3Q21 New Space Earnings Review

Key Themes and Trends

Disclaimer: This post is not investment advice and represents Case’s opinions only. While Case aims to write with an unbiased opinion, he has long stock positions in $ASTS, $RDW, and $RKLB, which are all mentioned in this post. Please (respectfully) yell at Case if you think his bias is showing in an unprofessional manner, and he will take your feedback into account in the future.

For context to this post, see my previous summaries on 3Q21 earnings for:

Executive Summary

Though 4Q is nearly complete, I thought it would be helpful to summarize what I believe were key themes in New Space’s 3Q21 earnings as we start to mentally prepare for the 4Q earnings cycle in January (the stock market is a never-ending process of preparing for/surviving/wrapping up earnings).

New Space is scaling.

Having successfully secured hoards of cash after completing their SPAC mergers, launchers (Astra, Rocket Lab, Virgin Galactic) are increasing launch cadence and strengthening their vertical integration through M&A and expansion of in-house manufacturing capabilities; earth observation companies1 (BlackSky, Spire Global) are either still exploring which verticals they will specialize in (if they will specialize at all), or they are deepening expertise in the verticals they are prioritizing; AST SpaceMobile (the lone satcom space SPAC) is simultaneously prepare for its next test satellite launch while scaling in-house satellite production capabilities; and Redwire (space manufacturing/infrastructure) continues to both successfully develop technology for government customers as well as secure new partnerships with commercial customers.

However, at the same time these newly public companies are all dealing with growing pains associated with going public.

“Space is hard” is a catch-all for the delays and setbacks that are expected, and often happen, in the space industry; but it is a term that public space companies can no longer fall back on as they look to balance the transition from being private companies where setting and not-quite-meeting audacious goals has minimal repercussions, to operating in the public markets where management must either communicate realistic timelines for financial and operational goals, or see their stock suffer the consequences.

Thus far, only Rocket Lab has seemingly executed this concept—both its 2Q and 3Q earnings calls included a plethora of good news, from new launch agreements to financial upside surprises to M&A announcements, and its stock popped +37% and +8% the day after 2Q and 3Q earnings, respectively. Other new space companies have struggled with managing expectations and subsequently, $RKLB is trading >$10 (the issuance price for SPACs) while the other new space stocks are down -20 to -30% or more ($SPCE being an outlier, having benefitted from meme-mania).

Space is an industry that is literally pushing the forefront of what is possible for mankind, but the stock market is an area that requires a tempering of expectations—to see share price appreciation, it is often better to set expectations low and exceed them than it is to promise the world (the moon?) and end up short, even if progress made is material.

I’m not saying this balance should be easy (because let me tell you, it is not), but this concept is something public new space management teams will have to consider as they grapple with how to communicate their results and outlook—even if they view themselves to be long-term oriented and not concerned with day-to-day movement of their stock.

Anyways, on to the top themes from the quarter!

3Q21 New Space Earnings - Key Themes

Launchers ($ASTR $RKLB $SPCE)

VERTICAL INTEGRATION

The most apparent theme for launchers coming out of 3Q21 was vertical integration. Akin to how industry-leader SpaceX has organized its business—bring manufacturing in-house, produce rockets at scale, then take advantage of launch capability to offer higher-margin add-on services—upon de-SPACing both Astra and Rocket Lab put their money where their mouth is and took immediate steps toward building vertically integrated rocket companies.

The first thing each company did after completing its SPAC merger was to acquire key technologies management didn’t want to develop in-house:

Astra acquired Apollo Fusion, a leading electric propulsion engine manufacturer, for $20M cash/$30M stock and up to $95M in potential earn-outs. Management believes Apollo technology enables Astra to offer launch and space services beyond LEO to MEO/GEO/lunar orbits

Rocket Lab was even more aggressive, acquiring Advanced Solutions (flight software + GNC) for $40M cash and $5.5M in potential earn-outs; announcing a DA to purchase Planetary Systems Corp (spacecraft separation systems) for $42M cash + 1.7M shares, with up to ~1M in earn-out shares; and announcing a DA to purchase SolAero (space solar power products and precision aerospace structures) for $80M cash.

