October Space Stock Review + Space Industry Frameworks

Topic of Interest: What is the Best Framework for Evaluating the Space Industry?

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 October Market Overview

✍️ Space SPAC Performance and Valuation

Note: Satixfy ($SATX) closed its SPAC transaction on 10/31. However, I won’t be including SATX in my space stock reviews until the company files documents with the SEC indicating net deal proceeds, redemption rates, share count, etc.

🗣️ Topic of Interest: What is the Best Framework for Evaluating the Space Industry?

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (11/8).

1. OCTOBER MARKET OVERVIEW

Legacy space companies dominated the stock market in October.

Across the board, market sentiment improved in October as investors began to expect the Federal Reserve to “pivot” toward less aggressive interest rate increases—specifically, investors were hoping for a +75bps increase in November, followed by only +50bps in December (vs prior expectations for +75bps).

The hope for a pivot came from press reports suggesting there was debate amongst Fed policy makers regarding the pace of rate hikes and how to balance curbing inflation vs inadvertently causing a recession.

A pivot to less aggressive interest rate increases would be positive for stocks because as we discussed last month (see link here), rising interest rates are bad for valuations and a deceleration in rate increases would mean we are closer to the end of this rate hike cycle.

However, on 11/3 the Federal Reserve issued strong language reaffirming its current plan for aggressive rate hikes (the following quotes are from Federal Reserve Chairman Powell on 11/3):

“It's very premature…to think about or be talking about pausing our rate hike”

“…we still have some ways to go, and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected…We will stay the course until the job is done”

So why did legacy space stocks do so well in October?

Simply put, in the face of an oncoming recession, the near to mid-term outlook for legacy space companies is bolstered by steady demand from the government; investors seized on the opportunity to buy these stocks during what seemed like a potential market-bottom in October.

Aerospace & defense stocks are considered to be defensive stocks, meaning they are less sensitive to economic cycles relative to companies that sell discretionary products and services.

This is particularly true now since the majority of legacy space stocks are dual-use (i.e. serving both the commercial market and government/military) and geopolitical conflict + rising tensions are pushing governments to spend more on defense; during 3Q22 earnings calls in October, companies like Honeywell, Lockheed Martin, Northrop Grumman and Boeing all highlighted that the long-term outlook for defense spending remains favorable, which compared favorably vs tech stocks providing soft forward-looking guidance on their 3Q earnings calls.

