Hello fellow space enthusiasts! 🚀

Please ignore that we’re 11 days into August and I’m just now sending you a July overview—delays are expected in space and I promise you there is some juicy info within!

In this month’s Space Stock Recap:

📈 July Market Overview

✍️ Space SPAC Performance and Valuation

🖱️ Double-Click on July Performance Drivers

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, SPIR at the time of this post, 8/10.

JULY MARKET OVERVIEW

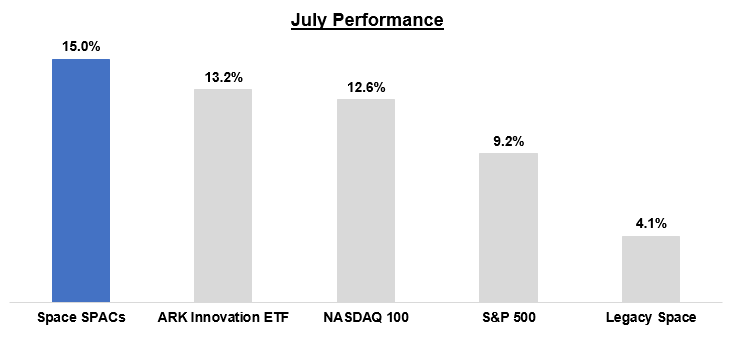

Space SPACs bounced back in July, outperforming broader index, tech, and legacy space benchmarks.

This was the space SPACs’ 1st month of positive returns in 2022 and the 1st month of the year where they beat all the other indices I track; having said that, the space SPACs still lag the other benchmarks year-to-date given that they are down -55% (as of July month-end).

The market’s reversal from June bear market territory (i.e. down -20% or more from prior highs) reflected the combination of several themes that resulted in a rally:

There was so much pessimism and negativity as we exited June and began July that 2Q22 public company earnings reports were good enough to bolster investor confidence, given that Q2 is expected to be the worst quarter of the year.

There was an incremental acceptance of the idea that inflation peaked in July, and the Federal Reserve’s interest rate increases may become less aggressive as a result.

Some investors were concerned that The Fed would raise interest rates +1.00% in July, and were relieved when officials signaled and followed through with a +0.75% increase.

As the market rally began, we saw short covering from some of the more downtrodden areas of the market (crypto-exposed, SPACs, pre-revenue growth stocks, etc) as investors looked to close out their positions and re-assess the macro environment.

Personally I am not convinced that we are out of the woods yet, and believe we are experiencing a bear market rally. Of course I wish I had bought more of the names on my watchlist at the depths of the late June/early July market (I did begin a position in SPIR and PL), but I anticipate the stock market will continue to be volatile this year and there will be more buying opportunities down the road.

Perhaps I would have been more prepared if I had already created the framework for “being greedy when others are fearful” that I shared last week 😉 (see below).

SPACE SPAC PERFORMANCE AND VALUATION

Stock Performance Commentary

Launchers and Earth Observation (EO) SPACs, up +18% and +15% respectively, saw all of their constituents experience positive returns in July.

Performance within each subsector was varied however, with Rocket Lab, Virgin Galactic, Spire Global, and Planet Labs leading the pack with >20% returns, while Astra, Virgin Orbit, BlackSky, and Satellogic saw more modest returns.

Meanwhile Other Satellites and Manufacturing / Infrastructure SPACs were mixed.

Velo3D stood out as its shares experienced the largest single-month growth in shares of any of the space SPACs in 2022.

Valuation Commentary

It is hard to separate the signal from the noise when looking at changes in valuation from June to July, given that much of July’s performance (and subsequently low valuations) can be attributed to macro factors that resulted in 52-week low share prices for almost all of the space SPACs.

However, given that the market has continued to rally in early August, by taking a sneak peek at August month-to-date valuations (through 8/10) we can see that a handful of companies have returned to/exceeded May valuation levels: Rocket Lab, Planet Labs, Spire Global, and Velo3D.

Could this be an indication of investor favorites in Launch, EO, and Manufacturing/Infrastructure? I would say TBD—I think we will see more meaningful share price movement after these companies report 2Q earnings in the coming weeks after we will hear management team outlooks for the remainder of 2022 and into 2023.

DOUBLE-CLICK ON JULY PERFORMANCE DRIVERS

While most of this month’s across-the-board negative performance can be explained by macro factors, it is still useful to examine material news from each company during July.

Launchers

Astra Space / ASTR: +10%

We heard no news from Astra in July—management was completely silent following its unsuccessful TROPICS mission on 6/12 until early August when the company announced a $100M equity purchase agreement with B. Riley.

Rocket Lab / RKLB: +23%

On 7/6, Rocket Lab introduced a Responsive Space Program “designed to on-ramp commercial and government satellite operators to the Company’s 24/7 rapid call-up launch capability and streamlined satellite build and operation options.”

