In this month’s Space Stock Recap:

📉 January Performance and Market Trends

🛒 Space SPACs on Sale…

☠️ …Buyer Beware

JANUARY SPACE STOCK PERFORMANCE AND MARKET TRENDS

Space SPACs took a beating in January, with shares trading down -23% since the end of December. This is >4x worse than the S&P 500 and >2x worse than the NASDAQ 100 over the same time period. Legacy space stocks1 outperformed not just the space SPACs in January, but the overall market as well, driven by megacap aerospace & defense stock performance (I assume due to the looming threat of US participation in the Russia-Ukraine conflict, which would benefit these companies).

Overall Market Trends

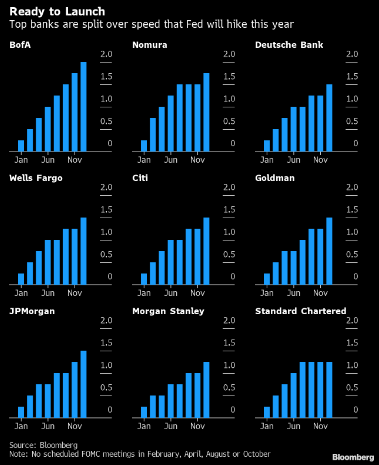

In general, market volatility over the past few months has primarily been driven by uncertainty regarding the Federal Reserve increasing interest rates in 2022.

While the Fed began to signal a pivot toward a more hawkish stance in November 2021 (see my prior writeup on this here - link), investors have remained wary that the central bank must toe the line of staving off inflation while simultaneously not damaging economic recovery from COVID-19.

The Fed’s more hawkish stance and outlook for rising rates have caused growth stocks to underperform because most of their future cash flows are located in the future, and higher interest rates means future cash flows are worth less in the present day (see here for more detail - link).

Additionally, de-SPAC’d companies in particular have faced strong negative sentiment over the past few months as the Federal Reserve’s pivot triggered investors to more closely evaluate the outlook for companies whose valuations and projections may have gotten a pass in the equity-friendly, low interest rate environment of late 2020 and 2021.

Space SPAC Trends

In January, manufacturing and infrastructure (M&I) space SPACs outperformed launchers and satellite constellations.

I believe this outperformance is more about the lack of investor belief in the outlook for small launchers and satellite constellation space SPACs, and less so about confidence in space M&I stocks:

Launchers: investors believe there is questionable demand for dedicated small launch service versus ridesharing on larger rockets; even if demand exists, small launchers still have a long way to go with scaling their businesses to monthly launch cadence (or more)

Virgin Orbit outperformed its small launch peers as it benefitted from a PR stunt that brought one of its rockets to Times Square, followed by its 3rd consecutive successful orbital launch just one week later; bulls have pointed to the company’s flexible launch capability relative to other launchers as a competitive advantage

Satellite Constellations:

Investors view earth observation as a fragmented and competitive vertical; outside of Planet (which benefitted from a number of recent BUY Rated initiations of research coverage at Wall Street banks) these stocks were some of the worst-performing space SPACs in January given skepticism that all these companies can achieve >50% revenue CAGRs over the next several years at the same time

Arqit and AST SpaceMobile are both pre-revenue companies; one of the key criticisms of SPACs in general has been that they took young companies public too soon, so its unsurprising to see these two stocks down ~30%

