Notes From the Road: What Are Investors and Entrepreneurs Saying?

Key Takeaways from Conversations on My Texas Space Tour

Hello fellow space enthusiasts,

Last week I traveled >2,000 miles from Philadelphia to Texas to see SpaceX’s Starbase with my own eyes.

Along the way, I also stopped in Houston to learn about NASA at the Johnson Space Center, and I visited Austin to meet with space investors and entrepreneurs at SXSW.

In this post I’ve included the top four themes from conversations I had during this trip:

🛰️ Starlink

🏭 Dual-Use Technology

💲 Space SPACs vs Private Companies

🤝 Space SPAC M&A

Key Themes From My Texas Space Tour

Topic #1: SpaceX’s Starlink—What is Missing from the Story?

All roads lead to SpaceX when discussing the future of the space industry. Last week my SpaceX conversations centered on Starlink and what is misunderstood about the constellation’s business plans.

While Starlink is a game-changer for consumers who have the service, Wall Street analysts who cover the US cable industry are generally negative on Starlink, stating:

The constellation’s current capacity can’t support the number of customers needed to generate meaningful free cash flow.

Starlink is superior to legacy satcom service, but it isn’t good enough to compete with fixed cable/fiber broadband. As a result, Starlink will be relegated to serving rural markets that potentially lack a meaningful number of customers that have the financial means to subscribe to Starlink’s $550 deposit + $110/mo service.

SpaceX will require an absurd number of Starship launches (i.e. multiple a week) to create and maintain the full 40k Starlink satellite constellation.

These are valid areas of criticism, but my conversations with investors tended to take the other side of the debate. Pushback from investors included:

Inter-satellites links (ISLs) could be a game-changer: Currently, most Starlink satellites do not use ISLs. As a result, a Starlink user only has access to the capacity of the satellites within view of their terminal, and the constellation is heavily reliant upon ground stations to deliver service to customers. However, once Starlink satellites are capable of using ISLs and the entire constellation can be utilized to satisfy user demand, speeds will go up, latency will go down, and Starlink’s limitations on the number of uses in a geographic area will potentially be alleviated.

The analyses I have seen from Wall Street only contemplate existing satellites which do not have ISLs; therefore these analysts are concluding that the beta service isn’t a technically or financially viable business.

Build once, monetize over and over: Monetization of the Starlink constellation doesn’t have to solely depend on offering a connectivity service. If SpaceX actually creates a constellation of 40k satellites, don’t you think the company would want to take advantage of this enormous scale in every way possible? It doesn’t seem like a stretch to envision Starlink satellites that are also capable of: earth observation, 3rd party payload hosting, or in-space debris removal/satellite maintenance/orbital transfer. These use cases open up an even larger total addressable market for Starlink to monetize its satellites beyond just satellite-delivered connectivity.

Topic #2: Dual-Use Taking the Front Seat

Despite New Space’s promise of growth driven by commercial demand, the present day reality is that the space industry’s primary customers are governments and militaries.

While most space investors do believe that there will meaningful commercial demand in the future, the timeline for that demand materializing and the path between then and now are unknown—especially in the context of inflation + rising interest rates in the near to mid-term.

As a result, investors are beginning to more heavily focus on space companies that can serve governments/militaries, underpinned by the belief that a government contract’s steady funding puts companies that can secure these contracts in the best position to survive potential economic hardship.

We can see this thesis is playing out in real time in the stock market right now. Since 2/23 when the Russia-Ukraine war began, space companies with exposure to government/military demand have outperformed the S&P’s +7% return over this time period:

Aerospace & defense companies such as Lockheed Martin and Northrop Grumman that primarily support US military and intelligence efforts, but also provide space services have seen their stocks return +13% and +15%, respectively, since 2/23.

Pure-play legacy space companies that support the US government, such as Maxar and Viasat, have seen even stronger equity returns (+52% and +19%, respectively).

New Space earth observation SPACs have seen mixed results, though Satellogic and Planet Labs have gotten the most publicity for their support of government intelligence efforts during the Russia-Ukraine conflict and their returns are +50% and +10%, respectively, while Spire Global and BlackSky have not gotten as much publicity and have returned -9% and -25%, respectively.

Topic #3: The Best Space Companies are Private…And They May Stay Private

Investors generally agree that aside from Rocket Lab and Planet Labs, the space SPACs are not top-tier space companies.