For those of you keeping track, that’s >$230M of up-front cash and equity being utilized in acquisitions right out of the gate by these two launch companies.

While both companies are looking to expand the higher-margin-than-launch services they can offer customers with these deals, they are taking divergent paths with how they do so.

Astra is seemingly focused on providing beyond-LEO orbital positioning services by utilizing Apollo propulsion technology (management commentary suggested they might even use the Apollo engines on vehicles that could ride-share on a Falcon 9/other 3rd party rockets for the first stage of launch before delivering payloads in orbit), and recent FCC filings + earnings call commentary indicate plans to operate an LEO connectivity constellation.

Rocket Lab on the other hand has used M&A to enhance the company’s ability to scale, diversify revenues, and increase cross-selling opportunities. I think Rocket Lab’s strategy has been particularly well-articulated—management is laser-focused on becoming an end-to-end space company offering launch service, spacecraft manufacturing, satellite subsystems, flight software, and ground operations (see slide 5 of its SolAero acquisition presentation).

INCREASING LAUNCH CADENCE

Launch is a volume-driven business—companies can take advantage of economies of scale and spread out overhead the more rockets they produce and launch.

Though none of the three public launchers can yet touch SpaceX’s 1H21 pace of launching a Falcon 9 every ~9 days, Astra, Rocket Lab, and Virgin Galactic all spoke to their plans for increasing launch cadence on their respective 3Q21 earnings calls:

Astra continues to reiterate its long-term goal of daily launches by 2025, with a 2022 goal of reaching monthly launch cadence.

The company has gone to the launch pad 2x in 2021—August 28 and November 20—and Astra announced its next launch for early January 2021 in Cape Canaveral (vs Kodiak, AK for prior launches).

This suggests that Astra could be launching anywhere from 42 to 72 days after its November launch given the vague “January” timeframe, which compares to 53 days between launches in August and November.

I will be keeping an eye out for an announcement that Astra is launching within the first two weeks of January—this would ensure the company is shortening the time between launches (i.e. first two weeks of January would mean <53 days since the Nov. launch) and would be a proof-point they are progressing toward monthly launch cadence.

One thing to note is that Astra technically had previously guided to three test launches in 2021…and it is scheduled to only complete two. While likely minor ($ASTR shares didn’t react the day the January launch was announced), and immaterial if the company continues to decrease time between launches/increase launch cadence, slippage regarding management timelines is something to monitor given how specific Astra has been with the timing of its key business milestones.

Rocket Lab management declined to provide specific commentary on 2022 launch guidance, but did say they expect to continue to increase launch cadence following the lifting of COVID restrictions in New Zealand, which had impacted the company’s two existing launch pads from August to November 2021.

Rocket Lab’s three 1H21 launches were averaging ~50 days between attempts, but coming out of the August-November NZ lockdown the company set a new turnaround record after sending two BlackSky satellites to orbit on 11/18 and then returning to the launchpad just 21 days later on December 9.

Of note, Rocket Lab is optimistic that it will receive the final approvals needed to begin launching from NASA’s Wallops Flight Facility in 1H22, which should help accelerate launch cadence, though it remains to be seen if the company can maintain a ~20 day launch pace. Currently, Rocket Lab has ~12 launches scheduled for 2022.

