June 2023 Space Stock Review

Bonus: BlackSky Valuation Premium Overtakes Planet Labs

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

🗣️Update from Space Case

📈 June Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (7/23/23).

1. UPDATE FROM SPACE CASE

After a busy June filled with due diligence, work travel, and some well-deserved time off we are back on track with a newsletter this month.

However, to keep my writing process moving smoothly, going forward I am making some changes—we are going to try out 2 posts per month vs just the 1 per month cadence I’ve been going at through 2023 year-to-date.

The 1st post each month will be similar to the one you are about to read right now—it will be focused on market + space stock commentary. I can usually finish these two sections of my posts relatively quickly—what has held me up lately is the “topic of interest” section that typically follows. Going forward, each month’s “topic of interest” will be its own separate post.

Making two separate posts will hopefully enable me to send you market + stock related commentary and analysis in a more timely manner (instead of the much-delayed analysis you have been getting from me in 2023), and will relieve some of the pressure I feel to finish my “topic of interest” quickly (when I generally need to marinate on these analyses for some time before hitting “publish”).

With that housekeeping out of the way, let’s get to the good part 👇

2. MARKET COMMENTARY

In June 2023 the space SPACs led the way (for once) with a +13% return, beating out both tech stock indices and the S&P 500; legacy space lagged, but still posted a strong +5%.

In June + into July, the broader stock market was primarily supported by an increasingly optimistic outlook vs what many (including myself) have anticipated, particularly that the Federal Reserve might not have to raise interest rates as aggressively as originally feared (with only 1-2 more hikes remaining in the current cycle) and that we may be able to achieve a “soft landing” (i.e. reducing inflation while avoiding a recession).

This optimism has been underscored by: 1) continued reduction in headline inflation, 2) the Federal Reserve’s decision to “skip” a rate hike in June + its forecast of only 2 more 25bp rate hikes in 2023, and 3) generally strong economic data (link for more details).

Year-to-date (YTD), tech indices are up roughly +40% (see above) led by the “magnificent seven” big tech stocks (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA) which have been driven by their allure of profitability and a frenzy around developments in artificial intelligence.

Given their higher beta (a measure of a stock's historical volatility in comparison with market index movement) space SPAC performance in 2023 has been volatile, but overall the group has done well at +20% YTD.

While legacy space had a strong performance in 2022 (+13%, link) driven by heightened government funding related to the Russia-Ukraine war, the group has lagged in 2023 given 2022’s outperformance.

“SPY vs Magnificent 7” Stocks

I’m not going to go into private market detail here, but check out these resources for a more comprehensive overview of the private market trends thus far through 2023:

3. SPACE STOCK COMMENTARY

Lots of big moves for the space SPACs in June, with 9 of 12 stocks moving up or down double-digits!

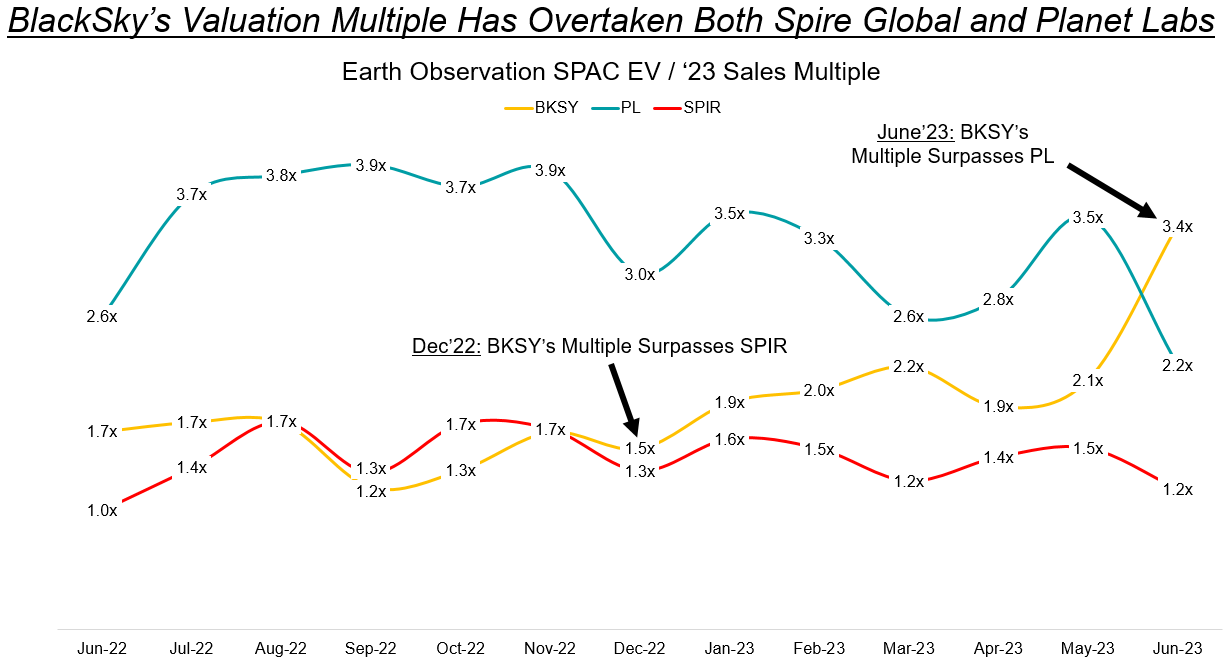

While it is hard to choose between RKLB (now up ~100% through 7/21), SPCE (finally re-commencing commercial operations), and LLAP (mystery satcom customer Rivada starting to look more real), I actually think the most interesting movement in June took place in earth observation (take a close look at the differences between May and June valuation multiples in the table above).

