August Space Stock Review: Back-to-School Edition

Topic of Interest: 2Q22 SPAC Earnings Report Card

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 August Market Overview

✍️ Space SPAC Performance and Valuation

🗣️ Topic of Interest: 2Q22 SPAC Earnings Report Card

👀 In Case You Missed It: Best of Case’s Twitter

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post—9/8.

SpaceDotBiz is the newsletter for startups and investing in the space industry. We bring you interviews with top space investors and entrepreneurs, as well as key insights into the trends driving space markets. Join the over 700 SpaceDotBiz readers from leading organizations in space and investing, including SpaceX, Morgan Stanley, Blue Origin, the Aerospace Corporation, NASA, Planet, and more.

AUGUST MARKET OVERVIEW

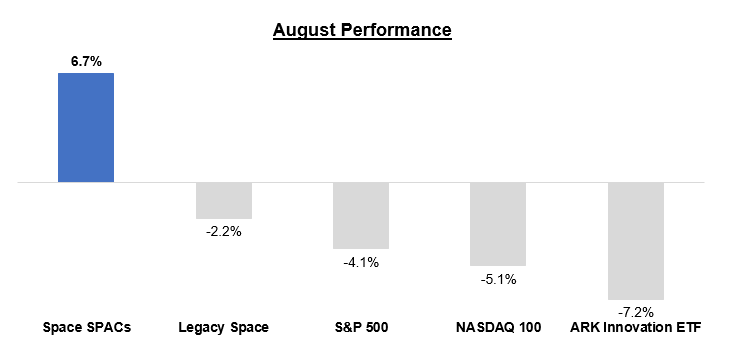

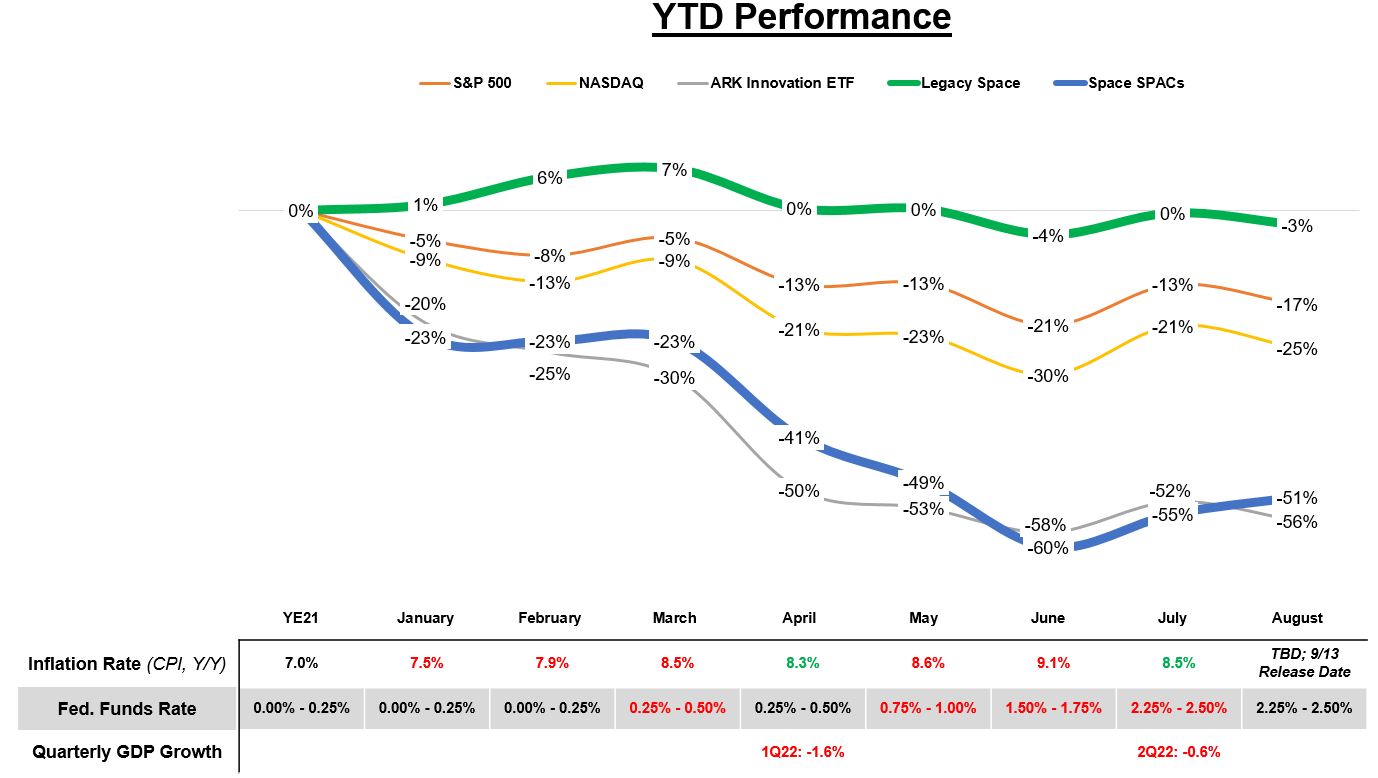

Space SPACs outperformed the broader market in August, posting their 2nd straight month of positive returns at +6.7%—this is the 1st time in 2022 where the space SPACs have had back-to-back positive monthly returns.

However, these results were primarily driven by AST SpaceMobile’s +71% performance in August; ex-ASTS, space SPACs were -1.2% for the month.

MARKET DRIVER COMMENTARY

In general, the stock market started August strong—investors believed that the Federal Reserve might ease up on interest rate hikes following the negative 2Q22 GDP print in July, as officials are looking to balance reducing inflation while minimizing economic damage; however, sentiment (and stock market returns) turned negative as the month progressed following strong comments from Fed officials that made it clear they will do what it takes to reduce inflation, despite risk of a recession.

Specifically, Fed officials commented that they believe rates could be increased to 3.5% - 4.0% by early 2023, and that rates will be held at an elevated level through next year. This compares to the current Federal Funds rate of 2.25% - 2.50%.

As I noted in last month’s space stock review, I believe we are far from finished battling inflation and the market will continue to be volatile as the Fed navigates implementing further interest rate hikes vs creating a recession by doing so.

