Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

Space SPACs roared back to life in November 2024 following Donald Trump’s presidential election victory, ending the month up +100%(!)

President Trump’s win triggered a broad market rally driven by positive investor sentiment around anticipated tax cuts and deregulation.

Space stocks disproportionately benefited from this rally given the general point of view that: 1) President Trump seemingly loves space (both the US Space Force and the Artemis Program were established during his first term in office) which could translate to more federal budget for space technology during his 2nd term in office; and 2) Elon Musk’s growing relationship with President Trump + his role as co-lead of the Department of Government Efficiency (DOGE) could benefit the US commercial space industry

Notably, it was primarily the SPACs that benefited from this rally and not legacy space companies, likely due to a combination of the SPACs trading at (somewhat) subdued valuations prior to the election + concerns around defense budget growth under the new Trump administration (which would more disproportionately impact the aerospace & defense primes)

Despite a slight pullback in December, the space SPACs + the S&P 500 finished the year strong at +329% and +23%, respectively.

Driven by an AI-fueled rally in big tech stocks in 2024, the S&P 500 wrapped up its best consecutive years (+24% in 2023 and +23% in 2024) since 1997 and 1998 (+31% and +27%, respectively) per the WSJ (link).

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

What is Venture Capital Now Anyway? (New York Times)

Down round trends (Carta)

VC fundraising power law (Pitchbook)

“When will the IPO window open?” (Contrary Research)

Will your startup get acquired? (Carta)

AeroVironment to acquire BlueHalo - a good M&A comp for dual-use investors + VC/PE backed companies (deal slides, transcript)

2. SPACE STOCK COMMENTARY

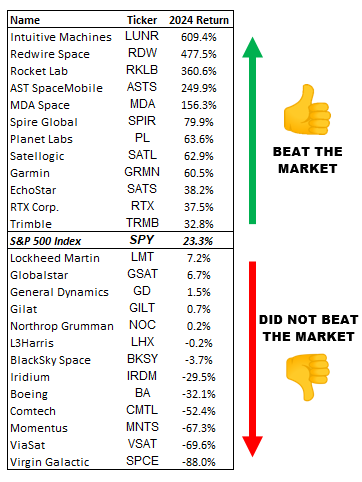

2024 was an extreme example of ‘haves’ vs the ‘have-nots’ for space stocks—five companies saw their stock grow over +100% and six companies saw their stock decline -30% or more. While the majority of space stocks saw performance somewhere between -30% and +100%, I find it much easier to read the tea leaves for the companies at the extreme ends of the spectrum:

You’ve heard of the FAANG and the Mag7, but are you ready for the Cosmic 5? The Cosmic 5 space stocks that saw >100% performance in 2024 (LUNR, RDW, RKLB, ASTS, MDA) are all companies that have demonstrated explosive growth potential, steady execution, and ability to raise capital as needed; all of these companies were trading at a discount relative to their growth prospects prior to 2024, but due to a combination of material company-specific catalysts + broader investor interest in space, they each experienced rapid re-ratings throughout the year, particularly in 2H24. Though SpaceX is dominating nearly every category of the space industry that it participates in, investors are interested in “what else” is out there in the space industry given SpaceX’s astounding $350B valuation, and they seemingly view the Cosmic 5 (LUNR, RDW, RKLB, ASTS, and MDA) as “the next best thing” they can invest in to get exposure to space

The six companies that saw double-digit declines (IRDM, BA, CMTL, MNTS, VSAT, SPCE) were primarily the victims of company-specific pain: BA suffered from downstream effects of “Welchification” (link for more); CMTL never recovered from early 2024 re-financing anxiety; MNTS is in “cockroach mode” and no one understands how the company hasn’t gone under yet (link); VSAT is facing an existential threat from Starlink (link); SPCE is burning through cash faster than a re-entry capsule and investors are skeptical of its business model + scaling plans; and IRDM’s cash generation + growth is at risk as Starlink’s momentum continues.