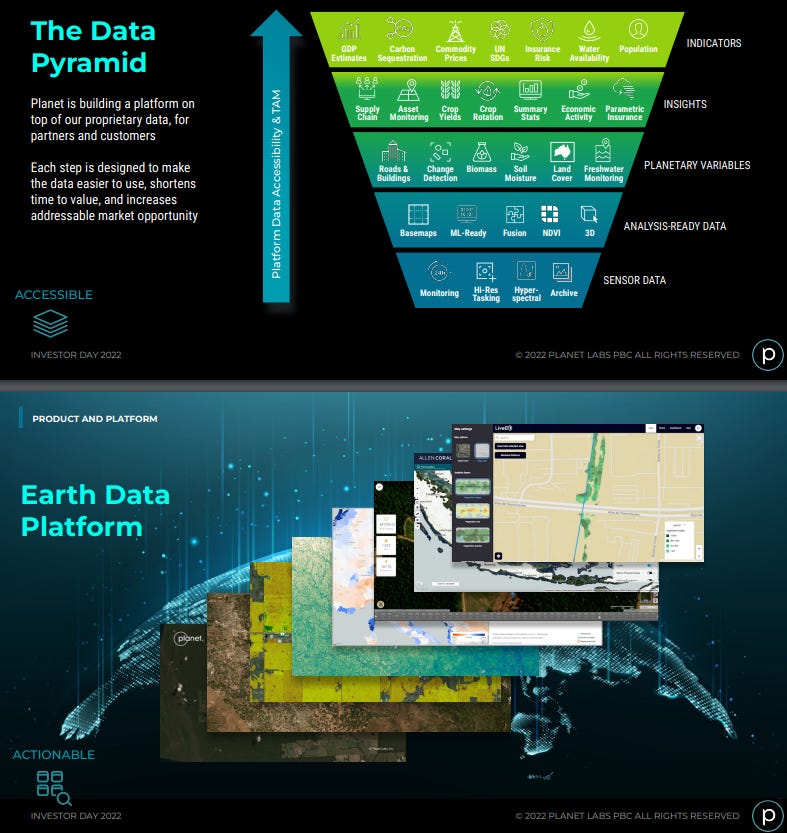

Since going public, Planet Labs has generally been considered the de-facto earth observation leader amongst the SPACs given its heritage (founded in 2010), constellation size (>200 satellites on orbit), software prowess (transforming from a data company to a platform company), financial heft ($191M of revenue in C2022, +46% y/y; $376m cash on the B/S), and grand vision/strategy (attacking both data collection and analytics/insights to enable a larger total addressable market).

This compares to BlackSky, Spire Global, and Satellogic, which have generally been viewed as less mature and less ambitious than Planet given inferior comparisons in regards to some or all of the aforementioned factors.

As a result, since going public Planet Labs has generally traded at a premium versus its earth observation peers—that is, until now.

Planet was dethroned from the pole position in June following its 1Q earnings report where the company lowered C2023 revenue guidance from $258M (midpoint of guidance range; 31% y/y growth) to $230M (midpoint; 20% y/y growth), a -11% decrease. The change in guidance came as a surprise given that the company had only issued it 2 months prior—management pointed to lengthening sales cycles and some bigger deals closing at lower-than-expected contract values, with these trends being particularly pronounced with government customers; they also noted that these trends are expected to continue.

I am guessing that this surprise downgrade in near-term revenue outlook (and what it means for Planet’s revenue growth in 2024+beyond if C2023 is slowing to just 20% y/y) combined with increased uncertainty regarding the return on investment of Planet’s platform development costs are what led to the stock’s -30% decline and have resulted in PL’s lowest revenue multiple since we flipped to using 2023 estimates last summer.

Meanwhile BlackSky has been consistently executing in 2023, closing multiple multi-million/multi-year deals and signing several partnerships to develop new products, as well as continuing to steadily march toward profit breakeven (EBITDA margins have improve q/q for the last 6 quarters; FCF progression has not quite been as consistent though). As a result, the stock is up 25% YTD through 7/21 (compared to the same magnitude of decline for PL shares).

Time will tell if Planet Labs can regain the favor of investors, or if BlackSky will retain its position as lead of the EO SPAC pack.

A&D Primes Breathe a Sigh of Relief

Defense primes stocks rose in June after the debt ceiling federal budget negotiations in late May reaffirmed that the DoD budget would increase in FY24; later in June, the House approved a plan for the FY24 DoD budget to increase 3.6% y/y.

Good insight, Case. EO space SPACs are fun to watch, and good to see BKSY executing. For me the big story is still RKLB as they continue to execute. Keeping a close eye on them and the next few quarters as Neutron takes shape. Also waiting to see if there is some consolidation coming soon on the M&A front

The defense primes are actually not “space stocks” because, at most, 20% of their revenue is from Space. In fact, if you look at Boeing, defense overall is maybe 15% of their market cap.

It would be interesting to do the math on how much of their market cap is attributable to their actual space business.