August 2023 Space Stock Review

LEO Satcom Valuation Being Driven by Direct-to-Device Monetization

Hello fellow space enthusiasts! 🚀🛰️

In this month’s Space Stock Review:

📈 August Market Overview

✍️ Space Stock Performance + Valuation

Disclosure/Disclaimer: Case Closed should not be interpreted as investment advice or an investment recommendation; posts represent Case’s opinions only. Please do your own research before investing. Case owns shares of ASTS, PL, and SPIR at the time of this post (9/14/23).

1. MARKET COMMENTARY

Public Markets

Both space and non-space stocks suffered in August, as is typical for late summer; August is usually the 3rd worst month of the year for stocks (link). This is partially attributable to lower trading volumes due to traders/investors being on vacation leading to price volatility (one potential reason for the already lightly-traded SPACs to see such a sharp downswing in the month) and investors looking to close positions and take profits before September, which is historically the worst month for stocks (link).

From a fundamental perspective, market weakness could also have been driven by renewed concerns that the Federal Reserve might raise interest rates again as the release of minutes from the central bank’s July meeting (link) suggested that the Fed believes a resilient US economy will result in sticky inflation. It didn’t help that July Consumer Price Index (CPI) data (released 8/10) showed trailing twelve month inflation increased in July vs June, going to 3.2% from 3.0% (respectively), and August inflation (released in September) accelerated further to 3.7%.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.”

- Federal Open Market Committee, July Meeting Summary

As I’ve explained before, rates being higher for longer will more adversely impact growth stocks vs non-growth stocks, adding another potential reason why space SPAC performance was so much worse in August vs the other indices.

Private Markets

I won’t go into as much private market detail here, but check out these resources for a more comprehensive overview of private market trends.

Series A Valuation Trends (Carta)

Series A Price Correction Halts Seed-Valuation Ascent (Pitchbook)

2. SPACE STOCK PERFORMANCE + VALUATION

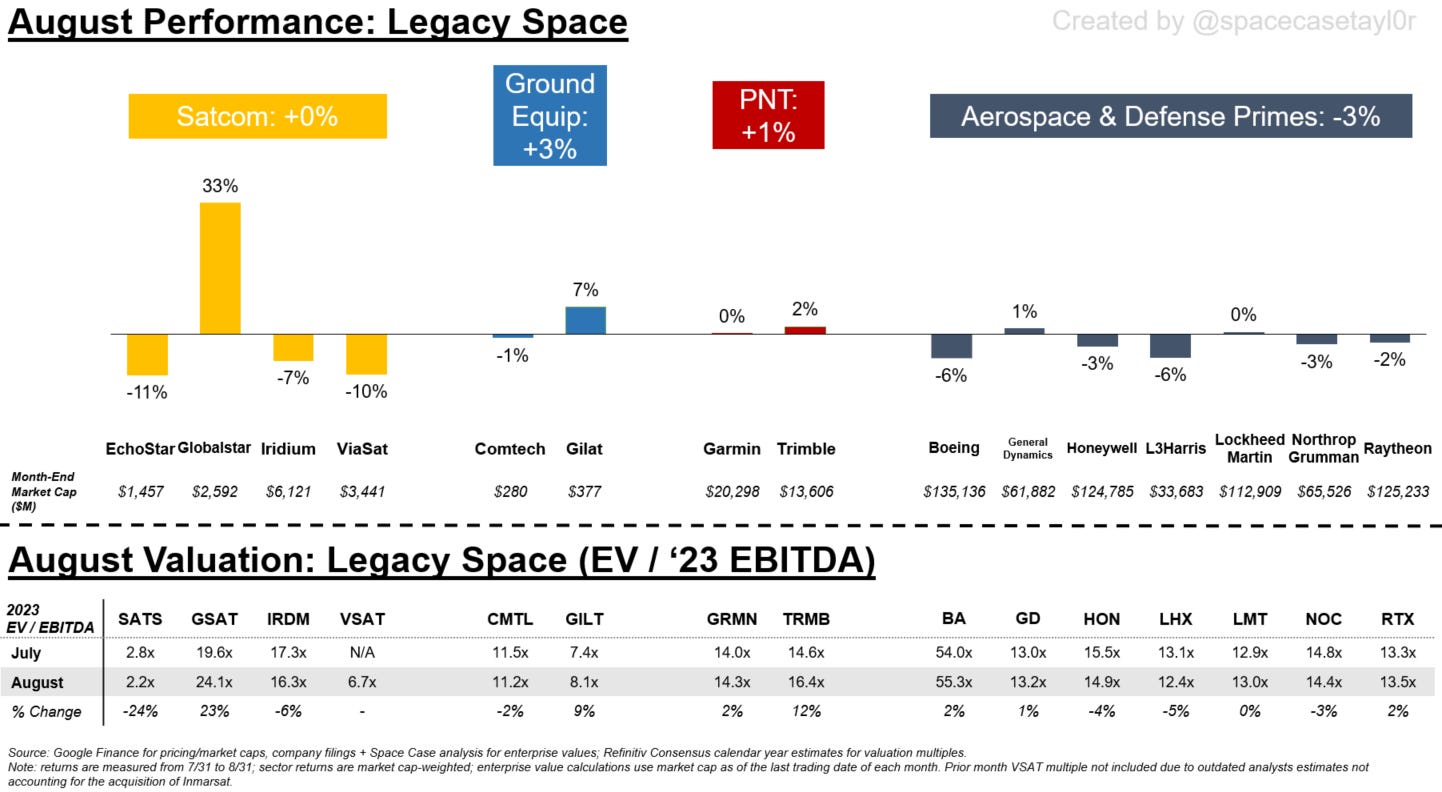

All the SPACs declined in August, with 10 of 12 seeing double-digit declines.

Most of what I’d want to focus on for the SPACs this month will be covered in a 2Q earnings wrap-up post that I will post later in September—stay tuned!

Despite Globalstar and Iridium’s similarities as LEO satcom providers, I believe their valuation is diverging due to differences in direct-to-device monetization. Globalstar’s 2Q earnings underscored tailwinds the company is seeing now from both internet-of-things (IoT) and Apple wholesaling revenue, with 2Q results that beat both consensus revenue + EBITDA and included management raising the lower-bound of 2023 revenue guidance. More notable to me is that the stock’s +24% pop after the report led to an EBITDA multiple increase from 20x to 24x and the company is now trading at a 50% premium to LEO satcom peer Iridium. I believe investors are excited by Globalstar’s evidence of successfully monetizing the emerging satcom subcategories of direct-to-device (via the company’s wholesale agreement with Apple) and IoT; on the other hand, Iridium’s EBITDA has multiple declined from ~20x in 1H23 to mid-teens in July and August after management downplayed the company’s near-term monetization potential from direct-to-phone connectivity. While it is still early days for direct-to-device satcom, this trend paints a clear picture that investors are enthusiastic about the potential for these satcom subcategories.

Meanwhile ViaSat just can’t catch a break. In late August, just over a month since reporting the failure of its $750M ViaSat-3 Americas satellite, the company reported that one of its newly acquired satellites (Inmarsat-6 F2) suffered an anomaly; the company is still assessing whether it will be able to perform its mission or not. While neither of these satellite failures impacted ongoing customer services, they represent another blow to ViaSat’s growth outlook. The company now has nearly $800M of pending insurance claims following this latest incident (link).