Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

Space SPACs crushed the market in June, returning +18% vs +6% for the NASDAQ and +3% for the S&P 500; combined with the SPACs’ +9% in May, this marks the group’s 1st two-month streak of positive returns since November/December 2023. Legacy space lagged, with its -2% in June, making the group 50/50 with positive/negative return months in 2024.

More broadly, the market’s returns continue to be driven by a small number of AI-related stocks and analysts note that while indices have seen relatively steady price movement in 2024, underlying single-stock volatility is notably high.

Interestingly we have seen similar trends within space SPAC performance this year, demonstrating extreme volatility and performance being driven by just 2 stocks:

The SPACs were down as much as -23% year-to-date (YTD) in April before swinging to +74% YTD in June

The SPACs +74% YTD returns have been entirely driven by Redwire (+152%) and AST SpaceMobile (+93%); meanwhile 8 of the other 10 SPACs are not only lagging the S&P 500, but are down double-digits on the year

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

2. SPACE STOCK COMMENTARY

Virgin Galactic / SPCE shares declined -51% this month after it began a planned shutdown of commercial operations to focus on developing its next-gen vehicle (the Delta class spacecraft) which the company hopes to debut in 2026.

I believe SPCE’s June decline was clearly attributable to the company’s commercial operations shutdown—its last flight with its current vehicle and the commercial ops shutdown was on 6/8 (a Friday) and the stock began a -53% decline starting on 6/11 (Tuesday) the following week. While this drop continues a steady decline in SPCE shares since its 1st successful commercial flight in summer 2021, I view the latest sell-off as a sign that investors don’t believe SPCE management can pull off its current business plan.

For context—the strategy behind Virgin’s decision to pause commercial operations is that its current spacecraft design has bad unit economics (it generates <$2M of revenue per flight) and isn’t designed for rapid reusability (thus severely limiting the vehicle’s lifetime revenue generation potential); the company is shutting down commercial operations to preserve capital and entirely focus on a next-gen vehicle that can generate more revenue per flight + unlocks a path to profitability via a vehicle design that can withstand >60 flights per year (read here for more information on this situation, link)

While this sounds great in theory, SPCE does not have a strong track record of executing its strategy on time (it took two decades to build a vehicle that would make a total of seven commercial flights) or on budget (it has been burning >$100M/quarter of cash for the last seven quarters). Given that the company has reportedly struggled to raise additional capital (link), it is understandable why the markets are taking a pessimistic view of SPCE’s ability to not run out of money before realizing its strategic goals

Spire Global / SPIR increased +18% last month, with most of the month’s returns coming after the company’s announcement on 6/13 that it has partnered with Thales and European Satellite Services Provider (ESSP) to develop a space-based, real-time air traffic surveillance service (link). In this partnership Spire will build the 100+ satellite constellation that will collect airplane automatic dependent surveillance-broadcast (ADB-S) signals from space + transmit the data back to earth in real-time; the goal is to launch this service in 2027

While the press release threw around some big numbers (100+ satellites just for this use case compares to Spire having built 175 total satellites over its 12yr history), it seems more like a planned new service announcement vs announcement of a new revenue-generating contract. Additionally, given that the service won’t go live until 2027, I am not holding my breath hoping to see new customer contracts related to this partnership any time soon

While there wasn’t mention of this in the press release, last year Spire was awarded a €16M contract from the European Space Agency (ESA) for the EURIALO project (link) to build and test preliminary designs for a space-based aircraft surveillance system—perhaps this new partnership with Thales and ESSP is related to the EURIALO project

While we mostly only have questions and no answers right now, I assume we will learn more about this partnership from SPIR management on the 2Q earnings call—it will be helpful to get clarification around the dynamics of this partnership and how Spire makes money from it; what is the investment required for this project + what could return on investment look like; and who are key potential customers?

