In this month’s Space Stock Recap:

📊 March Overview

🖱️ Double-Click on Space SPACs

🤔 Performance Drivers

MARCH PERFORMANCE OVERVIEW

Space SPACs were left in the dust in March, as major indices bounced back following tough January and February market conditions created by uncertainty regarding inflation and rising interest rates; more speculative investments such as the ARK Innovation ETF and space SPACs didn’t follow suit, underperforming the main indices.

Meanwhile legacy space stocks saw positive returns in March, beating the space SPACs for the 3rd consecutive month.

DOUBLE-CLICK ON SPACE SPACs

A closer look at the space SPACs shows that it is hard to broadly describe performance by sub-category this month:

Launcher stock performance had a range of 37%

Earth Observation stocks had a range of 60%

Other satellite SPACs had a 43% range

Manufacturing + infrastructure stock performance varied by 82%

This wide range of returns (and a number of huge single-day moves; see below) suggests that under/over-performance was primarily driven by individual stock catalysts, versus broad industry trends or news.

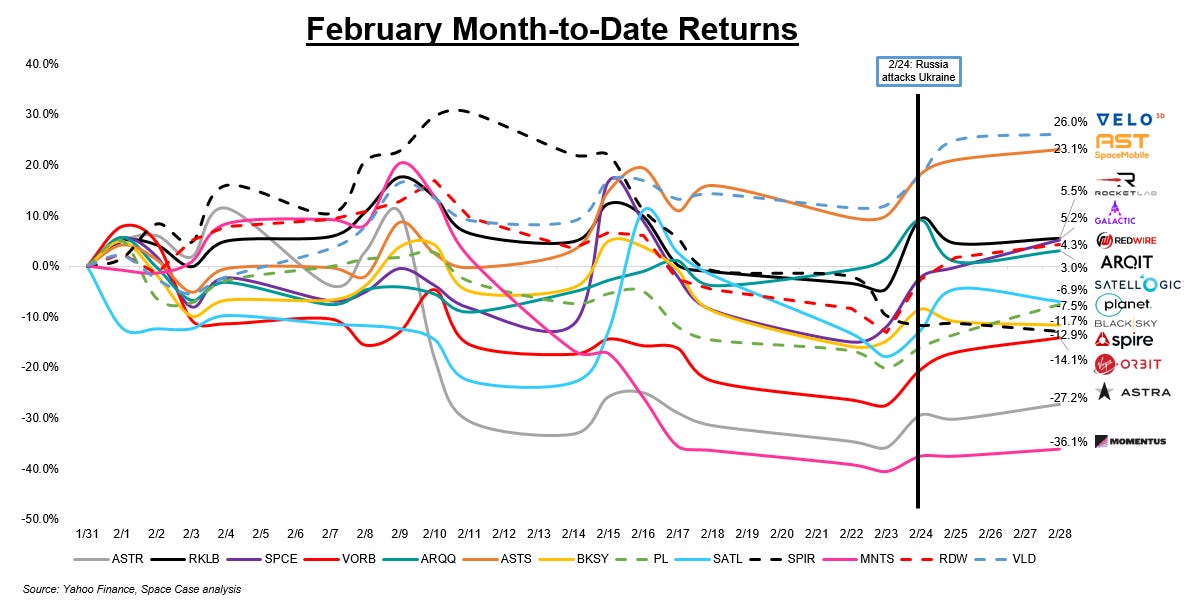

This contrasts with February (chart below) when the space SPACs moved more in unison, particularly following the Russian invasion of Ukraine on 2/24.

SPACE SPAC PERFORMANCE DRIVERS

Let’s discuss catalysts that drove notable returns in March (this will not include commentary on every space SPAC).

Launchers

Astra / $ASTR: +11%

Astra bounced back from a failed launch in February to successfully deploy a customer payload to low earth orbit on 3/15; $ASTR rallied 11% through the end of March following the launch.

Rocket Lab / $RKLB: -16%

Rocket Lab had two negative catalysts in March:

The company’s 4Q21 earnings (technically reported after-hours on 2/28) were not received well by investors (despite a plethora of announcements suggesting the company is firing on all cylinders), as forward-looking guidance implied one fewer launch in the quarter than expected, management suggested that small launcher demand is softer than anticipated, and space systems revenue growth has yet to meaningfully accelerate (ex-M&A).

