April 2023 Space Stock Review + 2022 SPAC Guidance Analysis + 1Q23 Earnings Scorecard

Topic(s) of Interest: Analyzing 2022 SPAC Results vs Original Guidance + 1Q23 Space SPAC Earnings Scorecard

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 April Market Overview

✍️ Space Stock Performance + Valuation

🔍 Topic of Interest #1: Analyzing 2022 SPAC Results vs Original Guidance

🗣️ Topic of Interest #2: 1Q23 Space SPAC Earnings Scorecard

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (5/30/23).

1. MARKET COMMENTARY

Space stocks once again trailed the broader stock market in April.

Trading ranges and volatility were relatively subdued compared to the first three months of 2023 as investors digested mixed signals and were in “wait-and-see” mode regarding the path going forward.

A solid March inflation reading (down a full percentage point from February’s readout) and the collapse of First Republic Bank validated Street expectations for the Federal Reserve to pause its rate hikes beginning in June (and potentially lower rates later in the year) given continued deceleration of y/y inflation and concerns regarding the US’ broader economic health.

At the same time, tensions and uncertainty related to the impending US Treasury debt default date increased as April progressed; investors highlighted a litany of near-term and long-term negative consequences that would arise if Democrats and Republicans didn’t come to an agreement to raise the debt limit, with negotiations hinging on setting guidelines for federal government spending limits.

Meanwhile, big tech drove the broader market’s (marginal) returns again in April (just like in March) as Microsoft, Google, and Meta all reported 1Q results + issued guidance above consensus expectations in late April. Apple and Nvidia followed suit with similarly strong earnings reports in May.

With the backdrop of heightened uncertainty, an outlook for recession due to tight capital markets, and feared fallout from a potential US Treasury default it makes sense that growth stocks (i.e. less established and not profitable space stocks + the ARKK ETF) lagged in April.

Meanwhile in the private markets, reports (link) suggest that valuations, deal sizes, and aggregate dollars raised continued to decline meaningfully y/y in 1Q23 (and also q/q for most stages).

2. SPACE STOCK COMMENTARY

Note from Space Case: I started out 2023 highlighting the comp table I created in the style of what Street analysts publish; however, over the last few months I’ve realized my old style of comparing monthly stock performance + valuation multiples (see below) is easier for storytelling in my newsletter. I’m including both in this month’s newsletter, but there’s a chance I stop producing the Street-style comp table going forward to save myself time (and sanity).

You might not have noticed (or cared) if I didn’t point this out, but I am no longer including Satixfy / SATX in my space SPAC cohort going forward because: 1) the company has foreign issuer status with the SEC (it is an Israeli-based company) and is only required to provide financial updates 1x/yr; 2) SATX didn’t issue 2023 guidance with its 2022 annual report; and 3) SATX has no analyst coverage. As a result, I can’t track SATX’ valuation and I am not going to bother keeping up with the company going forward.

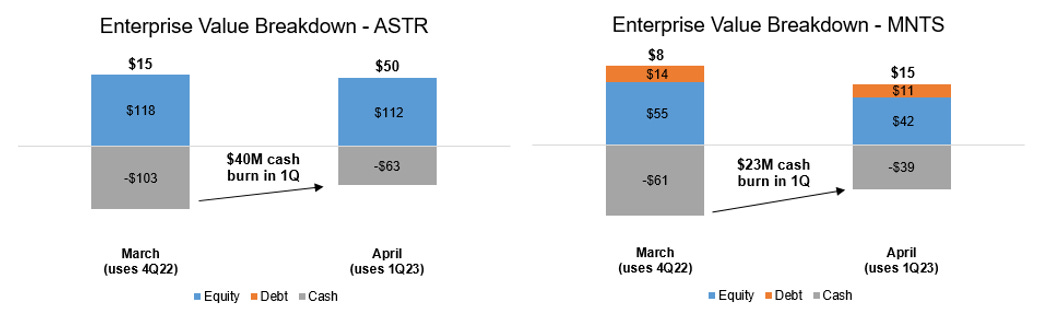

Lower Cash = (Artificially) Higher Multiple: At first glance, ASTR and MNTS’ higher valuation multiples in April seem like an error (that was my first thought at least); but upon closer inspection, the higher multiples are driven by each company’s use of cash in 1Q23. The formula for enterprise value (EV) can be simplified as EV = equity + debt - cash; given that I updated my underlying enterprise value calculations from 4Q22 balance sheet data in March to 1Q23 balance sheet data in April, we can in the charts below that the updated EV was primarily driven by updated cash balances and we can ignore ASTR and MNTS artificially high month-over-month multiple variance.

