Quite a few people reacted to my last post (see here) with a question: can private space stations really be profitable?

I decided to explore this concern by evaluating Axiom Space’s claim that their proposed station can self-fund development.

“It’s probably between half a billion and a billion dollars that ultimately we’ll raise to build our space station,” he said. That project will have an overall cost of about $3 billion, but most of that will come from revenue from operations.

- Axiom Space President & CEO Michael Suffredini, regarding Axiom’s planned space station, SpaceNews (Feb. ‘21)

My conclusion is that this is a valid question for investors to ask given the capital intensive nature of space activity and the limited opportunities Axiom will have to monetize its investment. While there are many unknown factors regarding Axiom’s business model, I think it is plausible to envision a scenario where the company is able to partially self-fund station development; however, I believe Axiom will ultimately require more investor funding than management has said it will need. Additionally, it seems like operating at EBITDA or FCF positive levels will be difficult, at least in the business’ early stages.

SETTING THE STAGE

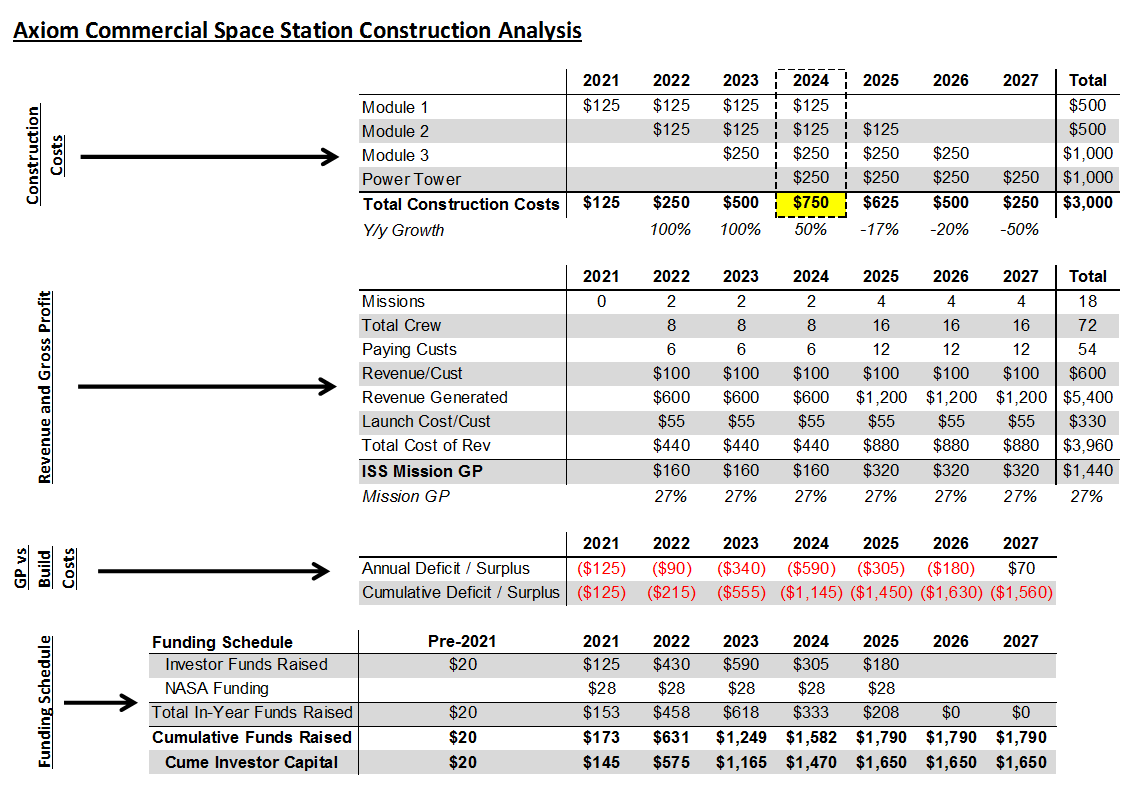

The below image contains what we know about Axiom’s initial construction and ISS mission plans based on management public comments.

Note that my analysis only takes into consideration Axiom’s original 4-module station, and doesn’t include impact from its announced 5th module (a media production studio, link here) given that management’s build cost comments were directed towards its 4-module design.

KNOWN VARIABLES

As we continue this exercise, you will see that key variables in the business case include:

1 - Revenue / customer / mission

2 - Number of planned ISS missions / year

3 - Total investor funds raised

STEP 1: CONSTRUCTION COSTS

Management expects that its original 4-module design will cost $3B. I’m assuming the 3rd/4th modules (which are seemingly more technical to create) will cost more than the 1st/2nd modules.

Based on these assumptions, we can see that build costs ramp 2021-24, then decline 2025-27. Obviously the inclusion of Axiom’s production studio module (expected to launch in 2024) would further burden capital requirements in the early years of construction—but we are leaving that out of this exercise.

Note: I encourage the audience to read the assumption bullets below the Excel exhibits during this exercise—they likely contain answers to questions and/or objections.