Going into 2025, here is what is top of mind for me as I think about key themes for space stocks next year:

I expect investor interest in space companies will remain high, driven by SpaceX’s rapid develop of Starship and the continued expansion of Starlink; the higher SpaceX’s valuation climbs, the more investors will continue to look for “the next big thing” in space or “the next best thing to” SpaceX

2025 will be a big year of growing up for the space SPACs, which could lead to volatility depending on progress vs key initiatives: 1) the earth observation SPACs (ex-SATL) will have to demonstrate ability to generate FCF as they have been promising for years, while continuing to balance growth (SATL just needs to generate more revenue); 2) Redwire will have to demonstrate ability to secure larger contracts from bigger programs; 3) Rocket Lab will have to launch Neutron, successfully deploy the satellites it built for MDA / Globalstar, and potentially reveal more details about their planned space application business; 4) AST SpaceMobile will have to demonstrate ability to scale manufacturing + satellite operations as it ramps from 6 satellites on orbit to 45-60 over 2025-26, receive FCC approval for testing with AT&T + Verizon, and continue its momentum with commercialization and generating revenue; 5) Intuitive Machines needs to nail its next CLIPS mission; 6) and Momentus needs to show some signs of life and generate revenue

New Space Development Agency (SDA) Proliferated Warfighter Space Architecture (PWSA) awards will continue to be a key driver of success for any company that manufactures satellites given the 8-9 figure contracts that awards generally represent; within my space stock coverage, these awards could affect RDW, RKLB, ASTS, MDA, RTX, LMT, GD, NOC, LHX, BKSY, BA, and MNTS

I will be on the lookout for any changes to US federal spending on commercial space capabilities, whether that is in the form of: 1) SpaceX favoritism given Musk’s relationship with President Trump, position with DOGE, and incoming NASA Administrator Jared Isaacman’s relationship with Musk and SpaceX; or 2) increased budget for space in general given President Trump’s supposed love for space and Musk’s close relationship with the president

Satellogic / SATL’s stock rose +187% in November and December (though in early December SATL was up nearly +380% vs the end of October); the company saw a mix of good and bad news over the last two months:

The main positive catalyst for SATL was that on 11/19, Howard Lutnick was picked by President Trump to be Secretary of Commerce; Lutnick was a board member at Satellogic (he has resigned from the role since being named Commerce Secretary) and SATL shares rose over +370% in next three weeks following this announcement. Investors clearly included SATL in the bucket of “could benefit under a Trump admin” as a result of Lutnick’s connections to the company (Lutnick owned 13.9M shares of SATL as of 11/27, link)

SATL’s momentum was halted on 12/10 however, when the company announced a $10M private placement (i.e. a block sale of new shares) with Alyeska Investment Group. While a $10M infusion of cash for an unprofitable company would seem like good news, what stood out was that the deal was priced at $2.80/sh vs SATL shares trading at $4.74 the day prior to the announcement (a 40% discount!); on top of this, SATL also filed for a future $50M equity offering, which is again nice to know that the company has support to raise $50M of equity again in the future, but bad because it represents material potential dilution. Unsurprisingly, the combination of these two pieces of news caused SATL to trade down -40% from 12/9 to 12/31

However, a material piece of good news that might have gotten lost in the mix was Satellogic announcing a partnership with Maxar, where Satellogic granted Maxar exclusive rights to task Satellogic’s constellation and use its satellite imagery to support national security missions for the U.S. Government and select U.S. partners internationally. This partnership is significant for Satellogic because 1) Satellogic has struggled to secure contracts with the USG given its international roots (+early relationship with Chinese customers, link); 2) the USG is the largest buyer of commercial earth observation data & analytics and Maxar has an extremely strong relationship with this customer (e.g. Maxar won a $3.24B / 10yr deal with the NRO in 2022, link; and Maxar recognized $722M of imagery & analytics revenue from work with the USG in 2022, link); 3) this relationship essentially unlocks Satellogic’s ability to sell to with USG seemingly without having to invest the capital they would otherwise have needed to do so. While we don’t know how much revenue this relationship will generate for Satellogic, and Maxar taking its cut of sales will probably make this revenue lower margin than the 70-80% gross margins that Satellogic has targeted in the past, this is undoubtedly a good deal for Satellogic since it gives them access to the largest buyer of commercial EO imagery. It seems like a safe bet to assume this deal will drive Y/y revenue growth for the company

