January 2025 Space Stock Review

Includes Commentary on BKSY, PL, SPIR, RDW, SATS, GSAT, MDA, CMTL

Hello fellow space enthusiasts! 🚀

In this month’s Space Stock Review:

📈 Market Overview

✍️ Space Stock Performance + Valuation

Earth Observation Valuation Re-Rating

Redwire Acquires Edge Autonomy

EchoStar Future Optionality

Globalstar and MDA’s Silly Selloff

Comtech Woes Continue

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s personal opinions only. Please do your own research before investing.

1. MARKET COMMENTARY

Public Markets

The space SPACs led the way yet again in January, though nearly every asset class from stocks, to gold, crypto, government bonds, and real estate notched gains last month despite uncertainty from escalating trade disputes, an uncertain path for interest rates, and concern around impact to AI infrastructure demand following the DeepSeek AI shock.

This is seemingly a continuation of the trend we saw post-US election in late 2024 where President Trump’s win triggered a broad market rally driven by positive investor sentiment around anticipated tax cuts and deregulation. Space stocks have disproportionately benefited from this rally given the general point of view that T2 (President Trump’s 2nd admin) loves space and Elon Musk’s growing relationship with President Trump could benefit the US commercial space industry; and space SPACs have disproportionately benefitted from improved sentiment around space stocks as they were trading at (somewhat) subdued valuations prior to the election.

Space SPAC 4Q24 earnings (likely released at the end of February/beginning of March) will be key to SPAC momentum continuing, so keep an eye out for releases from the Cosmic 4 leaders like Rocket Lab, AST SpaceMobile, Intuitive Machines, and Redwire.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends:

Starlink 2024 Annual Report (enter your email at bottom of page to view)

Global startup investments rebound while number of deals fall

The pervasive, head-scratching, risk-exploding problem with venture capital

2. SPACE STOCK COMMENTARY

A Quick Note from Space Case:

Hey everyone, quick housekeeping item - we are adding Eutelsat / ETL.PA, SES / SESG.PA, and Telesat / TSAT to our space coverage this year.

Satellite communications (satcom) is a critical segment of the space industry and I want to cover these companies to force myself to do a better job staying on top of their activity, particularly in the context of legacy GEO companies struggling to figure out how to compete in light of Starlink’s dominance of the global satcom market.

We considered adding other smaller space companies to our coverage, but companies like Mynaric / MYNA, Satixfy / SATX, and Imagesat International / ISI don’t report quarterly results and/or host calls with analysts, so I passed on covering them in 2025.

Earth observation (EO) stocks (BlackSky / BKSY, Planet Labs / PL, Satellogic / SATL, and Spire Global / SPIR) crushed it yet again in January, with the group returning +40% last month. This outperformance continues a trend that began post-election, with the four EO stocks up an average of +143% since the election through the end of January compared to +118% for average for all space SPACs and +4.4% for the S&P 500

While all space SPACs have benefitted from the Trump Bump given anticipated greater US federal government spending on commercial space services, I view the EO SPAC outperformance as benefitting from a valuation re-rating to align with SaaS (software as a service) company valuation ranges

