November 2023 Monthly Space Stock Review + 4 Things I Learned in My 1st Year as an Investor

Stock Commentary Discusses ASTR, SATL, SPIR, PL, ASTS, and BA

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 November Market Overview

✍️ Space Stock Performance + Valuation

🎉 Bonus: 4 Things I Learned in My 1st Year as an Investor

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, RKLB and SPIR at the time of this post (12/5/23).

Update from Space Case: Wanted to let folks know we are on track for an upcoming post about the Space Development Agency later in December. I’d hoped to share this SDA post last month, but October + November ended up being busy months filled with travel + due diligence!

1. MARKET COMMENTARY

Public Markets

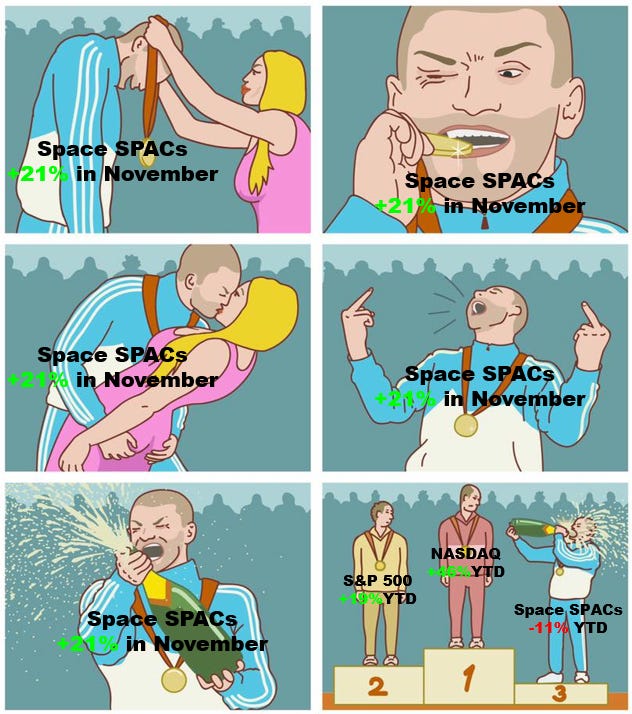

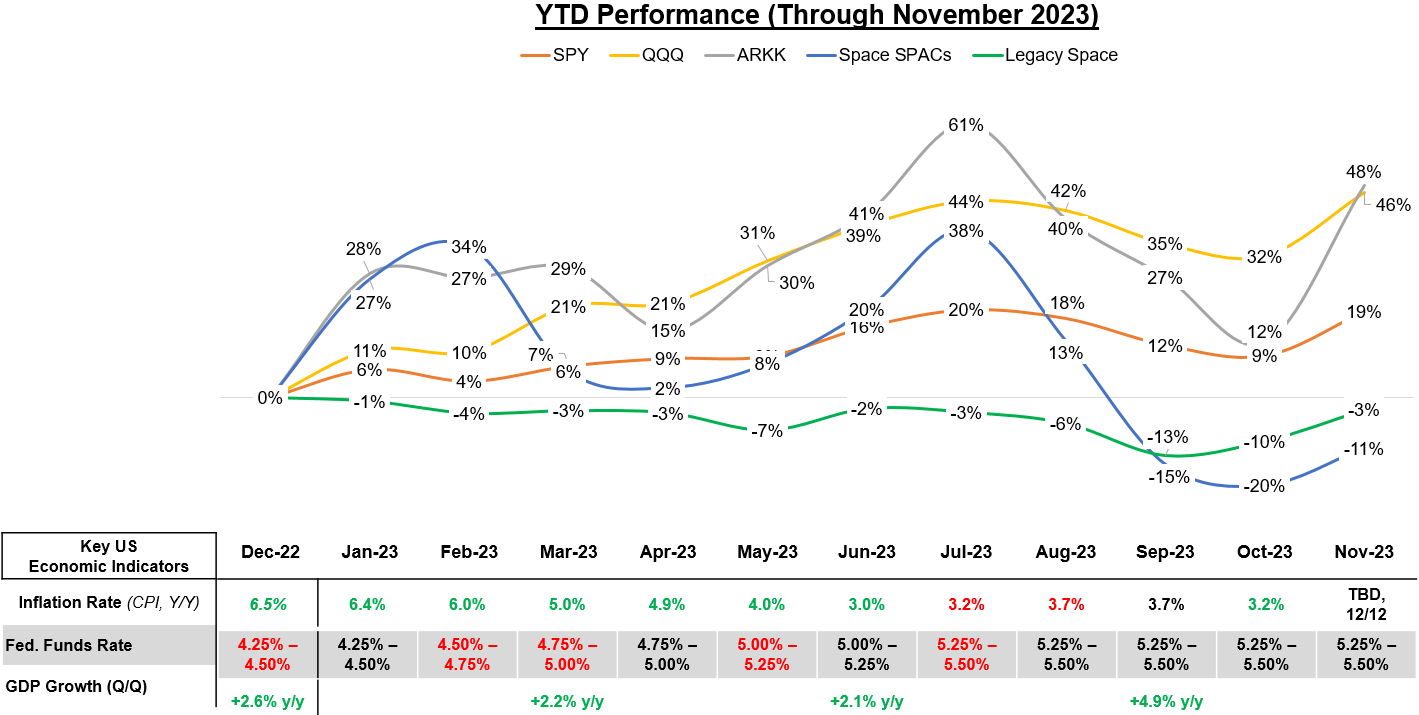

November was the best month of for stock performance thus far in 2023—4 of our 5 indices recorded their best monthly returns of the year last month, with only the space SPACs not hitting a monthly high (November’s +21% was the SPACs’ 2nd best monthly return in 2023; their best month was January at +28%).

November’s market rally was driven by increasing belief that the Federal Reserve may actually pull off a “soft landing” (i.e. reducing inflation while simultaneously avoiding a recession), as we received both solid inflation data (October’s y/y inflation was down to 3.2%) and solid economic data (3Q GDP growth was +4.9%) in November (see details below).

Additionally, investors are increasingly confident that the Federal Reserve’s current rate hike cycle is likely over and that we might even see rates begin to come down in 2024.

Remember that lower rates are good for all stocks, but particularly good for growth stocks, which have the majority of their profitability in the future (lower rates = higher present day value of those future cash flows). This is partly why the ARK Innovation ETF and the space SPACs had such strong returns this month. (link to my previously written primer on “Why Should Space Investors Care About Interest Rates?”)

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

2. SPACE STOCK COMMENARY

Astra Space / ASTR rose 69% (nice) in November after the company’s founders, Chris Kemp and Adam London, offered to take the company private at a $30M valuation (or $1.50/sh; a ~100% premium vs the day before the offer)

