July + August 2024 Space Stock Review

Includes Commentary on: PL, SPIR, 🅰️STS, LLAP, VSAT, MDA, and LMT/NOC/RTX

Hello fellow space enthusiasts! 🚀

After very busy 3Q24, we are publishing a delayed double-feature analyzing BOTH July + August space stock trends; in just a few weeks’ time, subscribers will receive the September Space Stock review on the traditional beginning-of-the-month schedule. Enjoy!

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

3Q24 has been a Space SPAC Summer.

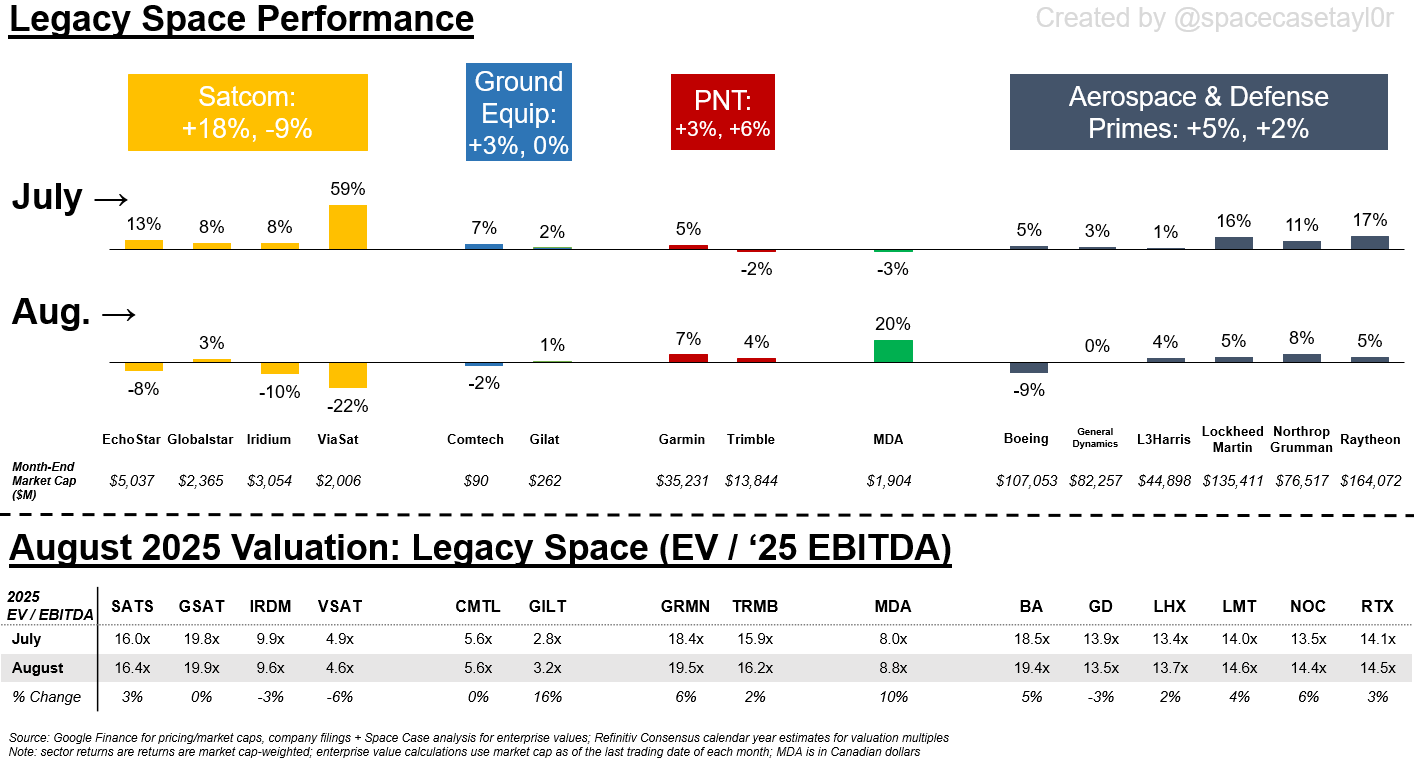

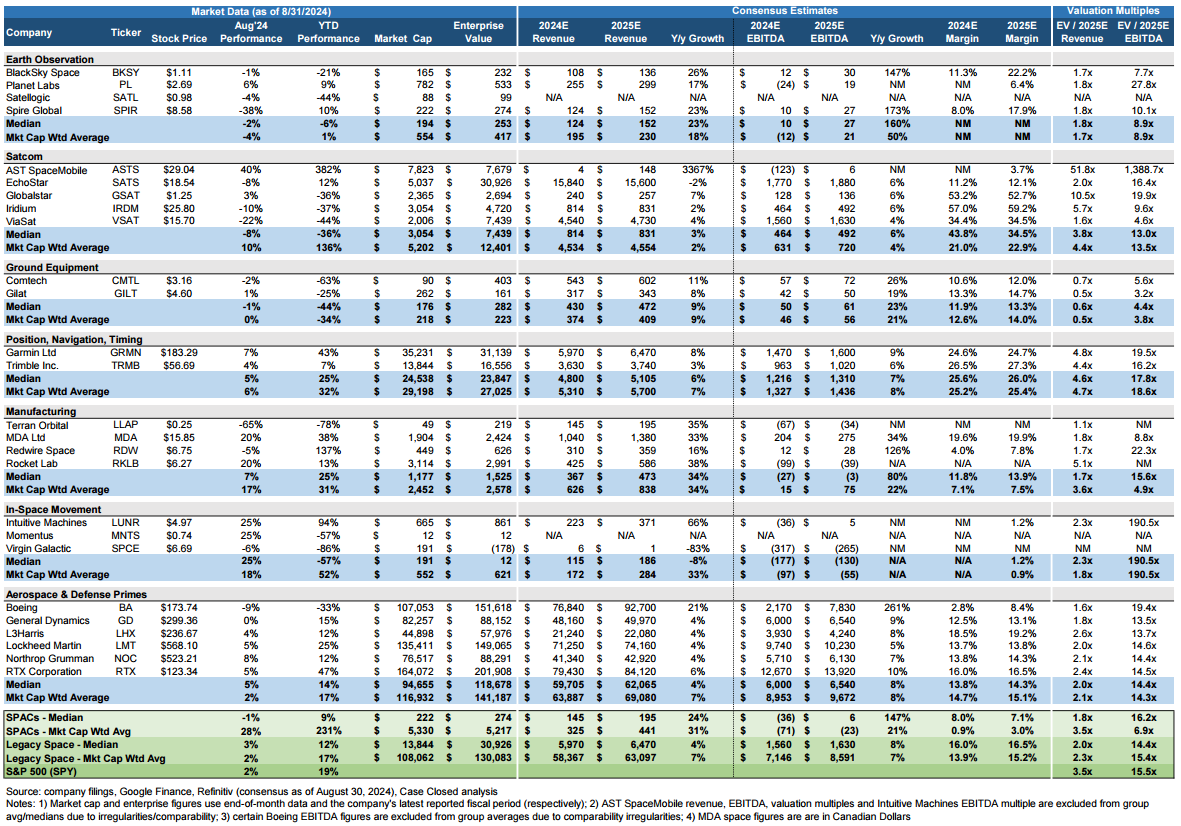

Led by AST SpaceMobile, the space SPACs handily beat the broader market and legacy space stocks in both July and August; however, even excluding ASTS’ +78% and +40% returns in July and August (respectively), the SPACs still led the way with nearly +13% and +12% returns the past two months.

In July and August, the SPAC’s volatile performance is similar to, but the opposite of broader market volatility over the same time period.

Over the past two months, investor uncertainty has increased as economic data has begun to indicate that underlying economic trends are weakening; while we are on the verge of interest rate cuts that investors have been looking forward to for some time now, the concern is that high interest rates meant to combat inflation have been successful at the expense of harming underlying economic growth and that rate cuts are coming too late to avoid a recession.

This economic uncertainty may explain the strong July + August for Aerospace & Defense primes, as defensive stocks (i.e. companies that generally produce consistent earnings regardless of economic conditions) have benefitted during this period as some investors look to decrease their exposure to risk, and the Aerospace & Defense primes are considered defensive stocks (no pun intended).