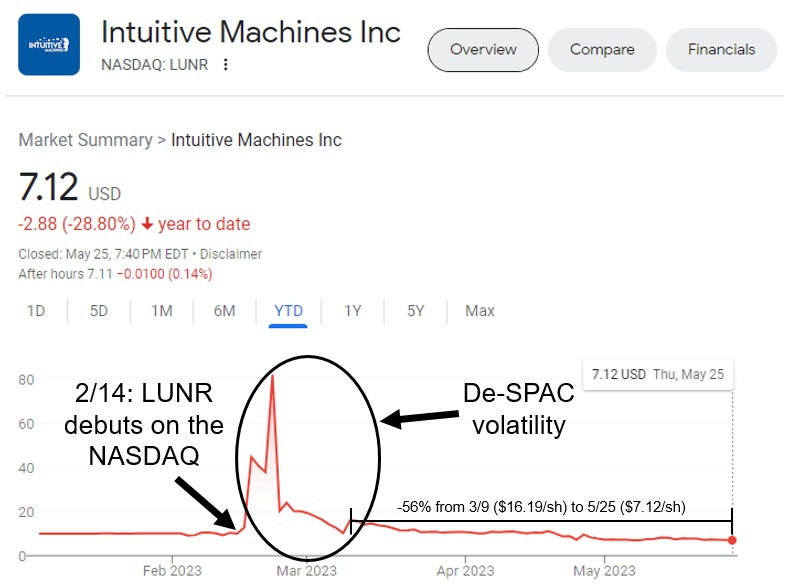

LUNR’s -28% decline in April was not attributable to any real news, but was rather a continuation of the stock’s decline since reaching >$100/sh in its initial trading days after de-SPACing (an outsized example of typical de-SPAC volatility).

Boeing 737 MAX Woes Continue: As I detailed in my last newsletter (link), Boeing’s core aviation business has been hamstrung since 2019 due to complications related to its 737 MAX aircraft. In mid-April this continued, as a newly discovered production issue is expected to impact the Boeing’s planned pacing of 737 MAX deliveries in 2023 (now more heavily weighted toward 2H23). On the company’s 1Q earnings call management assured investors that the company still plans to deliver 400-450 plans in 2023, but analysts clearly expect to see some shortfall in deliveries as BA’s consensus 2023 EBITDA decreased -23% between March and April as a result of updated forecasts following earnings. This explains the company’s 2023 EBITDA multiple jumping +29% in the quarter (i.e. the denominator declined while the numerator stayed relatively flat).

3. TOPIC OF INTEREST #1 - ANALYZING 2022 SPAC RESULTS vs ORIGINAL GUIDANCE

One of the most controversial aspects of companies going public via SPAC is that safe harbor protections (used to) enable management teams to provide more forward-looking information vs going public via IPO by protecting them from investor lawsuits related to overly optimistic projections.

In the latest wave of SPAC-mania (2020-22), these management guidance figures were the target of intense criticism—and rightly so.

A 2022 study (link) showed that just 42% of SPACs from 2004-2021 met or exceeded their original revenue guidance figures the 1st year after going public.

For the space SPACs, only 4 of the 13 companies met or exceeded their original 2022 revenue projections (~31%)…but 2 of them don’t count:

LUNR issued its guidance in December 2022, so the better comparison will be to look at how the company’s reported 2023 revenue compares to original guidance.

SPCE went public in 2018—its 2022 revenue forecast is extremely dated at this point.

Excluding LUNR and SPCE, only 27% of the space SPACs met or exceeded their original 2022 revenue projections, which is below the average of 42% from the 2004-2021 SPAC cohort analysis.

Perceived best-in-class Planet Labs and Rocket Lab achieved at least 100% of their forecasted revenue

RKLB completed a number of acquisitions in 2022 (including SolAero which contributed $80M of revenue/year at the time of acquisition)—so it is hard to know what deals were contemplated at the time of its SPAC merger and where the upside came from.

For Planet Labs, I was surprised when the company didn’t increase guidance after being awarded an Electro-Optical Commercial Layer contract from the National Reconnaissance Office in mid-2022—I had expected to see both PL and BKSY increase revenue guidance after getting those contracts, but I guess the government was very transparent with each company about what it planned to award them!

Another surprise was seeing that Terran Orbital met 100% of its forecasted revenue, which highlights the company’s insight into its long-lead cycle manufacturing business, with 2022 results benefitting from its contract with Lockheed Martin for 10 satellites for the Space Development Agency (SDA) and 2023 looking to benefit from additional SDA orders and a megacontract from planned satcom operator Rivada Networks (link).

Note that I am only evaluating Terran’s manufacturing revenue. The company pivoted in October 2022 and abandoned plans to operate a SAR constellation after receiving a $100M investment from Lockheed Martin that was conditional upon LLAP management agreeing to focus only on satellite manufacturing.

Intuitive Machines literally gave its last forecast <1mo before YE22, so it’s not surprising to see that it met 98% of forecasted revenue in 2022. As I mentioned earlier, the better comparison for LUNR will be to monitor its 2023 reported revenue vs original guidance.

Spire Global and BlackSky both lowered their 2021 revenue guidance figures around the time of their de-SPAC dates, which carried through to 2022 results missing original projections as well. Since 2021 however (and ignoring the original SPAC guidance figures), both companies have issued much more reliable quarterly and annual guidance.

Redwire’s ability to generate revenue in 2022 was negatively impacted by delays in contract awards (delay of US Federal budget approval led to a continuing resolution), supply chain issues, and volatility associated with orders from emerging commercial space contracts; I suppose this is the risk that comes with a business that is primarily a government contractor.