SPACE SPAC PERFORMANCE AND VALUATION

PERFORMACE COMMENTARY

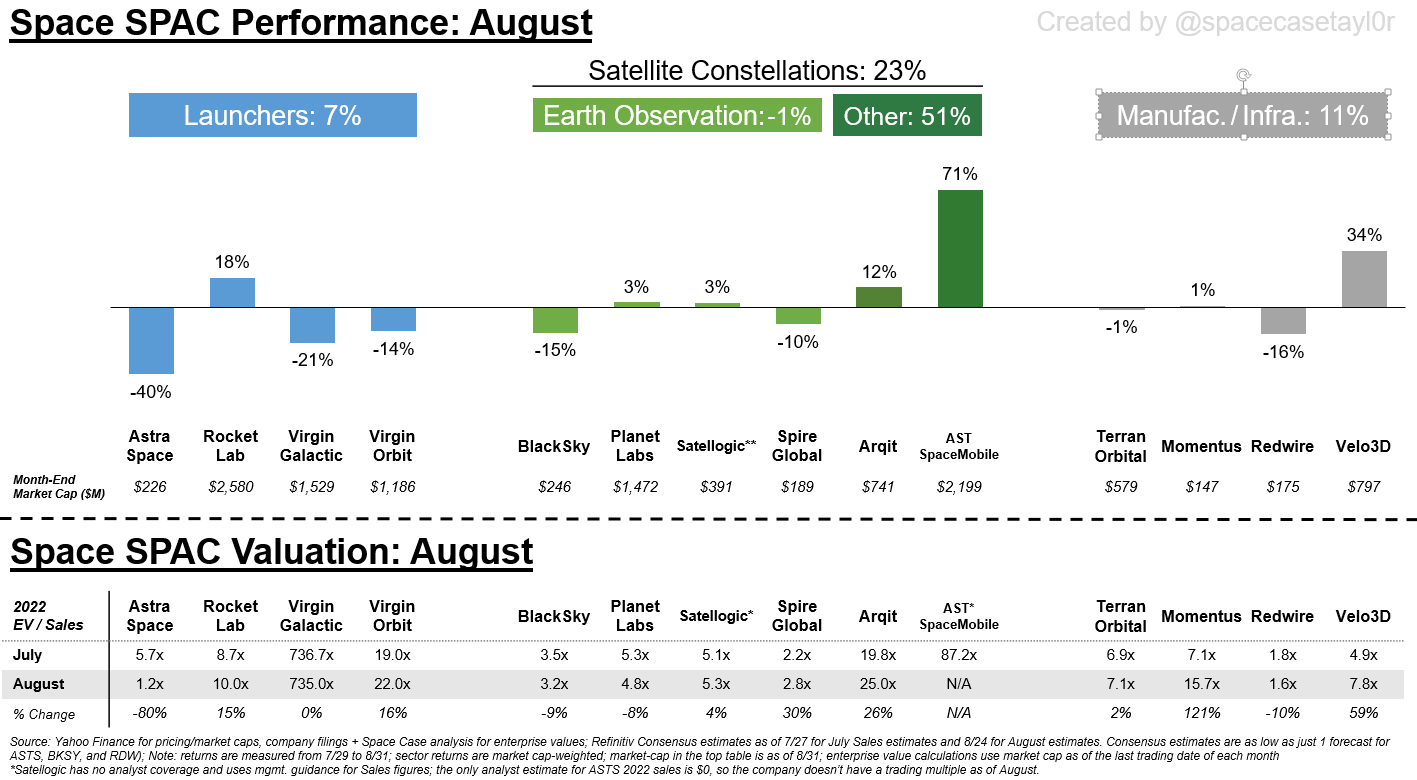

As noted earlier in this report, overall space SPAC performance in August was entirely driven by AST SpaceMobile’s / $ASTS’ +71% return and would have been -1.2% excluding ASTS.

A $2.2B market cap at the end of August made $ASTS the 2nd highest value space SPAC, ahead of Planet Labs ($1.5B) and only trailing Rocket Lab ($2.6B).

Velo3D / $VLD continued its winning streak, following its +133% July performance with another +34% in August.

I assume the continued momentum was driven by the company’s relatively strong 2Q earnings report combined with continued positive customer reactions to new products.

Astra / $ASTR declined 40% following the company’s announcement that it would 1) retire its Rocket 3 design given inconsistencies in performance during recent flights and 2) was suspending all further launches until its next-gen rocket and launch system are ready to debut sometime in 2023.

VALUATION COMMENTARY

Normally at this point of the year investors pivot valuations to next year’s estimates (i.e. they start looking at 2023 valuations instead of 2022 valuations because 2022 is more than halfway over and the stock market is all about future growth).

However, I will wait to pivot to using 2023 valuations until after 3Q earnings in November—I don’t believe analysts have put much effort into adjusting their 2023 estimates yet, and want to wait to see if they make substantial changes after 3Q earnings.

Following the market’s rebound in July/early August, Rocket Lab, Virgin Orbit, Spire, and Velo3D have now all exceeded their May valuation levels.

Could this be an indication of investor category favorites (RKLB/VORB for launchers, SPIR for earth observation, and VLD for manufacturing)? TBD for RKLB and VLD, but probably no for SPIR and VORB:

The increase in valuation for VORB and SPIR from July to August can primarily be attributed to analysts reducing their 2022 revenue estimates following 2Q earnings (this is bad), while the increased valuation for RKLB and VLD is due to their stock going up in August.

TOPIC OF INTEREST: 2Q22 SPAC EARNINGS REPORT CARD

In August I shared a framework that could be used to identify which space SPACs were in a position to survive the oncoming economic “winter” and therefore might be suitable to invest in amidst a market downturn (link to August post).

I’ve found that this framework is also useful for evaluating the quality of the space SPAC earnings reports.

Note that this “back-of-the-envelope” approach to analyzing an earnings report ignores results in the context of previously issued guidance, analyst expectations, or management commentary—all of which should be included in a full earnings analysis.

With this framework BlackSky is the “winner” of 2Q22 space SPAC earnings, with a perfect 8 of 8 score!

