Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

🤔 A Look Back at 2022

💡 Going Forward in 2023

📈 Topic of Interest: New Year, New Analysis Tools

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (2/22/23).

1. A LOOK BACK AT 2022

In 2022, Case Closed primarily focused on the space SPACs—they were shiny, new, and exciting.

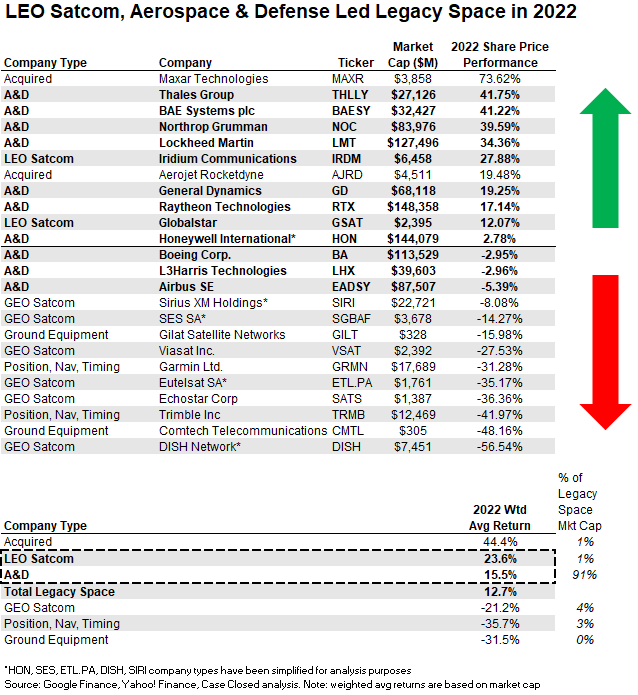

However, the best performing space stocks in 2022 were not SPACs—they were legacy space companies, which as a group returned +13% vs the S&P 500’s -19%.

In particular, LEO satcom and aerospace & defense (A&D; emphasis on defense) stocks led the way1 and returned +24% and +16%, respectively.

Meanwhile the space SPACs returned a lousy -70% in 2022, and the “best” space SPAC “only” lost -29% of its value during the year.

2. GOING FORWARD IN 2023

While 2023 is off to a better start for the SPACs and a worse start for legacy space, I believe it would be prudent to more closely analyze legacy space companies going forward.

Given heightened focus on “dual-use” investing (which includes space) in the present day due to the counter-cyclical nature of defense budgets, it makes sense to better understand the range of valuation multiples for A&D stocks relative to pure-play space stocks (both legacy and the SPACs).

Additionally, now that I am a private market investor I find it useful to track public market valuations for a broader set of space companies than just the SPACs (though they will always have a special place in my heart).

As a result, I’ve updated my comparable company valuation analysis sheet for the following changes2:

Legacy Space Companies Being Added:

LEO Satcom: Iridium (IRDM), Globalstar (GSAT)

US A&D: Boeing (BA), General Dynamics (GD), Honeywell (HON), L3Harris (LHX), Lockheed Martin (LMT), Northrop Grumman (NOC), and Raytheon (RTX)

Ground Equipment: Comtech (CMTL), Gilat (GILT)

US GEO Satcom: EchoStar (SATS), ViaSat (VSAT)

Position, Navigation, and Timing: Garmin (GRMN), Trimble (TRMB)

Space SPAC cohort:

Velo3D (VLD) is out.

While the 3D printer manufacturer counted space & aerospace its largest customer segment in 2021, as Velo3D’s customer base has expanded we believe it is less meaningful to count the company as a space SPAC.

Intuitive Machines (LUNR) and Satixfy (SATX) are in.

LUNR (space exploration, infrastructure, and services company) and SATX (a satellite communications systems provider) have de-SPAC’d in recent months and will be integrated into future Case Closed analyses.

3. NEW YEAR, NEW ANALYSIS TOOLS

Before we move on to look at my new valuation comp sheet, I want to make sure we all understand what I mean by a comparable company valuation analysis sheet or a “comp sheet.”

Since no Substack post in the year 2023 would be complete without a reference to ChatGPT, I asked it to explain what comparable company analysis is + why investors use it:

So with that out of the way—behold!