ASTR shares were trading at $0.74 the day before the offer, shot up 86% to $1.38 the next day, and are now at $1.40 (as of the time of writing). At this point, investors feeling confident that the deal will go through could make ~7% by buying ASTR shares at $1.40 and then having Kemp and London purchase their shares at $1.50.

Satellogic / SATL announced two notable pieces of news in November that might have influenced the company’s +58% performance in the month:

The company received a license from the National Oceanic and Atmospheric Administration (“NOAA”), removing a key regulatory headwind and increasing SATL’s chances of winning business from the US government, the largest buyer of commercial satellite imagery in the world

This was a fairly material announcement given that SATL couldn’t do business with the US government without this certification, and might be a positive signal to other foreign governments to do business with the company as well.

On 11/29 Satellogic announced a strategic contract with Tata Advanced Systems to develop local space technology capabilities in India to support India’s defense and commercial markets

While there was no dollar figures included in this announcement, any progress with monetization of Satellogic’s IP or constellation is good news for the company and shareholders

Spire Global / SPIR’s +40% performance made me curious about earth observation valuation trends and I realized that I missed a notable event in October—Planet Labs / PL now trades at a discount to both BlackSky Space / BKSY and Spire Global (see chart below for details).

We have been tracking this trend since mid-2023 (link) and we find it notable because Planet Labs was once valued at a significant premium vs BlackSky Space and Spire Labs (ex. PL went public at 10x 2023E revenue vs 5x for BKSY and SPIR)

While all the SPACs have been beaten down since going public, the loss of a premium valuation versus peers goes to show how much confidence investors have lost in PL’s outlook at this point in time given a series of successive earnings report misses + lower revenue guidance. The company likely needs to both build momentum by beating / meeting quarterly guidance for a number of quarters in a row, and/or reaccelerate revenue growth while continuing to march toward profitability to gain back favor with investors.

AST SpaceMobile / ASTS’s +47% performance in November was in part driven by the company’s 3Q earnings call on 11/14—shares popped +24% the day after the report. The most important disclosure from the report was that management believes they will close an investment from “multiple strategic partners…[by] November or December.”