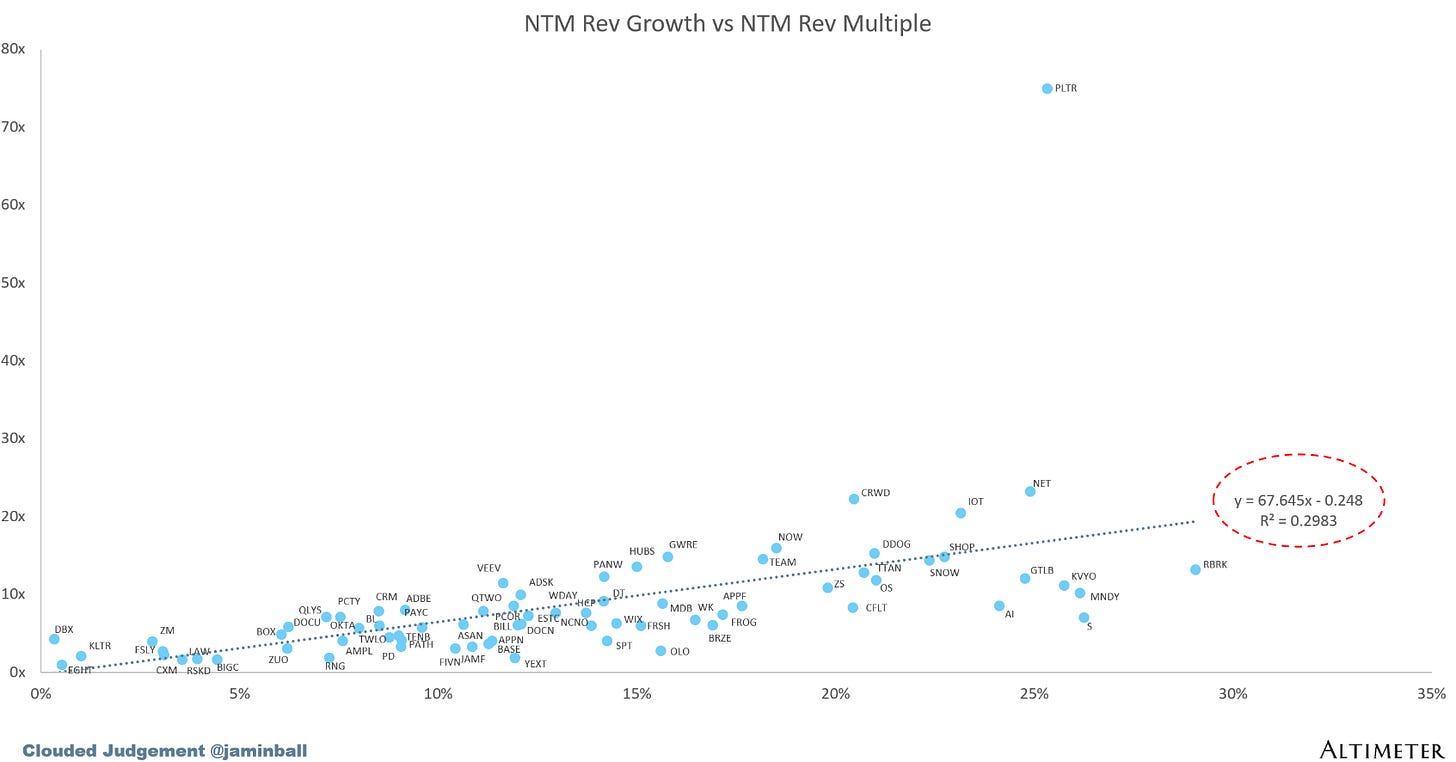

When the EO SPACs went public they all made the argument that their valuations should be compared against SaaS companies given somewhat similar business profiles (see image above for select slides from PL, BKSY, SATL, and SPIR’s original SPAC deal presentations); the primary similarity between SaaS business models and EO business models is that both groups generate the majority of revenue from high-margin, multi-year agreements. SaaS businesses generally trade on a premium revenue multiple (the long-term pre-COVID next-12mo (NTM) revenue multiple for SaaS businesses was 7.8x, per Altimeter’s Jamin Ball) so it is understandable why the emerging EO category wanted to be compared against them, because then they too might be valued with premium multiples

However, when interest rates began to rise in 2022, the EO SPACs were thrown in the trash and valued like all other unprofitable technology companies (remember that interest rates disproportionately hurt unprofitable companies, link), and they traded at 1-3x revenue between 2022-24 (see above)

Fast-forward to the modern day, and the EO SPACs are getting a second chance, with investors looking into space stocks and finding that these companies have better fundamentals than in 2022 (i.e. near or at profit and cash breakeven) and the earth observation market is likely to continue growing for the foreseeable future as governments across the world increasingly rely on commercial EO companies for intelligence, surveillance, and reconnaissance data, analytics, insights, and systems

In fact, if we compare BKSY, PL, and SPIR vs current SaaS company valuations and NTM revenue growth expectations (see above from Jamin Ball’s “Clouded Judgement” newsletter, link) there is meaningful valuation upside for BKSY and SPIR, while PL seems to be fairly valued. However, note that this is a fairly narrow POV of company valuation (only looking at NTM revenue growth) and doesn’t mean the EO SPACs should be valued exactly the same as SaaS companies

