA’s PWSA represents a MASSIVE new opportunity for the space industry.

To give some context around how big of an opportunity the PWSA buildout is, look at the SDA’s budget growth—since being founded five years ago, the SDA’s annual budget has gone from <$100M to nearly $5B, a sign of serious support within the Federal Government. Going forward, the agency anticipates a run-rate annual budget of $4B-$5B.

Additionally, as the agency’s budget has ramped, so has the dollar amount of contracts it has awarded—through January 2024, the SDA has awarded nearly $11B worth of contracts to build, launch, and operate 455 satellites.

In the current FY2024, the agency has already awarded $4.4B and will award at least one other $400M-$500M contract (likely in the April/May timeframe) for 20 Tranche 2 Transport “Gamma” variant satellites. Going forward, the SDA will continue to award contracts for new Tranches of satellites every 2 years as the existing satellites on orbit reach their end of life and need to be replenished.

PWSA satellite contracts are not small awards—SDA contracts to build satellites have almost all been 9-figure deals!

Additionally, as the number and complexity of satellites being built has increased, so has the deal size—Tranche 2 contracts have averaged over $700M per award!

Through January 2024, the SDA has given out 20 contracts to 12 different prime (i.e. lead) contractors—this is blazingly fast and includes much more variety of partnerships relative to the traditional world of government contracting for a single project.

Additionally, while traditional aerospace & defense contractors (Northrop Grumman, Lockheed Martin, L3Harris, Raytheon, General Dynamics, and Ball Aerospace) have won 73% of contract value, the SDA has stayed true to its promise of avoiding vendor lock and several companies such as York Space, Rocket Lab, and Sierra Space have successfully won 9-figures or more in SDA contracts.

But it’s not just the prime contractors who are benefitting from SDA contracts—there have been at least 20 different subcontractors that have announced partnerships to provide various components for SDA satellites.

Meanwhile, the actual buildout of the PWSA has gone relatively well.

23 Tranche 0 satellites were built + launched between 28mo-33mo after contracts were awarded—well within the organization’s goal of <36mo

1 York satellite was kept on the ground for software testing

4 L3Harris satellites are being held back to share a launch with other DoD satellites to test a different orbit than originally planned

Space Case Note: corrected this bullet from erroneously saying these 4 satellites were from RTX

Tranche 0 satellites have successfully tested capabilities that validate the PWSA’s baseline technology and operating procedures ahead of future generations of the constellation coming online

Tranche 1 satellite contracts were awarded in 2022/23 and are set to begin launching to space in 2024

Tranche 2 satellite contracts were / are being awarded in 2023/24 and will begin launching to space in 2026

Tranche 3 satellite contracts are likely to be awarded in 2025, with satellites launched to space in 2028

5. INVESTOR CONSIDERATIONS

The easiest way to get exposure to the SDA opportunity is to buy stock in one of the 13 publicly traded companies providing satellite manufacturing and/or components for the SDA in the image below (Northrop Grumman, Airbus, Leidos, MDA, Mynaric, Lockheed Martin, Terran Orbital, L3Harris, Redwire, Honeywell, Rocket Lab, RTX, and Microsoft):

However, here are a few things to consider about the SDA opportunity for publicly traded companies:

SDA contracts are more meaningful for smaller companies versus larger ones

Ex. a company like Northrop Grumman has won nearly $3B of contracts from the SDA, but this revenue will be recognized over a multi-year period and is incremental to the company’s $40B annual revenue base

SDA contracts are even less meaningful for companies like Honeywell and Microsoft that are subcontractors to only 1 deal each vs their massive revenue bases

This compares to Rocket Lab’s $515M contract being recognized over a multi-year period, but on top of an existing revenue base of $250M in 2023 and $430M in 2024 (per consensus estimates)

There is execution/scaling risk for smaller companies

For example, Mynaric has accumulated a backlog of 794 lasercom terminals as of YE23 (up from 256 at YE22), in part driven by orders from Northrop Grumman, RTX, and Ball Aero/Loft Orbital for SDA satellites

Consensus is estimating Mynaric’s revenue grows from $4M in 2022 to $141M in 2025 as the company scales it manufacturing capabilities

With an enterprise value of ~$150M versus 2024E revenue of $67M, 2.2x 2024E revenue is not a bad valuation, but the company isn’t expected to become profitable until 2025 and it needs to transition from an R&D shop to a scale manufacturing organization—this is serious scaling risk that investors need to consider

Competition for SDA contracts is growing

The SDA has openly admitted to wanting to foster a diverse set of suppliers to avoid vendor lock

While early SDA contracts only saw a handful of bidders, the latest round of Tranche 2 contracts saw up to 9 companies bidding for 3 awards

I expect this kind of heated competition for SDA contracts to continue, and believe the SDA will strongly consider spreading out contract wins amongst promising new entrants over time

This is currently playing out with more recent contract awards, as Rocket Lab and Sierra Space have both won contracts for the first time for Tranche 2 satellites

This has the potential for SDA revenue to be “lumpy” and non-recurring if a company doesn’t successfully “defend” its contract wins in future tranches

Additionally, remember that the SDA is prioritizing both speedy/reliable satellite deliveries AND low costs—the incentive to submit low-cost bids is likely driving down margins for companies participating in these deals, though this is offset by the large size of deals (both Terran Orbital (link) and Rocket Lab (link) have alluded to this when discussing their SDA deal dynamics)

New capabilities will lead to new opportunities

As the infographic below indicates, each new Tranche of the PWSA aims to incorporate more sophisticated technology and enhanced capabilities for warfighters, which will likely result in more opportunities for new companies to participate over time (either as primes or subcontractors)

6. CONCLUSION

Of course as is the case with anything in the space industry, there will likely be delays that impact the PWSA’s actual deployment and operations, but given progress thus far I am encouraged by the prospects that the SDA can actually deploy T1/2/3 satellites on their projected timelines and deliver warfighters the more resilient communications and ISR capabilities they need, and I am excited by the multi-tens of billions of dollar opportunity that the PWSA buildout + replenishment represents for the commercial space industry over the next decade.

Semper Citius! (Always Faster)

I say this, but I’m sure there have always been people focused on the protection of US military space assets!

Great post. One quick comment on the Geo satellites: while it may be true that three satellites is sufficient to get line of sight coverage to everywhere on earth, in practice it isn’t sufficient.

Beam scan loss on both the satellite payload and terminal side along with field of view geometry (that is a shallow angle of intercept may lead to poor feature definition in imagery) mean that communications and earth observation satellite constellations need to fly birds in orbits that specifically cover the poles to have full earth availability and coverage. This is why you see systems like AEHF, SBIRs high and others fly birds in Molniya (12 hour orbit with 10 hours hang over the pole) or increasingly popular Tundra (24 hour orbit) orbits to provide full coverage over at least the North Pole.

That launch chart for 2023 has a bigger wedge for the U.S.

2024 will be even more lopsided.

And if you adjusted the graph to instead count launches by mass? Oh boy...