April 2024 Space Stock Review

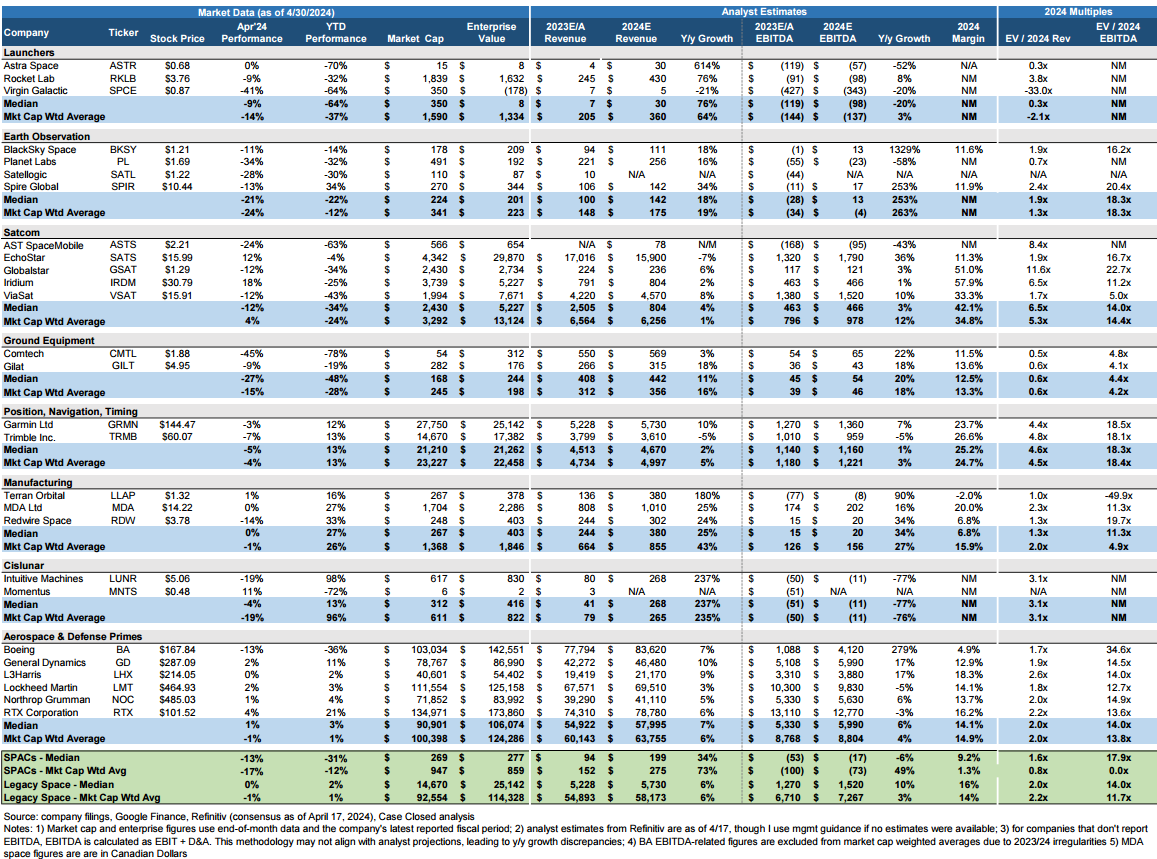

Includes Commentary on PL, SPCE, IRDM, CMTL, LMT, LHX, GD, RTX, and more

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing. Case owns shares of PL, RKLB, and SPIR at the time of this post (5/8/24).

1. MARKET COMMENTARY

Public Markets

Old habits die hard—the space SPACs recorded another double-digit decline in April.

However, the SPACs weren’t alone in their subpar performance as the broader market also went down in April, breaking a five-month streak of positive returns for the S&P 500 & the NASDAQ.

Meanwhile legacy space outperformed in April (down just -1%) due to positive returns from the aerospace & defense primes (ex-Boeing), potentially reflecting impact of headlines such as the fiscal 2024 defense budget being passed in late March and the Senate + Biden Administration approving an additional $94B of aid for Ukraine, Israel, and Taiwan in April.

Overall market sentiment soured in April as economic data (such as March’s CPI readout) and commentary from the Federal Reserve suggested that inflation isn’t as close to being tamed as investors had hoped, dousing hopes of near-term interest rate cuts and renewing fears of rates being higher for longer.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

JPMorgan’s Jamie Dimon on the “extreme importance of interest rates” for investors (Space Case note: this link isn’t purely related to private markets, but it does relate to my constant ranting on the importance of interest rates for unprofitable company valuations, and since most VC backed companies aren’t profitable I am including it here!)