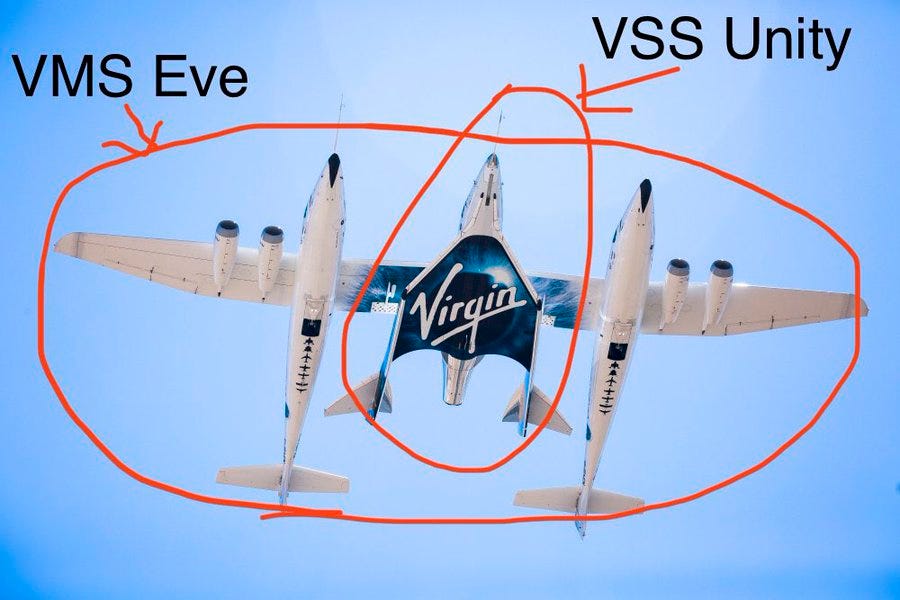

Virgin Galactic’s 3Q21 earnings included an announcement that its lone pair of launch vehicles (see below) would be grounded until mid-2022 as part of an enhancement period which should improve flight frequency by increasing time between required maintenance (Unity will be able to fly ~every four weeks vs just 2x in 2021).

Beyond 2022, the company is working to introduce in 2023 a spaceship that can launch every two weeks (VSS Imagine). However, Unity and Imagine can only fly a total of 39 times/yr, and management doesn’t expect to reach profitability until it can reach 400 flights/yr. They will reach this annual launch cadence via a ship that is still in the design phase, called VSS Delta (discussed more in the next section).

Keep an eye out for potential news announcing delays during this “enhancement” period, as this could further pressure $SPCE shares in addition to current macro headwinds.

SCALING MANUFACTURING CAPABILITIES

Launching more rockets obviously requires building more rockets, and launchers are gearing up operations to do so:

Astra has emphasized progress in ramping its manufacturing capabilities, noting on the 3Q21 earnings call that its next three launch vehicles were already in production or nearing completion, and highlighting that in 4Q21 the company will complete an update to its current Alameda warehouse, increasing its facility by 100k sq ft.

On the 3Q21 earnings call the company also addressed rumors from The Verge that suggested Astra had purchased a number of Reaver engines from Firefly to be used in Astra’s next-gen rocket design (rocket 4.0). During Q&A on the earnings call, CEO Chris Kemp responded to a question about the rumor, stating “…what I can tell you and I will reiterate here, is that all intellectual property required to produce all of our technology will be owned, licensed, or developed by Astra and anything you've read, it is not inconsistent with this strategy.”

I find it curious that a company planning to expand to daily launches is purchasing engines from a different launcher that hasn’t successfully reached orbit yet.

Virgin Galactic noted that it is currently searching for additional warehouse space to be used for manufacturing its Delta Class spaceship, as VG needs more room than its current Mojave Desert facilities provide in order to begin producing Delta rockets at scale.

In an interview with TechCrunch, management indicated it would need ~12 Delta vehicles to accelerate flight operations to a profitable level of 400/launches year. This is a big ramp in vehicle production, as VG has only produced three spaceships to date (SpaceShipOne + SpaceShipTwo (both decommissioned) and VSS Unity). Management expects that the Delta Class of vehicles can be manufactured at a lower price point than VSS Unity.

Earth Observation ($BKSY $SPIR)

I will be dedicating a future post to a more in-depth compare and contrast between BlackSky and Spire as well as Planet Labs and Tomorrow.io, to better understand their products and services, their go-to-market strategy, their target customers, their financials, etc.

But in this post I will only focus on BlackSky and Spire Global.

DEFINED PRODUCT VERTICALS (OR LACK THEREOF)

The earth observation SPACs as confusing as they are interesting, at least to an industry outsider like me. However, I gained a basic understanding of differences between BlackSky and Spire from reviewing their earnings materials and what is clear is that they are in different stages of their product development lifecycle, best exemplified by articulation of (or silence on) the verticals each company is targeting and how they are providing customers specific data and analytics catered to those verticals.

So far, I am looking at these two earth observation companies on a spectrum—we have BlackSky on one end, and we have Spire on the other.

Spire has a clear, four-pronged product strategy serving customers interested in maritime, aviation, weather, or space services data and analytics (I believe the last item is a catch-all for any other data the company can collect, but doesn’t fall into the first three buckets).