At the same time, interest rate-sensitive stocks have also benefitted recently, as the one-two punch of decelerating inflation and weakening economic conditions increases the odds of a lower interest rate outlook—as I have described many times before (link to my previously written primer on “Why Should Space Investors Care About Interest Rates?”), high-growth and unprofitable companies disproportionately benefit from lower interest rates since the majority of their cash flows are in the future and the present value of their future cash flows are worth more in the present day if interest rates are lower vs higher (all else equal).

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

Startup valuation trends from Carta: Part 1, Part 2, Part 3, Part 4

Deep tech doesn’t have to be capital & time intensive (from Arpit Dwivedi, founder of Cache Energy)

2. SPACE STOCK COMMENTARY

A Note from Space Case: there have been notice a few changes to our SPAC groupings (see above) since our last Space Stock Review in July

Astra has been removed since it is no longer a public company

Rocket Lab was moved to the “manufacturing” category since its old grouping with Virgin Galactic in the “launcher” category no longer made sense and for the foreseeable future, the majority of Rocket Lab’s revenue will be coming from its Space Systems manufacturing business

Virgin Galactic was moved from the now defunct “launcher” category (and let’s be real, it was never a launch company) to the new “in-space movement” category with Intuitive Machines and Momentus (which were previously categorized as “cislunar”). I am not sure these three companies belong grouped together, so feel free to suggest an alternative grouping for name for these companies in the comment section if you have ideas

Planet Labs’ / PL returned to positive year-to-date returns (+9%; YTD) in July and August following a strong two-month period

These positive results can probably be attributed to a string of good news for the company over the summer where it disclosed winning five government contracts and two contracts with humanitarian non-government organizations (NGOs) (link for more information)

This series of announcements was encouraging given that Planet has been increasingly relying on government customers to drive its revenue growth, and management has been alluding to upcoming government contract awards the past few earnings calls (link for details)

Spire Global / SPIR had good news in July and August overshadowed by accounting missteps disclosed by the company on 8/14

On 7/24, Spire announced that it would release its 2Q24 earnings on 8/14; however, when 8/14 came around the company abruptly announced that it needed to reschedule the call due to an inability to file its 2Q24 10-Q filing because of an ongoing internal investigation into revenue recognition practices related to its Space Systems line of business (i.e. hosted payload contracts; see here for more details on the contentious situation between Spire and one of its customers that is probably behind this situation - link). Spire noted that although its cash position would be unaffected by this review, revenue could be affected by $10M-$15M/yr and management believed the company was now violating the covenants (i.e. rules) of its $120M debt agreement with Blue Torch Capital

Needless to say, the markets did not like this and SPIR shares traded down -34% the day after this news was announced

Later in August however, the company announced that it had worked out an agreement with Blue Torch: in exchange for a $10M payment, Spire was able to renegotiate its debt agreement so that it wasn’t violating any covenants. While the payment was painful for Spire (which only had $46M of cash on hand prior to this agreement and hasn’t reach consistent cash generation from its operations yet), putting the covenant violation to bed is a relief for equity investors. However, Spire still hasn’t filed its 2Q24 10-Q and has yet to announce the conclusion of its internal revenue recognition practices, so the company isn’t through the woods yet with this situation

Unfortunately this accounting drama overshadowed four multi-million contract wins for Spire in July and August (all from government customers; link to SPIR press releases)

AST SpaceMobile / ASTS’ hot streak continued in July and August, with ASTS shares appreciating +150% over the two month period. There were two main updates from the company that seemed to act as catalysts for ASTS in July and August:

On 7/25, ASTS shares jumped +25% on the news that AST’s 1st five commercial (i.e. revenue-generating) satellites were fully assembled and prepared for shipment to SpaceX for launch. Personally I don’t think this news merited that kind of share price movement, but it did officially kick off the hype train ahead of the company’s 1st multi-satellite launch, and ASTS shares continued to move steadily upward through mid-August; perhaps shareholders were relieved that the company’s launch plans weren’t impacted by SpaceX’s mission failure on 7/12, which resulted in the FAA grounding the company’s rockets until it completed a mishap investigation