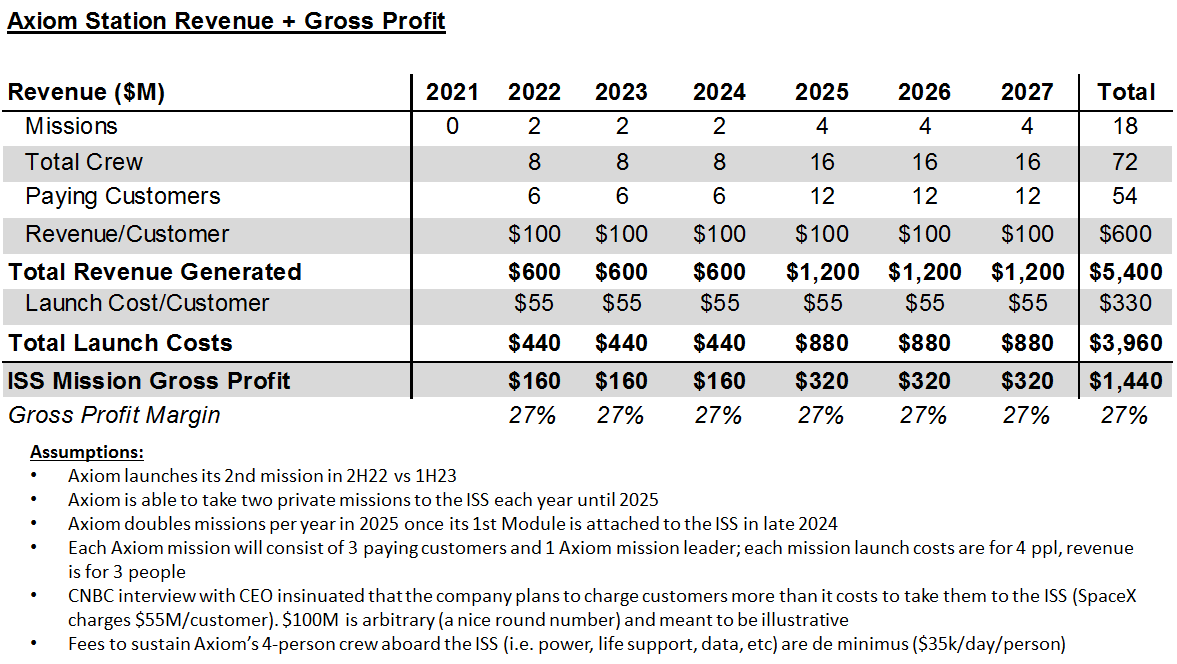

STEP 2: REVENUE + GROSS PROFIT

This is where things start to get tricky, as there are many unknowns regarding Axiom’s revenue generation potential.

In the base case, we will assume that Axiom is limited to 2 missions/yr to the ISS through 2024. After 2024, once its 1st owned module is delivered to the ISS, we will assume Axiom is able to do 4 missions/yr. I don’t know if Axiom will actually have the freedom to accelerate mission cadence to 4/yr (or more!) once it has its own modules at the ISS, but I have to think the company will want to do so.

For context, there haven't been >5 missions to the ISS per year in the last 4 years and SpaceX has only been doing 2 launches/yr.

In addition to the number of missions / year being an unknown, we do not know how much Axiom will charge per customer.

Each of Axiom’s 1st two missions have three customers + one Axiom employee leading the mission—mission economics therefore need to account for three revenue-generating members, but four cost-generating members.

Launch costs are $220M ($55M/person), which means management must charge at least ~$73M/customer to breakeven each mission.

By looking at various combinations of missions per year (in 2025 - 2027 when we assume Axiom can accelerate ISS mission cadence) and revenue / customer, it is clear to see that there is incentive to charge much more than $73M/customer, as Axiom can generate solid gross profit with even just 2 missions/yr by doing so.

The Ax-1 mission crew will be conducting 25 experiments while on board the ISS, and you have to assume that Axiom is charging customers to both bring the experiments TO the ISS as well as BACK to Earth—perhaps that will be justification for why Axiom might charge customers >$100M / seat to the ISS.

HOWEVER—ISS missions are just one driver of revenue generation…there are likely other sources of revenue that we don't know the economics of!

For example, Axiom's ability to potentially generate revenue from research or manufacturing scales with each module it deploys to the ISS:

Its 2nd module 2x’s living and working space

its 3rd module is an industrial research and manufacturing facility

And its 4th module will enable space walks—another premium service

Again, I am not layering in this level of complexity to this exercise, I merely want to note that there are many unknown drivers in Axiom’s current business case.

STEP 3: ASSESSING PROFITS VS COSTS

Assuming Axiom charges its customers $100M/seat/mission (a nice round number), the company is looking at a scenario where it will reach annual gross profit breakeven sometime between 2025-27 (depending on mission cadence) and will reach cumulative gross profit breakeven sometime beyond 2027.

As I said before, there could be revenue growth upside that I am not aware of,

BUT

I am also not taking into account ANY type of operating expenses, depreciation & amortization, maintenance capex, etc…so the company is even more in the red from an EBITDA or FCF perspective versus what I am showing here.

STEP 4 (FINAL STEP): EXPECTED INVESTOR FUNDING

Axiom management said it plans to raise a cumulative total of $500M-$1B of investor capital with $150M raised to-date, most recently completing a series B round in February 2021 that valued the company >$1B. Axiom has also received $140M in funding from NASA to build its station.

However, in the base case scenario pictured above, it looks Axiom will far exceed raising $500M-$1B—that will be closer to $2B, peaking in 2025.

If Axiom ramps ISS missions to 8/yr in 2025-27, investor fundraising will peak in 2023 at $1.2B—still outside the range that management had previously discussed.

CONCLUSION

Of course there are many factors you can change in this analysis to impact outcome—and there are quite a few financial drivers that we completely left out of this exercise.

However, I tried to stick with conservative assumptions to demonstrate that while there are believable scenarios where Axiom could partially self-fund its development, there is validity to reader concerns regarding commercial space station profitability (especially if evaluating EBITDA and FCF vs gross profit like we looked at here).