Also of note—since going public RDW acquired 2 companies (QinetiQ Space NV and Techshot), but clearly their acquired revenue was not enough to offset the other negative factors described above.

While Virgin Orbit (RIP) wasn’t the worst of the SPAC cohort in terms of meeting its 2022 revenue generation targets, its downfall was ultimately due to needing to burn hot and scale launch operations 10x from 2022 levels to reach breakeven after reaching north of $300M of revenue in 2024 (clearly not a realistic plan).

Meanwhile ASTR, SATL, ASTS, and MNTS overestimated their ability to commercialize in 2022. In particular, ASTR, ASTS and MNTS all saw their revenue-generation capabilities move to the right/into the future given lower levels of technology readiness than what was anticipated at the time of guidance. All of these companies not only face the risk of needing to mature their underlying technology, but they need to scale operations to generate enough revenue to become profitable—a similar situation that VORB was faced with.

Admittedly, Virgin Galactic’s 2022 revenue guidance is quite stale, having originally been issued in 2018 (it is the OG space SPAC). However, management had originally anticipated generating material revenue in 2020 ($33M) which is still ahead of 2023 consensus revenue estimates ($12M). Additionally, management had originally forecasted that SPCE would be at nearly $600M of annual revenue in 2023 vs current long-term consensus estimates that don’t even have the company reaching $500M of revenue by 2027.

Something to keep in mind is that many of the companies that went public via SPAC between 2020-2022 weren’t necessarily ready to go public—they were taking advantage of favorable capital market conditions to raise hundreds of millions of dollars and allowing venture capital investors to exit their positions. Management teams toed the line of optimism and irrational exuberance in order to get public market investors excited about their businesses, despite the uncertainty in their business plans.

And this isn’t unique to the space SPACs—the SEC felt strong enough about this topic that in March 2022 it issued stricter rules related to SPAC financial guidance figures, allowing SPACs to be sued by investors for excessively rosy business forecasts (link).

I will acknowledge that is super easy for me as an analyst (the armchair experts of the investing world) to sit back and point all this out, but having worked in investor relations for a publicly traded megacap company I feel compelled to highlight that unrealistic guidance will hurt a company’s stock and impact management credibility.

Note: something I am not looking at here is comparing 2023 consensus estimates vs original management forecasts—perhaps I will do so in a future report. Additionally, I only looked at 2022 revenue because not every SPAC provided extensive financial forecasts and this was a common metric that each of them had guided to.

4. TOPIC OF INTEREST #2 - 1Q23 SPACE SPAC EARNINGS SCORECARD

Below is the framework that I have been using to evaluate space SPAC earnings.

This “back-of-the-envelope” approach to analyzing an earnings report ignores results in the context of previously issued guidance, analyst expectations, or management commentary—all of which should be included in a full earnings analysis.

However, the framework was inspired by the Josh Wolfe quote “survival is a necessary precondition for growth (link),” and it was originally developed to identify which space SPACs were in a position to survive the oncoming economic “winter” and therefore might be suitable to invest in amidst a market downturn (link to August 2022 post).

So with that sentiment in mind, let’s dig in.

These results are easy to segment:

Companies on the left are pre-revenue and are burning cash to mature their technology and monetize their businesses. In the meantime, they are balancing burning hot and doing their best to manage FCF, while also taking advantage of equity facilities where possible (which is hard to pull the trigger on given that their present day equity value is so low relative to their SPAC debuts).

This cohort includes SPCE, ASTR, ASTS, and MNTS (which I highlighted as at-risk companies in Topic of Interest #1 as well)

Companies on the right are more mature businesses, and have been consistently reporting better quality earnings than the other space SPACs.

However, of note is BlackSky’s performance with only 3.5 of 8 possible points—the company has typically been 6 of 8 or better for the past several quarters, with a slight deceleration in revenue growth and uptick in FCF burn impacting this quarter.

Redwire reported positive EBITDA for the first time since de-SPACing (which is also a first for all space SPACs). Given that the company touted the potential for near-term profitability in its SPAC deal announcement, it is exciting to see if the company can continue to grow profitability.

While Rocket Lab continues to grow revenue and still has nearly $450M of cash on the balance sheet, the company is in the midst of a period of heightened investment at it develops its next-gen rocket (Neutron, which management anticipates will require $250M of capital)—hence its growing FCF burn. In the meantime, its launch business was roughly gross profit breakeven in 1Q23 and its manufacturing business had a ~20% gross margin (which the company hopes to grow to 50% long-term).

Spire Global reported a strong 1Q23, highlighted by continued reduction in FCF burn, margin improvement, and revenue growth. At this point, Spire’s main question is: will these trends continue so that the company meets its guidance of turning FCF breakeven in 10-16mo?

Note: LUNR was excluded because the company didn’t break out its 4Q22 results for me to compare vs 1Q23, so I couldn’t calculate most of the metrics needed for this chart; I hope to include it in the future.

Great work. Spire

This is great! Looking forward to a positive EBITDA for 23 for at least one of the space SPACs