Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 July Market Overview

✍️ Space Stock Performance + Valuation

Dissecting Rocket Lab's Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (8/15/23).

1. MARKET COMMENTARY

Public Markets

While July marked the fifth consecutive month where both the S&P 500 and NASDAQ indices saw positive returns, it was growth stocks that took home first place with +14% returns for both the ARK Innovation ETF and space SPACs.

Similar to June, July’s overall solid stock market performance was driven by the increasingly likely “soft landing” scenario where inflation cools while the U.S. economy continues growing (see table below). Big Tech’s “magnificent seven” (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA) continued to outperform driven by their allure of profitability and a frenzy around developments in artificial intelligence (though during 2Q earnings calls, Big Tech management teams reminded analysts and investors that AI is still more of a cost than a driver of revenue in the near-term). Growth stocks have surged since April driven by renewed interest in more speculative stocks, with ARKK and the space SPACs now up over 60% and roughly 40% YTD, respectively.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends.

2. SPACE STOCK PERFORMANCE + VALUATION

RKLB is up nearly 100% year-to-date in 2023. If I had to explain why in the simplest terms possible, I’d say “because Rocket Lab is the closest thing to SpaceX that public market investors can own.” While Rocket Lab is very different from SpaceX, this isn’t a completely misguided thought process:

Rocket Lab and SpaceX are vertically-integrated companies unlocking a low-price transportation layer (i.e. launch) for the space industry, which is expected to grow at an above-GDP rates for the foreseeable future.

Rocket Lab is the only US launch provider not named SpaceX that has steadily executed upon scaling a launch business. While its Electron rocket is in the micro-launch category, in the current launch market that is supply constrained being a reliable alternative to SpaceX can’t be understated. The company has pricing power as competition has slowly dropped out of the market (RIP VORB + the future for ASTR doesn’t look very bright).

Management even highlighted plans to continue raising Electron launch pricing in 2024 (link).

While Rocket Labs’s launch business doesn’t yet have strong gross margins, it is taking measures to improve profitability. In the near-term, the company is doing so by reusing 1st stage boosters, but more importantly, it is increasing launch cadence of its Electron rocket + developing the medium-launch Neutron rocket, which should provide better margins longer-term via reusability and will expand the company’s total addressable market for launch customers. SpaceX went through a similar process (albeit more quickly than Rocket Lab), moving from the Falcon 1 to the Falcon 9, and then developing reusability of its 1st stage.

Additionally, just like SpaceX, Rocket Lab has diversified its business away from purely being a launcher; however, unlike SpaceX, Rocket Lab has focused on space-for-space applications (i.e. its spacecraft and component manufacturing business serves other space customers) which is a moderately sized market (Rocket Lab estimates it has a $380B TAM), while SpaceX has focused on space-for-earth applications (i.e. Starlink serves broadband connectivity to people on earth) which is a massive market (the global telecom industry is a $1T-2T market).

Having said all that, investors looks at SpaceX’s $150B valuation and clearly like what Rocket Lab is cooking up in comparison. Proof of this favorable investor sentiment is evidenced the fact that Rocket Lab has traded at a premium vs SPAC peers, both since the time of its SPAC deal announcement and in the present day:

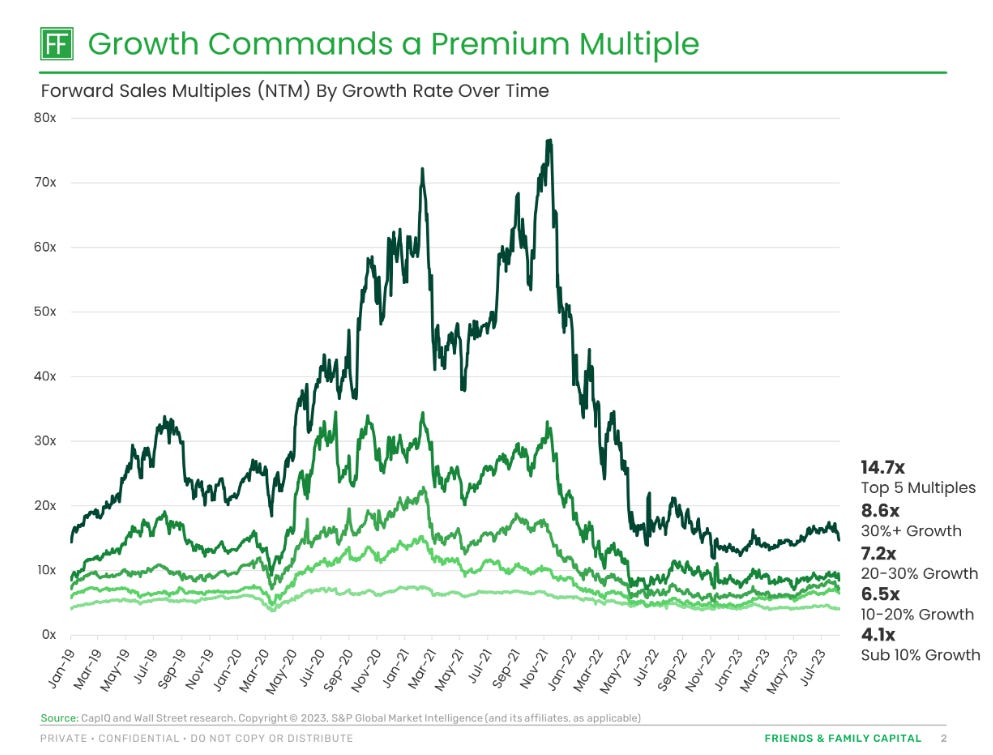

RKLB’s 10.8x 2023E multiple is technically a discount to its 17.8x SPAC deal valuation, but a 10.8x revenue multiple is still very rich based on the multiple analysis done by Friends & Family Capital, showing revenue multiples over time by anticipated revenue growth (link to chart below; to subscribe to the F&F research newsletter, link).

However, sell-side analysts are forecasting RKLB to grow revenue at nearly a 50% annual growth rate from 2022-2027, demonstrating that analysts have great expectations for RKLB’s commercialization over the next five years.

Another way to look at Rocket Lab’s valuation is to evaluate its Launch business and its Space Systems business separately via a Sum-of-The-Parts (SOTP) valuation.

Estimate Space Systems Revenue: Using consensus 2023 revenue estimates and average Electron launch pricing + anticipated launch volume (both figures provided by Rocket Lab management), we can see that consensus is forecasting $184M of Space Systems revenue in 2023.

Pick a Revenue Multiple for the Space Systems Business

Option 1 is to use the current average “space manufacturing” revenue multiple that Terran Orbital and Redwire Space trade at—1.3x 2023E revenue. However, that reflects negative market sentiment…and people are clearly excited about Rocket Lab! 1.3x seems too punitive, so I don’t love this option.

Option 2 is to use deal valuations for satellite bus manufacturers: Terran Orbital’s SPAC deal multiple (it was priced during the SPAC-mania of 2022) + the estimated 2023E revenue multiple for York Space Systems’ deal where AE Industrials acquired a 51% stake in the company ($1.125B valuation from 2022; I estimate York could generate as much as ~$200M in revenue in 2023 via its SDA contracts)

Both companies traded at 5.6x 2023E revenue in these scenarios. This seems like a better option given that acquisition of LEO megaconstellation manufacturing contracts (which both companies have), while low-margin, can be viewed as annuities providing revenue into perpetuity—and investors love steady, predictable revenue streams.

Calculate the Value of Rocket Lab’s Space Systems + Launch Businesses: By applying the two different revenue multiples to RKLB’s Space Systems business and backing out an implied Launch business valuation, we can estimate that Rocket Lab’s launch business is valued between $3.0B to $2.2B, or 26x to 19x 2023E launch revenue. To put that in context, generating that much revenue via its Neutron rocket (@ $55M/launch) would require Rocket Lab to scale Neutron between 39 to 54 launches per year.

It is worth noting that it took SpaceX 12 years from its 1st Falcon 9 launch in 2010 to reach at least 39 launches in a year (surpassing the figure in 2022 with 61 launches vs 31 launches in 2021).

Regardless of valuation method used for analysis, it is clear that investors are heavily betting on the future successful development + scaling of Neutron. This dependence on launch to drive valuation is in contrast to SpaceX’s $150B valuation, which is predominantly based on the success of its Starlink business case.

The biggest news for legacy space in July was ViaSat’s -25% decline driven the company’s failed ViaSat-3 America’s satellite deployement, disclosed on 7/12 (link for the full story/context).

This timing couldn’t have been worse for ViaSat, which had just closed its multi-billion dollar acquisition of Inmarsat in early June, and had been banking on this latest satellite to boost revenue generation capabilities. Now the company is faced with how to re-group after this failure, with the immediate impact only partially offset by a potential $420M insurance claim (~60% of the satellite’s $750M cost; link), which doesn’t account for the revenue that satellite would have generated for a decade-plus.

The company plans to provide more details regarding “corrective actions” on next quarter’s earnings call.

Thanks for the deep dive on RKLB. They remain my favourite space SPAC, and continue to execute. Getting the Virgin facilities at such a discount during the bankruptcy firesale will also help accelerate Neutron development. RKLB continue to execute and I find their presentations very professional

Thanks for the excellent analysis!

A comment on "To put that in context, generating that much revenue via its Neutron rocket (@ $55M/launch) would require Rocket Lab to scale Neutron between 39 to 54 launches per year." Is it a bit odd to compare revenue with enterprise value (EV) because achieving that EV you don't need an equal amount of sales? Although I guess you want to provide a comparison here only.

Nonetheless, I just did a very quick search: In May 2019, SpaceX is valued at $33 billion, with 2018 launch revenue at $2 billion (CNBC). It has sent the first batch of Starlink to orbit in the same month, so let's assume the valuation has some but not a lot of impact on the valuation.

This should give them a similar P/S ratio? But of course, there are many other factors not being constant so we can never compare directly.