Having said all this, let’s look at Satellogic’s valuation ($271M market cap at the time of writing). Unless Satellogic generates >$90M of revenue in 2025, then it is currently trading well above the ~3x revenue multiple that BlackSky / BKSY, Planet Labs / PL, and Spire Global / SPIR trade at. Given that the company’s revenue has grown from $4.2M in 2021 to $6.0M in 2022, $10.1M in 2023, and I estimate between $14M-$20M of revenue in 2024, it seems highly unlikely that the company will suddenly grow revenue >4x to $90M in 2025 (even with its new Maxar deal in place). Unfortunately, Satellogic doesn’t report its results on a quarterly basis so we don’t have anywhere close to real-time data on the its financial status (they just reported 1H24 in Dec’24), and we don’t get regular updates from the company’s management team

Rocket Lab / RKLB grew +138% through November and December and the company is now valued at nearly $13B (as of the time of writing); RKLB is now up >600% from the stock’s <$4.00/sh lows in April 2024 when its market cap was as low as $1.7B

While Rocket Lab has always traded at a premium vs the other space SPACs (even at the stock’s low point this year, it was valued >$1B and ~4x revenue vs <$1B and 1x-2x revenue for most of the other space SPACs at their low points), the company has been the primary beneficiary of renewed investor interest in space companies given comparisons to SpaceX, which is currently valued at $350B

Though Rocket Lab doesn’t have stated ambitions to colonize Mars like SpaceX does, the company does have similar ambitions to build a vertically integrated space business (which RKLB management refers to as building an “end-to-end space business”). To date, RKLB has established credibility in its potential ability to achieve this goal given its firm footing in launch as the 2nd highest cadence US launcher behind SpaceX and the impending initial launch of its medium-lift, partially reusable Neutron rocket; it has rapidly grown its satellite manufacturing operations to a 9-figure business; and it is planning to take advantage of its ability to build and launch satellites at cost to develop a space application business at some point in the future (details are TBD). So it makes sense why investors might get excited about Rocket Lab—Rocket Lab is the closest thing to SpaceX that public market investors can own, and because it is earlier in its development as a vertically integrated space company, there is great long-term upside potential

The SpaceX / Rocket Lab connection is clearly reflected in Rocket Lab’s valuation, which is a mirror of SpaceX’s at this point in time: SpaceX’s $350B valuation is ~20x 2025 revenue, which is very similar to Rocket Lab’s 22x 2025 revenue multiple (at the time of writing); Rocket Lab’s $12.6B valuation (as of 12/31) is 3.6% of SpaceX’s $350B valuation, which matches Rocket Lab’s $600M 2025 consensus revenue estimate representing 3.5% of SpaceX’s $17B of 2025 revenue (my own ballpark estimate, I don’t have insider information about the company).

However, I don’t think Rocket Lab deserves the same multiple as SpaceX and I don’t think this SpaceX-ratio approach to valuation is the right way to think about Rocket Lab’s valuation given that an investment in Rocket Lab has more inherent risks than an investment in SpaceX. For example, Rocket Lab’s future depends on its next-gen Neutron rocket, which hasn’t been flown 1x yet let alone proven partial reusability; the company hasn’t fully proven that it can mass manufacture satellites yet (it hasn’t deployed the 17 satellites it is building for MDA/Globalstar yet, or the 18 satellites it was contracted to build for the SDA); and it isn’t operating + commercializing its own constellation of satellites yet. The 20x multiple SpaceX currently has is a monopoly multiple—Falcon served ~90% of the global launch demand in 2024, Dragon is the most reliable western in-space transportation provider, and Starlink is the fastest growing business in the multi-trillion dollar global telecom market. While it is credible to believe that Rocket Lab can get Neutron to work, scale its satellite manufacturing business, and build a space application business, it is still has a long way to go in its journey and I don’t think it deserves the same valuation premium as SpaceX.