In fact, one of Spire’s first moves as a de-SPAC was to announce a DA to acquire exactEarth, a leading maritime data and analytics provider, for $161M (the biggest new space SPAC acquisition to-date).

BlackSky on the other hand has not emphasized as strong of a focus on any specific vertical for its product offerings. The customers they are fielding interest from are in a variety of industries (mining, financial services, transportation, construction, and government), and I get the feeling that BlackSky would rather keep its options open for the time being since most of its success to date has been from government contracts and the company doesn’t want to limit itself to specific verticals until it has a better sense of commercial customer interest.

Additionally, until BlackSky identifies what type of commercial customers are most interested in its products and services and what verticals it wants to focus on, I don’t anticipate the company to execute any vertical-specific M&A (ex. the company’s partnership with Palantir enhanced BlackSky’s data analysis and go-to-market capabilities, rather than focusing on any particular vertical).

CONTRACT DELAYS IMPACTING REVENUE GUIDANCE

Revenue guidance is particularly important for space SPACs given that most of these companies are not yet profitable, and thus far, both Spire and BlackSky have struggled to meet initial 2021 revenue guides.

In July, Spire lowered its FY21 revenue guidance from $54M to $40-$42M, citing “certain project-based revenue contracts experiencing delays related to customers or third-party launch providers, along with delays in the anticipated closing of several large new customer contracts.”

BlackSky has lowered its FY21 revenue guide 2x—once in June ($46M—>$40M due to contract delays) and again in November ($40M—>$30-$34M, due to “the timing of new contract start dates and supply chain impacts due to the COVID-19 pandemic. These supply chain delays specifically impacted the execution schedule of engineering & integration projects and, thus, the recognition of revenue for these programs”)

Ironically, SPAC investor presentations for both of these companies point to revenue visibility as a key reason to like their respective businesses.

While this may be a characteristic of earth observation companies longer-term after they create larger revenue bases where any single contract isn’t as meaningful a driver of quarterly results (note: $BKSY $8M of revenue in 3Q21 and $SPIR reported $10M), it is clear that neither BlackSky nor Spire Global has great visibility into their quarterly revenue outlook given the lumpiness of contract acquisition.

I expect it will continue to be difficult for these companies to give reliable quarterly guidance and I wouldn’t be surprised if they decided to stop doing so starting in 1Q22, instead sticking to just annual guidance to enable greater wiggle-room for timing of results. I mean, they aren’t required to give explicit quarterly guidance, so why continue to do so?

Regardless, contract acquisition timing will likely be an issue that plagues public EO companies for some time.

Satcom and Infrastructure ($ASTS $RDW)

Satcom and infrastructure—a logical pairing, right? In some ways maybe yes, but in this case I am just kidding.

I’m bucketing AST SpaceMobile and Redwire in the same review section this quarter because although both companies have continued to make progress with their underlying businesses, around the time of 3Q earnings each company disclosed notable negative developments that have yet to be resolved (as of 12/19/21), leaving investors with unanswered questions and depressed share prices in the meantime.

For full disclosure I have positions in both $ASTS and $RDW, so I remain cautiously optimistic that these companies will figure their sh*t out, but I will discuss their issues without bias as best I can here.

THE GOOD - CORE BUSINESS PROGRESS

AST SpaceMobile

BW3 Testing: Management said development of its BlueWalker3 test satellite is progressing in-line with expectations, noting that the company is in the final stages of integration and pre-launch testing.

Scaling Manufacturing Facilities: AST entered into an agreement to more than double the size of its manufacturing facilities in TX, providing the company the potential capacity to reach management’s production target of six full-constellation satellites/mo in 2023. AST’s final constellation will consist of 168 satellites and management made the decision to manufacture satellites in-house in order to better control production pacing and costs.

BB1 Development: AST has proactively begun procurement of components that have long lead times and are needed for its first 20 revenue-generating satellites, BlueBird1, currently scheduled to begin launching in 4Q22.

Redwire

Partner of Choice for Commercial Customers: Since August, Redwire has announced four partnerships to develop key technology for commercial space initiatives (including with Firefly for a lunar lander mission, Virgin Orbit for digital engineering solutions, BigBear.ai for development of space systems cyber resiliency capabilities, and Terran Orbital for satellite manufacturing).

