October 2024 Space Stock Review

Includes Commentary on: LLAP, BKSY, RDW, RKLB, MNTS, VSAT, and CMTL

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

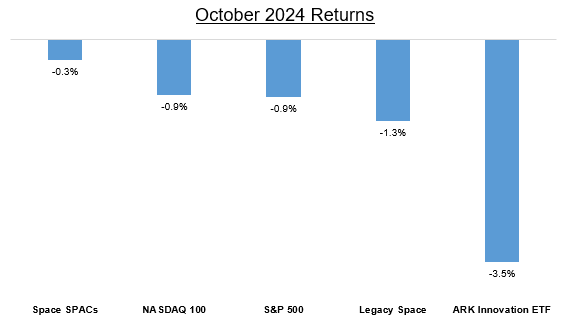

Both space SPACs and the broader stock market ended 5-month winning streaks in October, with negative monthly returns for the 1st time since April 2024.

The market bounced between positive and negative returns multiple times during October, which suggests that investor uncertainty around the economy, the geopolitical landscape, and in particular, the US election continued to weigh on market sentiment.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

2. SPACE STOCK COMMENTARY

Terran Orbital / LLAP was officially acquired by Lockheed Martin in October, reducing the number of space SPACs we cover to just 10 companies

Following LLAP’s distressed acquisition, we now have three failed space SPACs (LLAP, Virgin Orbit / VORB, Astra Space / ASTR) from the class of 2020-23

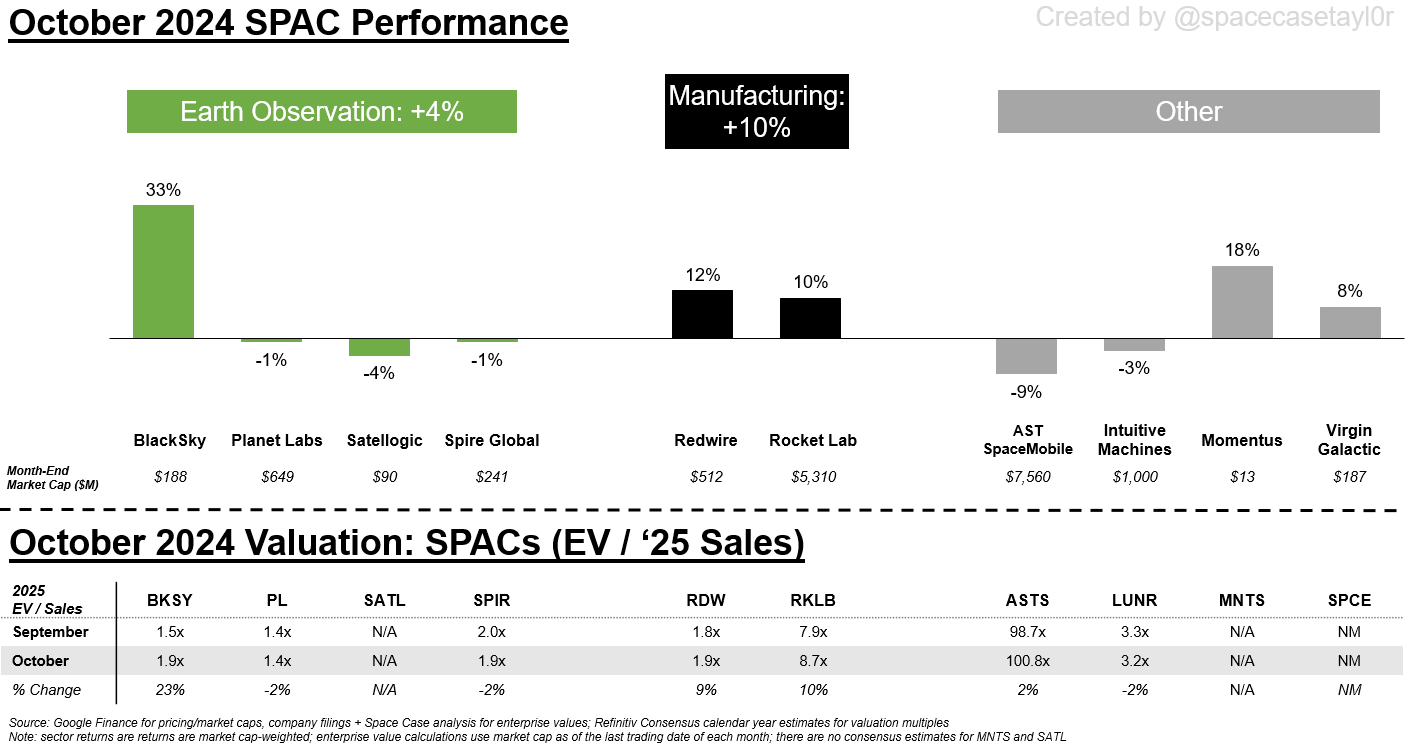

BlackSky / BKSY shares partially recovered in October (+33% in the month) following a tough September (-47%)

Remember that we previously discussed how BKSY shares tumbled in September following a surprise 1-for-8 reverse stock split announcement on 9/4, which signaled an upcoming equity dilution; once the fundraise was officially announced on 9/24 however, management disclosed that a portion of the proceeds would be used “to gain more control over the parties that impact our Gen-3 supply chain and production operations.” This comment suggested M&A was the reason for the raise, not underlying weakness in BKSY’s business.