Redwire Space / RDW increased +39% last month, with half of that gain coming the day after the company announced that its Roll-Out Solar Array (ROSA) wings were designed-in to Thales Alenia Space’s newest GEO satcom satellites (Space Inspire)

While GEO satellite manufacturing is a dying industry, it seems like Thales already has up to seven orders for its Space Inspire satellite (link). This PR didn’t include enough details to know if Redwire will make solar arrays for all of those seven satellites, but the market clearly liked seeing Redwire align with a key prime satellite manufacturer (the stock traded up +20% the day after this was announced). I hope to get more details on this relationship from the company on the next earnings call

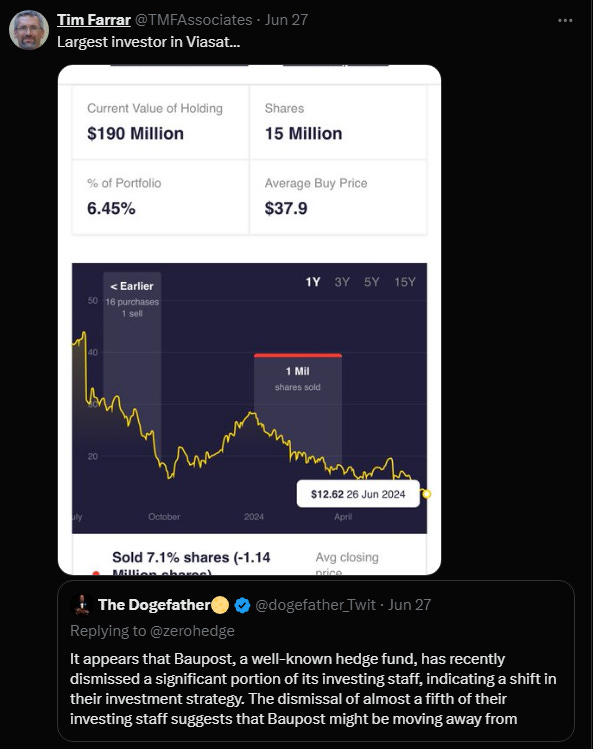

While I am not sure there was any one driver of Viasat / VSAT’s decline last month (other than general angst about ongoing impact to its business from Starlink), I did find it interesting to see that Baupost, one of Viasat’s largest institutional investors, recently let go ~20% of its investment staff—this is something to watch in case their VSAT position is affected by staff turnover.

Comtech / CMTL increased +22% in the month because the company finally announced a long-awaited debt refinancing.

CMTL shares have been under pressure since December 2023 when the company missed guidance on timing of when management said it would refinance $168M of debt due in October 2024; following the miss, investors began to fear the company wouldn’t be able to line up the necessary financing to push out the date of repayment beyond October 2024, and CMTL shares declined -83% between Dec’23 and mid-June’24 (it didn’t help that the CEO was dismissed by the board of directors during this time period)

However, on 6/17, as part of its F3Q earnings release the company announced it had strengthened its balance sheet by acquiring a new $222M credit facility that alleviated the need for a $168M payment in the fall + provided additional debt capital—CMTL shares increase +88% the next day

Given how much these debt woes have weighed on CMTL shares the last six months, I am curious to see if shares will continue to recover to pre-debt crisis levels in the future

Gilat / GILT declined -19% in June following the company’s announcement to acquire Stellar Blu, a satcom terminal manufacturer with a product currently in-market for in-flight connectivity (IFC); the company hopes to make satcom terminals for other mobile use cases (trains, drones, maritime, etc) some day in the future (link).

On one hand, I like the strategy to acquire a company actively in the market producing multi-orbit terminals given the strong satcom trend of end-customers desiring “one terminal to rule them all” that is spectrum and constellation operator agnostic (to avoid lock-in to any one connectivity provider) (see here for context on the multi-orbit trend)

However, investors were clearly not happy with the choice to buy vs build this type of technology—GILT shares are down -15% since this deal was announced—likely because GILT had been attempting to develop the same capabilities in-house, and the price GILT paid for Stellar Blu ($98M base, up to $245M total) is more than GILT’s current enterprise value of $141M (as of 6/30)

At the same time, the expert analysts at Quilty Space suggests that this could be a reasonable acquisition price according to their base + upside case scenarios (link)