Given that Rocket Lab management has lamented that it would launch at a more rapid cadence if not for lack of customer readiness, I am not surprised to see this announcement—the more you launch, the better your margins are!

On 7/13, Rocket Lab launched the 1st of 2 planned missions for the National Reconnaissance Office—the 2nd being delayed until August due to last-minute customer preparations

On 7/27, Rocket Lab announced that it would provide solar panels for 3 Next Gen OPIR GEO satellites for the United States Space Force (i.e. missile warning system satellites).

While this deal may be small, Rocket Lab shareholders should do one “hail Peter Beck” every time the company secures another Space Systems (non-launch) contract—following the company’s various acquisitions to bolster its satellite manufacturing business, Rocket Lab needs to demonstrate to shareholders that the combination of SolAero, PSC, and ASI can create revenue synergies.

Virgin Galactic / SPCE: +24%

July was actually a big month for Virgin Galactic’s long-term business prospects:

On 7/6, the company announced that it had selected a Boeing subsidiary (Aurora) to build two next-gen motherships for SPCE. The new motherships are expected to enter service in 2025, the same year SPCE’s Delta-class spacecraft is planned to make its debut.

On 7/14, Virgin Galactic announced the location for a new 151k sq. ft. manufacturing facility—Mesa, AZ—with the facility adjacent to the Phoenix-Mesa Airport. The building is already under construction and is expected to be fully operational by 3Q23, at which point it will be capable of producing up to 6 Delta-class ships/year.

SEC filings indicate that the lease for the building is a 10yr + 5mo lease, with rent starting in year 1 at $2.5M.

On 7/21 (yours truly’s birthday🎂), the company noted that it was partnering with Virtuoso for a ticket referral program.

Virtuoso is a company specializing in luxury and experiential travel and via this partnership SPCE has access to the company’s network of travel advisors in North and Latin America, the Caribbean, Europe, Asia-Pacific, Africa and the Middle East.

Given that SPCE’s ticket sales have continued to decelerate since re-opening in 3Q21 and sales are now for flights well into 2025/26, SPCE getting outside help to expand its distribution capabilities makes sense. Notably, these sales will be lower margin for SPCE however, since they are still being sold at the standard price of $450k.

Virgin Orbit / VORB: +7%

The biggest news for VORB in July was its successful ‘Straight Up’ mission on 7/2—its 4th consecutive successful mission—where it delivered seven satellites to orbit for the United States Space Force after launching from the Mojave Air and Space Port in California.

VORB stock was +6% the day after this launch vs +0% for the S&P 500

VORB is slowly establishing a solid reputation for consistency and flexibility—its next test will be its 1st international launch from Cornwall in the UK later this year.

Earth Observation

BlackSky / BKSY: +3%

BlackSky notched a new contract win + a distribution partnership deal in July:

The former was a $4.4M contract from the Intelligence Advanced Research Projects Activity (IARPA) to provide advanced artificial intelligence for space-based dynamic monitoring, expanding upon BlackSky’s core Spectra AI platform capabilities.

The latter was a deal with Esri—a leader in geographic information system (GIS), location intelligence, and mapping—to provide Esri’s customer base access to BlackSky’s tasking service via Esri’s ArcGIS Online platform.

I am not as familiar with Esri as some of you readers, but to me this seems like a deal that could help BlackSky further penetrate the US commercial market—notable, since to-date most of BlackSky’s business has been serving government customers.

Planet Labs / PL: +23%

July was a productive month for Planet with 3 new contract announcements across Civil government (NOAA + German Federal Agencies) and agriculture (Organic Valley…and the German Federal Agencies announcement included reference to agriculture as well)

There are 2 clear sources of demand for @planet’s prods/services based on recent wins: gov + agriculture $PL Recent Contracts - NOAA (civil) - Organic Valley (agriculture) - German federal agencies (civil) - Bayer (agriculture) - NRO (military+intelligence) - Leaf (agriculture)Excited to share that @NOAA is leveraging both our PlanetScope and SkySat products to monitor oil spills, identify plastic debris, and track humpback whales!🐳Read how our satellites helped them combat the longest running oil spill in U.S. history: https://t.co/sKzoc9fzq4 https://t.co/BmA86emElE

There are 2 clear sources of demand for @planet’s prods/services based on recent wins: gov + agriculture $PL Recent Contracts - NOAA (civil) - Organic Valley (agriculture) - German federal agencies (civil) - Bayer (agriculture) - NRO (military+intelligence) - Leaf (agriculture)Excited to share that @NOAA is leveraging both our PlanetScope and SkySat products to monitor oil spills, identify plastic debris, and track humpback whales!🐳Read how our satellites helped them combat the longest running oil spill in U.S. history: https://t.co/sKzoc9fzq4 https://t.co/BmA86emElE Planet @planet

Planet @planet

Satellogic / SATL: +2%

N/A - I am beginning to think that Satellogic’s status as a “foreign private issuer” is enabling them to get away with less disclosure than other US-based space SPACs.