2. SPACE SPAC PERFORMANCE AND VALUATION

PERFORMACE COMMENTARY

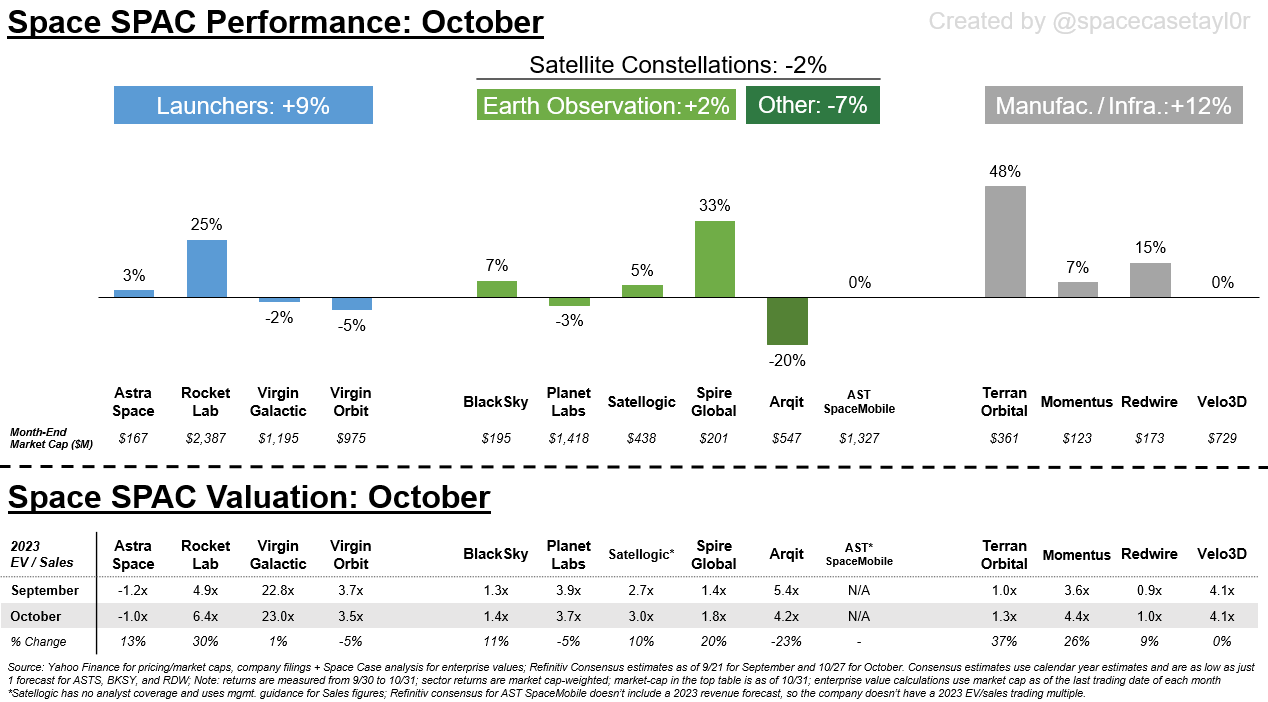

October was a mixed month for the space SPACs—while 9 SPACs traded <10% up/down for the month, 4 SPACs traded >20% up/down.

The four biggest movers were Terran Orbital, Spire Global, Rocket Lab, and Arqit Quantum—I’m not sure any of these companies had material news that drove their outperformance in the quarter, but the bullets below highlight what each company has been up to lately.

Terran Orbital (LLAP): +48%

Terran Orbital didn’t have any material news in October until the 31st, when it was announced that Lockheed Martin was investing $100M into the company to help to expand production facilities in Irvine California.

This announcement was notable because 1) it provided clarity around LLAP’s near-term funding, 2) it deepened the relationship between LMT and LLAP (LMT invested in LLAP’s original SPAC deal and LLAP is building satellites for LMT as part of servicing orders from the Space Development Agency), and 3) LLAP officially ditched plans to operate its own SAR constellation (not a surprise—management has been walking back these aspirations for several quarters now; however, management was originally forecasting ~65% of long-term revenues to come from operating its own SAR constellation, so this is a big strategic pivot).

Spire Global (SPIR): +33%

Spire didn’t have any particularly notable news announced in October, but its strong October performance is potentially attributable to investors “buying the dip” during October lows following a flurry of contracts announced in September, including:

2 hosted payload contracts (deal with NOAA to deliver hyperspectral microwave sensors for collecting weather data; deal with GHGSat for greenhouse gas emission monitoring), new data deals with NOAA and the NRO, and an expansion of a current data contract with NASA.

Rocket Lab (RKLB): +25%

In October Rocket Lab highlighted a new manufacturing deal (solar cells for a NASA program), it set a new company-record for launches in a year (8), and it delivered the rocket that will make the company’s inaugural launch from the east coast to NASA’s Wallops facility.

None of these items are enough to make the stock go up 25% in a month, but the difference in Rocket Lab’s maturity as a company vs most of the space SPACs is SO apparent each month when I review their press releases—it feels like the company is consistently announcing new milestones and is participating in major developments spanning both commercial and government space activity.

Arqit Quantum (ARQQ): -20%

Since de-SPAC’ing Arqit has been a relatively quiet company, not putting out more than a couple of press releases in any given quarter. However, the company highlighted two of what I believe to be reseller agreements in October, making its quantum-encryption software available via reseller partners’ platforms in both the UK and Australia.

VALUATION COMMENTARY

The main valuation theme for October was “no change”

Most of the SPACs didn’t have their stock move more than a couple percent this past month, and revenue estimates didn’t move much going into 3Q earnings either; the net-net is that valuations didn’t really change vs September and mostly held within a range we have been observing since 2Q of this year.

3. TOPIC OF INTEREST: WHAT IS THE BEST FRAMEWORK FOR EVALUATING THE SPACE INDUSTRY?

There is so much happening in the space industry these days—I have a really tough time keeping track of everything.

And I know I’m not the only one out there who feels this way.

The current wave of space commercialization has created a steady drumbeat of major announcements that make it hard for even the most in-touch executives, founders, and investors to keep up with developments—hence the creation (and success) of new space industry media such as Payload’s daily newsletter (sign up here via this link if you don’t already subscribe to Payload’s newsletter).

Recently I’ve been fixated on the problem that I’ve heard about from every corner of the industry: we need more people working in the space industry (link).

Given that much of this labor growth is expected to come from people not currently working in space, I believe that a big part of the recruiting challenge is inspiring these people to switch industries by helping them understand the big picture of what is happening in the space industry—that way they can understand how they fit in to the exciting developments that are taking place!

The best way to help communicate the big picture is via thought frameworks.

So in late October I decided to get help from my friendly and smart Twitter audience by asking about their preferred frameworks for evaluating the space industry—it turned out to be a very controversial question! But it generated a lot of thoughtful discussion.

Here is what I learned (visual frameworks are below).

1. Define What You Are Looking For

Before you can find any answers, you must first define the problem.