To back up my point here we can actually use a different SpaceX comparison—when SpaceX was at a similar stage of maturity as Rocket Lab back in the 2012-2014 time frame (before it had proven Falcon 9 was partially reusable and before Starlink) and was also in a similar revenue range as Rocket Lab (on the path from hundreds of millions to $1B), it had a ~10-13x revenue multiple (secondary sales valued SpaceX at $4B-$5B in 2012 (per Pitchbook), the same year it generated ~$400M of revenue, link).

While Rocket Lab is probably going to be worth more in the future if it executes on management’s long term vision, companies that trade at high valuations have high expectations—the company’s 20x revenue multiple suggests that investors are assuming it can achieve all of its developmental milestones without issue. But if Rocket Lab slips up on any of their major technical, scaling, and execution milestones it still needs to de-risk in the coming years, the stock could easily see material declines. As I have stated previously, be honest with yourself if you are buying RKLB right now—is it out of FOMO seeing the stock price go up so much in the last few months, or do you have a real investment thesis and have underwritten specific investment scenarios?

Globalstar / GSAT saw its stock increase +97% through November and December, primarily driven by the company’s expanded relationship with Apple / AAPL announced in early November

On 11/1, GSAT filed an 8-K (link) outlining an expansion of its existing relationship with Apple, where Apple will invest over $1.7B for a new constellation of satellites that will deliver “extended mobile satellite services (MSS);” the $1.7B investment is comprised of $232M for GSAT debt refinancing, $1.1B for network buildout costs, and $400M for Apple to take a 20% stake in the legal entity that will own the constellation

GSAT’s existing relationship with Apple gives Apple 85% of the network capacity of Globalstar’s existing 31 satellites + an upcoming 17 refreshment satellite (which Apple is using to provide iPhone customers free text service when they are off the grid with no cellular or WiFi coverage in the US and Canada); while the extended MSS network’s designs and capabilities are TBD at this point in time (management has given limited details on their plans), it is safe to assume this constellation is the key driver of the company’s recent guidance for revenue to reach nearly $500M long term (vs consensus for $247M in 2024)

Understandably, GSAT shares closed +73% the day after the news broke and GSAT shares continued to trend upward through the end of 2024

On a related note, on 12/6 Bloomberg broke news that Apple is exploring the development of its own modem technology (link); while these new modems will debut with new iPhones in 2025, they are also expected to be deployed in Macs and Vision Pros, which could potentially bring cellular connectivity to those devices for the 1st time (to date, cellular connectivity has been reserved for iPhone, Apple Watch, and iPads). It doesn’t strike me as coincidence that this news broke within a month of the expanded Apple / Globalstar partnership; I expect Globalstar’s direct-to-device connectivity will expand beyond just iPhones and is likely to increase in capability beyond texting as Globalstar builds out its extended MSS network

Appreciate the comprehensive article! I'll be bookmarking this for reference!

One thought on IRDM - They've mentioned in many earnings calls and interviews that while SpaceX is eating into their revenue for broadband, that's not really their focus. Maybe it wont last, but there are maritime mandates that services like IRDM's must serve as a backup to Starlink.

Other things working for the business:

- The Satelles acquisition to solidify their position in the PNTS market.

- You could argue that their use of L band is a differentiator (moat?).

- The last round of buybacks at around $27.50 sent a clear signal to the market that the business felt that they were undervalued at the time. A $500M buyback program thru 2027 for a $3B company isn't nothing!

Granted, you're buying IRDM for a different reason than LUNR. This one's not "going to the moon," but I think at these prices that there's market beating potential in the next 5 years if the company stays fiscally responsible and continues to cannibalize itself.

One narrative has that only the gov't buys space observation data, do you see that continuing? those companies growing? E.g the government asking for more data, non-government enterprises asking for more data?