I’ve reached out to their IR team for clarification, but have yet to hear back from them—not surprising given that the company is still using a 3rd party group for their IR functions and has not yet hired an in-house rep.

Spire Global / SPIR: +29%

Weather was a big theme for Spire’s business development in July, with a $1.7M contract award from NOAA for weather-related data + announcement that Spire is developing a new generation of satellites carrying microwave sounders to gather atmospheric moisture and temperature measurements, which will further enhance the value and accuracy of Spire’s global weather forecasts when combined with the company’s existing weather data collection capabilities.

Other Satellite Constellations

Arqit Quantum / ARQQ: -14%

N/A

AST SpaceMobile / ASTS: +12%

AST had a number of announcements on both the financial side and the technology side of its business:

On the financial side, the company 1) announced the sale of its stake in NanoAvionics—a Lithuanian smallsat manufacturer—for a net $28M cash proceeds:

Using 2021 revenue, this deal values @NanoAvionics at 5.4x NanoAvionics grew revenue >100% y/y in 2021, so that seems fair $ASTS can’t cut cash burn rate, so asset divestiture for additional cash it is—the new CFO came in and this was likely one of his first orders of businessThis morning, @KOGDefence, a Norwegian tech company, announced it has entered into an agreement to acquire a majority stake in @NanoAvionics. The deal values the Lithuanian smallsat manufacturer at €65M ($67M). https://t.co/E9Iinaylpu

Using 2021 revenue, this deal values @NanoAvionics at 5.4x NanoAvionics grew revenue >100% y/y in 2021, so that seems fair $ASTS can’t cut cash burn rate, so asset divestiture for additional cash it is—the new CFO came in and this was likely one of his first orders of businessThis morning, @KOGDefence, a Norwegian tech company, announced it has entered into an agreement to acquire a majority stake in @NanoAvionics. The deal values the Lithuanian smallsat manufacturer at €65M ($67M). https://t.co/E9Iinaylpu Payload 🚀 @payloadspace

Payload 🚀 @payloadspaceAnd 2) the company pre-reported its 2Q22 earnings, with the most notable figure being that AST now has $202M in cash (+$28M in proceeds from the NanoAvionics sale + $75M in their back pocket from an equity purchase agreement with B. Riley).

AST was under no obligation to release results early, so I assume this move was done to provide assurance of the company’s financial standing (aka cash) and allow analysts to digest this news so that the company can discuss something else of note on the earnings call—prepare yourself for what could be announced in the official 2Q22 earnings release!

On the technology side of its business, the 🅰️-Gang got hot and bothered when AST announced that the company’s BW3 test satellite had left Midland, TX for the first leg of its journey to Cape Canaveral, FL—though admittedly, this first step actually went the wrong direction and took the satellite West to Cali for final pre-launch testing.

Manufacturing & Infrastructure

Terran Orbital / LLAP: -7%

The majority of Terran’s news this quarter was related to successful performance of satellites/payloads it manufactured (CAPSTONE, Pathfinder 3, CENTAURI-5).

However, the company also hired a SVP of Corporate Development (who will also function as head of investor relations)—this guy was previously an analyst and portfolio manager at Fidelity (one of the biggest/best investing groups out there) so he will hopefully be a good influence for Terran’s Wall Street presence.

Momentus / MNTS: -19%

N/A

Redwire / RDW: +9%

Redwire’s biggest news in July was announcement that it would be partnering with Eli Lilly to develop a new in-space manufacturing technology for growing small-batch crystals of protein-based pharmaceuticals to enable pharmaceutical companies and researchers to develop new therapies to improve human health and quality of life on Earth.

Specifically, Lilly’s investigations will focus on the development of treatments for diabetes and cardiovascular disease.

Velo3D / VLD: +133%

On July 12, VLD announced that Pratt & Whitney—a Raytheon business—had acquired a VLD printer to manufacturing jet engine components in-house. This was notable because previously Pratt & Whitney utilized VLD’s printers for work, but via a 3rd party—a direct relationship with the company enables the opportunity for an expanded relationship in the future.

On July 21, VLD announced that it was partnering with the Hartech Group—an equipment supplier for the federal government—to distribute VLD’s technology to government agencies, including the DoD.

Honestly I am not 100% sure these two announcements justified the company’s +133% July share price appreciation, but the company had been trading at depressed levels in the depths of June (<1x 2022 revenue) and it has since returned to valuation levels more typically associated with manufacturing & infrastructure space SPACs (in July, median of 5.7x vs VLD’s 4.7x).