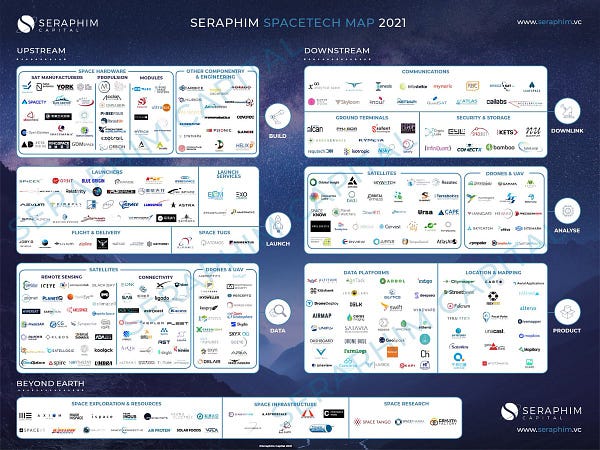

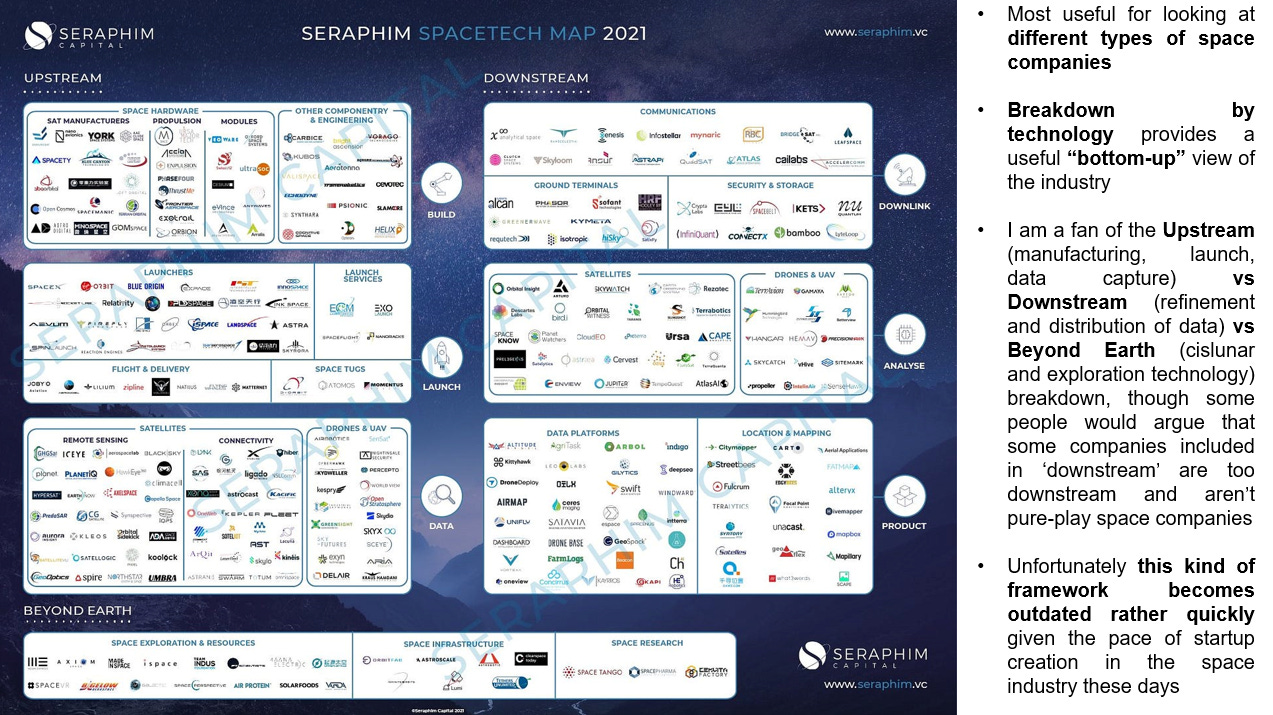

Do you want to map out different types of space companies by technology? Distinguish buyers vs suppliers? Are you trying to determine the size of the space “economy,” and if so, will you include downstream industries or companies that utilize satellite data (Uber and other companies using GPS data could fall in this category, if yes)?

These are big questions, but responses from my Twitter audience made it clear that I need answers to them before I can identify a framework that fits my needs.

2. Acknowledge That All Frameworks Are Flawed

Most of the responses to my Twitter question were comments about how incomplete any single space industry framework was—and these were fair criticisms ranging from revenue double-counting, incomplete lists of companies, and subjective inclusion (or exclusion) of space-adjacent industries/companies/organizations.

Rather than get hung up on this, I prefer to acknowledge the limitations of any one framework and move on.

3. Use Multiple Frameworks for Best Results

As unsatisfying as this is to admit, there is no “one-fits-all” framework for evaluating the space industry.

Rather, a combination of multiple frameworks can provide a holistic perspective that can be used to track what is happening in the industry.

Here are the frameworks I like best:

Any new articles coming soon? I keep refreshing looking for the new one that usually comes every 2 weeks :)

Any new articles coming soon? I keep refreshing looking for the new post that usually comes every 2 weeks :)