2. SPACE STOCK COMMENTARY

Virgin Galactic / SPCE’s -41% decline in April resulted in the company having a month-end enterprise value (i.e. market cap + debt - cash) of -$178M; generally, a negative valuation reflects strong negative investor sentiment towards a stock

While the market assigning a negative valuation to Virgin Galactic is likely not going to last because the company still had $946M of cash on the balance sheet (as of YE23) and it probably has cash runway for a few more years, negative valuation (even if temporary) is usually indicative of serious negative sentiment toward a company’s future prospects (note that both Astra / ASTR and Momentus / MNTS—companies flirting with bankruptcy—have traded at negative valuations in recent months)

I don’t disagree with investors who are down on SPCE; the company burned -$452M of cash in 2023 and it is projecting a serious ramp in mission cadence in 2025/26, which I am skeptical that they can achieve

Additionally, in March/April SPCE was sued by Boeing / BA over SPCE’s lack of payments for R&D work Boeing had done for SPCE’s next-gen vehicle (link) + SPCE counter-sued Boeing saying the work done was poor quality (link); this litigation is burning more of SPCE’s cash, is potentially distracting management, and Boeing’s contracted work might have to be re-bid, causing further tech roadmap delays—no bueno

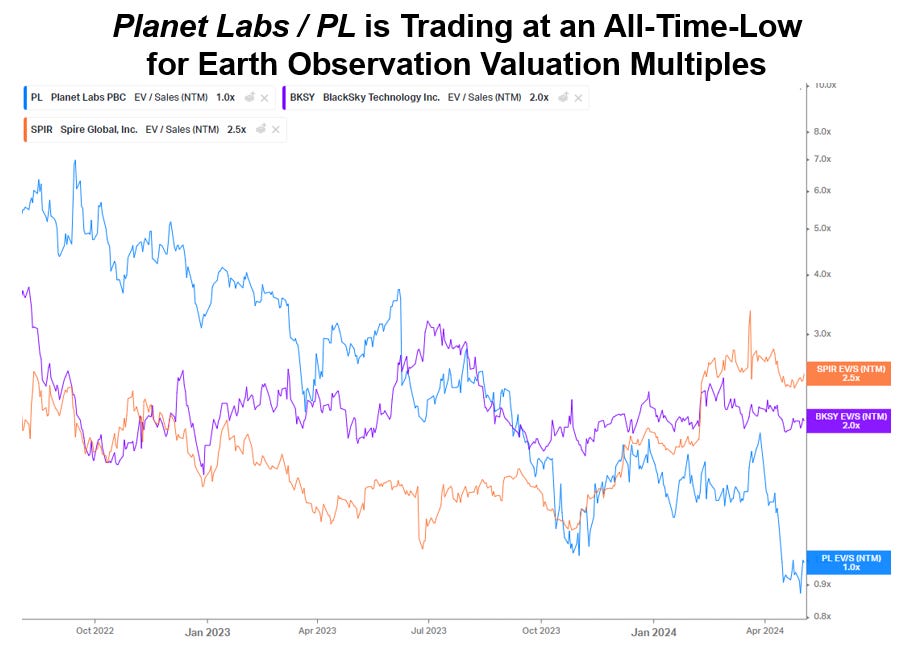

Planet Labs / PL’s -34% decline in April now has the company trading <1x revenue, which makes it interesting from a valuation perspective

While PL is rightfully trading at a discount to SPIR and BKSY given a slower revenue growth outlook, a longer timeline for reaching FCF generation, and a worse outlook for long-term margins vs it’s publicly traded earth observation peers, I can’t help but wonder if the company is over-sold right now

For context, look at the chart below for a comparison of enterprise value / next-12 months revenue multiples for SPIR, BKSY, and PL—PL’s current valuation is an all time-low for the earth observation companies! (note that there are some differences between multiples quoted in the chart below and the multiples included in my comp table due to sources of information (I use Google Finance, company filings, and Refinitiv consensus for my multiples; chart below is sourced from Koyfin.com) + date of data pull (my comp sheet is as of 4/30 and the chart below is as of 5/3))

Iridium / IRDM had a nice April, up +18% in the month, with returns almost entirely occuring after its 1Q earnings report on 4/18.

To give credit where credit is due, I think it was the IRDM management’s color commentary on the earnings call that drove shares higher in April, namely: 1) reiterating commitment to ~$3B of capital returns to shareholders through 2030 + noting the potential for near-term acceleration in share repurchases; 2) commentary on the satcom competitive landscape that quelled fears related to Starlink’s anticipated impact on Iridium (ex. mgmt alluded to the potential to actually be sold as a complement alongside Starlink for maritime customers); and 3) management’s belief that Iridium’s growth + FCF profile suggests the company should trade more in-line with cellular tower and data center REITs, which have EV/EBITDA multiples nearly 2x that of IRDM (high-teens to low 20s for the towers / data center REITs vs low double-digits for IRDM)

Given that I am doing a deep dive on Berkshire Hathaway shareholder letters right now, it is refreshing to hear the Iridium management team speak with clarity on their capital allocation plans + valuation goals; however, I need to think through + validate management’s rationale for why IRDM should trade at tower / data center REIT valuations (of note, Globalstar / GSAT already trades at ~20x EBITDA and has slightly lower margins vs IRDM, but higher growth)

Comtech / CMTL’s downslide continued in April

I didn’t see any incremental news that would have caused CMTL shares to decline -45% in the month, so see here (link) for my prior commentary on the myriad of reasons why the stock is down over -80% since December 2023

The aerospace & defense primes (A&D stocks; ex-Boeing) had positive returns in April, outperforming the broader market

Given that April’s outperformance was likely at least partially attributable to the nearly $100B aid package for Ukraine, Israel, and Taiwan that was approved in April, I decided to update my chart tracking A&D stock performance since the October 7, 2023 Hamas terrorist attack—through 5/3/24, A&D stocks (+26%) are outperforming the S&P 500 (+19%)