Sure enough, on BKSY’s 3Q24 earnings call management disclosed that it was acquiring the 50% of LeoStella that it didn’t already own (LeoStella is a satellite manufacturing company, originally created as a joint venture between BlackSky and Thales Alenia Space; LeoStella manufactures BlackSky’s remote sensing satellites)

Since the 9/24 disclosure that foreshadowed M&A and dispelled fundamental business momentum concerns, BKSY shares increased +25% through the end of October and +60% as of 11/10/24. Given that BKSY is now trading at pre 1-for-8 reverse split-panic levels, the “buy the dip” opportunity for BKSY shares seems to be over for now

Rocket Lab / RKLB (+10%) and Redwire / RDW (+12%) each saw solid gains in October

With neither company announcing material news in the month, I view recent gains as being driven by greater awareness of each company given strong year-to-date returns (RKLB shares have increased +94% through October and RDW shares have increased +170% through October; RKLB in particular has seen its market cap grow from $2B earlier this year to nearly $7B, which makes it easier for large institutional investors to take a meaningful position in the company) as well as a more general “risk-on” attitude from investors as interest rates come down

Anecdotally, I am seeing a TON of retail investor interest on social media around space companies (primarily AST SpaceMobile / ASTS, Intuitive Machines / LUNR, and RKLB) as the market has heated up over the last 6mo

I have been ignoring Momentus / MNTS for months now because the company hasn’t been filing quarterly earnings reports or 10-Qs and I didn’t understand how/why the company hasn’t gone bankrupt yet (and with a market cap of $10M-$20M these days, frankly the company hasn’t been worth discussing); however, MNTS filed its 1Q24 and 2Q24 10-Q filings in October, so I will share what I learned from reading them

To recap for those who haven’t been paying attention to Momentus, things have not been going well for the company since it decided to go public via SPAC: its founder and CEO left the company because of US Department of Defense concerns and the company was hamstrung by NatSec regulatory approvals for years afterwards (link); the company was accused of lying to investors about the maturity of its technology and was fined by the SEC (link); the company suffered anomalies in two missions since going public; and management has paused recent planned missions due to lack of cash and announced layoffs to preserve remaining capital (link). Additionally, the company has been extremely delayed filing its financial statements with the SEC—we have basically been in the dark with what has been going on at Momentus from a financial standpoint for the last year; However, with its 2023 annual filing made in June and its 1Q24 / 2Q24 filings made in October, we now have an updated POV

For background on what Momentus does, go to page 1 and read “The Company” section here (link)

Here is what I think is going on at the company based on recent SEC filings: 1) Momentus has successfully gone into “cockroach mode,” slowing monthly cash burn from ~$5M/mo in 2023 to just $374k/mo in 2Q24; 2) following completion of its National Security Agreement (which satisfied the Department of Defense’s prior NatSec concerns about the company) in January 2024, Momentus is clearly focused on serving the US government (USG) with nearly 100% of revenue ($1.7M in total) through 1H24 coming from USG contracts in 2024; the company has publicly announced contract wins from NASA (for launch services, flight and payload integration services), DARPA (classified defense space work, support of “large-scale space structures”) and the Space Development Agency (HALO program) thus far 2024, though I assume most if not all of these contracts are small-dollar research & development contracts; 3) Momentus has been living hand-to-mouth since 4Q23 when its cash balance hit ~$2M, but it has avoided going bankrupt by: A) raising ~$13M in equity and convertible notes; and B) selling a SpaceX rideshare spot to D-Orbit for $1.2M; I estimate that the company has ~$4M of cash on hand right now based on the timing of these raises

While it may seem like Momentus is showing signs of life, note that the company has been in noncompliance with NASDAQ listing rules for some time now and management is in the process of appealing a potential delisting from the exchange (which would obviously be bad for MNTS shares). Investing in a publicly traded company this small is inherently risky

ViaSat / VSAT was down -20% in October and is now down -68% YTD

I think those of us that follow the space industry and satellite communications understand why VSAT is under pressure these days (Starlink + fixed-wireless access operators are eating its lunch), but I thought it was interesting to see VSAT pop up as a US Presidential election investment play (see screenshot below) in recent days

Taking an even further step back, VSAT has actually been a profitable short investment for the last five years, which aligns with Starlink’s constellation buildout (v1.0 satellite launches began in late 2019)

Comtech / CMTL was down -23% in the month following a major strategic update

On 10/17 CMTL management disclosed that the company was undergoing a strategic review of its assets to potentially sell its terrestrial & wireless networks business to focus purely on satellite and space communications (link)

While the market initially reacted positively to the news with CMTL shares trading +16% the day after the announ q cement, CMTL shares resumed a decline that had begun at the end of September the following day, so it seems like this news wasn’t welcomed warmly by investors. Analysts on the company’s F4Q earnings call on 10/31 seemed skeptical of the current management’s strategic realignment plan since prior management teams at CMTL had attempted to (and didn’t succeed in) selling the company’s terrestrial & wireless networks business in the past