SPACE SPACs ON SALE…

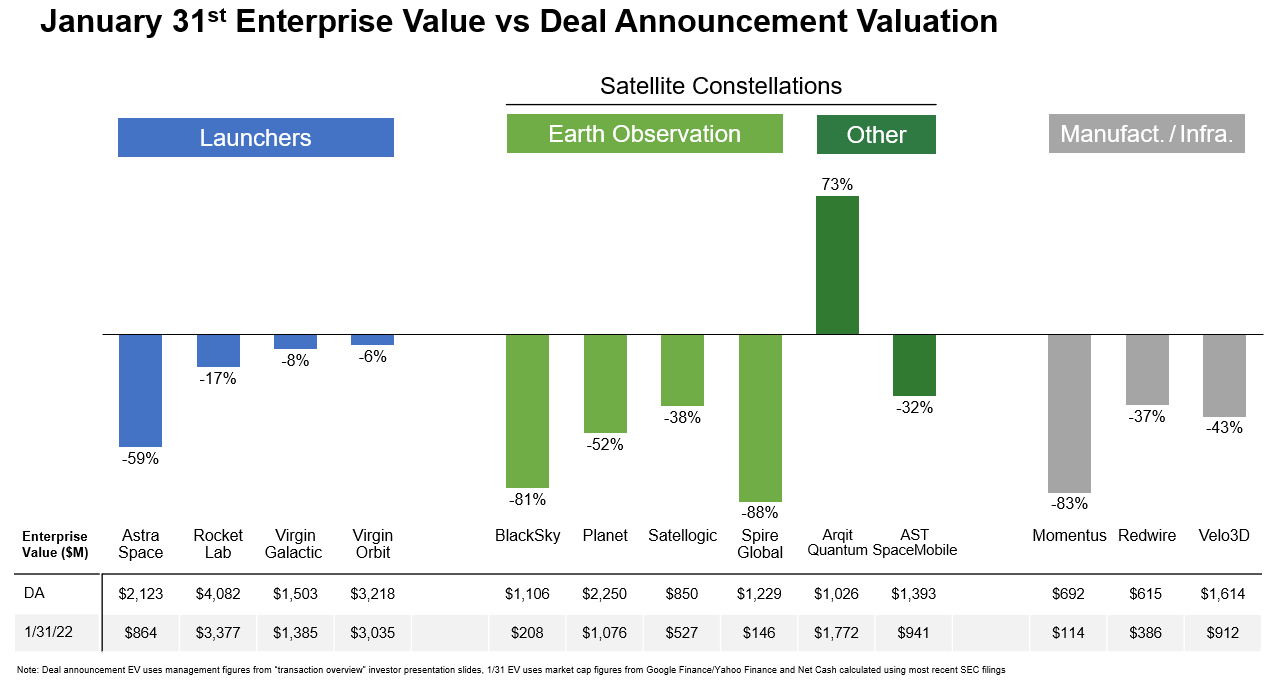

With space SPAC stocks trading down ~40% over the last three months, it makes sense to re-visit valuation—one of the main concerns for these companies when they announced plans to go public.

As of January 31st, the 13 post-merger space SPACs are only worth ~70% of their original deal announcement valuations (see chart below).

Arqit Quantum is the lone outlier, now worth +73% more than it was initially valued at the time of its deal announcement

Excluding $ARQQ, the remaining 12 space SPACs are worth just 63% of what they were valued at the time of deal announcement

Launchers have fared best, with enterprise values “only” down -21%

Satellite Constellations are in the middle, with enterprise values down -41%, though there is great disparity between Earth Observation (-64%) and Other (+12%)

Even within EO and Other there is a wide range (-90% to +70%)

Manufacturing and Infrastructure companies have fared the worst, with valuations down -52% vs deal announcement EV

…BUYER BEWARE

While current valuation comps may look appealing, investors must consider the believability of the management forecasts that underpin these comparisons in order to not fall into a value trap—are lower valuations a buying opportunity or a sign of a poor investment?

As I stated before, investor sentiment on SPACs as a whole is negative right now given skepticism that these companies will be able to execute upon management guidance.

For space SPACs, while there are quite a few projections for the space economy to grow from several hundred million now to >$1T by 2040, there is a plausible argument that expected industry growth is overstated:

“Wall Street estimates that the space economy could grow from ~$350M in 2016, to >$1T by 2040 (some forecasts going as high ~$3T by 2040 or 2045).

But skeptics have rightfully questioned these astronomical projections:

For example, the federally funded Science and Technology Policy Institute notes that the aforementioned estimates…for both the current size of the space economy as well as projections for future growth use flawed methodology (link).”

- What is “New Space”?, Case Closed, 12/30/21

4Q earnings will be critical. The 2022 outlook that management teams provide will set the near to mid-term narrative for their respective stocks, as updated guidance and commentary will be compared to what management told investors to expect during lengthy analyst presentations last year.

Going forward, I believe sentiment is so poor for SPACs right now that even just meeting prior guidance (let alone beating/raising expectations) should be enough to drive share price appreciation.

Look at the reaction to Spire Global’s pre-announced 4Q earnings/2022 guidance—the stock initially popped +25% in after-hours trading on the positive news that the company didn’t completely miss vs analyst expectations (though shares only ended up +2% the day after their pre-report, as investors digested the lukewarm results and outlook).

Until Next Time—Good Luck Out There Everyone!

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or investment recommendations; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of AST SpaceMobile, which is the only space company he has a position in at the time of writing.

My self-made index of legacy space stocks includes: Honeywell, Raytheon, Boeing, Lockheed Martin, Airbus SE, Northrop Grumman, Garmin, Thales SA, Trimble, DISH Network, Iridium, SES SA, Aerojet Rocketdyne, Eutelsat SA, Echostar, Globalstar, Maxar, Telesat, and Gilat