On 3/24, Rocket Lab lowered 1Q22 revenue guidance due to weather delaying a dedicated launch for BlackSky. While $RKLB shares traded down -8% the next day, this delay was not material—the revenue for that launch was likely just shifted from 1Q22 to 2Q22.

Satellite Constellations

🅰️ST SpaceMobile / $ASTS: +41% (+82% since the end of January)

The big news for AST SpaceMobile in March was the announcement of a multi-launch agreement with SpaceX, covering its next two launches and establishing a framework for future launches. AST’s stock popped +45% the day this was announced!

The readthrough from this announcement is that AST is confident enough in its technology development and readiness that it wanted to establish a long-term agreement.

Specifically, this deal was notable because it confirmed that:

AST’s test satellite, BlueWalker-3, is on-track for a summer 2022 launch (this follows a number of delays).

There is a definite timeline for the launch of AST’s first revenue-generating satellite (with more expected afterwards).

But does this news warrant a +45% single-day move? Probably not. There was speculation that AST was experiencing a short squeeze, which exaggerated reaction to the news (explained here):

1/ Folks we potentially have a short squeeze situation developing $ASTS now up ~40% on today’s non-news @CatSE___ApeX___ @NomadBets and others have been discussing the potential for this for some time now Details below 👇$ASTS +16% pre-market up on this announcement Summer 2022 launch for BW3 is now official + the deal includes multiple launches w/ @SpaceX Still no explicit date for BW3 launch though—remember, summer is from June to Sept Perhaps mgmt will tell us specifics at 4Q21 earnings https://t.co/p2PeWRwzL3

1/ Folks we potentially have a short squeeze situation developing $ASTS now up ~40% on today’s non-news @CatSE___ApeX___ @NomadBets and others have been discussing the potential for this for some time now Details below 👇$ASTS +16% pre-market up on this announcement Summer 2022 launch for BW3 is now official + the deal includes multiple launches w/ @SpaceX Still no explicit date for BW3 launch though—remember, summer is from June to Sept Perhaps mgmt will tell us specifics at 4Q21 earnings https://t.co/p2PeWRwzL3 Space Case (🛰,📈) @spacecasemartin

Space Case (🛰,📈) @spacecasemartin

Satellogic / $SATL: +36%

Satellogic firmly cemented itself as a dual-use company in March, announcing two different agreements related to providing the Ukrainian government earth observation data & analytics—in light of what we know about the market’s proclivity for dual-use space companies right now (discussed in more detail here), Satellogic’s stock move this month makes sense.

Manufacturing & Infrastructure

Terran Orbital / $LLAP: -31%

Terran was a victim of unfortunate, but predictable de-SPACing share price volatility. The stock followed the typical de-SPACing path of a spike upward in price around the time of deal close, followed by a hard crash well below $10 in the days after the stock transitions to its new ticker (in the case of Terran, $TWNT —> $LLAP).

Momentus / $MNTS: +39%

Momentus had two positive catalysts in March. These may seem minor, but for a pre-revenue company with minimal proven technology, this news is enough to move the stock big time.

4Q21 earnings 1) provided reassurance that the company was on-track to be ready for its June mission (1st revenue-generating launch, big test of technology) AND 2) included announcement of a series of future launch agreements with SpaceX (suggesting that both Momentus management and SpaceX are confident in Momentus’ outlook).

On 3/25, the company noted that its orbital vehicle successfully completed thermal vacuum testing, and is nearing the final stages of its pre-launch testing.

Redwire / $RDW: +51%

While Redwire stock saw the biggest move of all the space SPACs this month, there wasn’t any specific company news driving the stock (as far as I’m aware of).

$RDW’s rally coincided with the broader market rally, so perhaps once the market’s sentiment turned positive investors were finally able to take note that the stock’s main overhang the last 3-4 months (an internal accounting investigation that has held up the company from reporting financial results to the SEC) had actually been alleviated in February, and the outlook was improving for the only EBITDA-positive space SPAC.

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or investment recommendations; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of AST SpaceMobile at the time of this post, 4/5.