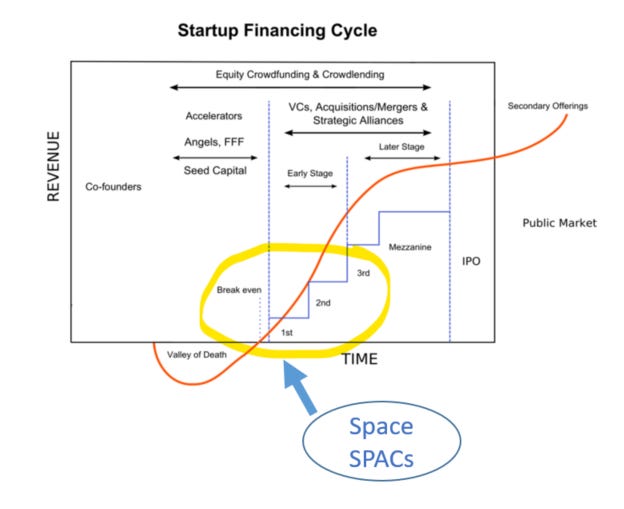

The space SPACs took advantage of last year’s stimulus-funded market euphoria, trading the opportunity to raise hundreds of millions of dollars to fund the next stage of their growth (and allow early investors to exit their investments)…in exchange for going public at an abnormally early stage of their business life cycle.

The result is that these companies are failing / experiencing growing pains in a more public and highly scrutinized manner than they would have if they’d stayed private. Additionally, they are now burdened with daily market value fluctuations and the myopically-focused quarterly earnings cycle that distracts from their big-picture missions.

Most of the space SPACs were clearly just not ready to be evaluated in the public market, but founders jumped at the opportunity to raise large amounts of cash to fund their capital intensive businesses when the money was flowing and abundant—I don’t blame them for doing so!

Additionally, loose SPAC regulations enabled the space SPACs to bypass some of the stages of private investor due diligence that normally weeds out the good startups from the bad startups.

The market clearly does not believe the outlook for the space SPACs is as rosy as they have projected, and their stocks have been punished accordingly—most of the space SPACs are trading solid double-digits below their SPAC deal valuations.

Now if you are private space company, why would you want to go public amidst that backdrop? Market sentiment for publicly comparable peers (i.e. the space SPACs) is hugely negative, and even if you think of yourself as a higher-quality company you’d be fighting an uphill battle vs investor opinions about your sector. Going public now would just make life harder for management, and would potentially damage the company’s market value.

Clearly this is something top private companies have considered. Industry-leader SpaceX has been private for two decades despite extreme investor enthusiasm for the company (it is currently valued at ~$100B), and there are numerous other private space “unicorns” valued >$1B that could have gone public over the last year or two via easy SPAC money, but thus far have chosen not to.

While private capital liquidity may be a little harder to come by in the near-term depending on how inflation and raising interest rates impact macro-economic growth, I believe a tighter private market will moreso affect smaller startups and not the top private space companies that have the luxury of choosing between private capital raises vs going public to raise money.

Considering these factors, along with the idea that investor enthusiasm for space will grow over time as space technology’s prominence in society grows (catalyzed by the advent of an operational Starship, humans returning to the moon, etc), then it seems obvious that top space startups will not be rushing to go public in the near-to-mid term.

Topic #4: Space SPAC M&A…There Is More to Come

There is a general consensus among investors that the space SPACs should drive quite a bit of M&A in the coming years, though conversations note this could come from two different angles:

Space SPACs as M&A Targets: Given that space SPACs have all seen material declines in valuation as of late (trading multiples are down well into the double-digits vs original SPAC deal valuations), these companies could make for interesting M&A targets for a variety of acquirers:

Legacy aerospace & defense companies that would rather acquire new technology vs develop it in-house, and/or are looking to tap into new/higher growth markets.

Big tech companies that have hundreds of billions of dollars of cash on their balance sheet and wouldn’t blink to acquire a space company worth <$2B. Note that companies like Google and Apple already have (or are rumored to have) space-adjacent businesses (Google Maps/Earth and LEO-enabled emergency messaging, respectively).

Private equity groups that would combine a space SPAC with other portfolio companies, either milking the newco for cash or rolling up the new group of companies and spinning them off for a higher valuation at some point in the future (à la AE Industrials and its series of acquisitions that resulted in Redwire).

Space SPACs Acquiring Other Companies: On the other hand, following their SPAC mergers the space SPACs all have a lot of cash burning holes in their pockets.

Companies like Rocket Lab, Planet Labs, and Astra each have upwards of ~$400M of cash on hand and have both demonstrated an appetite for M&A as well as indicated they will continue to utilize strategic acquisitions to drive growth in their businesses—Rocket Lab and Astra have focused on higher-margin space systems and vertical integration, while Planet Labs has focused on strengthening its position within certain industry verticals.

I assume the space SPACs will look to acquire smaller space startups (especially if private capital dries up for smaller private companies, who might then be happy to be acquired by a space SPAC), but if public space company valuations go low enough then peer space SPACs could become targets as well.