Given that management expects it needs to raise at least $550M to design, assemble, launch, and operate the company’s 1st 25 satellites needed to provide commercial service, strategic funding from potential customers is absolutely crucial.

Check out this post for more info on what we learned from ASTS’ 3Q earnings report (link)

Boeing / BA’s +24% performance in November is mostly attributable to a rumor (link) that China is considering resuming purchasing Boeing’s 737 Max aircraft; the company had essentially been shut out of new orders from Chinese carriers since 2017 amid rising political and trade tensions between Beijing and Washington

Since this rumor was first published on 11/12 following meetings between US President Joe Biden and Chinese President Xi Jinping at the APEC summit, BA stock has increased +19%

Last month I highlighted that since the 10/7 escalation in the Israel-Hamas conflict, defense stocks have been following the same pattern that emerged following outbreak of the Russia-Ukraine war in February 2022

Through 12/1/2023, the observed trends have held up (see below); if they continue to follow the same pattern as in 2022 though, we may see defense stocks trail off through December into 2024.

3. BONUS: 4 THINGS I LEARNED IN MY 1ST YEAR AS AN INVESTOR

In December 2022 I began my career as an institutional investor, joining a growth equity VC firm where I covered not just space, but also AI and semiconductor technology. (link to my announcement last year + personal backstory)

Given that we are coming up on my one year anniversary since “going pro” and since I usually only wear my analyst hat here on Case Closed (i.e. I write analysis as an unbiased observer) I thought it might be fun to share with everyone here a few things I’ve learned since joining the buyside as an investor (where I put my analysis to work):

Intellectual Curiosity is a Must

Part of what made this job feel too good to be true was that I am getting paid to learn new things—constantly, and at a breakneck pace. This was in part due to covering multiple industries, which was both challenging and fun—I had a stronger background in space, but was tasked with helping come up with our thesis on the vertical; AI has been a tough one to keep up with given the pace of innovation since the explosion of ChatGPT this time last year; and although I’ve actually found semiconductors to be nearly as interesting as space, the technical barrier to understanding the intricacies of this industry has kept me on my toes and guessing if I know ANYTHING every time I think I have a grasp on trends.

I can’t say this is the experience everyone who is an investor has, but I have a hard time imagining being good at this job if you aren’t intellectually curious and genuinely passionate about learning.

Discipline Requires Patience

When investing in cutting-edge technology, it is easy to get caught up in the excitement of what is “cool” and the potential for massive growth—we all know this happened with space technology the past few years, and this same sentiment is currently sweeping through AI and semiconductors.

Having spent 2021 + 2022 writing and Tweeting about the hysterics of the space SPACs, I came into this VC role determined to not get “SPAC’d” (i.e. to not get fooled by overhyped promises of growth), and I was lucky enough to join a team that was equally focused on discipline. Our diligence process was highly structured and as such, it became (somewhat) easy to say “no” if prospective deals didn’t meet our criteria (deal stage, company sector, business, tech, etc). This also went the opposite way—if we liked a deal, we steel-manned the arguments why it might be a bad investment to pressure test our ideas.

Ultimately, we had to be patient that we would find deals that met ALL the criteria we wanted in our investments.

A Good Business Does Not Always Equal a Good Investment

Now let me be clear—just because an investor says “no” to investing in a deal, it doesn’t mean that is a bad company. Some companies might have excellent products and strong market positions, but do not necessarily offer attractive investment opportunities.

Factors like valuation, time to exit, and market size were all reasons we passed on deals with otherwise good companies last year—those factors impacted the returns profile that we were targeting, and it just wasn’t a good fit.

Timeframe Matters

This one is more focused on my personal investing—having previously come from the world of public stock investing where a 12-month investment is considered a long time (note: I used to work in equity research and price targets are meant to have a 12mo outlook), it was a real shift to start thinking about investments with a multi-year timeframe.

Going forward, I am fully convinced of the value of using this long-term mindset when investing in stocks in my personal trading account—a longer time horizon gives time for my investment thesis to play out (if I am correct) versus shorter-term trading being impacted by the particular “animal spirits” influencing the market in a given month or quarter.

This point reminds me of the Warren Buffett quote: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” I take this to mean that in the long-run, the truth wins out.

An additional bonus of taking a longer-term POV for investing is a lower capital gains tax rate on profits from investments held over one year (15-20%) versus investments held under one year (taxed at the ordinary income rate).

Overall, there was a very steep learning curve to this job, but I am pleased with how my “rookie year” as an investor went; I look forward to growing and continuing to improve in the future.

Really interested in your take on SDA.