NASA Project Hot Streak: Since October, Redwire has highlighted technology it has provided for four NASA missions (including navigation technology for NASA’s Lucy Mission, roll-out solar arrays for NASA’s DART Mission, navigation and power generation components NASA’s IXPE Mission, and manufacturing technology + planet science experiments for NASA aboard SpaceX’s 24th Cargo Resupply Mission)

M&A: In-line with other newly de-SPAC’d space companies, Redwire put its SPAC cash to work right away and announced a DA to acquire Techshot, a leader in space biotech, for an undisclosed figure. This acquisition aligns with Redwire's growth strategy to leverage strategic investments to scale in-space manufacturing in LEO.

THE BAD - NOTABLE NEGATIVE OVERHANG/UNCERTAINTY REMAINS

Despite this underlying progress, both companies have been dealing with drawn-out negative catalysts.

At the time of 3Q21 earnings:

AST SpaceMobile on its 11/15 earnings call said it would likely delay (for a second time) the launch of its BW3 test satellite, to allow for more time for pre-launch testing/integration.

Redwire on 11/9, the day before its scheduled 3Q21 earnings call, announced that it would be delaying its earnings call until further notice. The next day the company detailed that on 11/5 “Redwire management was notified by an employee of potential accounting issues with a business subunit. Management promptly informed the independent Audit Committee of the Board of Directors. The Audit Committee has commenced an independent investigation.” As a result, Redwire stated that it intended to file a NT-10Q with the SEC, as the company didn’t anticipate being able to file its 3Q21 10-Q on time.

Since these initial disclosures:

AST SpaceMobile officially delayed the launch of its BW3 launch to “summer 2022”.

Redwire officially filed its NT-10Q with the SEC on 11/15, stating that the company was unable to file its 3Q21 10-Q on time. Additionally, Redwire issued a press release on 12/2 stating that the company’s Audit Committee investigation while not complete, had “not identified any material misstatements or restatements of its previously filed financial statements…[and] The Company reassures its customers, shareholders, suppliers, and employees that the ongoing investigation does not impact Redwire’s product performance, technical and mission excellence and does not affect its ability to continue to generate revenue and cash flow.”

Though we do not know the degree to which either company would actually be able to provide any update on their situation right now…

For AST SpaceMobile: details of a new launch date are likely still up in the air—negotiations with current launch provider SpaceX could still be in progress, and AST management may be shopping around for other launch providers as well.

For Redwire: clarity on timing for conclusion of the Audit Committee investigation/filing its 10-Q is likely something Redwire management doesn’t even have a concrete answer to internally, and promising an end date sets investors up for further disappointment if the company needs additional time.

…the uncertainty surrounding each circumstance has created notable downward pressure on $ASTS and $RDW shares in the near-term, both trading down 30-40% from just before the initial disclosure of these negative items.

Investors can handle bad news and transparency on key issues allows them to move forward with how to think about a company’s core business outlook + enables them to appreciate positive developments like I outlined above for each company—Redwire in particular has shown consistent positive operating momentum that, had this SEC filing overhang not existed, could have been positive for $RDW shares the same way Rocket Lab’s the steady stream of operating momentum announcements has benefitted $RKLB shares.

Going forward:

One would assume that Redwire will try to wrap up its Audit Committee investigation and file its 3Q21 10-Q prior to the timeframe for filings its 2021 10-K (early-mid February)—not doing so would be a major red flag, as the company would then be behind on two major SEC filings.

For AST SpaceMobile, I assume the company provides an update on its 4Q21 earnings call in February with either a new launch date for BW3, or a timeframe for when investors can hope to hear what the new launch date is. Failure to communicate these details on its earnings call would likely be another negative catalyst for $ASTS shares.

Enjoy this post? Subscriber to get more commentary and analysis from Case

Additionally, subscribe to Case’s Twitter for more short-form content

I am purposefully excluding Planet Labs from my comparison this quarter out of spite—I announced the conclusion of my individual company 3Q21 earnings reviews on 12/2, and Planet announced intention to release C3Q21 earnings on 12/7. I will include them in my reviews going forward.