On 8/15, ASTS shares increased +51% following its 2Q24 earnings call where I don’t think there was any one piece of good news that drove shares higher, but rather a string a positive updates from management as AST transitions from R&D mode to commercialization mode, including: 1) the launch of AST’s 1st five commercial satellites was officially scheduled for the first half of September; 2) AST had begun production for its next 17 satellites, with launches for these satellites beginning in 1Q25; 3) AST’s next-gen ASIC chipsets that will 10x the bandwidth of the company’s satellites successfully taped out (i.e. finished design and were sent out for manufacturing); 4) AST’s partners, Verizon and AT&T, were supporting AST’s ongoing FCC regulatory approval processes; 5) the company is executing upon its initial US government (USG) contract and anticipates winning additional USG contracts in coming months; and 6) management reiterated funding plans centered on non-dilutive capital, including that AST continues to work with the Ex-IM bank for a debt financing package + management doesn’t anticipate pursuing a public equity offering to raise capital through the remainder of 2024 due to prioritization of prepayments from MNO partners instead

Following its strong July + August, ASTS’ market capitalization (i.e. the value of its equity) was 40% greater than the combined market cap of the other 10 space SPACs ($7.8B for ASTS vs $5.7B for the other 10 space SPACs)

Terran Orbital / LLAP shares declined -65% in August after the company announced plans to be acquired by Lockheed Martin / LMT for $450M, a -25% discount versus LMT’s previous ~$600M offer, but a -75% difference for equity shareholders since Terran’s equity was now being valued at $0.25/sh vs $1.00/sh prior

As I noted previously (link), Terran management was playing a game of chicken with Lockheed by rejecting the company’s March takeover offer of $600M in hopes that Terran’s biggest potential customer (Rivada Space) would actually begin to make material payments on its $2.4B contract for 300 satellites; if this had happened, Terran might have been able to self-fund its business and remain independent, or it at least would have been able to argue that it was worth more than $600M

However, Rivada never came to save the day and Terran didn’t get its “winner winner, chicken dinner,” likely due to Rivada’s own funding issues (see the following SEC filing from Terran Orbital detailing their engagement with Rivada + why Terran removed the $2.4B Rivada contract from its backlog here, link); notably, since Terran’s acquisition announcement, Rivada’s CEO has made a number of interesting statements including: that Terran’s acquisition by Lockheed is a “real confidence builder;” Rivada continues to be financially is supported by sovereign wealth funds; and the company still anticipates meetings its regulatory constellation buildout deadline of 300 satellites on orbit by 2026 (link)

ViaSat / VSAT had an unusually volatile July and August, where shares spiked +59% in July and then declined -22% in August (and have since trended back to June levels in September, completely erasing July gains)

I can’t point to any fundamental reasons why VSAT shares would have increased so much in July (the company didn’t announce any material news that would have acted like a sharp positive catalyst), so it makes sense to me that VSAT has since drifted back down to pre-July share price levels

MDA Space / MDA’s +20% gain in August was driven by the company’s 2Q earnings report

Notably, the 2Q report included positive updates on the company’s 2024 guidance, including: 1) increasing 2024 revenue guidance to +30% y/y growth vs +25% y/y growth guidance prior, with matching higher EBITDA dollars (though margin stayed the same); 2) an improved cash flow outlook, where the company now expects to generate free cash flow in 2024 (vs 2025 prior, due to changes in working capital requirements) and plans to continue delevering its balance sheet (i.e. paying off debt) as a result

In general, this earnings report underscores MDA’s momentum as a key manufacturing player in the space industry, with its backlog now at a company record high of $4.6B for projects across civil space and commercial space (though just two deals, the $1B Canadarm3 contract and $2.4 billion Telesat Lightspeed contract, make up the majority of this backlog)

Aerospace & Defense Primes (in particular, Lockheed / LMT, Northrop Grumman / NOC, and Raytheon / RTX) all saw strong performance in July and August

As I noted earlier in this post, uncertainty related to mixed economic data may explain the strong July + August for Aerospace & Defense primes, as defensive stocks (i.e. companies that generally produce consistent earnings regardless of economic conditions; again, no pun intended) have benefitted during this period as some investors look to decrease their exposure to risk

LMT, NOC and RTX in particular all raised 2024 guidance metrics and shared a generally a positive outlook for 2025 during their 2Q earnings reports in late July—the timing of doing so was perfect to emphasize to more risk-averse investors that these companies can continue to drive earnings growth in uncertain economic conditions