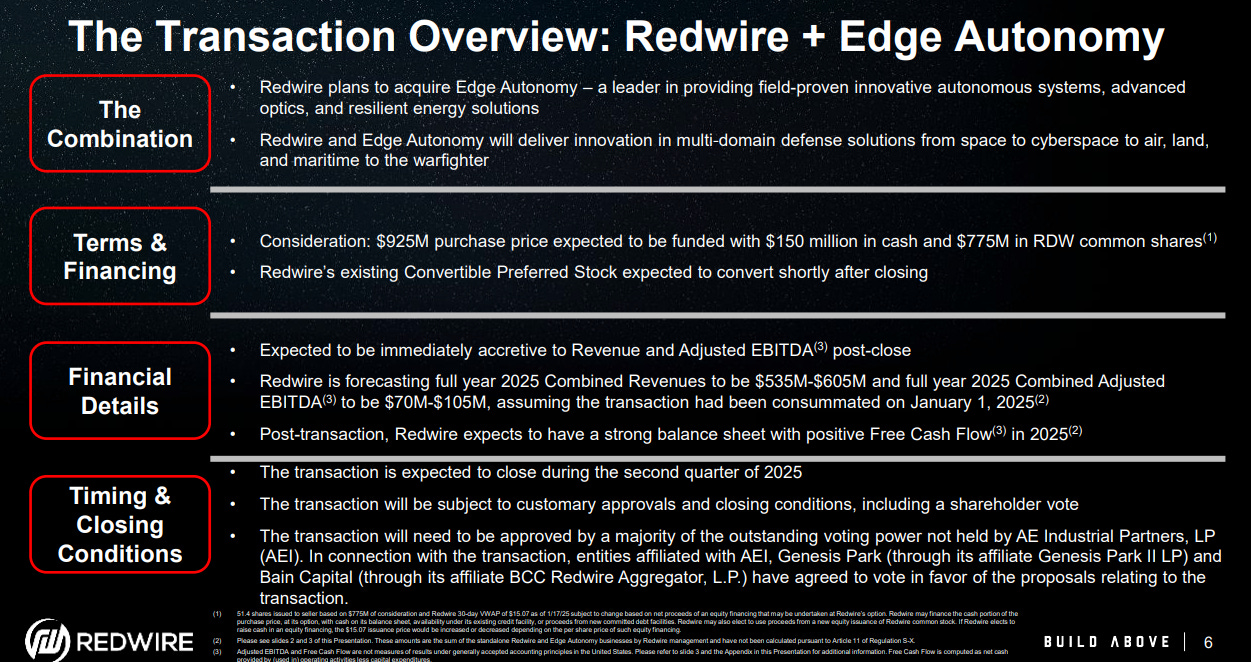

Redwire Space / RDW saw +45% share price movement in January after the company announced plans to acquire Edge Autonomy (press release, slide deck, call transcript) on 1/20

At first glance, it seems like Redwire didn’t overpay to acquire Edge Autonomy (a profitable uncrewed airborne systems (UAS) technology company), in a transformative transaction that changes Redwire’s strategic positioning from a space infrastructure pure play to a multi-domain defense contractor

However, upon closer inspection a key detail of this transaction is that AE Industrials, a leading aerospace private investment firm, has material ownership in both companies; it created Redwire Space via combination of nine different smaller space hardware companies between 2020 and 2024 and took the company public via SPAC in Sept’21, and it acquired Edge Autonomy (then called UAV Factory) in Jan’21 (link)

With this context, the attractive price that Redwire paid for Edge Autonomy ($925M, or 4.2x trailing 12mo revenue and 12.8x trailing 12mo EBITDA) makes sense since it is really AEI combining two of its own assets. A recent comparable transaction (Aerovironment’s acquisition of Blue Halo, link to PR and slides) was done at 4.7x trailing 12mo revenue and 24x EBITDA, which suggests Redwire was able to “acquire” Edge Autonomy for something like a 50% discount

Given enthusiasm for defense investing right now, this deal was well-received by the markets, with RDW increasing +51% the day after the deal was announced

EchoStar / SATS saw +21% share price movement in January

Given that the company’s core underlying fundamentals are mostly declining, I assume SATS’ recent appreciation (the stock is +130% since DISH Networks and EchoStar merged in January 2024) is reflective of investor optimism surrounding the company’s future optionality tied to some combination of the company’s unique 5G network architecture, its stated desire to pursue direct-to-device (D2D) satcom connectivity, or its rich spectrum assets (which the company values at $39B on its balance sheet and analysts have valued even higher in a spectrum sale scenario)

Globalstar / GSAT and MDA Space / MDA both suffered declines in January (-26% and -22%, respectively) thanks to Apple / AAPL and Starlink

On 1/28, news broke that AAPL has been working with Starlink and T-Mobile / TMUS to add support for the Starlink network in its latest iPhone software, providing an alternative to the company’s in-house satellite-communication service that it has developed in partnership with GSAT

The following day, both GSAT and MDA saw material share declines (-18% and -9%, respectively) which continued through the end of January. I believe these movements were driven by investors assuming that AAPL’s work with Starlink means Apple is abandoning its partnership with Globalstar (and therefore MDA, since that is who is leading the buildout of Globalstar’s constellation)

I think this reaction was foolish—it doesn’t make sense for Apple to literally just in 4Q24 commit to investing up to $1.7B in Globalstar to deepen the partnership between the two companies, and then turn around and abandon GSAT in January 2025. I’m sure the Apple / Starlink testing was happening when GSAT and AAPL made their deal last year, so this feels like an overreaction to me

For such a small company that isn’t a SPAC, I sure do write about Comtech / CMTL a lot, and this month is no different because in January CMTL declined -50% after a challenging fiscal 1Q25 earnings report

CMTL’s bad performance in January was driven by the company’s fiscal 1Q earnings released on 1/13, where the company announced an abrupt change at CEO (the prior CEO had just transitioned from interim CEO to permanent CEO on October 30th), 1Q results missed vs guidance (despite issuing the guidance at nearly the end of 1Q on the 4Q call), and the company noted that it expected to be in violation of debt covenants beginning in February 2025

After the call, analysts revised their revenue and EBITDA estimates for fiscal year 2025 down -10% and down -58% (respectively) and I believe this material reduction in the company’s financial outlook is the driver of CMTL’s adverse stock movement in January

Gilat look like is trying to recovery this year...