My comp sheet no longer just tracks the SPACs, but it now includes key legacy space companies that touch on many segments of the space industry—launch, earth observation (constellation operators), satcom, ground equipment, position/navigation/timing, satellite and component manufacturing, cislunar, and aerospace & defense.

If there are any important US space companies that you think are missing from this list, please reply to my email or comment your suggestion below.

This beast of a spreadsheet took me some time to set up (as it is mostly automated and can be updated in in near-live time), but it is a tool I find legitimately useful.

Here are a few of the things that stood out to me at 1st glance.

Aerospace & Defense stocks trade at 2-3x revenue and 14-15x EBITDA

While A&D stocks outperformed most non-energy stocks and nearly all other space stocks in 2022, that does not mean they trade at a premium—A&D median revenue and EBITDA multiples (2.2x and 14.3x, respectively) are right in line with the median multiples for all space companies in the comp sheet (2.3x and 14.7x, respectively).

In fact, according to analysis by valuation guru and NYU professor Aswath Damodaran, A&D company EBITDA multiples trade right in-line with the broader market at ~14x (link).

For companies with no EBITDA, note that if you are comparing yourself to A&D companies you are asking for a 2-3x revenue multiple.

Satcom commands a premium revenue multiple at 6.8x median EV / 2023 revenue

The LEO satcom operators (IRDM, GSAT) are the drivers of this premium, trading at 12-14x 2023 revenue (they also have a premium EBITDA multiple at ~23x). This stands in contrast to GEO satcom operators SATS and VSAT, which have revenue and EBITDA multiples below median legacy space multiples of 2.2x revenue and 14.2x EBITDA.

The LEO operators have a premium relative to the GEO operators for several fundamental reasons:

Both LEO operators are expected to see above-GDP revenue and EBITDA growth in 2023 (with EBITDA margins >50%), as core 2022 tailwinds from accelerating commercial IoT usage are expected to continue, driving strong financial results in the face of a potential economic slowdown.

While the GEO operators have mixed stories (SATS is seeing both topline and EBITDA declining, while VSAT is set for strong trends in 2023 thanks to the launch of new satellites which will expanding capacity to service demand), their EBITDA margins are notably lower at 20-30%.

Ultimately however, I believe the LEO operators trade at a premium not just to their GEO counterparts, but versus all of legacy space and the SPACs due to hype surrounding their direct-to-device connectivity plans which are expected to generate incremental revenue and unlock previously unserved markets for low-bandwidth connectivity in regions with limited terrestrial cellular service.

GSAT has outlined material revenue from its wholesale direct-to-device connectivity agreement with Apple (management expects GSAT’s 2022 revenue of $150M to double by 2026); and while IRDM has yet to disclose explicit guidance, it has alluded to potential for the 80-100M Qualcomm Snapdragon phones produced each per year to be compatible with its LEO constellation.

Additionally, there is probably some element of investor FOMO in light of SpaceX’s $137B valuation, which is primarily attributable to its LEO satcom business Starlink. Public market investors are looking at Starlink’s TAM + valuation, and might be making some overzealous assumptions regarding the future of IRDM and GSAT.

I am ignoring how awesome your returns would have been if you’d been holding MAXR or AJRD shares in 2022. Maybe you could have predicted another company attempting to purchase AJRD after Lockheed Martin gave up in February 2022, but no way Maxar getting taken out by private equity for a fat premium was on your 2022 bingo card. Good for you if you were long those companies.

I am not including certain prominent internationally-based space / A&D companies (ex. Airbus, Thales Group, SES, Eutelsat, etc.) because they don’t have the same reporting requirements as US-based companies, which makes it difficult to track and analyze their business trends and financial data. Sorry international readers :(

Great run down! Appreciate the insight. This early 2023 SPAC rally can’t last, right?

Excellent. I like the changes, and this approach for moving forward. This macro environment, with the interest rate increases from the Fed, are not kind to tech companies with no earnings that went public on the promise of blockbuster future growth. Most space SPACs fell into that camp. Adding legacy space to your comp sheet does provide more context that will be important for analyzing the sector in the coming years.