BlackSky operated efficiently in 2Q by maintaining its FCF burn pace vs 1Q, increasing revenue q/q, improving EBITDA margin q/q, and improving its Burn Multiple q/q—these are the type of financial results we would want to see from a resilient, maturing space startup in the current stock market.

However, while BlackSky maintained its May 2023 capital runway date (which is good) the company either needs to raise capital or quickly flip to FCF generation (very unlikely) if it is going to survive beyond the next eight months.

In terms raising capital, it would be unfortunate for the company to have to raise equity and dilute existing shareholders in the current down market…but given that BlackSky already has $77M of debt or 1.3x annualized 2Q22 revenue, management is in a tricky situation if they take on incremental debt—BKSY could end up in a situation like earth observation peer Spire Global, which has less cash than debt on its balance sheet.

I will update this scorecard following Planet Labs’ results on 9/12, and will provide more individual company commentary at that time.

IN CASE YOU MISSED IT: BEST OF CASE’S TWITTER

Thread addressing reader responses to my “SpaceX vs SpaceMobile?” post.

1/ Reader Feedback from "SpaceX vs SpaceMobile?" 3 Themes $ASTS Shareholders Need to Consider

1/ Reader Feedback from "SpaceX vs SpaceMobile?" 3 Themes $ASTS Shareholders Need to Consider 2/ SpaceX’s disruption of the satcom industry began a new chapter last night following its announced partnership w $TMUS Rather than summarize the event, I wrote about why the announcement matters for $ASTS investors + why it was a net-positive for $ASTS https://t.co/M3KInCtXRT

2/ SpaceX’s disruption of the satcom industry began a new chapter last night following its announced partnership w $TMUS Rather than summarize the event, I wrote about why the announcement matters for $ASTS investors + why it was a net-positive for $ASTS https://t.co/M3KInCtXRT Space Case (🛰,📈) @spacecasetayl0r

Space Case (🛰,📈) @spacecasetayl0rAudience suggestions for “satellite communications 101” books.

Satcom folk—is there a ‘satcom 101’ type of book you’d recommend to me, akin to this SAR book Joe is always praising? Ya boi want is trying to be more learned about satcom, but I don’t have a technical background and am not sure where to start Would appreciate suggestions!Went to the gas station today and left my windows down when I went inside to pay. Ran back outside as soon as I realized I had left my copy of “Essentials of SAR” in the back seat…sure enough. Disaster. Someone had thrown two more in the back while I was inside. https://t.co/WEll2BHh7n

Satcom folk—is there a ‘satcom 101’ type of book you’d recommend to me, akin to this SAR book Joe is always praising? Ya boi want is trying to be more learned about satcom, but I don’t have a technical background and am not sure where to start Would appreciate suggestions!Went to the gas station today and left my windows down when I went inside to pay. Ran back outside as soon as I realized I had left my copy of “Essentials of SAR” in the back seat…sure enough. Disaster. Someone had thrown two more in the back while I was inside. https://t.co/WEll2BHh7n Joe Morrison @mouthofmorrison

Joe Morrison @mouthofmorrisonThe 3rd episode of my monthly podcast with earth observation expert and TerraWatch Space’s own Aravind Ravichandran

My reaction to Spire Global being featured in the Wall Street Journal + why I invested in the company.

1/ $SPIR +17% after being featured in the WSJ today The article highlighted @SpireGlobal as 1 of only 2 private cos NOAA is buying space-based weather data from I believe this strong reaction is due to…After six years @NOAA ‘s effort to improve weather forecasts by using private #satellite data is showing results, but more slowly than expected, @IsabelleBiscuit reports @SpireGlobal @GeoOptics #CIO #data #weather https://t.co/JfLFyc9pQO

1/ $SPIR +17% after being featured in the WSJ today The article highlighted @SpireGlobal as 1 of only 2 private cos NOAA is buying space-based weather data from I believe this strong reaction is due to…After six years @NOAA ‘s effort to improve weather forecasts by using private #satellite data is showing results, but more slowly than expected, @IsabelleBiscuit reports @SpireGlobal @GeoOptics #CIO #data #weather https://t.co/JfLFyc9pQO Steve Rosenbush @Steve_Rosenbush

Steve Rosenbush @Steve_Rosenbush